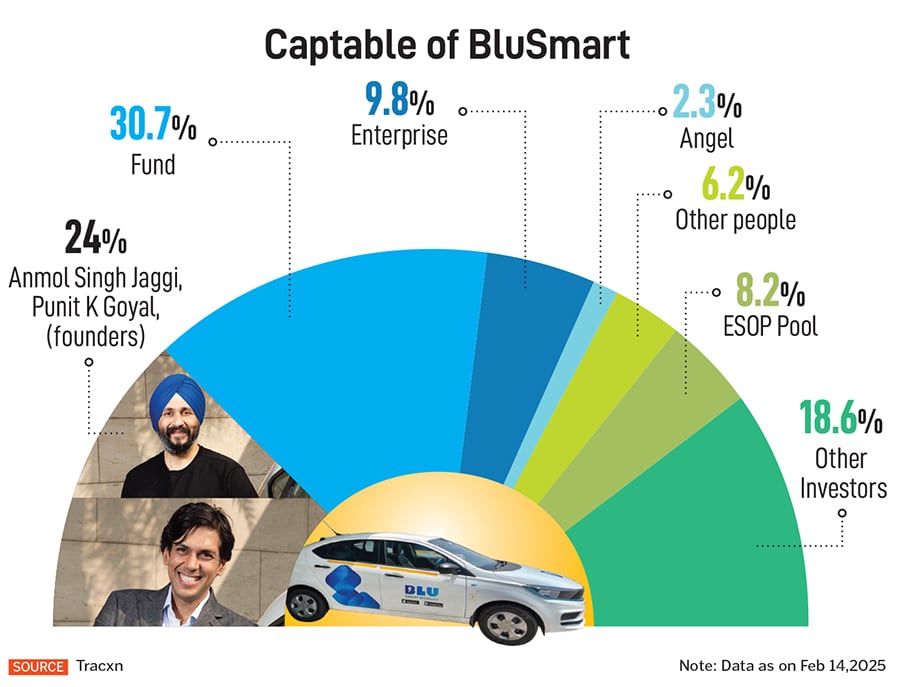

BluSmart has raised around $278 million through 14 funding rounds from 259 investors as part of ESG, green or sustainable funds, shows a Forbes India analysis based on data provided by market intelligence firm Tracxn. Some of BluSmart’s marquee investors in ESG, green and sustainable space include Zurich-based impact asset management firm responsAbility Investments AG, Sumant Sinha (chairman and CEO, ReNew Energy) and BP Ventures (the corporate venture capital arm of British multinational oil and gas giant BP).

A little less than a year ago, in July 2024, BluSmart had raised $24 million (`200 crore) in a pre-Series B round to power its expansion plans. However, the company’s future appears bleak now as it has shut all its operations since April after Sebi’s interim order exposing the financial crisis in BluSmart.

Emails sent to both BluSmart and responsAbility Investments about the future of the company and related investments went unanswered at the time of going to press.

Amit Kumar Nag, partner, Aquilaw, believes the Gensol and BluSmart scandals expose a serious credibility crisis for ESG claims in the electric vehicle (EV) and solar engineering, procurement and construction (EPC) sectors.

These companies aggressively marketed themselves as green disruptors, leveraging the ESG label to gain investor trust and regulatory goodwill. However, Sebi’s revelations—ranging from fund diversion for luxury purchases to falsified no-objection certificates (NOCs) and misrepresented loan servicing—reveal a pattern of deceit masked by sustainability rhetoric.

“When companies claiming to champion green values are found guilty of financial misconduct, it undermines the authenticity of their ESG promises. It suggests that sustainability branding may be used as a smokescreen to distract from unethical practices. This erodes trust in other companies operating in the same space," Nag explains.

