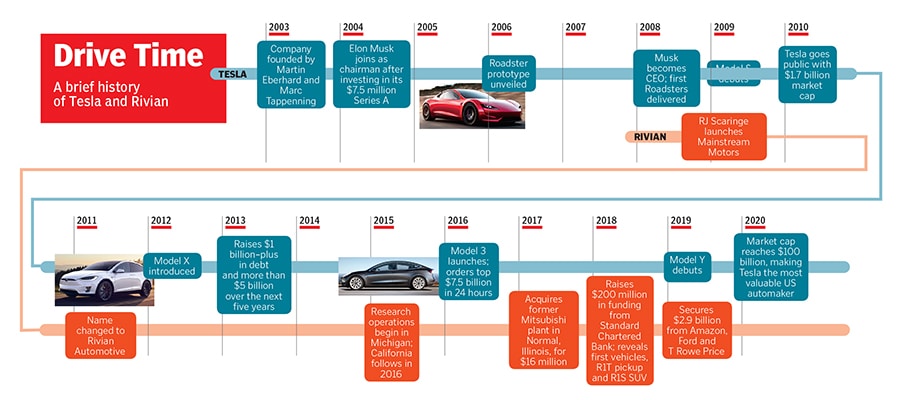

Elon's new nemesis

Check your rearview mirror, Tesla. Rivian has a $3 billion war chest from Amazon, Ford and the Saudis, and is revving up production on its electric SUVs and trucks. Now all the secretive automaker has

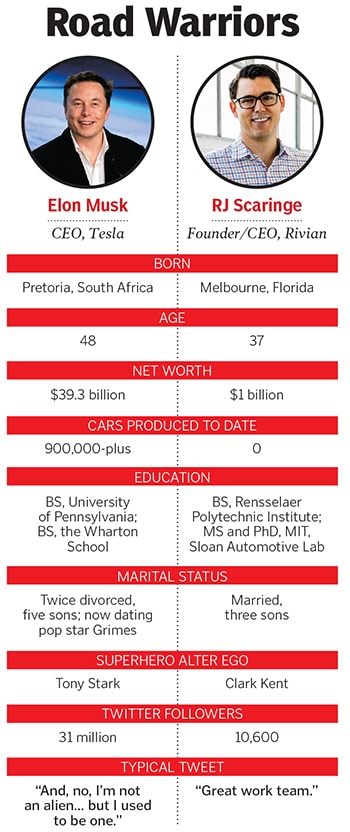

RJ Scaringe, Rivian’s CEO, introduces his company’s R1T all-electric pickup and all-electric R1S SUV at the Los Angeles Auto Show in California

RJ Scaringe, Rivian’s CEO, introduces his company’s R1T all-electric pickup and all-electric R1S SUV at the Los Angeles Auto Show in California

Image: Mike Blake / Reuters

It’s 8 o’clock on a January morning, and the temperature in Normal, Illinois, just a few hours south of Chicago, is well below freezing. The small pond in front of Rivian Automotive’s assembly plant has turned to ice, the grass is covered with frost and there is snow in the forecast. It’s not much warmer inside the plant. Nearly the entire 2.6 million-square-foot facility is a construction zone, undergoing a massive $750 million renovation to prepare for the end of the year, when it expects to start rolling out battery-powered trucks, vans and SUVs. So minor details like heat are not exactly a top priority.

The only finished area—a second floor at the front of the building that overlooks the factory—is where the plant’s previous owner, Mitsubishi, had its executive offices. Back then, access to this floor was restricted to the suits. Now it’s a giant open workspace, accessible to all, with a cafeteria, polished concrete floors and lots of natural light, just like the floor plan at Rivian’s research and design centre in Plymouth, Michigan. The concept for both offices was to merge industrial and outdoor aesthetics that mirror the company’s brand—an automaker that builds sustainable vehicles usable in off-road settings. Rivian, which was founded in 2009 but is finally releasing its first vehicle this year, also has operations in San Jose and Irvine, California, where it develops its technology and batteries.

“When we’re done cleaning, painting and installing the equipment,” says Rivian’s 37-year-old founder and CEO, Robert Joseph Scaringe (better known as just RJ), “we will eventually be able to produce 250,000 vehicles per year by mid-decade.”

