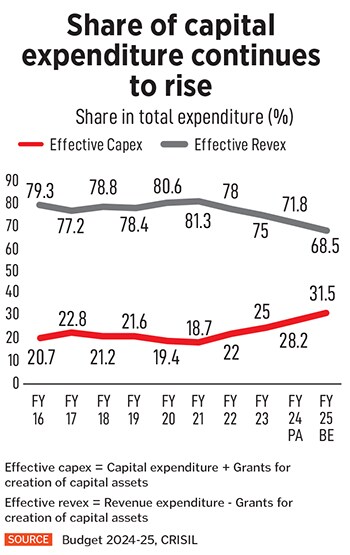

Growth remains at the core of this budget, the first one from NDA 3.0. The government has continued to focus on capex to create long-term durable economic growth.

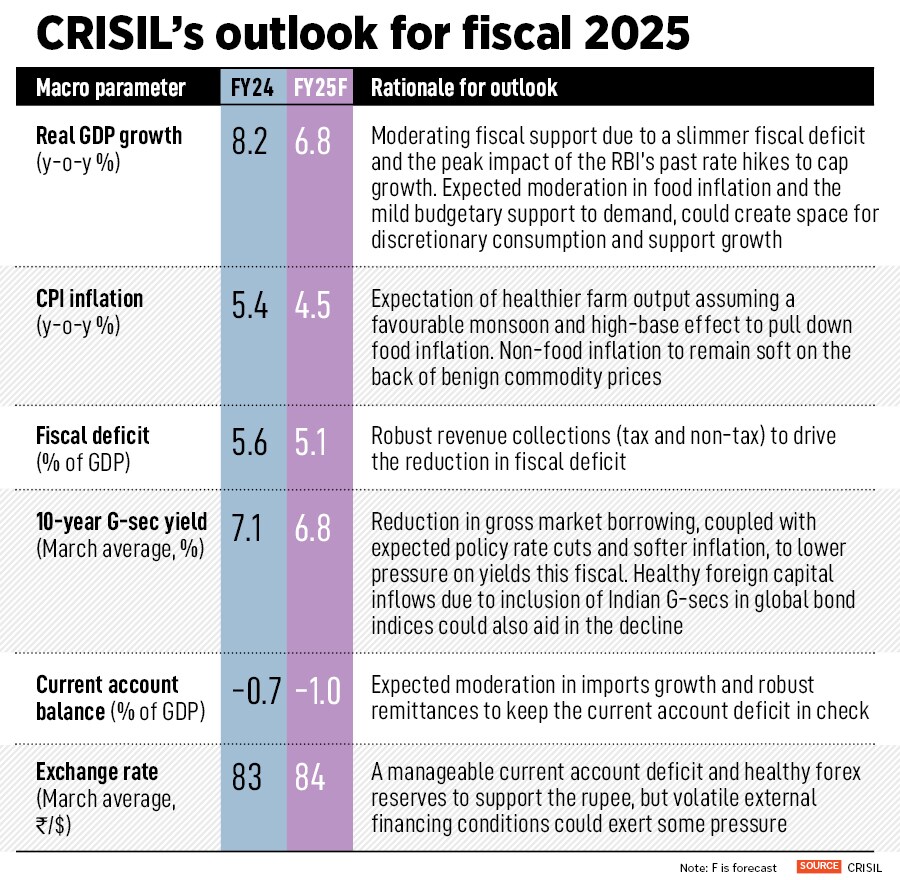

CRISIL expects real GDP growth at 6.8percent this fiscal, lower than the 8.2percent in fiscal 2024. Despite the moderation, growth will remain above the pre-pandemic decadal average of 6.6 percent. Consumption growth, which was lagging till fiscal 2024, is expected to pick up this fiscal, buoyed by better agriculture incomes, expected decline in food inflation and enhanced government funding for rural-focused schemes.