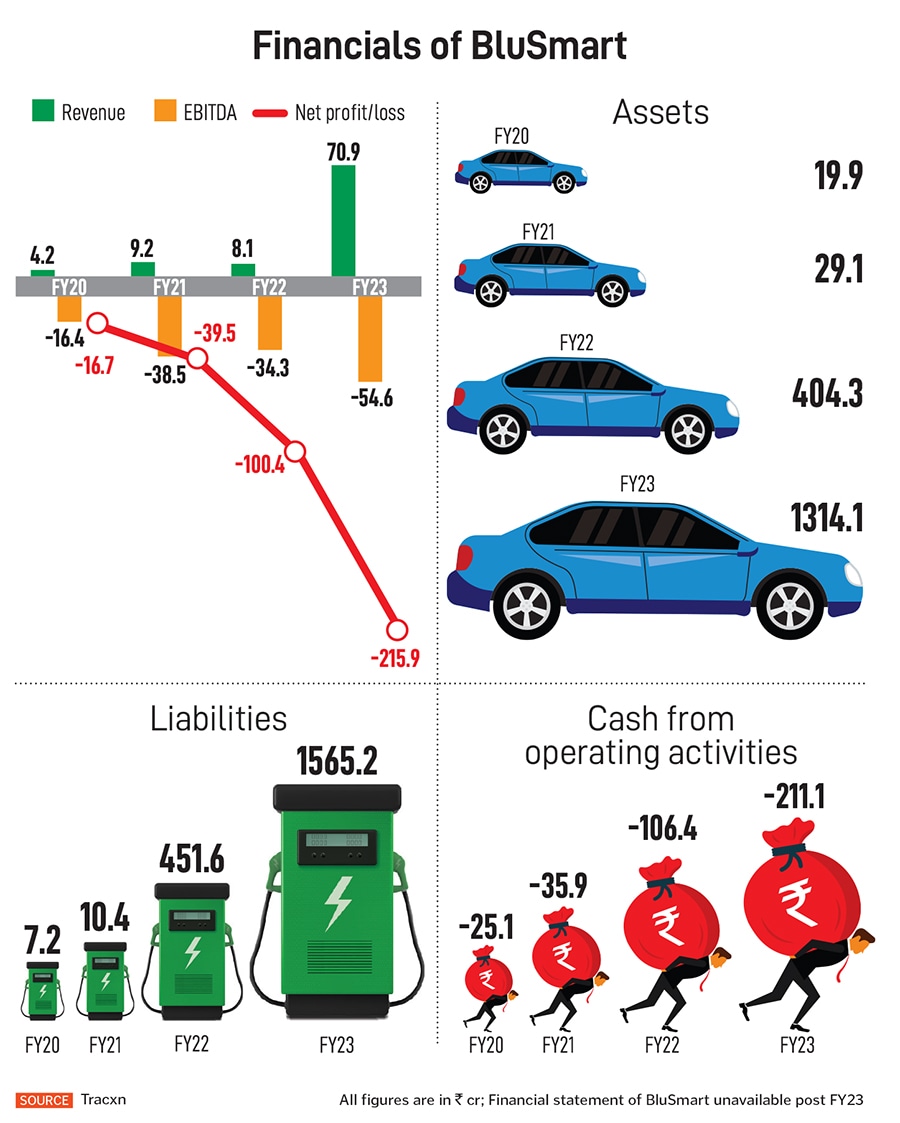

Before shutting operations, BluSmart had claimed to be India’s and South Asia’s first and largest vertically integrated EV ride-hailing service and EV charging infrastructure network. Founded in 2019, it had been consistently stressing about its commitment to building a vertically integrated energy-infrastructure, mobility and technology business to “decarbonise mobility at scale". It operated in Delhi-NCR, Mumbai and Bengaluru, and made its first international foray with a launch in the UAE in June 2024 as a premium all-electric limousine service.

![]()

Jamil Khatri, co-founder, and Anu Chaudhary, partner, global head, ESG, Uniqus Consulting, say the fact that a company operates in the EV or renewable space doesn’t automatically guarantee that it adheres to ESG principles holistically. What these episodes underline is the importance of independent assurance, credible disclosures and strong board oversight. “As ESG matures in India, especially in sunrise sectors like EV and solar, we need a sharper focus on G (governance) alongside E and S. Ultimately, it’s not the sector’s promise, but the company’s conduct and oversight on the conduct that determines credibility," they say.

