“It was this recognition that there’s this opportunity for tremendous disruption and innovation in tech services that led me to getting together with my partners to form Recognize," D’Souza says. Recognize is a private equity (PE) firm at which D’Souza and his three co-founding partners—long-time colleague, former president of Cognizant, Rajeev ‘Raj’ Mehta Charles Phillips, former president of Oracle and former CEO of Infor, an enterprise software company and David Wasserman, a PE veteran who’s led several well-known deals—announced their inaugural fund of about $1.3 billion in January.

The plan is to identify the next generation of tech services companies early in the game, and get in with operational control, offering the prospect of tremendous growth in return. All this, on the back of Recognize’s founding partners’ collective 100 years of experience in building multi-billion dollar businesses.

The timing seems perfect. Even before Covid, technology was advancing and changing at a never-seen-before pace. And the pandemic permanently changed the way companies needed to do business and how individual employees worked.

“It’s a particularly challenging time," D’Souza points out. “You have this tremendous amount of innovation happening, acceleration in the need to deploy, and at a time of significant fragmentation in the technology stacks that enterprises need."

That means both the need for very deep specialisation and also the ability to work in an ecosystem. Therefore, the technology services providers need to come up with new models that deliver end results—meaning tangible business outcomes—for customers and not a service as simply an input. This conversation has been happening for a while, but D’Souza feels we’re at the tipping point now. And that’s the opportunity that the partners at Recognize see—to identify the entrepreneurs who are building these new models and help them become global businesses.

Changing Landscape

If one goes back many years, the tech services industry was largely a people-focussed industry. While that will continue— even taking automation into account—the first big change, and therefore the opportunity, D’Souza sees is the necessity to embed significant amounts of intellectual property (IP) into the services businesses.

This will mostly be in the form of software, data and data management. The next generation of tech services companies will have far more IP-based solutions to offer than the companies we know today.

Even today’s big IT companies recognise this, and have been moving to build as well as acquire specialisation at scale. In Cognizant’s own case, the $2.7 billion acquisition of TriZetto Corp, seven years ago, in the health care space, is an example. And Capco, a financial services consultancy, whose sale to Wipro was led by Wasserman, is another example.

![]()

The second big change that is unfolding is around managing people, often referred to as ‘future of work’. Especially after the pandemic, the human need to do work that feels meaningful and fulfilling has been spotlighted, even as employers seek ways of keeping churn down and maintaining a degree of predictability over the talent that they can rely on for upcoming projects.

Torc, a small startup that Recognize has invested in, is an example of a new generation of services companies that is addressing this problem, with its marketplace for connecting talented freelance developers with enterprise customers. More on that later.

And the third big change is one that has been discussed a lot, but which is now seeing actual adoption, is about focusing on business outcomes and not on tech inputs. “We think that the time has come when services businesses have to focus on creating outcomes for clients and creating commercial relationships that are based on outcomes, as opposed to the traditional model, which has been more input focussed," D’Souza says.

There is also the funding gap. “The tech services space is three times the size of the software space, and yet has only attracted a third of the PE capital compared to software," D’Souza says. “So it’s a tremendously large opportunity and that’s one of the reasons we’re so excited about Recognize."

![]()

The recognize team

In addition to the timing of the Recognize fund, D’Souza argues that the collective strengths of the founding partners will be another important advantage that the firm can bring to its portfolio companies. Both Mehta and he were “co-conspirators in building Cognizant" into one of the world’s biggest IT services companies.

“We understand how to identify talent and how to build organisations, how to identify new market opportunities in the services space and scale businesses quickly," he says. “That’s what we did, over and over again, at Cognizant."

After leaving Cognizant, wanting to understand PE better, D’Souza sought a brief meeting with Wasserman, a long-time partner at investment firm Clayton, Dubilier & Rice (CD&R), whom he had known because of the finance expert’s involvement in the tech services deals, including, very early on, the purchase and sale of Covansys, and more recently Capco.

What was initially supposed to be a half-an-hour quick catch-up over a cup of coffee turned into a two-and-a-half-hour meeting, in which D’Souza was pleasantly surprised to find Wasserman seeing the same trends of rapid innovation, fragmentation of tech stacks, need for speed and focus on outcomes. “I would say that that meeting with David was probably the genesis of Recognize," he recalls.

D’Souza had first appeared on Wasserman’s radar in the early 2000s when Cognizant was outperforming competitors, including Covansys, which CD&R had acquired. And when D’Souza joined General Electric’s (GE) board as its youngest director in 2013, that had caught people’s attention as well. With CD&R having had many people from GE, the two connected again.

Wasserman brings experience like what he did with Capco, which he carved out of the American multinational fintech giant FIS, in 2017, and then helped grow it into a strong, independent financial services tech consultancy. Wipro acquired it in 2021 for $1.4 billion, about three times what CD&R paid for the 60 percent it bought in Capco.

“At Recognize, we wanted to create a fund that gave us enough flexibility, from studio investments to larger growth capital, which meant that something around a billion dollars would be ideal," Wasserman says. “We exceeded our target and ended at just under $1.3 billion."