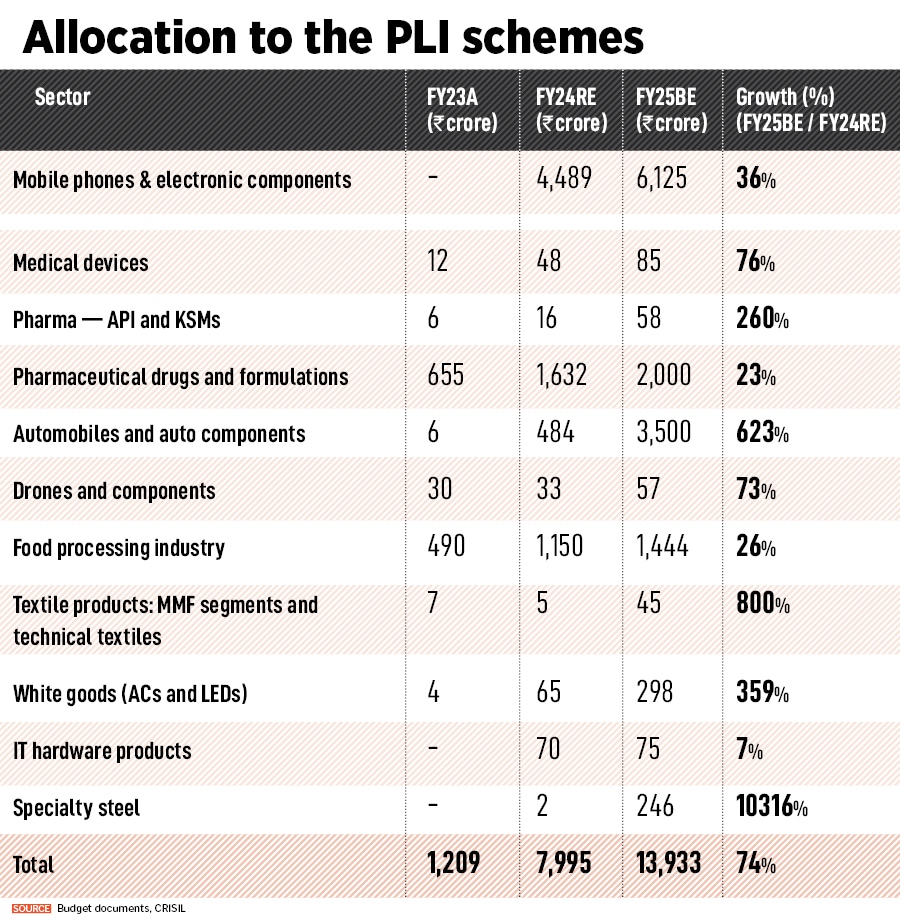

On the investment front, the government’s continued emphasis on the Production-Linked Incentive (PLI) scheme helps private investment in strategic areas. The budget has also tried to incentivise employment generation in the economy, which should over time spur consumption demand and act like an indirect support to push up private investments.

To be sure, overall private investment is not yet broad-based. As the government consolidates further fiscally (a fiscal deficit-to-GDP ratio of below 4.5 percent in fiscal 2026, down from 4.9 percent budgeted for this fiscal), its ability to support the investment cycle via investments in infrastructure will reduce. The private sector will have to take on a larger role to keep the overall investment momentum going.

![]() A strong investment-driven growth momentum and a fiscally consolidated budget favour inflation control. We expect headline consumer price inflation to soften this fiscal as healthy agriculture output eases food inflation. Other measures announced in the budget, such as increased focus on agriculture research and development, push towards adopting climate-resistant seed varieties, improving vegetable supply chains, etc, should also help keep inflation under control on a durable basis.

A strong investment-driven growth momentum and a fiscally consolidated budget favour inflation control. We expect headline consumer price inflation to soften this fiscal as healthy agriculture output eases food inflation. Other measures announced in the budget, such as increased focus on agriculture research and development, push towards adopting climate-resistant seed varieties, improving vegetable supply chains, etc, should also help keep inflation under control on a durable basis.

Meanwhile, lower gross market borrowings, along with the expectation of an RBI policy rate cut (CRISIL expects the first rate cut to be in October) and lower inflation, will help temper government security (G-sec). yields this fiscal. India’s inclusion in global bond indices will mean more eyes on Indian government finances.

Fiscal prudence should ensure healthy demand for Indian G-secs. To that extent, the budget has ticked quite a few check boxes.

Continuity on two key fronts — capex and fiscal consolidation — bodes well for India’s long-term growth prospects. Capex, particularly in infrastructure, has a multiplier effect on growth while fiscal consolidation will shrink debt, creating fiscal space for supporting the economy during a shock. With rising geopolitical uncertainties and climate risks, maintaining a fiscal buffer for times of distress is important.

Thankfully, the budget is largely non-inflationary with a focus on infrastructure spending while revenue expenditure growth remains moderate. In this manner, fiscal policy is in sync with monetary policy – a combination that brings stability and durability to growth prospects.

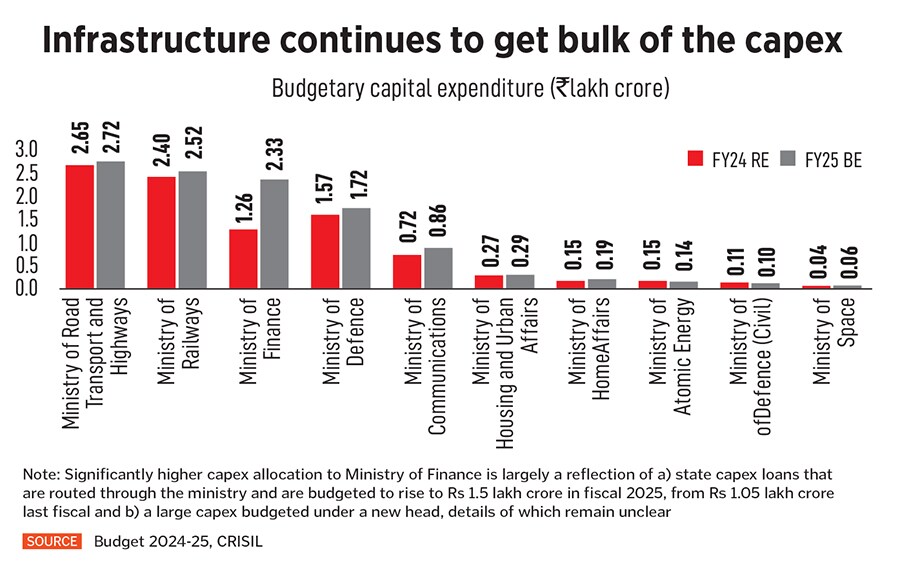

Capex break-up across sectors

![]()