BluSmart has also been granted a US patent for its pioneering allocation system for electric mobility by the United States Patent and Trademark Office. However, the market regulator’s investigation into the listed entity, Gensol Engineering (BluSmart’s related company), triggered by complaints relating to manipulation of share price and diversion of funds from Gensol Engineering showed gross violation of corporate governance, fund embezzlements and related-party transactions to benefit promoters.

Pooja Chatterjee, partner, King Stubb & Kasiva, Advocates and Attorneys, agrees that the BluSmart-Gensol incident highlights a growing gap between ESG branding and actual governance practices. Financial frauds in such companies highlight how weak governance can undermine the credibility of ESG claims. “Particularly in high-growth sectors like EV and solar EPC, where environmental impact is often front-loaded in narratives, governance risks tend to be overlooked. These cases should prompt a more balanced and rigorous ESG evaluation approach, where financial integrity and accountability are treated as core to sustainability—not separate from it," she says.

In its order in April, Sebi said Gensol’s funds were routed to related parties and used for unconnected expenses, as if the company’s funds were the promoters’ piggybank. The result of these transactions would mean the diversions mentioned above would, at some time, need to be written off from the company’s books, ultimately resulting in losses to the investors of Gensol.

Navomi Koshy, partner, Saraf and Partners, feels an important takeaway of the Gensol-BluSmart saga is that in the current AI (artificial intelligence) era—where document fabrication is effortless—a deeper and comprehensive due diligence is a must nothing can be taken at face value anymore. However, she dismisses that this single incident will cast a pall over the entire industry.

“These frauds should not take away from the fact that Gensol and BluSmart did undertake sustainable initiatives. However, recent frauds underscore the need for all companies to ensure transparency in governance practices and adopt robust audit measures," Koshy elaborates. “The financial frauds by promoters are not confined to the ESG sector. A financial fraud in a single ESG initiative does not and should not tarnish the entire movement—ESG still remains the need of the hour and will continue to attract investor interest."

Russell A Stamets, partner, Circle of Counsels, argues that the Gensol-BluSmart case is nothing more than ordinary corporate malfeasance if the charges are proved. “The worthy goals of ESG principles have nothing to do with ordinary theft and fraud… ESG is simply a label to remind us that corporations have societal duties that go far beyond maximising profits for their shareholders," he says. “It’s a failure of late-stage capitalism that one has to remind companies that they exist in society and are given special privileges because they are supposed to contribute positively to society as a whole."

Chartered accountants’ body ICAI is likely to complete a review of the financial statements of Gensol Engineering and BluSmart Mobility in six months, according to media reports. Sebi has removed promoter brothers Anmol Singh Jaggi and Puneet Singh Jaggi from holding the post of director or any key post in Gensol Engineering. The brothers and the company are barred from accessing the securities market.

Deeper deficiencies

Kinjal Champaneria, partner, Solomon & Co, says such misleading actions by companies raise serious concerns over sound corporate governance, but there seems to be no accusation (by Sebi) on ESG compliances.

Currently, investors demonstrate their commitment to environment and prefer ESG-compliant investments. Therefore, such actions may have an indirect impact on the sector concerned, making investors possibly more cautious, Champaneria says. “These developments not only undermine the confidence of investors and the broader public, but also expose the danger that prominent ESG branding may conceal deeper governance deficiencies," she adds.

The financial issues in Gensol-BluSmart have ignited widespread concerns among investors and consumers as governance lapses indicate mere greenwashing, while ESG claims without ethical backing are meaningless. “Yes, there is growing scepticism, and rightfully so," Khatri and Chaudhary add.

![]()

Investors and consumers are increasingly looking beyond the ‘green’ label and asking: Is this business truly accountable? “Governance lapses or financial misconduct, especially in companies championing sustainability, damage not just reputations but also trust in the broader ESG movement. This is why transparency, third-party validation and integrated ESG reporting are critical," Khatri and Chaudhary say.

BluSmart Mobility had been emphasising on its commitment to reducing carbon emission, championing the cause of green and sustainable business. In July 2024, it claimed to be leading the decarbonisation and electrification of mobility in India at scale. “BluSmart EV fleet has scaled over 110 times, from 70 (January 2019) to 7,500 across Delhi-NCR and Bengaluru. BluSmart has achieved a historic milestone of over half a billion (500+ million) electric kilometres and delivered over 16 million electric trips saving nearly 40 million kgs of CO2 emissions since launch," the company had said in a press statement.