Starting an independent car company is not easy. Among the roadkill in automotive history are Preston Tucker, who challenged Detroit in the late 1940s, and John DeLorean, who failed to take the Motor City back to the future in the early 1980s. Producing a line of mass-market vehicles in the 21st century is even more difficult than it was for Tucker and DeLorean, and considerably more perilous in the EV (electric vehicles) category.

With the emergence of Rivian, the electric vehicle market is no longer a one horseless carriage race. Indeed, the 2020s are gearing up to be the decade of the EV. According to research at Oppenheimer, EVs and plug-in electric hybrids accounted for a mere 2.2 percent of all US vehicles sold in the last quarter of 2019. And only a third of those were purely electric. But that is changing rapidly. While only 5.1 million electric cars were sold worldwide in 2018, that figure is expected to surge throughout the decade—21 million units are projected to be sold in 2020, 98 million in 2025 and 253 million in 2030.

Building a new EV, however, requires investing in cutting-edge research into components like battery packs and powertrains. The only company that has been remotely successful is, of course, Tesla—and even it has had a rough go of it.

“We spent a lot of time looking at and understanding how different [automakers] were built,” Scaringe says. “And we spent a lot of time understanding the risks associated with how to build and scale a business, and the working capital that’s [required].” Over the past 13 months, his team and he have raised $2.85 billion to fund Rivian’s future. First Amazon (and others) invested $700 million in February 2019. Then Ford ponied up $500 million two months later. Cox Automotive, whose brands include Autotrader and Kelley Blue Book, came through with another $350 million in September. And if that weren’t enough to turbocharge Scaringe’s outsized ambitions, just before Christmas Eve, money management behemoth T Rowe Price led yet another investment round worth more than $1.3 billion.

That early infusion of capital—on top of investments of nearly $500 million, including from JIMCO, the investment arm of Abdul Latif Jameel, a Saudi corporation that has bet big on energy and mobility—has given Rivian a valuation just north of $5.5 billion. Scaringe is estimated to own slightly more than 20 percent of the company, making him the latest automotive billionaire. The funding has also allowed Scaringe to nearly triple the size of Rivian’s workforce, from around 700 in 2018 to more than 2,000 today, which is how he can scale production this year.

The question is: Even with $3 billion, does Rivian have enough to realise Scaringe’s electric dreams?

Until now, it’s been a far smoother road than the one Musk faced with his first vehicle. Tesla raised around $100 million between 2003 and 2008 to produce the Roadster, which was soon abandoned in favour of the Model S, and the Model S required more than $350 million in funding (including a 2010 IPO that valued the company at $1.7 billion). The journey of the Model 3 was particularly rocky. Supply-chain issues and Musk’s desire to completely disrupt the manufacturing process led to a two year–plus delay in delivering cars to customers and a slew of quality-control issues. The fallout from these problems reportedly cost the EV maker hundreds of millions of dollars. (Tesla did not respond to multiple requests for comment.) The company then took on billions in debt as it scaled its production for the mass market.

So if the mighty Tesla has faced so many detours and potholes, what makes Scaringe think that Rivian, which hasn’t made a single car, can have a smooth ride? He doesn’t. “Things will go wrong,” admits the young CEO. And Scaringe, who comes across like a mild-mannered Clark Kent type compared to Musk’s manic Tony Stark, is confident he can overcome any perils or roadblocks. After all, Rivian is built for treacherous terrain. Rivian’s adventure SUV can accommodate seven people, but the company has also filed for a patent to adapt a seat for first responders

Rivian’s adventure SUV can accommodate seven people, but the company has also filed for a patent to adapt a seat for first responders

Image: Mike Blake / Reuters Rivian

RJ Scaringe first dreamt of starting his own car company when he was in high school. But unlike most teenage gearheads with the same ambition, Scaringe backed it up by studying engineering. His vision changed in 2007 while attending MIT’s prestigious Sloan Automotive Lab, where he attained a doctorate in mechanical engineering and the skills he would need to build the vehicle he imagined in his head. “As I became increasingly aware of how many problems were born out of the automobile—geopolitical, climate, air quality and more—it became a huge source of internal conflict for me,” he recalls. So he scrapped his plan for a gas-powered sports car for one that was battery-powered, much like Tesla’s original Roadster.