The following chart shows the top 10 ministries/departments, which account for almost 98 percent of the budgetary capex of Rs 11.1 lakh crore this fiscal. Ministry of Road Transport and Highways continued to get the highest capex allocation in the budget (24.5percent of total budgetary capex), followed by Railways (22.7percent share), Ministry of Finance (21.1percent share), Ministry of Defence (15.5percent share) and Ministry of Communications (7.7percent share). These five ministries together get a commanding 91.4percent share of the total budgetary capex.

![]() Apart from supporting investments in the economy through its own infrastructure spending programmes, the budget has also been trying to incentivise private sector investments in several sectors through the PLI scheme (for more details and sector-wise allocations, refer to the manufacturing section).

Apart from supporting investments in the economy through its own infrastructure spending programmes, the budget has also been trying to incentivise private sector investments in several sectors through the PLI scheme (for more details and sector-wise allocations, refer to the manufacturing section).

The government has also announced steps such as reduction in corporate tax rate on foreign companies to 35 percent from 40 percent, abolition of angel tax and increase in basic customs duties in some cases (to incentivise domestic production). At the same time, import tariffs have been cut for some segments, which will support value addition in those areas and can eventually lead to capex. All these steps should provide some push to the private investment in the economy.

A support to consumption

The budget prudently uses part of the higher revenue to support some consumer segments. While most fiscal allocations in this direction are expected to strengthen consumption in the short term, others such as the nudge to employment generation are intended to lift job creation, incomes and, thereby, private consumption over time. Last fiscal, consumption was the weakest in recent times owing to sluggish rural demand. The higher allocations will offer some respite.

Four measures are expected to play a larger role in lifting consumption this fiscal:

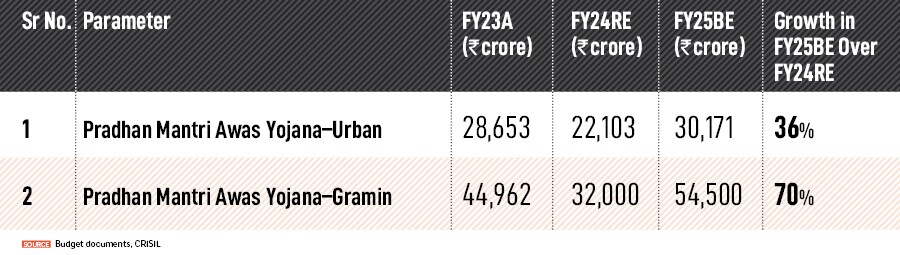

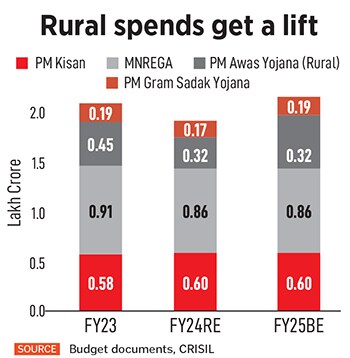

- Higher allocation under PM Awas Yojana-Rural (up 70.3 percent on-year) and PM Gram Sadak Yojana (up 11.8 percent on-year), driving the aggregated allocation on major rural schemes [Pradhan Mantri Kisan Samman Nidhi (PM-Kisan), Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), PM Gram Sadak Yojana, PM Awas Yojana-Rural] to Rs 2.2 lakh crore, a 12.6 percent on-year increase. This will support rural employment, incomes and consumption

- Besides these, the announcement of the Purvodaya scheme for the enhancement of infrastructure and road connectivity in the eastern states of Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh can also create employment opportunities in construction in the region. As most of these are asset-creating spends, the inflation impact is low

- On the urban front, the budget has increased allocation under PM Awas Yojana-Urban by a sizeable 36.5percent on-year

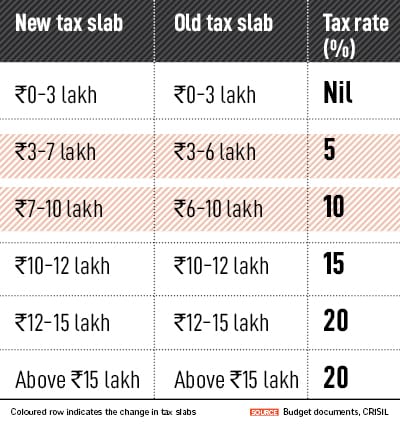

- Changes to personal income taxation, leading to increased tax savings for salaried taxpayers under the new tax regime, will increase the middle class"s discretionary spending ability. However, a sustained revival in consumption demand hinges on permanent income increases, which can come from higher employment.

The fiscal math

What has changed from the interim budget?

