Curious case of SME IPOs in India

Latest investment trends provide a strong indication that investors are looking to cash in the quick and handsome gains from SME IPOs and are disregarding the red flags and risks altogether

IPOs have always been a trusted way for retail investors to make money in the short term. Retail investors have shown enigmatic euphoria in the SME IPO market in the past few months. High market liquidity, fear of missing out (FOMO) on SME jackpots, and substantial returns in the short term are luring retail investors to SME IPOs. The news of smaller companies with questionable fundamentals and eye-popping valuation garnering very high subscriptions is becoming quite common. Recently, the news about Resourceful Automobile and Boss Packaging Solutions created a buzz on social media due to extraordinary subscription numbers while having a very modest business.

SME IPO of Resourceful Automobile, a dealer for Yamaha bikes in Delhi, was subscribed more than 400 times on August 26, 2024. It received bids for Rs4800 crore against issue size of Rs12 crore. This led to a lot of sarcastic commentary about how opening a bike dealership may become a road to raising a few thousand crore. Likewise, the SME IPO of Boss Packaging Solutions, which supplies packaging machines, labelling, capping, and filling equipment, was ridiculed with pictures of its dilapidated office while getting more than 135x subscriptions.

The market regulator SEBI also took note of such increased subscriptions in the recent SME IPOs and warned investors about the risks SME IPOs entail. SEBI also capped the listing day price to curtain gains to a maximum of 90 percent on listing day. Despite these, investors flock to the latest issues as if they are the golden ticket.

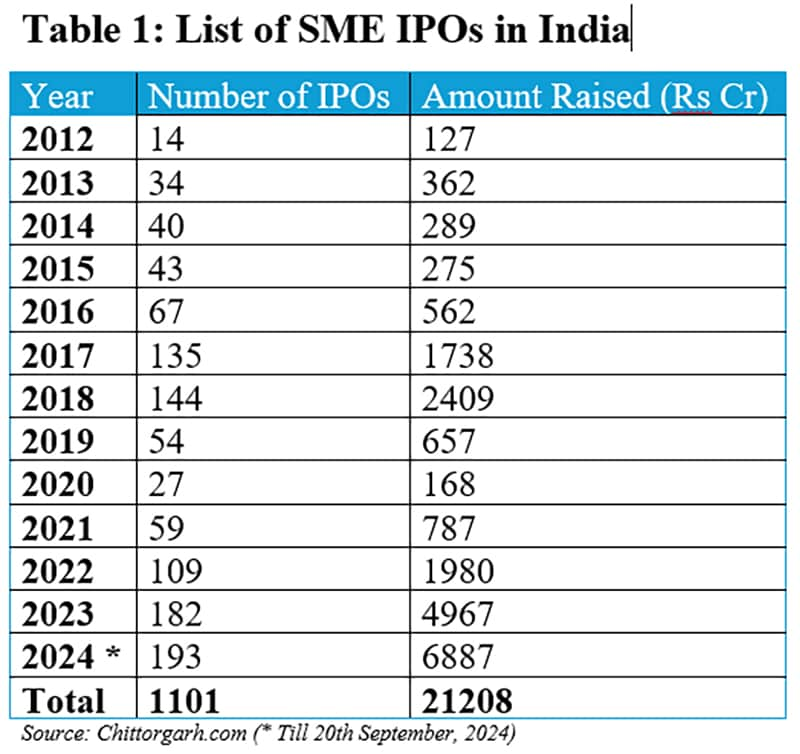

The SME IPO segment in India was introduced in 2012, with NSE and BSE launching their SME platforms BSE SME and NSE Emerge, respectively. The rationale was to provide the prospects for SME companies to access the primary market for fundraising, offering an alternative to relying solely on debt for expansion. Till September 20, 2024, 1101 SME IPOs have been done, raising over Rs21,000 crore (See Table 1). More than half of this amount was raised in the last two years. These trends provide a strong indication that investors are looking to cash in the quick and handsome gains from SME IPOs and are disregarding the red flags and risks altogether. The most important numbers they consider are not the fundamentals or financial performance metrics but the grey market premium (GMP).

It is imperative to examine the reasons for the euphoria from the perspectives of the important stakeholders in SME IPOs—the SMEs going public, market intermediaries, and investors.

SME Issuers: For issuers, SME IPOs present a valuable alternative to bank debt. SME IPOs are characterised by less stringent regulations and a simpler listing process compared to mainboard IPOs, making them an appealing option for SMEs seeking to raise capital and enhance their credibility with stakeholders. Many SMEs are trying to benefit from the upbeat market sentiment by taking the IPO route. With fewer checks and counterchecks on SME IPOs, even SMEs without strong business models and sound fundamentals are launching their IPOs and are assured of success due to the lure of investors for high listing gains.

