Inox India: Capitalising on the US's Shift Towards Shale

The US shale boom and some smart acquisitions have propelled the firm to great heights

Think Inox, think movies, right? Not in this case —far from it. Promoted by the DK Jain family, also the owners of the popular multiplex chain, Inox India is a specialised engineering company that manufactures cryogenic storage equipment and transportation tanks.

The storage equipment is for gases like argon, nitrogen and oxygen used by companies in the steel manufacturing, pharmaceuticals and food processing industries. It also manufactures gas cooling tanks used to transport LNG (liquefied natural gas) the tanks are sometimes used by oil drilling companies as well. The recent increase in global natural gas supplies has given a fillip to this business.

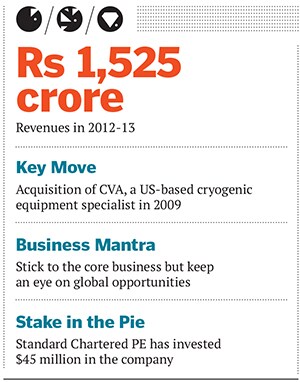

Until three years ago, Inox India enjoyed a monopoly in the Indian market but, since then, it has moved on to the world stage by acquiring a 70 percent stake in US-based Cryogenic Vessels Alternative (CVA) in 2009. This has, to a large extent, translated to a 10 percent market share in the global cryogenic storage and transportation business.

The shale gas boom in the US and the dollar’s resurgence have meant that the company’s profitability has doubled since the CVA acquisition, says Inox India’s director and CEO Parag Kulkarni. Its revenues today stand at $250 million, significantly up from $50 million in 2008. About 66 percent of the current turnover is derived from its global operations.

Last year, Standard Chartered Private Equity invested $45 million to aid Inox’s expansion in the US and Brazil, as well as to fund a joint venture with JAT, a Chinese company. “It will take a few years before we need more money. But this will also depend on how the market develops,” says Kulkarni. “So, while we are not looking for funding in the near future, it may make sense to go public a couple of years down the line.”

Inox India also makes small transport units of less than 30,000 cubic metres. The challenge with smaller payloads is the precise vacuum and temperature controls needed to transport gas. The company has used CVA’s knowledge to drive growth here.

THE MAN BEHIND IT

Parag Kulkarni is an industry veteran and could well be considered a loyalist. He has spent 39 years in the field of cryogenics. After getting a degree in mechanical engineering from Goa Engineering College in 1971 and an MBA from Jamnalal Bajaj in 1973, he joined IBP (now merged with Indian Oil). There he ran the cryogenics and high vacuum technologies operations from 1974 to 1992. Thereafter he joined the Inox Group and started Inox India at Vadodara. He has been with the firm ever since.  WHY IT IS GEM

WHY IT IS GEM

Inox India’s acquisition of CVA was a smart move, one that allowed it to capitalise on the changing energy landscape. Globally, industries as well as governments want to reduce ‘dirty’ fossil fuel consumption and move to either renewable energy or gas-based power. Inox India specialises in static gas storage, and CVA in transportation equipment. This synergy helped the company define its core business of industrial gas storage and transportation, and to enter the fast-growing LNG space in North and South America.

In the last two years, there has been a delinking of pricing between oil and natural gas. The latter has become much cheaper in the US and its usage has shot up too, creating demand for its transportation and storage. This has given impetus to the demand for barges and storage tanks. Its expertise in small-scale solutions gives Inox India an advantage. Additionally, since this is an extremely specialised engineering business, competitors don’t crop up overnight—it takes years of experience to join the fray.

Fracking (or induced hydraulic fracturing used to extract shale gas) has been a game changer as well: Many companies in the US are lobbying for permission to export. This bodes well for Inox India’s business.

Additionally, from its manufacturing plant in Sao Paulo, Brazil, Inox India will service South America—a region that doesn’t yet have a significant presence of global manufacturers of cryogenic tanks.

Why it was hidden

Cryogenic gas storage is a niche business. And Inox India operates in a segment that has two, or even three, degrees of separation from final consumers. “Also there are only a handful of suppliers and buyers in this trade,” says Kulkarni. The industry is still developing: Kulkarni estimates the total market for transporting LNG in small parcels to be $2-3 billion he pegs the industrial gas services business at $500 million.

Risks and Challenges

Inox India’s business is linked to macroeconomic conditions— volatility, therefore, becomes a concern. Almost 60 percent of its business comes from oilfield services and LNG shipping, both of which are cyclical in nature. Changes in energy policy can have a major impact on how customers move gas, especially LNG. Only 40 percent of its revenues depend on a steady business of servicing industrial units.

The industry has few buyers and sellers, hence the challenge lies in being consistent and credible. One small mistake could mean losing business to a rival, and for good. In India, Inox India faces competition from two European manufacturers: VRV of Italy and Cryolor of France, both of whom have recently set up shop in Chennai.

With large volumes of gases shipped at high pressures and low temperatures, safety standards are also a major concern in the business. Regularly updating the knowledge and skill sets of its teams and innovating engineering solutions to complex problems are key requirements. Hence, periodic investment in talent and knowledge is a must.

First Published: Aug 28, 2013, 06:36

Subscribe Now