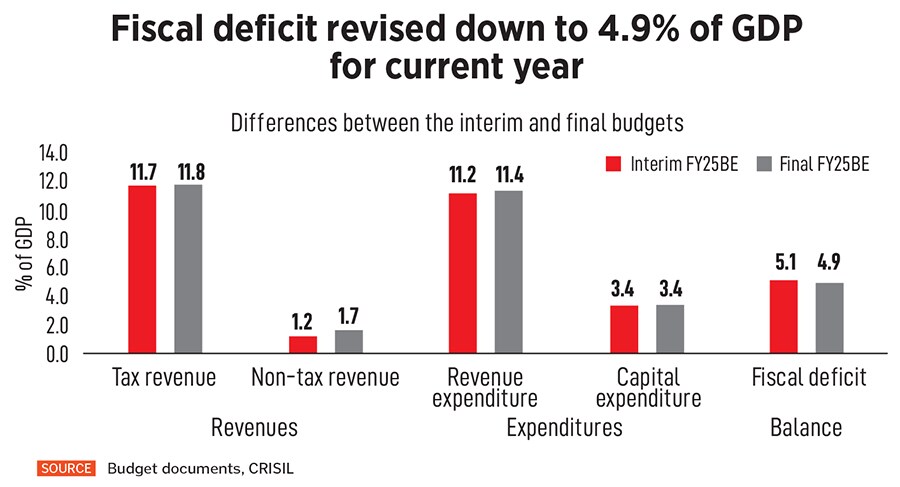

Our analysis shows that in the last two election years (fiscals 2015 and 2020), key metrics have usually not changed significantly between the interim and the final budget.

![]()

That said, since the interim budget this year, the government has benefitted from better-than-expected growth in the economy, and revenue collections. This has allowed it to reduce fiscal deficit – by 20 basis points (bps) each in fiscals 2024 and 2025. Even after reducing fiscal deficit in the current year, there was room for increase in spending.

Where the revenue gains came from?

- Better-than-expected tax revenues: Gross tax revenues were revised up 0.2 percent for fiscal 2025 (relative to interim budget estimates)

- Income taxes driving improved tax buoyancy: Income tax collections were revised up 2.7 percent for current year (relative to interim budget). This is despite higher standard deduction under the new regime. In contrast, corporate tax collections were revised down 2.2 percent for current year. GST collections were revised down 0.5 percent for the current year, reflecting waning benefits from compliance improvements over the past few years

- Sharper rise in non-tax revenues: Non-tax revenues were revised up 36.5 percent for fiscal 2025 (relative to interim budget). The sharp rise this fiscal comes from a 92.8 percent increase in dividends and profits

- RBI’s record dividend the main driver: The RBI gave a dividend of Rs 2.1 lakh crore, which was almost twice of Rs 1.04 lakh crore estimated in the interim budget from the RBI and other public financial institutions combined.

Dividends from other non-financial PSUs were also revised up 17.2 percent.

CRISIL’s outlook for fiscal 2025

![]()

Agriculture and allied sectors (Positive)

