What's led to the revival of India's luxury real estate?

In this edition, Forbes India delves into all things luxury in real estate, from the developers building those swank homes to the evolution of architectural and design elements in these abodes

An economy is often on solid ground when prices of equities and premium real estate move northward—not perhaps at the same pace, but nevertheless in tandem. Stocks tend to provide higher returns than most asset classes and are also one of the more liquid investments. This allows investors to book partial profits and pump that surplus into property.

As the Sensex vaulted from 70,000 to 80,000 in just 58 trading sessions—the fastest 10,000-point gain in its history—investors, particularly the higher net-worth ones, would be in a mood to take some profits off the table. A reasonable deployment of those returns would be in luxury real estate, as properties of all hues mushroom—from villas and holiday homes away from the big cities to lavish apartments and penthouses in mint-new urban towers.

The rush of liquidity has resulted in a revival of sorts in property—more so at the high end. In this edition, Forbes India delves into all things luxury in real estate, from the developers building those swank homes to the evolution of architectural and design elements in these abodes.

India’s population of high net-worth individuals was pegged at roughly 36 lakh in 2023 by The Capgemini Research Institute’s 2024 World Wealth Report. These individuals, with a net worth of at least $1 million (₹8.3 crore), were collectively sitting on wealth of a mindboggling $1,446 billion in 2023, according to the report.

A few notches higher, the number of those Indians with a net worth of at least $30 million (roughly ₹250 crore), the ultra HNIs (UHNIs), stood at a little over 13,200 in 2023, says Knight Frank’s 2024 Wealth Report. Many from this super-rich cohort would have been responsible for India’s most valuable developer DLF pulling in super-luxury apartment sales worth ₹1,500 crore in fiscal year 2024.

To be sure, as Samar Srivastava writes in ‘Homes That Last Generations’ on page 44, apartments in properties like Oberoi Realty’s 360 West in Mumbai are priced upwards of ₹45 crore. Small wonder, buyers range from billionaires like DMart founder Radhakishan Damani to Bollywood superstar Shahid Kapoor.

Knight Frank’s Wealth Report places India’s financial capital at No 8 in terms of price growth luxury housing. A casual, albeit slightly laboured, tour of a city that’s a work in progress will tell you why. High-rises are being built on land on which slums and chawls once stood, and middle-class colonies are making way for new-fangled towers with amenities like multi-purpose sports courts and, well, reflexology gardens.

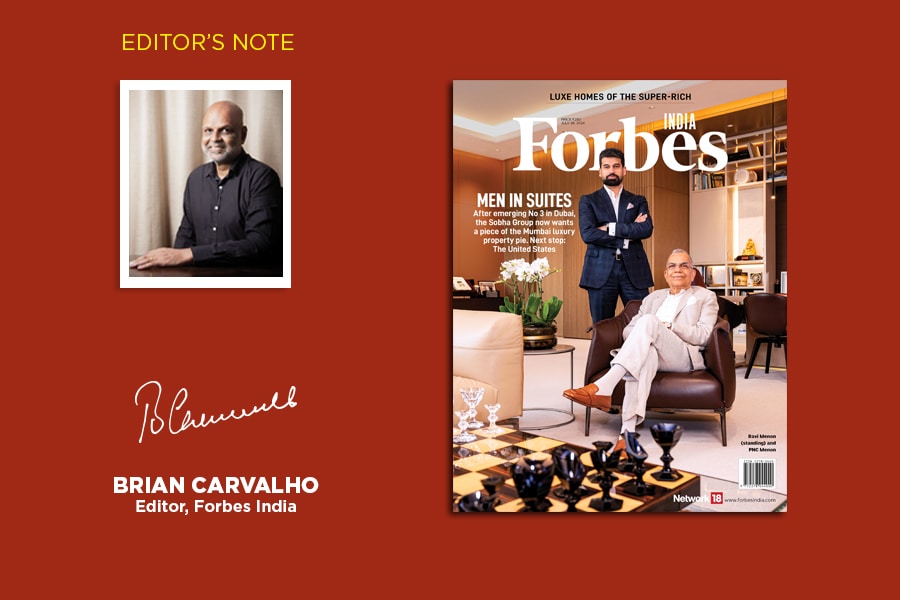

That’s why every property developer worth its nine-hole putting green (yes, that’s part of the amenities bouquet, too) can’t ignore Maximum City. On the Forbes India cover in this edition are the Menons of the Sobha Group, which has emerged the third largest real estate player in Dubai. Next stop is the United States, where patriarch PNC Menon reckons Sobha can rake in “about ₹100,000 crore over 10 years".

And there’s Mumbai, where Menon tells Manu Balachandran, who has written the cover story, that “we have to show something India has not seen. We can afford to spend the money and the only place in India that can pay that back is Mumbai". For more on the Mumbai—and the US—gambit, don’t miss Balachandran’s ‘Brick By Brick’.

There’s a lot more in this luxe property special. Mexy Xavier and Pankti Mehta drop into the homes of India’s super-rich to capture elements from the traditional to the glamorous that often reflect the personalities of this swish set. And Benu Joshi Routh delves into the design and architecture that are redefining luxury living.

Best,

Brian Carvalho

Editor, Forbes India

Email: Brian.Carvalho@nw18.com

X ID: @Brianc_Ed

First Published: Jul 15, 2024, 11:42

Subscribe Now