After graduating with his doctorate in 2009, Scaringe returned home to Melbourne, Florida, where he founded the company that became Rivian. His team and he spent four years developing a speedster-like EV before Scaringe found what he thought was an obvious gap in electric vehicles and one that spoke to his outdoorsy interests—a truck and a luxury SUV.

Scaringe also spent nearly a decade developing its innovative skateboard platform—a chassis that contains the battery pack, suspension, electric motors for propulsion and a computer to control it all. Finally, in November 2018, Rivian unveiled its two prototypes at the Los Angeles Auto Show: The R1S, an electric SUV that seats seven, and the R1T, an electric pickup truck. The so-called “adventure vehicles” look like the love children of a Range Rover—rugged, capable and luxurious—and are packed with the latest amenities such as internet connectivity and a host of driver-assist safety features.

The company expects to deliver an ambitious 20,000 units (combined truck and SUV) in 2021 and 40,000 in 2022, which could translate to approximately $1.4 billion and $2.8 billion, respectively, if all goes according to plan. By comparison, Tesla sold 25,000 units of the Model X in 2016, its first full year of release.

Beyond its first two releases, Scaringe says there will be three more vehicles in the Rivian portfolio by 2024. Though he is cautious about providing details, Scaringe admits that one will be smaller in size and all will be considerably lower in price. It’s a strategy akin to what Land Rover does with its Defender and top-of-the-line Range Rovers—that is, the same base model with fewer amenities. And if Scaringe can truly keep the price below $50,000, it will cause far worse headaches for Musk than a broken shatterproof window on his Franken-vehicle, the Cybertruck.

Tesla, of course, now dominates the EV market—by one estimate it represents nearly 80 percent of sales in the US—and Rivian will face stiff competition in the luxury battery-powered SUV segment from other automakers. The R1S SUV will enter a market in the fall that includes the Mercedes-Benz EQC (starting at $67,900) the Audi e-tron SUV ($74,800) the Jaguar i-Pace ($69,500) and, of course, the Tesla Model X ($84,990). Other automakers such as Hyundai and Kia will offer more affordable options, such as the Kona EV, starting at $37,190, and Niro EV, starting at $38,500, respectively.

Rivian should be without real competition in the truck category, however. Despite Tesla’s highly public debut of the Cybertruck, it’s not expected to be produced until 2022. And both Ford and General Motors have promised to release electric pickups in the next few years.

“The opportunities [in the EV market] are pretty substantial,” says Ed Kim, a market analyst for AutoPacific, an automotive research and consulting firm based in California. If Rivian becomes a threat to Tesla dominance, it could energise the category and set up a true EV rivalry. “Some experts have been predicting this for a while, and I think there are a few key factors happening now that [are leading to further] penetration of the EV,” says Steven Low, a professor of computer science and electrical engineering at Caltech. One is that vehicle range is expanding. Another is the availability of more charging facilities. And the third element is price.

Rivian claims its R1S and R1T will offer outstanding performance, including a range of just over 400 miles, or nearly 75 miles more than any other existing EV. Both will be able to sprint from zero to 60 mph in about three seconds. Above all, Rivian promises genuine off-road capability. Try driving your Tesla on the beach or into the woods.

The company also plans to build out a charging infrastructure, much like Tesla’s Superchargers. “We are developing them in parallel,” Scaringe says. As for the cost, Rivian’s pickup will have a base price around $69,000, and the SUV will be $72,500 (and both come with a federal tax incentive). Scaringe hints that these prices will come down closer to release but wouldn’t reveal a precise figure.

Much will depend on Rivian’s new deep-pocketed partners.

Having built a $3 billion war chest from Amazon, Ford and Cox in a short time is certainly an impressive start for Scaringe, but if Tesla’s history is an example, that won’t be enough funding to scale production to compete with Musk. Then again, those brands see opportunity in Rivian that Tesla could never provide.