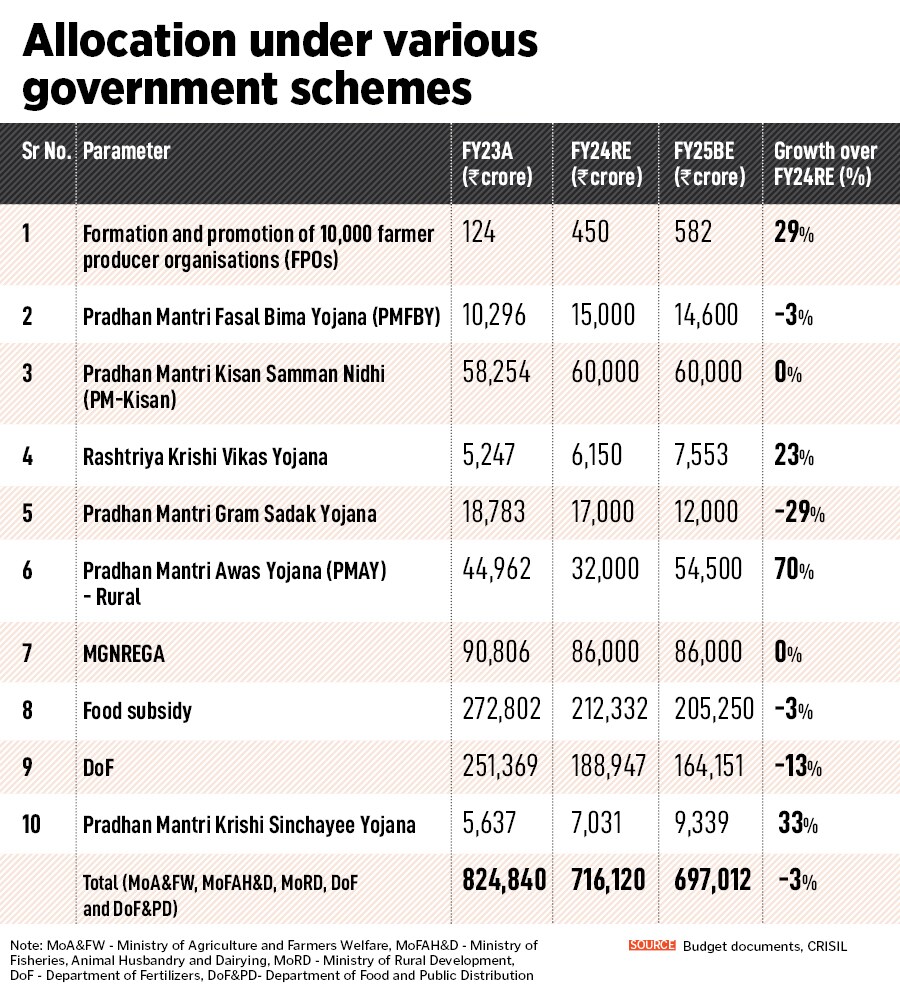

Key Announcements- The Ministry of Agriculture and Farmers" Welfare saw an increase of ~5 percent in allocation for fiscal 2025BE compared with fiscal 2024RE. The increase is focused on schemes dedicated towards integrated agriculture sector development, inclusive of sustainable agriculture, enhanced oilseed production (to reduce dependency on imports), provision of advanced and climate-resilient seed varieties and boosting the effectiveness of technology in agriculture

- The Ministry of Fisheries, Animal Husbandry and Dairying saw a 27 percent jump in allocation for fiscal 2025BE compared with fiscal 2024RE. The Department of Fisheries got a big leg-up (a jump of 54 percent over 2024RE) following the announcement of financial support for establishing a network of nucleus breeding centres for shrimp broodstock, shrimp farming, processing and exports which will be facilitated through NABARD

- Under the Ministry of Chemicals and Fertilisers, the Department of Fertilisers witnessed a dip of 13 percent in allocation. This is in line with the declining raw material prices for urea and non-urea fertilisers

- The Department of Rural Development saw ~ a 4 percent growth in the budget allocation for FY25BE. Allocation for the short-term employment programme MGNREGA, which has ~ a 48 percent share in the total allocation under the department, remained on par with fiscal 2024RE. Meanwhile, the allocation for the scheme focusing on long-term development, such as rural houses (Pradhan Mantri Awas Yojana), witnessed a significant jump of 70 percent over fiscal 2024RE.

![]()

Impact

The budget balances long-term structural developments with sustained support for short-term measures.

- The allocation under the Pradhan Mantri Fasal Bima Yojana for fiscal 2025BE has been reduced 3 percent over fiscal 2024RE as many states have withdrawn from the scheme, owing to financial constraints. However, in the wake of disruptions caused by inclement weather conditions, the government’s announcement to release 109 high-yielding and climate-resilient varieties of 32 field and horticultural crops is as an important step. Improved varieties will not only combat the vagaries of the weather but also enhance the seed replacement rate

- The integration of technological innovations into the agricultural ecosystem is underlined by schemes such as Digital Public Infrastructure, which would cover farmers and their land over three years, with annual digital survey for the kharif season in 400 districts, mapping of farmers to their land parcels through farmer and land registries and issuance of Jan Samarth-based Kisan Credit Cards. The initiative is expected to improve credit risk assessment and enhance formal credit penetration for farmers, which currently stands at ~60 percent

- With the government focusing sharply on promoting natural farming practice, it aims to promote sustainability and provide better realisations to farmers. The natural farming practice is estimated to provide a higher benefit/cost ratio owing to lower input cost and can leverage premium pricing for chemical-free produce. While the scheme aims at improving yield and ensuring higher realisation for farmers, as per CRISIL’s on-ground assessment, over 35 percent of organic produce had to be sold as conventional produce owing to lack of market linkages. Hence, in addition to promoting natural farming practice, market linkages will also need to be developed for aiding farmer realisations.

- On the oilseeds front, currently 55-60 percent of edible oil in India is imported from countries such as Indonesia, Brazil, Argentina and Russia, among others. Additionally, fluctuating prices of oilseeds pose a risk to farmers’ income. The budget highlights the importance accorded to self-sufficiency in oilseed production, especially for crops such as mustard, groundnut, sesame, soybean and sunflower, which will induce growth in these crops that are currently growing at a CAGR of 7.3 percent (2015-23)

- Irrigation penetration in India stood at 53 percent as of fiscal 2020. With a spike of ~33 percent in budget allocation under the Pradhan Mantri Krishi Sinchayee Yojana, the government intends to increase the gross irrigated area to focus on micro-irrigation and watershed management. An increase in irrigation penetration is expected to not only improve crop productivity but also increase the use of highly efficient liquid/water-soluble fertilisers through fertigation techniques. However, as irrigation investments largely come under the purview of state governments, the state’s involvement remains a key monitorable.

