Why investors say this is a good time for startups

As consumer behaviour and requirements change in the Covid-19 world, VCs are bullish about startups that will thrive after the pandemic

If one looks at events like the dotcom bust or the 2008 crisis, VCs have been investing and getting better returns: Sanjay Mehta, founding partner, 100X.VC

If one looks at events like the dotcom bust or the 2008 crisis, VCs have been investing and getting better returns: Sanjay Mehta, founding partner, 100X.VC

Image: Mexy Xavier

On April 16, Yellow Messenger, a Bengaluru-based startup, announced it had raised $20 million in Series B funding, from Lightspeed India Partners, an existing investor, and its US arm Lightspeed Venture Partners. There are other startups, too, that have raised funding amid the Covid-19 crisis. Itilite and Zupee, for instance, raised money from investors, including Matrix Partners India, Greenoaks Capital, Falcon Edge Capital and WestCap Group, while Camp K12 raised money from Matrix and SAIF Partners. All of these were announced in April.

The coronavirus pandemic has impacted the venture capital (VC) industry in a way that will see VC firms not close for business or even wait and watch, but proactively chase deals in sectors and with founders whom they see as potential winners in the post Covid-19 world.“We are working closely with our entrepreneurs to navigate these tumultuous times,” says Akshay Bhushan, partner at Lightspeed India Partners. “At the same time, we continue to look at new investment opportunities.”

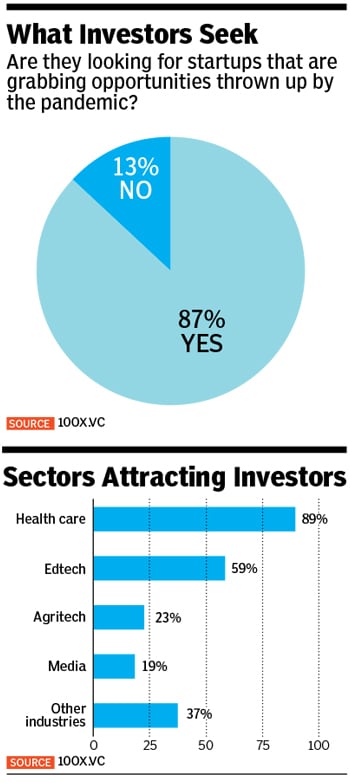

In fact, in a survey by the VC firm 100X.VC, 70 percent of respondent VC firms said they are seeking lower valuations from founders, and that 86 percent of investors will now look at sectors that are positively affected by the crisis.“There will be a recalibrating of the investment theses from the VCs’ side,” says Sanjay Mehta, founding partner at 100X.VC. “We are clearly seeing that there are specific winners and losers, among the startups. From an overall VC industry perspective, there is going to be a reset.”

The pandemic is forcing companies to follow financial discipline and strengthen their core businesses, and they might emerge from this crisis in a stronger position, long term, says Bhushan. Lightspeed is seeing an uplift in categories such as e-groceries (both in business-to-business and business-to-consumer models), a pick-up in usage and downloads of edtech and content-plus-social media. The current situation is essentially forcing consumers to try digital services and the VC firm expects this trend to rise in the post Covid-19 world.On the enterprise front, companies are being forced to evaluate how to ensure business continuity and are tapping technology for this.

Zoom, a popular videoconferencing app, is a universal example, but this trend extends to customer support, sales and even on-ground functions like logistics. “We expect this increase in technology adoption by enterprises will lead to long-term productivity gains and should be a catalyst for the industry to adopt software in their operations at a greater pace even post Covid-19,” Bhushan adds.

Yellow Messenger, in which Lightspeed has invested, enables artificial intelligence chatbots for enterprises. Given the remote working model in the current environment, Yellow Messenger helps companies continue providing customer support with less dependence on the traditional call centre model. The startup’s technologies are seeing adoption globally.

Freight Tiger, another Lightspeed portfolio company, offers a software-as-a-service (SaaS) platform to help large companies track their trucking supply chain with the help of smart location tracking technology. Given the various disruptions caused by the pandemic, customers are increasingly using Freight Tiger solutions to pinpoint blockages in their supply chain and troubleshoot in real-time.

