She headed out to Palladium mall in Lower Parel for a touch-and-feel of the collection she’d been browsing online. “That must be the first time I visited a mall in around one and a half years," she says. While she’d hoped that Palladium would have regained its pre-pandemic buzz, it was anything but so.

“Every moment inside the mall made me realise that we’re still in the midst of a pandemic," she adds. There was an all-pervasive smell of sanitisers, temperature and vaccine status checks at multiple points, queuing up outside shops to maintain social distancing and the ubiquitous masks. “It was like every step was being monitored inside the mall. I stood in queue outside Zara to get in, but once inside I was so worked up that I decided to shop extra as a reward for adhering to the safety protocols," she says.

Pareek’s isn’t an uncommon experience as visiting a mall today is significantly different from what it was in the pre-pandemic world. The freedom to move around is now limited, especially in the metros where Covid-19 regulations are restricting retail operations. Despite this, people are visiting malls, albeit with a slightly different approach: They are buying more. “There was as long a line at the billing counter as there was outside the store," Pareek says.

Shopping trips to the malls are now shorter, but shopping lists have gotten longer, says Dalip Sehgal, CEO, Nexus Malls. “People have become conscious about how they visit and the time they spend at malls. Shoppers are being responsible and follow Covid-appropriate behaviour. There is a lot less window shopping and trials."

![]()

With a network of 16 malls in India, Nexus claims to have reached 90 percent of pre-pandemic sales levels. “Since the first unlock phase, we have been seeing a massive shift in the type of consumers that are coming back. The high-value items go off the shelf the fastest—it could be attributed to the frustration of being locked at home and having a lot more disposable money that people ended up saving," says Sehgal, adding that with work-from-home becoming a part of life, electronic gadgets sales at malls are on the rise. “Only serious shoppers visit the malls today. Customers come in with a focussed intent. They know what they want to buy and from where they pick it up and head out," he says.

Footfalls at malls is still significantly low, primarily because of restrictions and the risk of being in a closed space, but people going to malls are not shying away from spending. “A lot of people are buying high-end products. Malls are being perceived less as a place to relax and more as a diligent shopping affair," says Abhay Gupta, founder and CEO, Luxury Connect, a luxury brand consulting firm.

[qt]There is a strong pent-up demand, especially after the second wave, as reflected in retail sales."

Anuj Sethi, senior director, Crisil Ratings[/qt]

Road to recovery

The customer reaction towards malls comes as a relief to the retail sector, one of the worst affected by the pandemic. Mall owners incurred a loss of around ₹4,500 crore during the second wave of the pandemic due to lockdowns and restrictions, while the overall retail loss during the second lockdown stands at ₹50,000 crore, according to the Shopping Centres Association of India (SCAI).

“Revenues have taken a serious hit—we have only collected around 45-50 percent of rental revenue across malls in FY20-21. Even in FY22, we don’t see revenues going beyond 60-65 percent of pre-pandemic levels," says Mukesh Kumar, chairman of SCAI. “We’re hoping to get support from the government in terms of waiving off property taxes, signage, and hoarding licence fees, since it’s difficult for retailers and mall owners to sustain themselves." Kumar is confident that current levels of customer engagement will get things back to normal soon. “It’ll take another three to six months for malls to get back to the 2019 levels."