The partnerships Scaringe forged weren’t just about the cash. In Ford’s case, the two companies will also build an electric vehicle together. “We’re providing the platform,” Scaringe says. “They will provide the body and the interior.” Although Scaringe is reticent in talking about the project, the vehicle will be a luxury SUV with Ford’s Lincoln brand.

Rivian hopes the Ford alliance will allow the company to grow beyond its own consumer electric vehicle offerings. For its part, Ford is seemingly doing it to keep the company’s options open, as it often does, to pursue the best option with which to achieve its electrification goals: 40 electric vehicle models by the end of 2022. Besides the Lincoln with Rivian, Ford is working on the electric Mustang-inspired Mach-E SUV and both a hybrid and all-electric version of the Ford F-150, America’s best-selling vehicle. Ford is also working with Volkswagen to develop EVs on its new EV platform.

Amazon, meanwhile, is looking to Rivian to develop a battery-powered delivery van as part of its pledge to be net-zero carbon across all its businesses by 2040 and use 100 percent renewable energy to power those businesses by 2030. Consequently, Amazon ordered 100,000 vans from Rivian. At least 10,000 should be on the road by late 2022, and all are expected to be operating in Amazon’s fleet by 2024. The vans will presumably become part of an end-to-end logistics network that Amazon has been working on since 2015. If so, expect more Rivian orders to come down the road.

But it’s the Cox partnership that could prove the most troubling for Musk. While Tesla has more than 100 service centres in 30 states, Cox handled more than 55 million service appointments in 2019 at its sprawling network of commercial and dealer partner service centres across the US. If something goes wrong with an R1T or R1S, the idea, presumably, is that a customer will be able to take the vehicle to a Cox service centre like Pivet to have it repaired correctly and in a timely fashion, something that Tesla has struggled with since its inception.

Cox is also playing the long game with Rivian—as more vehicles come to market, it wants to control secondary sales. “My hope is with the skills that we have,” says Cox president Sandy Schwartz, “and with all the things that we’re learning, that we’ll be the chief wholesale remarketer for all Rivians someday.”

Now they just have to build some.

The name of the Illinois town that Rivian calls home is the perfect adjective to describe Scaringe himself and differentiate him from Musk: Normal. Whereas Tesla’s co-founder is all bravado and showmanship—he has weaponised

his Twitter account and turned it into a de facto marketing division—Scaringe is soft-spoken and low-key. While Musk is photographed with models and pop stars, Scaringe is a family man, even if he rarely sees his family lately. These days, he lives out of a suitcase, spending five days a week travelling among the company’s four offices to make sure things are on schedule. His wife, Meagan, and their three boys (all under five) see him from Friday night to Sunday evening in their unassuming three-bedroom house near Irvine. On Sunday evening, he boards a plane to Michigan and repeats the process to ensure that his larger vision is being realised: Thinking globally and acting locally.

When the Mitsubishi plant closed in July 2015, for example, the mood in Normal was decidedly funereal. “It hurt,” says Mayor Chris Koos. “It left over 1,000 people out of work, which causes a ripple effect throughout the community.”

Even after the plant was sold to Rivian for $16 million in 2017, residents remained sceptical. That negative sentiment soon changed, however. “Rivian showed interest in the lifestyle of the community, the quality of education, affordable housing and access to transportation,” Mayor Koos says. The company even had a preview day in Normal last summer to answer any questions from local residents. It made a big impact on Normal’s perception of Rivian and, not surprisingly, proved valuable when it came to recruiting employees.

With the town onboard, Scaringe is now on a mission to lead Rivian through its first production cycle and expand its line. Though it’s too early to tell who will win the EV wars, Rivian is one of just a couple of companies that has a strong chance not only to survive, but also thrive, according to Navigant’s Sam Abuelsamid. He thinks Rivian might even be in a better position going forward than Tesla: “If you’re talking about who’s going to have potentially the most volume, getting more vehicles to market in the near to mid-term, [I’d say] probably Tesla.” But from an actual business standpoint, Rivian is “in the better position to succeed because of the nature of the products it has”.

But first, the rubber has to hit the road.

First Published: Mar 30, 2020, 13:56

Subscribe Now