ACT Grants: Using the VC model for philanthropy

A philanthropy collective set up by venture capitalists (VCs) who came together with tech entrepreneurs and social impact leaders during the pandemic in 2020, has continued and institutionalised its g

In 2022, Chandigarh-based Sukhmeet Singh, whose startup Agri to Power helps convert biomass to fuel, was looking to raise funds. Singh needed the money to expand from being a manufacturing firm to setting up a marketplace that brought all stakeholders—farmers from whom the biomass was sourced, to manufacturers of biofuel and industries using the fuel—together. Though the startup, which set up its first manufacturing unit in 2018, was registered as a for-profit company, there was more to Singh’s motivations and vision: It was a way to resolve the problem of stubble burning as well as help companies move towards cleaner fuels.

“We were clear that we didn’t just want the money part of it, for that we would have probably gone to a VC, but [we wanted] people who understand what else is required to grow in the space... because we do a lot of work with farmers and also as a social enterprise," says Singh. Besides, he adds, “We may not be able to give the multiples of growth that a VC would require."

A grant from ACT Grants enabled Singh to set up the platform and also look at if not 10x, then at least 4-5x growth.

Agri to Power is one of several startups in the social impact space that is building for Bharat and has been given grants by ACT Grants, a philanthropy collective set up by venture capitalists (VCs) who came together with tech entrepreneurs and social impact leaders during the Covid-19 pandemic in 2020 and have continued and institutionalised their giving, not just of money but also time, effort and resources.

It all started with a bunch of VCs sitting on a call one Saturday morning at the beginning of the pandemic, recollects Mohit Bhatnagar, MD, Peak XV Partners, and one of the founding members of ACT Grants. “We were like, we have taken care of our families, our own firms and employees, but what more can we do as a community? And someone on that call said, you know there’s a parallel call going on right now with a bunch of founders who are thinking of the same things and we immediately patched those two calls."

Before they knew it, they were meeting every evening, coming up with ideas, fundraising, and looking for and evaluating companies to back, basically a bunch of young VCs doing what they do in their normal jobs except that the companies were those creating solutions to fight the pandemic.

It all came together in a very organic way, says Anjali Bansal, founder of Avaana Capital. “We all said, what do we do best? We know how to raise money, we know how to make good decisions, and how to help businesses scale. And we can support founders and the startup ecosystem."

And so, ACT came into existence in March 2020 with a corpus of ₹100 crore and 34 founders and leaders, including Prashanth Prakash, partner, Accel, Sandeep Singhal, senior advisor, Nexus Venture Partners, Ashish Dhawan, founder, Central Square Foundation and Abhiraj Singh Bhal, co-founder, Urban Company.

Between waves one and two of Covid, it went on to raise another ₹464 crore, becoming one of the larger Covid platforms with strategic partners that included the Michael and Susan Dell Foundation and the Bill & Melinda Gates Foundation, among others.

“We started raising money, our own money to start with, and then a bunch of additional money," says Bhatnagar. “We said we know how to spot entrepreneurs who can create massive change. We believed founders who create successful businesses have the entrepreneurial mindset to also solve some of India’s societal challenges."

The funding was philanthropic in nature, the aim social impact, but the outlook was very much that of a VC. Evaluating with the same principles applied to investing in startups—where data is critical, bias for action is important, as is learning on the go, trying, failing, learning, pivoting, scaling—the platform evolved and supported everything from oxygenation, masks, vaccines, NGOs, public health initiatives, governments, constantly moving fast to provide both capital and additional support.

Anjali Bansal, founder, Avaana CapitalImage: Selvaprakash Lakshmanan for Forbes India

Anjali Bansal, founder, Avaana CapitalImage: Selvaprakash Lakshmanan for Forbes India

As the onslaught of Covid came to an end, and people went back to their day jobs of running their firms, the collective faced a choice. “When wave two got over, the choice was do we continue or do we disband," recollects Bansal. “And we said, ‘No, there’s so much momentum, so much energy. Let’s pick two or three other important issue areas, in addition to health care, that are critical development areas in India and ACT people are passionate about."

