His US Airways had finally bagged a major partner by agreeing to combine with bankrupt American. The new company would emerge with modest debt as the nation’s largest airline, with only three domestic carriers left among its global competitors.

The financial crisis was well in the past, the economy was humming and travel seemed to be entering a new golden age. Carriers like American had mastered the science of dynamic fare pricing, and now nearly every seat on every flight was full, maximising revenue and efficiency. Hailing the arrival of a “new American” by early 2014, Parker was eager to please Wall Street. “I assure you that everything we’re doing is focussed on maximising value for our shareholders,” he said on a call with investors.

Over the next six years, Parker borrowed heavily, tapping capital markets no fewer than 18 times to raise $25 billion in debt. He used the money to buy new planes and shore up American’s pension obligations, among other things. A host of passenger fees for additional baggage, more legroom, in-flight snacks, drinks and more helped swell the bottom line to $17.5 billion in combined profits from 2014 to 2019. Keeping his pledge, Parker declared a regular dividend in 2014—American’s first in 34 years—and began buying back billions of the airline’s stock.

“Holding more cash than the company needs to hold is not a good use of our shareholders’ capital,” he reasoned. That was music to hedge funders’ ears as they piled into American stock. Even Berkshire Hathaway’s Warren Buffett bought a chunk of the company. Out of bankruptcy, its stock took off almost immediately, doubling during Parker’s first year on the job. For his managerial brilliance, Parker was rewarded with annual compensation surpassing $10 million.

Fast-forward to April 2020, and a contagion known as Sars-CoV-2 has levelled the travel industry. American Airlines is flat broke, in part because of Parker’s profligate spending. Now the US government has agreed to advance it $5.8 billion in the form of grants and low-interest loans—the largest payment to any airline in the government’s $25 billion industry bailout package. Many hedge fund investors have sold their shares, as has Berkshire Hathaway. American stock is now worth just one-third of the $12 billion Parker spent on buybacks alone.

Despite recent boom times, American’s balance sheet is a disgrace. Over the last six years, Parker added more than $7 billion in net debt, and today its ratio of net debt to revenue is 45 percent, about double what it was at the end of 2014. American says it plans to pay down its debt “aggressively” as soon as business returns to normal.

![mcdonald mcdonald]()

Debt-laden American Airlines is not an outlier among the nation’s largest corporations, though. If anything, its financial gymnastics might well have been a playbook for boardrooms around the country. Year after year, as the Federal Reserve pumped liquidity into the economy, some of the biggest firms in the United States—Coca-Cola, McDonald’s, AT&T, IBM, General Motors, Merck, FedEx, 3M and Exxon—have binged on low-interest debt. Most of them borrowed more than they needed, often returning it to shareholders in the form of buybacks and dividends. They also went on acquisition sprees. Their actions drove the S&P 500 index ever higher—by 13.5 percent on average annually from 2010 through 2019—and with it came increasingly rich pay packages for the CEOs leading the charge. The coup de grâce was US President Donald Trump’s 2017 tax cut, which added even more helium to this corporate-debt balloon.

According to a Forbes investigation, which analysed 455 companies in the S&P 500 Index—excluding banks and cash-rich tech giants like Apple, Amazon, Google and Microsoft—on average, businesses in the index nearly tripled their net debt over the past decade, adding some $2.5 trillion in leverage to their balance sheets. The analysis shows that for every dollar of revenue growth over the past decade, the companies added almost a dollar of debt. Most S&P 500 firms entered the bull market with just 20 cents in net debt per dollar of annual revenue today that figure has climbed to 38 cents.

![vicki hollub vicki hollub]()

But as the coronavirus pandemic cripples commerce worldwide, American corporations face a grim reality: Revenues have evaporated, but their crushing debt isn’t going anywhere.

A year ago, Federal Reserve Chairman Jerome Powell sounded an alarm, but he could barely be heard above the roar of the ascendant stock market. “Not only is the volume of debt high,” said Powell last May, “but recent growth has also been concentrated in the riskier forms of debt. Among investment-grade bonds, a near-record fraction is at the lowest rating—a phenomenon known as the ‘triple-B cliff’.” Powell was referring to the fact that a large number of companies’ bonds were dangerously close to junk status. “Investors, financial institutions and regulators need to focus on this risk today, while times are good.”

