Info Edge's biggest edge

Naukri's stellar performance gives the firm enough room to hang on to a clutch of loss-making startup investments. But for how long?

Info Edge is backed by Sanjeev Bikhchandani

Info Edge is backed by Sanjeev Bikhchandani

Image by: Amit Verma

Last month, when internet firm Info Edge—the owner of portals such as Naukri and Jeevansathi—declared its financials for fiscal 2018, two things stood out. One, the Sanjeev Bikhchandani-backed company maintained its stellar record of posting a sizeable top and bottom line: A profit of Rs 182.37 crore on revenue of Rs 915.49 crore. Two, that the undisputed star of the show was jobs portal Naukri, with revenue of Rs 668 crore, and profits of Rs 366 crore.

Yet, it isn’t a report card without blemishes. For the first time in over 10 quarters, Info Edge posted a loss of Rs 13.76 crore for the fourth quarter of last fiscal. What’s more, the company has written off and provisioned Rs 186 crore in its startup investments for FY18, again a first for Info Edge.

While a Rs 53-crore investment in four startups—Ninety Nine Labels (Rs 28 crore), StudyPlaces (Rs 5 crore), Nogle Technologies (Rs 3 crore) and Big Stylist (Rs 17 crore)—was written off, Rs 133 crore was provisioned, which includes an investment in deals portal Mydala.Also of concern is the lacklustre performance of three of Info Edge’s four core businesses. Real estate portal 99 acres is still in the red, matrimonial portal Jeevansathi and education portal Shiksha continue to bleed, and partly-owned subsidiaries Meritnation and Canvera too continue with their losing streak.

But Info Edge, for its part, is in no mood to press the panic button. Reason: Average estimated fair value for its portfolio is over Rs 3,500 crore. So far, the total net of part-exits (primarily the recent part-exit of Zomato) by Info Edge is about Rs 535 crore. “Out of this, only Rs 53 crore has gone bad and Rs 133 crore is provisioned in the books,” says Chintan Thakkar, chief financial officer at Info Edge. “So net of bad and provisioned, the investments are about Rs 350 crore,” he adds.

Thakkar maintains that one must not look at profit and loss (P&L) alone to analyse internet businesses. The internet businesses, he explains, are asset light but operating expenses are heavy. Investment in fixed assets like plant and machinery is replaced by investment in creation of intangibles (building of IT platform, network effects, traffic share, brand), mostly reflected by people expenses and marketing through profit and loss. It means more operating losses reflected in P&L instead of investment in balance sheet.

Investee companies of Info Edge, especially Zomato and PolicyBazaar, have witnessed good traction and revenue growth, Thakkar claims. “These ideas are disruptive in nature and it may be many years before the financials start reflecting what actually has been built,” he contends.

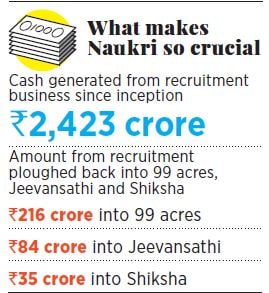

What gives Info Edge enough space to play the waiting game is the performance of Naukri. While total cash generated from the recruitment business since inception has been Rs 2,423 crore, only a fraction of it has been ploughed into 99 acres, Jeevansathi and Shiksha.

Analysts and venture capitalists don’t read much into the losses of startups under Info Edge portfolio for two reasons. First, the big cushion provided by Naukri, and second, the gambit of hunting for another Zomato.

“Clearly, Naukri is their crown jewel,” says Amit Somani, managing partner at Prime Venture Partners. In fact, thanks to Naukri, Info Edge has been one of the most capital efficient companies, having raised very little money before the IPO and delivering terrific profits year after year.

Sandeep Murthy, partner at venture capital firm Lightbox, avers that Info Edge has little to worry. “If they were able to build this type of portfolio once, they will be able to do this again,” he says.

First Published: Jun 16, 2018, 20:58

Subscribe Now