Along with D’Souza’s and Mehta’s services experience and Wasserman’s financial acumen, Charles Phillips brought deep knowledge of the software industry. With Cognizant having had a close partnership with Oracle as a systems integrator, the former IT company leaders already knew Phillips, who had been president of Oracle and later CEO of Infor, another enterprise software company that was later acquired.

Phillips started his career with the US Marines, where he was a captain when he left—after nine years of active duty—to get a law degree and then pursue a corporate career in technology. The military tradition is one that has been in his family, says Phillips, whose son is also in the military. “Service first before you do whatever else. Best thing I ever did, it’s always good for you," he says.

At Recognize, everyone understands that with the ongoing global war for technical talent, there is both the need to train more people and to increase the productivity of the existing workforce, Phillips says. The latter, in particular, is a strength that the firm brings to the table, he adds.

“And we think that there’s an almost unlimited demand over the next 10 years of finding companies that will sit in between the software companies that do the innovation and the customers that need to adopt it," he says. “That bucket of tech services right now is still constrained and we are trying to figure out ways to scale that."

One important result of having IP that is useful to customers is that it can become a source of recurring revenue and “you can get a premium for it", Phillips says. That, in turn, helps to make the tech services provider a “less bespoke and more predictable blended company".

“We think there are enough entrepreneurs out there who’ve reached $50-100 million (in revenue) and they wanna know how to get to a billion… I think they’ll value our operating experience," he says.

![]()

PE firm, VC’s heart

The Recognize fund is structured like a PE business, meaning the partners prefer to have a controlling stake in their portfolio companies, among other things, but the investments are more like growth equity, D’Souza says. He expects the fund to operate over the next decade or more, while somewhere along the line, it will also raise a second, larger, fund.

Wasserman didn’t reveal names of investors in Recognize, but said the list included “some of the largest and most prestigious university endowment funds in the US, state pension funds and family offices, alongside the partners themselves who are significant investors in the fund".

From the first fund, the plan is for Recognize to invest in a small number of companies, in the range of eight to 10, including at least a few platforms, in the tech services space. And then the partners want to work very closely with the co-founders and management teams of these ventures to rapidly grow the companies into large businesses.

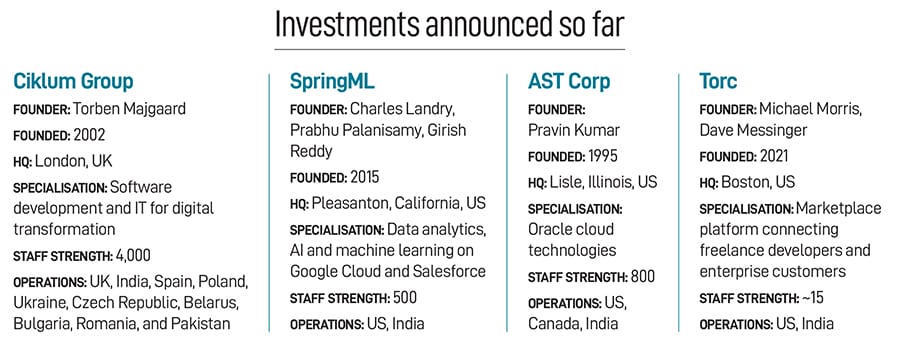

SpringML, a consultancy that offers deep data analytics capabilities on Google Cloud and Salesforce platforms, is an example. The company was co-founded in 2015 by Charles Landry, Prabhu Palanisamy and Girish Reddy, who saw an opportunity to deliver deep analytics-based results to customers in multiple areas.

When Recognize invested in the company last year, “I think it’s important to note that we weren’t running a process. We had not put ourselves up for sale or hired an investment banker, etcetera," says Landry. But the “phenomenally impressive" experience that Recognize’s founders offered swayed SpringML’s founders. “They truly have been there and done it," Landry says.

![]()

And from Recognize’s point of view, with respect to any of the companies on the firm’s portfolio, “the most important thing for us is that we feel that we’re investing in a company that is playing against a very powerful theme in technology services today and that has a great management team", Wasserman says. “So, in general, we are structured like a PE firm, thinking of ourselves more like growth equity players," adds D’Souza.

Typically, Recognize will cut cheques ranging from $50 million to $250 million, with scope for follow-on investments as well. In addition to SpringML and Torc, Recognize has announced two other investments to date. One is Ciklum Group, a digital engineering company with a strong client base in Western Europe and delivery capability in Eastern Europe. It has some 3,500 engineers. The other is AST Corp, an Oracle-focussed provider that helps clients implement Oracle databases and migrate to the Oracle cloud.

SpringML, Ciklum and AST are examples of the traditional PE/growth equity investments Recognize has made so far. But also, “very, very selectively, we’ll do what we call studio investments", D’Souza says, which will be more like investing in early-stage startups, in promising areas where there aren’t existing businesses of scale.

Torc is such an example. The company is trying to build a platform to connect tech gig workers from around the world with enterprises looking for their skills. Torc CEO Michael Morris had met D’Souza several years ago, when Cognizant had given him an award at another developer community-based company, Topcoder, for its novel approach to software development. Topcoder was later acquired by Wipro.