Powell has stopped preaching. Facing the frightening prospect of widespread corporate insolvencies, the Fed on March 23 announced a credit facility designed to support the corporate bond market. Two weeks later, the central bank stunned Wall Street by saying it would go into the open market to buy junk bonds as well as shares in high-yield bond ETFs.

All told, the Federal Reserve is now earmarking $750 billion, supported by $75 billion from taxpayers, to help large companies survive the pandemic—all part of its $2.3 trillion rescue package.

“We have a buyer and lender of last resort, cushioning pain but taking over the role of the free market,” groused Howard Marks, the billionaire co-founder of Oaktree Capital, in a memo on April 14. “When people get the feeling that the government will protect them from [the] unpleasant financial consequences of their actions, it’s called ‘moral hazard’. People and institutions are protected from pain, but bad lessons are learnt.”

The lesson to corporate-debt junkies is clear: Taxpayers be damned, the federal spigot is wide open. In the last two months, according to Refinitiv, no fewer than 392 companies have issued $617 billion in bonds and notes, including a record number of triple-B issues, piling on still more debt that they may not be able to pay back. As Warren Buffett observed during Berkshire’s annual shareholder meeting on May 2, “Every one of those people that issued bonds in late March and April ought to send a thank-you letter to the Fed.”

America’s foremost corporate citizens—companies found in nearly every retirement account—did not become debt dependents all by themselves. It took some prodding, mostly by Wall Street’s savviest participants. Take the case of McDonald’s, known for restaurants in nearly every town in the US, its iconic golden arches offering fast, budget-friendly meals to billions.

![corporate debts corporate debts]()

It all started before the 2008 crisis, when billionaire investor Bill Ackman began agitating the Chicago-based burger behemoth, demanding that it divest most of its 9,000 company-owned stores to independent operators in order to buy back $12.6 billion in stock. McDonald’s successfully repelled the hedge fund activist, but during the recovery, its growth stalled.

Starting in 2014, McDonald’s chief executive, Don Thompson, began piling on leverage to fund share repurchases. A year later, his successor, Steve Easterbrook, amped up Thompson’s strategy by selling company-operated restaurants to franchisees, just as Ackman had wanted. Today, 93 percent of the 38,695 McDonald’s worldwide are operated by small entrepreneurs who cover maintenance costs and pay the parent company rent and royalties for the privilege of operating in its buildings, using its equipment and selling its food.

The new and improved “asset light” McDonald’s no longer manages cumbersome assets instead, it receives those payments and is sitting on tens of billions in debt. From 2014 through the end of 2019, McDonald’s issued some $21 billion in bonds and notes. It also repurchased more than $35 billion in stock and paid out $19 billion in dividends, returning over $50 billion to shareholders, far in excess of its profit ($31 billion) over that period.

![heinz heinz]()

That was just fine by Wall Street. McDonald’s became a hedge fund darling, its shares more than doubling during Easterbrook’s tenure, from 2015 to 2019. His reward was $78 million in generous pay packages over five years.

The risk added to McDonald’s balance sheet has been dramatic, however. In 2010, the company carried just 38 cents in net debt per dollar of annual sales, but by the time Easterbrook was fired in late 2019 amid news of a workplace affair, it had $1.58 in net debt per dollar of revenue.

Today its net debt stands at $33 billion, nearly five times greater than before the financial crisis. Its bonds are rated triple-B, two notches above junk, down from their A rating in 2015.

With most of its restaurants nearly empty during the pandemic, McDonald’s stock initially fell by almost 40 percent. Thanks to the Fed’s intervention, though, McDonald’s debt, which at first slumped to 78 cents on the dollar, recovered along with the stock, as the company quickly raised an additional $3.5 billion. McDonald’s insists that it entered the crisis with a strong balance sheet and overall financial health. It recently suspended its share repurchases.