Manufacturing (Neutral)

Key announcements

![]()

- Allocations under PLI schemes are in line with the interim budget. The cumulative budgeted incentive payout for fiscal 2025 is pegged at Rs 13,933 crore

- Reduction in custom duties for critical minerals and metals

- Proposal to develop investment-ready ‘plug and play’ industrial parks with comprehensive infrastructure in or near 100 Tier 1 and 2 cities. Twelve industrial parks to be approved under the National Industrial Corridor Development Programme

- Additional announcements related to energy transition-related segments and promotion of incremental employment

- Allocation of incentives under PLI schemes is up 74 percent in fiscal 2025BE, reflecting robust policy support and widespread industry uptake. These schemes are part of the government"s strategy to enhance manufacturing value chains to reduce the country’s import dependence and improve the competitiveness of the domestic industries, which, in turn, will support exports. The schemes aim to transform the domestic manufacturing landscape by offering incentives worth Rs 1.97 lakh crore, targeting a capital expenditure of Rs 3.00-3.25 lakh crore over the medium term. Of this, Rs 1.28 lakh crore has been invested until May 2024 led by pharma, PV solar modules and auto components. As the policies mature, it is becoming increasingly evident the government"s efforts to invigorate the manufacturing sector are achieving success. For the current fiscal, budget allocation towards PLI schemes for various sectors stands at Rs 13,933 crore, with automobiles and specialty steel seeing a major uptick. A major capex boost is expected in fiscals 2025 and 2026. The subsequent incentive payouts would start to roll in in fiscals 2027 and 2028

- Rationalising import costs for critical minerals and raw materials through duty adjustments will reduce costs and incentivise domestic value addition in emerging sectors, such as electric vehicle batteries, storage systems, PV module manufacturing and electronics, where critical minerals form a crucial part of the value chain

- The plug-and-play initiative will be implemented in collaboration with the state governments and private sector, leveraging town planning schemes for optimal results. It is expected to enhance regional economic development and create numerous job opportunities. However, it requires a robust action plan and a roadmap for successful implementation

- The focus on energy transition is in keeping with the country’s move towards non-fossil fuels, with climate finance taxonomy aiding climate commitments and the 500 GW non-fossil capacity targeted by 2030. The budget has extended nil duty for ferrous scrap to improve import scrap availability and support carbon emission reduction in the steel sector

- The proposed employee-linked incentive scheme will encourage companies to create jobs, while EPFO reimbursements will support corporates

Electronics (Neutral)

Key budget announcements- Customs duty for printed circuit boards of mobile phones reduced to 15 percent from 20 percent

- No customs duty on specified goods used in the manufacture of connectors versus 5-7.5 percent earlier

- No customs duty on oxygen-free copper used in the manufacture of resistors versus 5 percent earlier

- Customs duty on mobile phones reduced to 15 percent from 20 percent

Impact- Since the electronics manufacturing ecosystem is import-dependent, reduction in custom duty on printed circuit boards of mobile phones along with nil levy on components used in resistors and connectors will boost domestic manufacturing, as these components are essential for production of various electronic devices such as mobile phones and IT hardware. Therefore, these revisions are expected to aid domestic manufacturers of electronic products

- About 96 percent of all phones sold in India are manufactured locally, while the remaining 4 percent are largely premium devices that are imported. The reduction in customs duty on mobile phones to 15 percent from 20 percent is expected to aid makers of premium mobile phones, considering they may not entirely pass on the cost benefits to customers

Power and renewable Energy (Positive)

Key budget announcement- The key budgetary allocations of Rs 0.52 lakh crore and Rs 0.87 lakh crore were made to the Ministry of New and Renewable Energy (MNRE) and Ministry of Power (MoP), respectively. The allocation in key schemes under MNRE increased 25percent from that announced in the interim budget owing to 16 percent higher allocation to the Indian Renewable Energy Development Agency (IREDA) and Pradhan Mantri Surya Ghar Muft Bijli Yojana of Rs 6,250 crore for fiscal 2025 BE

- Following the announcement of viability gap funding (VGF) support for Battery Energy Storage Systems (BESS) in February’s interim budget, the government further announced removal of basic customs duty (BCD) on critical minerals, such as lithium and cobalt from the existing rate of 5percent

- Continued exemption for capital goods used in manufacturing photovoltaic (PV) cells and panels also announced, and the exemption of BCD for solar glass removed

- Budgetary allocation for power projects, including setting up of a new 2,400 MW power plant at Pirpainti, among others, totalling Rs 21,400 crore, announced. The government will also provide financial aid to set up an 800 MW commercial coal power plant based on Advanced Ultra Super Critical (AUSC) technology through the joint venture between National Thermal Power Corporation and Bharat Heavy Electricals Ltd

- A provision of Rs 1.5 lakh crore for long-term interest-free loans to support states in their resource allocation was announced

Impact- The impetus on furthering green energy transition in India continues to take a leap in the fiscal 2025 budget. In addition to increase in allocation for key schemes promoting non-fossil capacities, the budget also focuses on green funding through taxonomy for climate finance. This will support the achievement of the country’s climate commitments and green transition. Additionally, the boost to residential rooftops, storage and development of a manufacturing ecosystem by relaxing duties continues to be a positive.