Market Intermediaries: In the case of SME IPOs, merchant bankers are the main market intermediaries. SEBI mandates merchant bankers to carry out due diligence on the issuer, write the prospectus, appoint other intermediaries, and ensure compliance. The names of credible merchant bankers add confidence to the issue.

Anchor Investors: Anchor investors are large institutional investors, including public financial institutions, banks, mutual funds and Foreign Portfolio Investors, who invest money on behalf of their clients. Anchors are required to invest a minimum of Rs1 crore in an IPO with a lock-in period of 30 to 90 days. They have to place bids one day before the opening of the IPO to the public. As they are institutional investors, it is expected that they have carried out in-depth financial and qualitative analysis of the issue before investing. Increasing participation of anchor investors in SME IPOs boosts the confidence of naà¯ve investors and is also driving the subscription of SME issues.

Retail Investors: Retail investors are flocking to SME IPOs due to the potential for very high short-term gains. Out of the SME IPOs listed in 2024, two-thirds have given a listing day return of 50 percent, while 40 percent of IPOs have increased by more than 100 percent. Many of them doubled on Day 1 itself till NSE imposed a 90 percent price cap a couple of months ago. Interestingly, the percentage and the quantum of gains are higher in SME IPOs per application. In a mainboard IPO, the size of one application is restricted to Rs15,000, whereas in the case of SME IPOs, the maximum amount is Rs1,30,000. If one gets an allotment in a mainboard IPO, a gain of 40 percent will translate to Rs6,000, while an allotment in an SME IPO with a gain of 70-80 percent would mean at least a Rs90,000 gain.

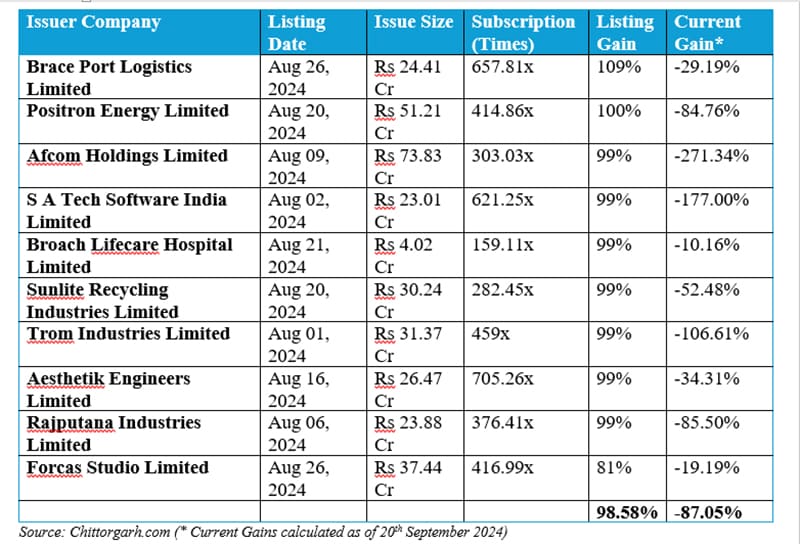

The biggest challenge is that once the initial euphoria dies down, the return and volume of SME stocks become stagnant. Most SME IPOs that list at substantial premiums start to trade below their listing price a few weeks thereafter and become illiquid in the following times. Table 2 shows the listing gains and current gains or losses of SME IPOs listed at a premium of more than 80 percent in August 2024. Notably, while the premium was obnoxiously high at the listing, within a few days of listing, the current market price has fallen below the issue price, leading to an average loss of around 87 percent on these IPOs with high listing gains. Notably, the average listing gain for all IPOs issued in August 2024 was 56.52 percent, while the current average loss is 59.68 percent.

Retail investors should, therefore, exercise prudence and not mindlessly follow the GMP numbers and social influencers when investing in the primary market. It is advisable that before applying to SME IPOs, retail investors read the offer document, understand the business model, competition, and industry, examine the financial health of the issuer, and compare the offer price with similar companies" valuations. Furthermore, the regulator must look to reign in on the purposive misleading by the market intermediaries and the issuers. Merchant bankers must be made to ensure a fair and prudent assessment of the issuer, which means only credible companies can bring an SME IPO.

Shikha Bhatia, Associate Professor - Finance & Accounting, IMI New Delhi

First Published: Oct 16, 2024, 18:01

Subscribe Now