Lockheed Martin will soldier on despite Trump's tweets

Never mind Trump's tweets. Lockheed Martin will continue to thrive, because for the Pentagon and politicians alike, the world's biggest defence contractor is Silicon Valley and Detroit combined

Lockheed CEO Marillyn Hewson parlayed a master’s degree in economics at the University of Alabama into the top job at Bethesda

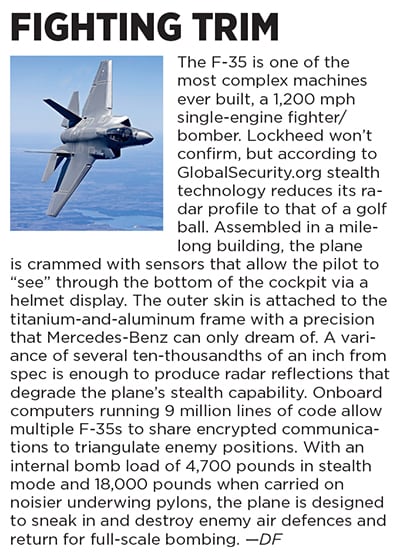

Image: Franco Vogt for ForbesWith a single tweet, Donald Trump carved $4 billion off the market capitalisation of Lockheed Martin, the world’s largest defence contractor. “The F-35 programme and cost is out of control,” Trump grumbled on Twitter at 8.26 am on December 12, attacking the F-35 Joint Strike Fighter, which at more than $1 trillion is the biggest defence project in history. Lockheed shares plunged by 5 percent as investors fretted Trump would kill or maim the effort. Lockheed hopes to make more than 3,000 F-35s, at $100 million each, in the next 30 years.

Investors needn’t have worried. That 5 percent decline was a blip in comparison with the 170 percent gain in Lockheed’s share price since chief executive Marillyn Hewson took over in January 2013. During that period, the company, based in Bethesda, Maryland, has delivered consistently higher profits and given back $12 billion to shareholders, despite declining defence budgets.

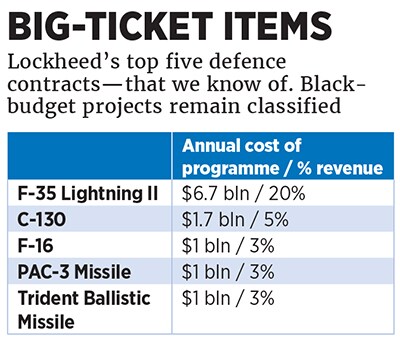

Trump will soon learn that the bullying tactics he uses at real estate closings don’t work so well with defence contractors. The F-35 was engineered not just for stealth but also for congressional support. Assembled at a 14,000-employee complex in Fort Worth, Texas, the fighter draws 300,000 parts from suppliers in 45 states, with a total estimated economic impact of almost 150,000 jobs.Even if Trump cancels the programme—about as likely as his nominating Hillary Clinton to the Supreme Court—it would be painful but hardly fatal for Lockheed, whose 2016 revenues will likely exceed $46 billion. The taxpayers have already covered some $45 billion in development costs on the F-35, and Lockheed sells billions of dollars’ worth of other gear to the government, from Trident ballistic missiles to helicopters to highly classified spy satellites. Trump can tweet his displeasure, but Lockheed is one of a handful of companies on Earth that can both invent an entirely new defence technology—say, radar-evading stealth—and then mass-produce it on an assembly line.

“Our business is not all around who is the president of the United States,” says Hewson, 62, who’s the daughter of an army hospital manager and worked her way through the University of Alabama as a night telephone operator. “We’re managing a huge supply chain, we have international partners around the world, and we expect a fair return for that.”

Hewson, who started at Lockheed in 1983 working on C-130 cargo turboprops in Marietta, Georgia, has long since mastered the vagaries of doing business with the government. For instance, Congress likes to break contracts into bite-size annual chunks, obscuring the total cost of huge weapons programmes like the F-35, even though that makes them more expensive and less efficient in the long run. Lockheed’s internal systems are optimised to deal with this sort of governmental nonsense.

Hewson is all in on defence, which accounts for over 90 percent of sales. One of her boldest moves was the $9 billion purchase of the Sikorsky helicopter unit from United Technologies in 2015, securing the $3.9 billion-contract for Marine One (the president’s personal fleet of 23 helicopters), which Lockheed had lost a few years before. That programme is ripe for an outraged Trump tweet, but Sikorsky also helps president-proof the company: Sikorsky helicopters are popular with foreign governments as low-cost weapons platforms and should help push overseas sales to 30 percent from around 25 percent today.

Sikorsky also allows Lockheed to display some of its Skunk Works-bred technical prowess. Take autonomous flight. Lockheed engineers are masters at the technology. The pilotless K-Max helicopter, for example, has hauled more than 4.5 million pounds of cargo to remote military posts in Afghanistan since it was deployed in 2011. In a few years, most of Lockheed’s helicopters could be pilot-optional.

R&D is another defensive strategy. On average, Lockheed spends $700 million a year to come up with technology the Pentagon can’t afford not to buy. The company’s Silicon Valley presence dates to the 1950s, when its engineers were pioneering the ballistic missile technology designed to deliver nuclear warheads. Now engineers in Palo Alto and elsewhere are working on hypersonic aircraft that could traverse the country in less than an hour, as well as on directed-energy weapons to blast incoming missiles apart with laser beams and a compact fusion reactor that can fit in the back of a pickup truck and power a city of 100,000. “My job is to make sure that as our customers’ priorities change, as the environment changes, we shift that portfolio of products to meet them,” Hewson says.But Lockheed isn’t just a massive research lab it’s also a manufacturing giant, producing not only sophisticated aircraft like the F-35 at scale but also robotic submarines and high-speed combat ships for the navy. It built the Patriot missile, the Aegis anti-missile system and the Viking rovers still cruising around Mars. Trump will discover that if he wants programmes like these, he has few other options.

The Pentagon can buy Sidewinder missiles from Raytheon and nuclear subs from General Dynamics, but Lockheed is probably the only contractor that can pull together a project the size of the F-35. Hewson’s biggest challenge is persuading Congress—and the Donald—to place larger orders so Lockheed can wring costs out of its immense supply chain and bring the price down to between $80 million and $85 million (less than the cost of Trump’s personal 757 jet).

“If you look at the global security environment and how challenging and crazy that is, and it’s our products that are going to help with that, I think we’re a great growth story,” Hewson says. “As I look at companies in our industry, I’d bet on us.”

First Published: Mar 07, 2017, 07:41

Subscribe Now