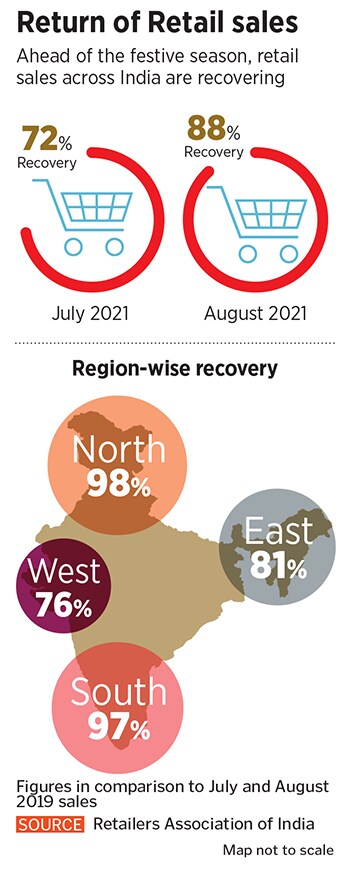

Based on an analysis by Crisil Ratings that covered India’s top 14 malls across most major cities, footfalls remained negligible as compared to pre-pandemic levels even during the first quarter of FY21. It adds that as malls opened up from Q2 of FY21, footfalls improved to around 50 percent and 70 percent of pre-pandemic levels in Q3 and Q4 respectively. The second wave and consequent lockdowns, however, hit footfalls again in Q1 FY22. “Nevertheless, shorter restriction periods—the average duration of closures in the top eight cities was seven to eight weeks during the second wave as compared to 13 to 14 weeks in the first—and sharper bounce rate after the second wave has resulted in footfalls crossing 50 percent of pre-pandemic levels," says Anuj Sethi, senior director at Crisil Ratings.

“Post the closure period, there has been a strong pent-up demand, especially after the second wave, as reflected in retail sales indicated earlier. A higher number of serious shoppers are visiting shops, though footfalls of leisure shoppers are also rising gradually. Consumer confidence is improving as vaccination gathers pace. Retail sales at malls were around 80 percent by Q4 FY21," adds Sethi.

![]() Visitors at the UB City Mall in Bengaluru

Visitors at the UB City Mall in Bengaluru

Image: Hemant Mishra for Forbes India

Mall operational rules vary across states. While some states demand a negative RT-PCR test for entry, others mandate the customers and the staff to have completed 14 days after their second vaccine dose. Some cities have no restrictions at all. Operating hours also vary from state to state, “leading to a lot of confusion across the industry", says Sehgal. “More than RT-PCR reports and vaccination certificates," he adds, “we feel these ever-changing and stringent regulations and preferential treatment for high streets have not allowed malls to recover businesses to their potential."

Social distancing norms and the wariness of closed environments have led various leading brands to eye high street markets. From April 2020 to May 2021, research by a real-estate consulting firm Anarock shows that major retail brands closed at least 119 lease deals at prominent high street markets. However, Pankaj Renjhen, COO and joint MD at Anarock Retail, says, “Most Indians prefer malls for their ambience, convenience and multiple options for entertainment and socialising, which, apart from their usual parking woes, high streets cannot match. So the preference for malls cannot be matched by high streets."

While safety mandates can be demanding, they also help establish trust in malls. DLF Emporio, Delhi, for instance, has been strictly following governmment safety protocols. “We religiously follow all Covid-19 safety protocols and have a zero-tolerance policy towards anyone not following them, because of which the customers have no hesitation in visiting the mall anymore," says Prashant Gaurav Gupta, VP and centre head, DLF Luxury Malls. “Restrictions on international travel has led to pent-up demand among shoppers, who now do not seem to be as affected by sale prices and are shopping from their favourite brands irrespective."

![]() A major problem being faced by malls is the lack of predictability of operations. “Switching on and off may be operationally inefficient and impact already stretched financials. Key tenants like cinemas remain closed or are operating at low capacity, which continues to impact footfalls. Capacity and timing restrictions for F&B is another problem. All these have reduced revenue visibility for malls even in peak timings," says Sethi.

A major problem being faced by malls is the lack of predictability of operations. “Switching on and off may be operationally inefficient and impact already stretched financials. Key tenants like cinemas remain closed or are operating at low capacity, which continues to impact footfalls. Capacity and timing restrictions for F&B is another problem. All these have reduced revenue visibility for malls even in peak timings," says Sethi.

The cost of maintenance during the pandemic has gone up considerably for malls. “The higher frequency of sanitising the premises, ensuring all staff members have equipment to remain safe, air conditioning maintenance etc, have added to overheads. Each time a mall has to shut or curtail operations, restarting the entire facility has been a cost-intensive exercise," says Sehgal. “Despite the differential treatment given to malls, there has been absolutely no support or respite on the financial front for mall operators from any of the authorities."

“Many retailers have learnt important business lessons from the first lockdown and have altered their strategies, like taking an omnichannel sales approach and offering home delivery services," says Gupta of DLF. “With most Delhi residents now fully vaccinated, the fear factor has drastically reduced. Add to that the upcoming wedding and Diwali seasons, which seem poised to be a big one as physical retail is beginning to look good once again."