The startling truth, though, is that the burger giant’s leverage is actually modest compared to one of its foremost competitors, Yum Brands, the $5.6 billion (revenue) owner of Pizza Hut, Taco Bell and KFC. After Greg Creed took charge as CEO in 2015, activist hedge fund managers Keith Meister, of Corvex Management, and Daniel Loeb, of Third Point, took big positions. By October that year, Meister was on Yum’s board of directors days after his appointment, the company said it was “committed to returning substantial capital to shareholders” and spinning off its Yum China division, which generated 39 percent of its profits.

Over the next year, Creed borrowed $5.2 billion to fund $7.2 billion of stock buybacks and dividends. Yum retired some 31 percent of its common shares, and as expected, its stock price doubled to over $100 by the end of 2019. Shareholders were thrilled, but Yum’s financial staying power was compromised. In 2014, Yum had just $2.8 billion of net debt, accounting for 42 percent of net revenue by 2020, that figure had swelled to $10 billion, or 178 percent of net revenue. Heading into the coronavirus economy, Yum was a basket case, but thanks to the Fed and a $600 million bond issue in April, it will live to see another day.

Yum management scoffs at the idea that the Fed helped in any way. “We’re not aware of Federal Reserve intervention in the high-yield market or in our ability to issue $600 million of high-yield bonds,” the company says.

Like McDonald’s, Yum sold many of its company-owned outlets to independent franchisees. Without access to capital markets and the Fed’s largesse, their future isn’t so certain. Yum is giving some of its franchise owners a 60-day grace period to make their royalty payments. David Gibbs, who replaced Creed as CEO in January, speculated at the end of April that if need be it would take over the franchises and sell them off.

Of course, some argue that the de facto leveraged buyouts of publicly traded companies like McDonald’s and Yum were actually prudent given the Federal Reserve’s decade-long easy-money approach to monetary policy. “As a corporate finance matter, it was almost irresponsible to overfinance with equity given that [debt] was unbelievably cheap,” says Arena Investors’ Dan Zwirn.

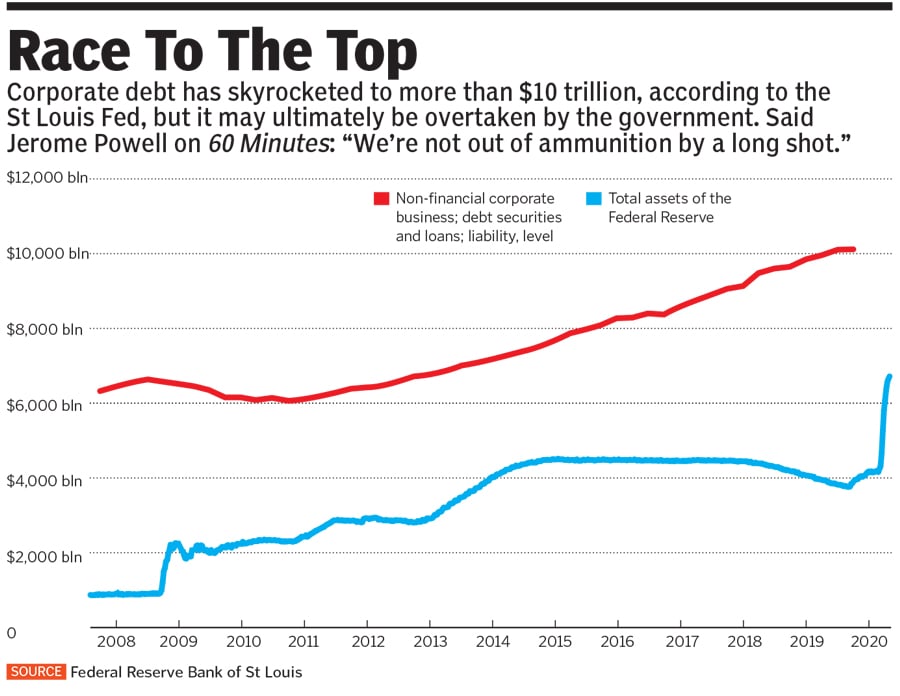

According to the St Louis Federal Reserve, as of the end of 2019, non-financial business debt totalled $10 trillion, climbing 64 percent from the beginning of the decade. “Every penny of the quantitative easing by the Fed translated into an equal match of corporate debt that went into share buybacks, which ultimately drove the share count of the S&P 500 to the lowest level in two decades,” says economist David Rosenberg. “This was a debt bubble of historic proportions. . Then again, nobody seemed to mind as long as the gravy train was still operating.”