BluSmart had further claimed to operate India’s largest EV charging infrastructure with 50 charging hubs spread across 2 million square feet, which it called the ‘bedrock for accelerating the EV adoption in India’. It had also claimed ‘phenomenal’ growth, crossing `550 crore ARR ($65 million annual revenue run-rate) in July 2024.

“Mere claims are not enough," says Sachin Mathur, associate professor, School of Business Management, NMIMS Mumbai. “Companies have to demonstrate their credibility in showcasing the existence of business assets, employees and turnover, real projects, and verifiable environmental impact of their products and services. Third-party ESG ratings and assessments may help, but larger investors and lenders may want to increase reliance on their own due diligence and analysis."

According to Mathur, the structural assessment of governance through board structure and corporate policies is not sufficient. Good governance must be reflected in practice in terms of simple corporate structure, appropriate use of funds, peer-comparable executive compensation and appropriate recognition of revenues and costs.

However, Shiju PV, senior partner, IndiaLaw LLP, calls the issue in BluSmart ‘not unique to ESG investments’—it is a case of age-old corporate fraud and fund diversion, a recurring issue in India.

“The collapse reflects a collective failure of auditors, lenders, independent directors and regulators to uphold their fiduciary and oversight responsibilities. While BluSmart marketed itself as an ESG-aligned venture, the underlying misconduct was rooted in governance lapses rather than ESG principles per se," he says.

Shiju PV explains that, globally, ESG investing is already witnessing a slowdown due to a combination of factors such as political shifts, concerns over greenwashing, and underperformance of ESG-linked funds. “Incidents like BluSmart only risk deepening investor scepticism and may further deter capital from flowing into ESG ventures. Nonetheless, such events should not discredit the broader ESG movement. Instead, they underscore the urgent need for robust governance, transparency and accountability in ESG-focussed businesses," he adds.

However, Chatterjee argues that she would be cautious about generalising investor and consumer sentiment as outright scepticism. “While recent governance failures have certainly triggered concerns, they are also prompting a constructive shift—investors are becoming more discerning, not dismissive, of ESG claims," she stresses.

Tighter regulations

Sebi has been stressing on ESG norms and the adaptability of such practices by companies with strict mandates for listed entities. Perhaps, there could be such disclosures for startups as well.

India made its first foray into ESG regulatory frameworks and disclosures by introducing the Business Responsibility and Sustainability Reporting (BRSR) by Sebi in 2021. BRSR guidelines make it mandatory for the top 1,000 listed companies by market capitalisation to make sustainability disclosures. Later, the market regulator added a set of key indicators, also known as BRSR Core, on the top 150 companies—they are expected to provide reasonable assurance as part of their annual reports.

Champaneria says Sebi has a robust disclosure mechanism already in place, which has been instrumental in pinpointing the actual financial misappropriation. Recent instances of financial misconduct at Gensol may motivate Sebi to play an active role in seeking additional disclosure or even conduct audits to protect the interests of investors engaged in sustainable investments across the broader market, rather than solely within the ESG sector.

![]()

“Further, Sebi will focus more to ensure greater transparency and accountability, reinforcing trust in the integrity of India’s evolving sustainable investment landscape rather than ESG investing," she says.

Mathur also agrees that the immediate and primary regulatory response to these cases could be to fix the accountability in financial auditing. “However, it could also result in stricter regulations related to corporate disclosures, including ESG disclosures. Recently, Sebi eased the ESG disclosure norms for listed entities, replacing mandatory assurance by either assurance or assessment to reduce the financial and compliance burden. If such scandals continue, the regulator may be prompted to rethink," he adds.

Others concur. Chatterjee says the recent financial irregularities in ESG investments could lead Sebi to introduce stricter measures, such as independent audits of ESG disclosures and harsher penalties for greenwashing. Additionally, Sebi may develop specific ESG risk metrics to help investors make informed decisions and launch educational initiatives to enhance awareness.