On the consumer front, people are shedding their bias for touch-and-feel and embracing online options for various needs. This will particularly benefit sectors like ecommerce in the long term where there is a pre-existing offline behaviour moving online, Bhushan says.

People are also much more comfortable with two-way videoconferencing, which will unlock all sorts of new use possibilities—from live-streaming platforms, online-only interactive events platforms and other new experiences. MyScoot, in which Lightspeed is an investor, offers a platform for home-hosted events that matches up groups of people with common interests. The venture has taken its business model online, where people from across the world can bond over video chat.

Economic recovery, however, is some time away. “It is now widely accepted that the current global health crisis will cause the largest annual GDP contraction globally in the last hundred years,” says Rajinder Balaraman, a director at Matrix India. “Businesses and startups will be deeply affected as their consumers, business partners and employees adjust to a new normal, which will last as long as it takes for a cure or a vaccine to emerge.”

VC-backed companies are stretching their cash to survive until demand recovers. Over the medium-term, Matrix is optimistic about companies that are able to navigate this crisis. Some behavioural changes during this lockdown period will become permanent, leading to a sustained shift towards online models in many categories such as health, education and commerce.Among Matrix’s recent investments are industries like SaaS, online education, skill-based gaming and mobility. Early evidence from China, which has relaxed its lockdown conditions, suggests that the first three industries will see increased adoption post-lockdown, relative to the pre-lockdown period. Mobility will take a little longer, but given that it’s more of a utility than a luxury, it will bounce back sooner than other industries, Balaraman reckons.

The SaaS industry will have to weather some challenges in the short term, but will grow as more companies move towards remote-working models. This shift will create the need for new SaaS solutions around collaboration, security, infrastructure and productivity. Similarly, education is witnessing a massive shift towards virtual classrooms and personalised learning enabled by technology. “Parents are invested in this shift and recognise how these models can equip their children for a future where the use of technology is increasingly important,” Balaraman says.

Grocery, as one the largest under-penetrated ecommerce categories, is also witnessing major changes. The shift towards digital payments and the recent Jio-Facebook deal will only accelerate the digitalisation of neighbourhood stores.

Fintech, especially lending, has been affected and companies are figuring out their defence strategies and keeping a close eye on cash flows. That said, India today has one of the most evolved fintech ecosystems in the world. This started with the Aadhaar-enabled payments system, eKYC and then the much-recognised launch of the United Payments Interface by the National Payments Corporation of India.

Today, countries across the world admire the sophistication of the Indian fintech landscape and the government’s role in shaping this ecosystem. Similar to this, India has an opportunity to innovate and lead again in health tech. All companies globally will have to think of health and safety as integral to their operations in the post-Covid-19 world. For example, Indian mobility companies are working closely with the ministry of health and family welfare and taxi drivers to create new guidelines to ensure safe rides for all.All industries, including ecommerce, e-health and e-pharmacy, are engaged with the government in creating the Bharat Health Stack, a common digital infrastructure around health and safety for a billion-plus Indians.In the short term, large transactional investors such as private equity firms, investment banks and large hedge funds, will slow down their investments and corporate VC firms within India will hit a pause, says Mehta of 100X.VC. On the other hand, firms that have VC investments at the core of their business will continue with business as usual because “there is enough dry powder available”, he adds. If one looks at other events such as the dotcom bust or the global financial crisis of 2008, VCs have been investing, creating more attractive deals and getting better returns, by taking advantage of the downturn, he says.

There will be lower valuations, leaner companies, less expensive talent and cheaper marketing costs. If one looks at how everyone is going digital, the cost of customer acquisition is going to come down. The cost of click-throughs on social media platforms has fallen by nearly 50 percent. Therefore money will be spent more efficiently and generate better returns for VCs, says Mehta. “VCs will continue to invest, but everybody will be rethinking where to invest.”

“We are seeing a new trend that we call the ‘home economy’. Everything is now from within people’s homes,” he says. “Anything that touches your home is valuable, and the digital customer journey is starting at home.” All this changes every aspect of business. Earlier people would walk into stores or showrooms. Now it is from the confines of their homes, including work from home. “Any startup that gets the home engagement right will see revenues flowing in, and such startups will see investment upsides,” he concludes.

â— With inputs from Varsha Meghani

First Published: May 12, 2020, 17:23

Subscribe Now