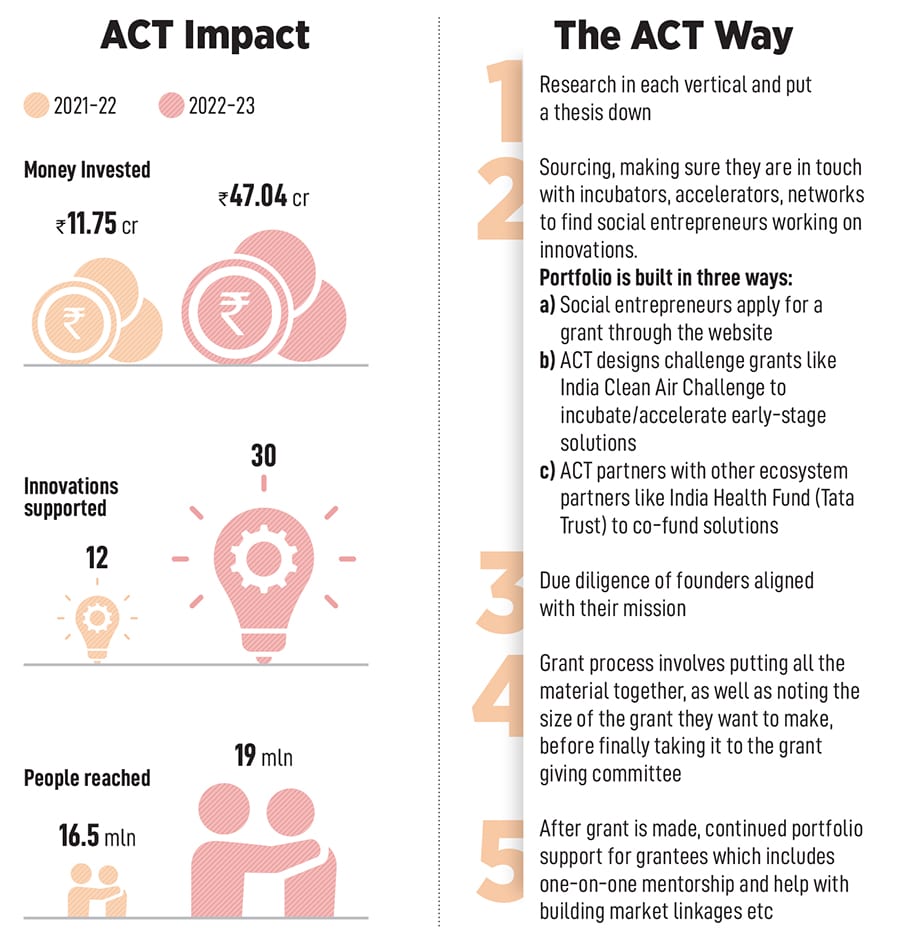

When it comes to NGOs and the social impact sector, points out Aakanksha Gulati, director at ACT Grants, who joined in November 2021, the grant capital available can be broadly divided into three big categories. “One is CSR, the second is large international foundations, and the third is individual philanthropy."

The typical model in the first two is that of programmatic funding, where 90 percent of the money usually goes to the last-mile beneficiary, leaving only 10 percent for operational costs. “If it’s, say, education, they will ask what’s the cost of supporting a child, that child times x number of children is the cheques you write," she says.

Where ACT Grants differs is that it offers seed capital without any conditions, providing funding for tech and innovation, as well as tech advisors to help build the technology and connections to and mentorship from experts in the industry.

Non-profit edtech startup Rocket Learning was one of the early beneficiaries of an ACT grant that has enabled it to fund innovation. “It was probably the only funding that was totally unrestrictive in terms of saying we are not funding you asking that you work in this district or that, we had other funders, CSR and so on, who were doing that. But ACT said use it on innovation, on tech, on content, whatever you feel is useful and that’s how we were able to build some of our early solutions," says Azeez Gupta, co-founder. The startup has built a free AI-enabled WhatsApp solution that enables low-income parents and Anganwadi workers to focus on early childhood education.

The association has also helped them scale. “The funding that ACT provides along with the connections has been massively helpful for us to reach the scale we are at today of impacting people," adds Gupta.

The focus, then, is also on sustainability and scale, where “the sustainability ultimately comes from the users who pay for it", says Singhal of Nexus. “The whole idea is that there is enough value-add in what the startup is doing that they will be able to charge for it and not expect grants to continue to fund it. We do a catalytic grant, we try and stay away from funding situations where the company will continuously need grants."

In the case of Rocket Learning, for instance, when it started partnering with ACT, it was working in eight districts, and now it is present in over 80 districts. The proportion of the grants too has gone down. “We were one of the first donors and at that time they had a ₹3-crore budget and we wrote a cheque for a crore," points out Gulati. Over time, even as they have scaled from 10,000 students to 3 million students on the platform, their dependence on ACT’s grants has gone down. “We went from being 33 percent to 25 percent to now less than 10 percent grant giver," says Gulati.

As with all VCs, they are also ready to take risks, knowing there will be some failures along the way. “We’re okay with knowing that some of our grants will not deliver impact in the long run, [that] they are early stages, high risk, and this has happened already. Some of our early-stage grant organisations have ceased to exist two to three years later," says Gulati. But, embedded in those failures are lessons about what works in Bharat, how sustainable models can be built and the mistakes founders might make. “We see our failures as important ways to push our learning forward as an ecosystem."

As in the life cycle of startups, it’s still early days for ACT Grants, with processes in the gender vertical still being put in place and in a different approach from the other three verticals, data is being collected first before going into dedicated grant making. A research study by ACT, ‘Women in India’s Startup Ecosystem Report 2023’ or WISER, aims to help Indian startups advance gender diversity and inclusivity at the workplace. But to start with, some cross-vertical grants have been made. “We’ve done a grant to Karya, for example, which is actually an education-cross-gender grant. There’s another grant to an organisation called Dvara Health Finance, which is a health-cross-gender grant. The hope is to, over the next six months, also raise gender grants," says Gulati.

The platform, which started out as a place for individuals to work in a collective philanthropy environment, has also been getting requests from people who want to pitch in with funds and get involved. And the idea, says Singhal, is that in five years, “once you have this set and we get more and more people involved, people take on individual areas of interest that they want to drive, as with Suman [Gopalan, ex CHRO, Freshworks] taking on women empowerment. So we expect that more and more people will come on board."

First Published: Feb 08, 2024, 16:35

Subscribe Now