![dukes dukes]()

If there were an award given for corporate recklessness, however, few would challenge mighty Boeing, the world’s largest aerospace and defence manufacturer and the nation’s single biggest exporter. Once the pride of industrial ingenuity in America, Boeing has been hypnotised by the lure of financial engineering.

Starting in 2013, the Chicago-based company decided it would make sense to commit nearly every penny of profit, and then some, to its shareholders. It sent $64 billion out the door—$43 billion worth of buybacks and $21 billion in dividends—saving little under CEO Dennis Muilenberg to cushion against the industry’s expected hazards, such as manufacturing difficulties, labour disputes and recessions.

After two of its 737 MAX planes crashed within five months and the FAA grounded the aircraft in 2019, Boeing’s aggressive financial policies were exposed, and it was forced to turn to debt markets for emergency cash. The company, which had essentially no debt in 2016, ended 2019 with $17 billion in net debt. This March, Boeing drew fully on a $13.8 billion credit line to contend with the grounding of air travel, and Standard & Poor’s downgraded its credit rating to the lowest rung of investment-grade.

Boeing flirted with a bailout, initially asking the government for $60 billion for the aerospace industry. But in late April, chief financial officer Greg Smith told investors the Defence Department was taking steps to bolster its liquidity, and that the Coronavirus Aid, Relief and Economic Security (Cares) Act had helped it defer some tax payments. Boeing also began weighing funding options from programmes run by the Treasury and Fed. “We believe that government support will be critical to ensuring our industry’s access to liquidity,” said Boeing’s new CEO, David Calhoun, on April 29. The next day, Boeing launched a $25 billion bond offering, eliminating the need for a direct bailout. The issuance, which includes bonds that aren’t redeemable until 2060, was oversubscribed, as institutional investors no doubt assumed that Boeing’s recovery was a matter of national importance to the government.

While delivering cash back to shareholders was an obsession of Boeing’s CEO, becoming a giant in entertainment via acquisitions has been the hallmark of Randall Stephenson’s 13-year tenure as CEO of AT&T. Since his start atop the 143-year-old company once revered as Ma Bell, Stephenson has spent more than $200 billion—mostly on acquisitions of DirecTV and Time Warner, among others, but also on stock buybacks and the telecom’s $2 annual dividend. All told, Stephenson piled on almost $100 billion in new net debt. “AT&T is the most indebted non-financial company the world has ever seen,” says telecom analyst Craig Moffett.

Hedge fund shareholder Elliott Management minces few words when it comes to Stephenson’s antics: “It has become clear that AT&T acquired DirecTV at the absolute peak of the linear TV market,” Elliott said of the $67 billion purchase in a September 2019 letter to the board. As for the $109 billion Stephenson spent on Time Warner, “AT&T has yet to articulate a clear strategic rationale for why AT&T needs to own Time Warner.”

Elliott, long known for rattling corporate cages, contends that Stephenson’s worst deal was his $39 billion run at T-Mobile in 2011. “Possibly the most damaging deal was the one not done,” Elliott said in the letter, referring to the year-long waste of corporate resources capped by AT&T’s ultimate withdrawal from the deal, which forced it to pay T-Mobile a record $6 billion breakup fee. “[AT&T] capitalised a viable competitor for years to come,” Elliott’s letter said.

Elliott and other investors were no doubt feeling ripped off by AT&T. Unlike Boeing, whose debt gorging and buybacks caused its stock to soar, AT&T’s shares have gone nowhere for a decade. What the debt-dependent duo do have in common is that financially, at least, they bear little resemblance to their former blue-chip selves.

Shocking as the pandemic of 2020 has been to the global economy, the fallout from a decade of debt binges by corporate giants might be only beginning. The landscape is littered with companies suffering from self-inflicted wounds. A prolonged recession could push some overleveraged firms toward insolvency, especially if interest rates rise and the Treasury’s multi-trillion-dollar “save the economy at any price” plan makes inflation do the same.