- The key budget allocation to MNRE increased 25 percent from February’s interim budget, owing to 16 percent higher allocation made to IREDA and PM Surya Ghar Muft Bijli Yojana. The allocations for the rooftop scheme are estimated to support residential rooftop additions in the range of 1.9-2.1 GW, considering a 2 KW average size for solar rooftop plants and MNRE capital expenditure benchmarks4

- Battery cells form 80-85 percent of the cost of storage batteries. With lithium and cobalt together forming 25-35 percent of cell costs, reduction in BCD from 5 percent to nil should reduce production cost by 1-1.5 percent. Though the announcement will only result in a marginal drop in capital cost in the near term, it will prove useful as India marches towards an addition of 27-29 GW of battery capacity by fiscal 2030 to strengthen energy storage installations. The allocation of Rs 96 crore as VGF for BESS will help add 1 GW to this total as planned by the government. A 77percent fall in lithium prices on-year in the first half of 2024 has also helped pare capital costs this calendar year

- The continued exemption for capital goods required to manufacture solar cells and modules will help pare capital costs for the setting up of 48 GW cells and module capacity as allocated under PLI. The capacity expansion is expected to drive investments to the tune of Rs 25,000-35,000 crore. The expansion of domestic PV manufacturing has the potential to reduce solar module import dependency from 50 percent as seen in fiscal 2024 to 7-10 percent by fiscal 2027. While BCD has been increased on solar glass, sufficient domestic manufacturing capacity will not result in an adverse impact

- The focus on coal additions, despite being at odds with India’s clean commitments, is necessary to manage power system requirements where coal is expected to form 50 percent of electricity generation by fiscal 2030. Bihar accounted for ~3 percent of the country’s power demand in June 2024, where supply comprised 90 percent from coal sources. Juxtaposed with this, Bihar’s peak deficit and energy deficit were 7.8 percent and 1.4 percent, respectively in fiscal 2024. Thus, additions of 2,400 MW (800 MW x3) of coal capacity in Pirpainti will help supplement power generation in the state to avoid deficit situations. The government’s fiscal aid for propelling the AUSC technology pilot project, expected in Sipat, Chhattisgarh, with a capacity of 800 MW, will be a critical first step to launching a more efficient coal fleet, where the technology promises an efficiency of 46percent, compared with 38-42 percent with the existing technologies

- Out of Rs 1.5 lakh crore provisioned for states to meet their resource allocation, a part of it can also be utilised by them to fund their RDSS share. States are expected to fund 67 percent of Rs 3 lakh crore of the total outlay under the scheme, currently being financed through debt offered by Power Finance Corporation/ Rural Electrification Corporation

Housing and real estate (Neutral)

Key announcements

- Increase in the Pradhan Mantri Awas Yojana (PMAY)–Urban target by 1 crore houses, or ~81 percent, from the previous target of ~1.2 crore houses with planned allocation of Rs 2.2 lakh crore over the next five fiscals

- Increase in the PMAY–Rural target by 2 crore houses, or ~68percent, from the previous target of ~3 crore houses

- Revision in long-term capital gains tax to 12.5 percent from 20.0 percent and removal of indexation benefit on sale of real estate properties, in addition to other taxation-related announcements

- Urban and rural land-related reforms and actions to be initiated in collaboration with states

![]()

Impact

- PMAY was introduced in 2015 with the aim of providing affordable housing to all by end-2022. The timeline was revised to fiscal 2024 and 2025 for PMAY–Rural and PMAY–Urban, respectively, owing to delays in completion. As of July 2024, while ~85 percent of the target of PMAY was achieved, many from the low-income group are still without pucca houses. The increase in the target by 3 crore houses (rural as well as urban) bodes well for those who could not avail the benefits of the scheme till date. It will also facilitate accommodation of growing number of families, particularly in rural areas

- Also, the planned allocation of Rs 2.2 lakh crore for PMAY–Urban over the next five fiscals is likely to revive interest in affordable housing, which has lately seen a decline in construction activity, with developers increasingly shifting focus towards the premium and luxury segments in metros, Tier I and II cities, etc

- The re-introduction of Credit-Linked Subsidy Scheme after a gap of two years is expected to support housing loan growth as well. The scheme provides subsidised home loans to buyers of affordable homes under PMAY

- The government’s initiative in implementing land reforms, particularly digitisation of land records and maps in urban areas, is likely to improve transparency and reduce documentation challenges, thereby streamlining land deals and transactions for developers

- The government’s continued focus on housing is expected to provide impetus to the real estate sector, stakeholders such as developers and EPC contractors, and allied industries such as steel and cement

- On the taxation front, although long-term capital gains tax on real estate property has been reduced to 12.5 percent from 20.0 percent, the removal of indexation benefit may have a larger negative impact on those planning to sell their old properties. The extent of impact would depend on various factors including tenure of asset holding and capital appreciation during the period. On the other hand, changes in the personal tax regime, such as increase in the standard deduction to Rs 75,000 from Rs 50,000, and changes in tax slabs, will put more disposable income in the hands of the salaried class, which is likely to boost the affordability of homebuyers. The government’s initiative to encourage states to moderate stamp duty rates can have a positive impact as well