His own career has taught him that entrepreneurs have to do two things in parallel—keep the talent pipeline strong and the customer demand channel robust, Morris says. In that context, “there’s a ton for me to learn from how Frank built Cognizant", he says.

In the long run, there may also be opportunities to get the portfolio companies to tap each other’s complementary strengths. For example, both SpringML and AST have a strong presence in serving state and local governments in the US, albeit in different areas.

While it’s early days, the potential exists for them to collaborate and offer a richer ecosystem of solutions and services to their government customers that each company wouldn’t individually be able to.

Another way the partners at Recognize want to actively help their companies is to figure out how to get them access to talent from around the world that they may not be able to reach at the current stage of their growth in terms of size, scale and market focus.

For now, the portfolio companies are mostly all focussed on the US market. Emerging markets, including India, represent a chance to test out new innovations that could find applications in the advanced economies as well. On the talent front, of course, having an increasingly global network is table stakes these days, D’Souza says. SpringML, for example, has nearly two-thirds of its total staff of 500 based in its India centre in Hyderabad. AST, too, has a base in India and Ciklum is about to announce one. Torc also expects to expand rapidly into India to tap the large pool of developers here. And Morris has recently hired a full-time head of India operations.

Shifting Dynamics

“We want to be known as the place where inspired entrepreneurs in tech services can find a place of like-minded operators and investors to build truly spectacular businesses," D’Souza says.

Recognize also wants to do it in a way that steers more of the high-quality jobs that the tech services sector creates towards under-represented parts of societies around the world, he says. And the “third leg of the stool" is about getting entrepreneurs to push the envelope and build the next generation of tech services leadership “much like we did at Cognizant where many of the Cognizant team members have gone on to run services businesses as CEOs and become leaders in their own right".

In the past, the critical success factor for an IT services business was how effectively it could generate demand, put together a set of services and solutions, and build the sales capability to get those out into the market.

“In the coming decade, the dynamic is going to shift to the supply side," D’Souza says. The tech services winners of the future are going to be the ones that are able to attract and retain the best team, and create an environment and a culture within the company for that.

The tech services company’s competitive advantage will stem from the ability to create an environment where employees can say, ‘This is a place where I can do my best work. I’m empowered. I am autonomous, I have a sense of purpose’. And those would be the tech winners of the future, he says.

D’Souza, the son of an Indian career diplomat who hailed from Goa, was born in Kenya. He started his career as a management associate at Dun & Bradstreet, in 1992, after an MBA from Carnegie Mellon University. He was tasked with building what became Cognizant as an in-house unit of the American data and analytics company.

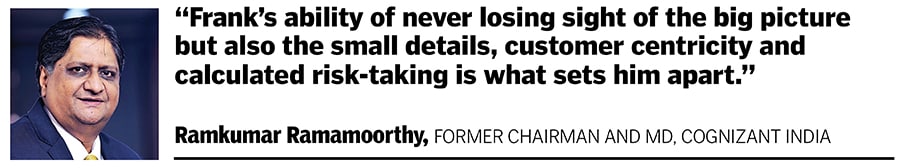

He rose through the ranks to become CEO in 2007. The following year, the global financial crisis struck. D’Souza steered Cognizant—which at the time had over 50 percent revenue exposure to financial services and 80 percent to the US market—through the next year to clock more than $450 million in incremental revenue, recalls Ramkumar Ramamoorthy, former chairman and managing director of Cognizant India, who spent 22 years at the IT company, working closely with D’Souza.

The series of meetings that D’Souza orchestrated for the company’s top executives during that period—getting them to fly into Frankfurt airport every month to meet at the basement Sheraton hotel, to take stock, customer by valued customer—has since become part of Cognizant lore as the ‘Frankfurt meetings’.

“He once took a flight to India just to spend half a day in person to help close a potential acquisition that Cognizant was looking at, and took a flight right back," Ramamoorthy says. In fact, on the day of Cognizant’s listing on the Nasdaq, in 1998, D’Souza didn’t try to be at the stock exchange or the company headquarters, but went to meet a prospective client in Omaha, Ramamoorthy recalls. That prospect turned into a prized client who continues to work with Cognizant, he says.

Other qualities that Ramamoorthy sees in D’Souza are decisiveness and “an uncanny ability to see what’s next". For example, TriZetto Corp’s $2.7 billion acquisition was more than 20 times bigger than the biggest acquisition that Cognizant had made up to that point, Ramamoorthy points out. “In TriZetto, D’Souza saw an opportunity to shape an entire industry, rather than merely transform individual client businesses," he says. “Frank’s ability of never losing sight of the big picture but also the small details, customer centricity and calculated risk-taking is what sets him apart."

Four-and-a-half-years ago, D’Souza had told Forbes India that “the best days (of tech services) are still ahead of us". At Cognizant, he helped set the IT services giant on the path to that future. At Recognize, he aspires to be a force multiplier for tomorrow’s tech services giants, today.