Altria, the seller of Marlboro cigarettes, increased its net debt from $10 billion to $26 billion over the past decade, spending most of its operating cash flow on dividends and share repurchases and wasting $15 billion on stakes in Juul Labs and cannabis company Cronos Group with little payoff. The cigarette merchant now holds $1.31 of net debt per dollar of annual revenue, up from 58 cents in 2010.

For most of its 118-year history, Minnesota’s 3M, the maker of N95 masks, Post-It notes and Scotch tape, carried almost no leverage. From 2010 to today, however, its net debt has swollen 17-fold to nearly $18 billion, or 55 percent of revenue. Standard & Poor’s downgraded 3M’s bonds in February, and it was among the first issuers to tap unfrozen bond markets in late March.

O’Reilly Automotive, the $10 billion (revenue) Missouri-based auto-parts retailer, has been one of the decade’s stock market darlings. The family-run business discovered cheap debt in the 2010s, using it to buy back $12 billion in stock and retire nearly half its outstanding shares. Over the decade, its net debt ballooned almost 12-fold to $4 billion. O’Reilly took on another $500 million, just in case, on March 25.

General Dynamics, known for its Navy ships, Gulfstream jets and government contracts, had little debt in 2010, but since CEO Phebe Novakovic took over in 2013, it has bought back about $13 billion in stock and paid out $6 billion in dividends, finishing last year with $11 billion of net debt.

IBM has been a buyback champion for years, paying 90 percent of its free cash flow to shareholders to return $125 billion to them from 2010 to 2019. Big Blue’s debt, including customer financing, has grown from 17 percent of net revenue to 70 percent, with $52 billion in net debt currently outstanding.

Even Berkshire Hathaway got caught up in the great debt binge. In 2013, Buffett teamed up with Brazilian private equity firm 3G Capital, co-founded by billionaire Jorge Paulo Lemann, to buy HJ Heinz for $28 billion and, two years later, Kraft Foods for $47 billion. The resulting company was stocked with brands of yore such as Jell-O, Velveeta and Oscar Mayer—as well as $30 billion of debt. After floating a $143 billion takeover of Unilever that would have reportedly required $90 billion of additional debt, business at the massive food conglomerate began to spoil.

Kraft’s market capitalisation has plunged from $118 billion at its peak in February 2017 to $38 billion, and Berkshire Hathaway’s shares, which are carried on its books at $13.8 billion, now trade for just $10 billion. In February, both S&P and Fitch cut Kraft’s bonds to junk. Kraft Heinz maintains that its balance sheet, and the demand for its brands, are strong.

In the oil patch, meanwhile, many are too sick even to take advantage of the Fed’s generosity. Vicki Hollub, CEO of Occidental Petroleum, has increased its net debt nearly five-fold since she took over in 2016, to $36 billion, not counting the $10 billion in preferred financing Hollub took from Buffett. Her $55 billion takeover of Anadarko Petroleum closed last August—just in advance of the worst oil-price plunge since the 1980s as Russia and Saudi Arabia flooded markets with supply early this year. With West Texas Intermediate crude hovering near $30 a barrel as of press time, Occidental looks to be heading for restructuring or even bankruptcy.

If Oxy is allowed to go bust, though, it will probably be the exception. The US government can’t afford to let market forces alone dictate the future of too many companies. Already, retailers Neiman Marcus, J Crew and JCPenney have filed for bankruptcy. The Federal Reserve has made it clear that to try to avoid global economic devastation worse than that seen during the Great Depression, it regards the nation’s largest publicly traded companies as, basically, too big to fail. “The Fed and Treasury have essentially created a new moral hazard by socialising credit risk,” wrote Scott Minerd, CIO of Guggenheim Partners.

BlackRock is predicting an expansion of the Federal Reserve’s balance sheet by a “staggering” $7 trillion by the end of the year.

In some ways, it seems, the Fed’s actions are tantamount to trying to cure addiction by increasing the dosage of the very substance the addict is abusing.

For a decade, chief executives of the world’s largest companies welcomed Fed-sanctioned debt on their balance sheets and made themselves and their shareholders rich. Covid-19 has turned the strategy into an addiction

For a decade, chief executives of the world’s largest companies welcomed Fed-sanctioned debt on their balance sheets and made themselves and their shareholders rich. Covid-19 has turned the strategy into an addiction