- Meanwhile, the three-fold increase in Housing and Urban Development Corporation allocation indicates that the PMAY–Urban capex may require internal and extra budgetary resources support in addition to gross budgetary support

Also read: Budget 2024: No surprises for semiconductorsCapital markets (Neutral)

![]() Social security measures

Social security measures

In a bid to enhance the pace of formalisation of the economy and increase employment in the organised segment, the budget has doled out incentives for employers and employees. The government will reimburse employers Rs 3,000 per month for two years for their contribution under the Employees’ Provident Fund Organisation (EPFO) to their workforce beyond a minimum threshold addition with a salary of less than Rs 100,000. Further, the government will provide one month’s wages as subsidy (maximum of Rs 15,000) to all employees with salary less than Rs 100,000 and entering the EPFO roll call for the first time.

Further, to expand the social security net for long-term retirement planning, the government has raised the contribution from employers under the National Pension System to 14 percent from 10 percent for all employees, including private sector workers subscribing to the new tax regime previously the 14 percent benefit was provided to government sector workers. The newly proposed NPS-Vatsalya, a plan for contribution by parents and guardians for minors, can be converted seamlessly into a normal NPS account once the minor becomes an adult.

The government’s move to reduce tax deducted at source (TDS) from insurance policy payout to 2 percent from 5 percent is also a positive for pension planning as it will increase the payout for policyholders, especially of annuities from life insurance companies.

Change in capital gains

Meanwhile, rationalisation and simplification of capital gains taxation has been proposed to reduce the compliance burden, promote entrepreneurial spirit and provide tax relief to citizens.

- Rationalisation of the holding period: There will be only two holding periods, 12 months and 24 months, for determining whether capital gains are short-term capital gains (STCG) or long-term capital gains (LTCG). Listed financial assets held for more than a year (12 months) will be classified as long-term, while unlisted financial assets and all non-financial assets will have to be held for at least two years (24 months) to be classified as long term. The holding period for units of listed business trusts (real estate investment trusts or REITs/ infrastructure investment trusts or InvITs) will now be on a par with listed equity shares at 12 months instead of 36 months to qualify as long-term capital assets

- Increase in LTCG tax, inclusion of instruments and enhancement in the exemption limit: LTCG tax has been revised to 12.5 percent for all financial and non-financial assets. Meanwhile, the taxation of equity fund of funds (FoFs) investing more than 65percent in equity, along with overseas FoFs, gold/silver exchange-traded funds (ETFs) and gold funds, has been changed to bring it in line with equity mutual funds and direct equity, having a material impact on their tax incidence. To reduce the impact of tax incidence on small taxpayers, the budget has increased the limit of exemption of capital gains on direct equity and equity mutual funds to Rs 1.25 lakh from Rs 1 lakh per year

- Increase in STCG tax, inclusion of certain instruments: STCG tax on certain financial assets such as direct equity, equity mutual funds and REITs/InvITs has been increased to 20 percent from 15 percent. Further, with the new reclassification of instruments, listed bonds, equity FoFs and gold/silver ETFs will also be subject to the new STCG tax rate compared with personal income tax slabs previously

- Changes in unlisted investment space: The government has also changed the LTCG taxation regime for unlisted assets such as physical real estate, gold, unlisted stock and foreign equities, and debt. Indexation benefits for these products have been removed, changing the tax from 20 percent with indexation to 12.5 percent tax for a holding period of 24 months. Unlisted bonds, however, will continue to be taxed as per personal income tax slabs, except for reduction in the holding period to 24 months. Meanwhile, all these instruments will continue to be taxed as per income tax slabs for STCG

- Abolishment of angel tax: The government has abolished angel tax for all investors

- Hike in securities transaction tax (STT) on futures and options (F&O): The government has almost doubled STT, from 0.0625 percent to 0.1 percent on sale of options in securities and from 0.0125 percent to 0.02 percent on sale of futures in securities.

A strong investment-driven growth momentum and a fiscally consolidated budget favour inflation control. We expect headline consumer price inflation to soften this fiscal as healthy agriculture output eases food inflation. Other measures announced in the budget, such as increased focus on agriculture research and development, push towards adopting climate-resistant seed varieties, improving vegetable supply chains, etc, should also help keep inflation under control on a durable basis.

A strong investment-driven growth momentum and a fiscally consolidated budget favour inflation control. We expect headline consumer price inflation to soften this fiscal as healthy agriculture output eases food inflation. Other measures announced in the budget, such as increased focus on agriculture research and development, push towards adopting climate-resistant seed varieties, improving vegetable supply chains, etc, should also help keep inflation under control on a durable basis.

Apart from supporting investments in the economy through its own infrastructure spending programmes, the budget has also been trying to incentivise private sector investments in several sectors through the PLI scheme (for more details and sector-wise allocations, refer to the manufacturing section).

Apart from supporting investments in the economy through its own infrastructure spending programmes, the budget has also been trying to incentivise private sector investments in several sectors through the PLI scheme (for more details and sector-wise allocations, refer to the manufacturing section).

Social security measures

Social security measures