Private equity investments in the retail sector in 2020 were also adversely affected due to the pandemic. While 2019 saw profits of ₹7,114 crore, the highest since 2015, 2020 saw negligible revenue. But deals are starting to take place now. “This year looks quite promising with several major deals being signed. Blackstone has invested in the Prestige Group with a portfolio deal that includes eight malls. GIC has formed a ₹5,387 crore joint venture with Phoenix Mills to set up and operate retail-led mixed-use properties in the country, and the Warburg-Runwal platform is evaluating various assets," says Renjhen.

Online-offline hybrid model

Nearly 80 percent of luxury sales today are “digitally influenced"—whether it is asking a friend on social media or checking out an influencer’s recommendation on Instagram—says a Knight Frank Wealth Report, 2021 by McKinsey. It forecasts nearly one-fifth of global luxury sales will take place online by 2025. During the lockdowns, too, all luxury brands started focussing on their online presence. Now, as malls open up, how important will in-store presence be?

![]() There is a focus on vaccinations, with mall staff being fully vaccinated, and visitors having to to show their vaccination status before entering stores

There is a focus on vaccinations, with mall staff being fully vaccinated, and visitors having to to show their vaccination status before entering stores

Image: Madhu Kapparath

Gupta says that for luxury retailers, in-store sales will always hold importance: “People like the touch and feel of luxury goods. Being physically present when you buy something super expensive and carrying it home will always be the preference of customers. Online shopping cannot replace that."

Uzma Irfan, director, Prestige Estates Projects Limited, which manages the luxury retail complex at UB City in Bengaluru, agrees: “The art is to strike the right balance between the physical/in-store and the online/e-commerce experiences. Online helped sustain the operations during the lockdowns, but it is time we accelerate our approach towards online shopping. When it comes to luxury brands, retail stores add value to the consumer’s decision-making journey."

The share of e-retail sales will likely rise to 8-9 percent this fiscal compared to the pre-pandemic level of 4-5 percent, as per Crisil Ratings. “The hybrid models are going to be prevalent in the future wherein physical stores will opt for online channels. Additionally, many online-only platforms are setting up physical stores as well," Sethi says.

Retailers are now focussing on an omnichannel presence, and incorporating digital advancements that make in-store experiences seamless. “There is a trend to lean towards the hybrid model. Stores are adopting high-tech fitting rooms, AR/VR, hospitality lounges, shipping online orders from stores as they reap the benefits of the best of in-store shopping and ecommerce at the same space," says Uzma.

The way forward

“Questions about the future of the mall culture have been raised ever since the first mall was built in India, and even when ecommerce started taking shape," says Sehgal, “To me, malls are here to stay. As an industry, we have suffered huge losses because of this inconsistent 15 months. Any more disparity would only make it difficult to sustain the lakhs of jobs that are directly and indirectly dependant on retail."

A third wave of the pandemic leading to further closures is a risk to recovery this year, says Sethi. “If the third wave impacts the festival season, the impact will be higher. Mall revenues may see a further contraction of 10 percent."

Gupta of DLF is optimistic: “The retail industry, in general, has been very resilient, and will continue to be so in the future. With vaccinations in full stride across the country, we are hopeful that a severe third wave can be avoided. If not, then the lessons learnt from the last two lockdowns and contingency plans put in place by businesses will no doubt see them through."

Customers queue outside a Louis Vuitton store at DLF Emporio in New Delhi

Customers queue outside a Louis Vuitton store at DLF Emporio in New Delhi

Visitors at the UB City Mall in Bengaluru

Visitors at the UB City Mall in Bengaluru A major problem being faced by malls is the lack of predictability of operations. “Switching on and off may be operationally inefficient and impact already stretched financials. Key tenants like cinemas remain closed or are operating at low capacity, which continues to impact footfalls. Capacity and timing restrictions for F&B is another problem. All these have reduced revenue visibility for malls even in peak timings," says Sethi.

A major problem being faced by malls is the lack of predictability of operations. “Switching on and off may be operationally inefficient and impact already stretched financials. Key tenants like cinemas remain closed or are operating at low capacity, which continues to impact footfalls. Capacity and timing restrictions for F&B is another problem. All these have reduced revenue visibility for malls even in peak timings," says Sethi. There is a focus on vaccinations, with mall staff being fully vaccinated, and visitors having to to show their vaccination status before entering stores

There is a focus on vaccinations, with mall staff being fully vaccinated, and visitors having to to show their vaccination status before entering stores