From brands' love for IPL 2025 to Bhavish Aggarwal's bet on Krutrim AI, our top

In this week's newsletter, also read about why India VIX is not showing signs of fear, upGrad's plans for an IPO, a quick chat with Deepinder Goyal, and more

By the time you scroll through this newsletter, franchises in the Indian Premier League (IPL) will have played a week"s worth of matches in packed stadiums nationwide, and millions joining in via TV sets or mobile phones. The spectacle has already started setting new records, and the number of sixes has already passed the three-digit threshold. Since its first match in 2008, IPL has seen revenue growth manifold, and brands have not left a stone unturned to leverage its reach. For the 18th edition, IPL has bagged six central sponsors, and JioHotstar has signed up 1,100 advertisers. Here"s how the money revolves around the world"s second-most-valued sports league.

The India VIX has slipped 12.5 percent from the beginning of January and so has the benchmark index, shows a Forbes India analysis. Illustration: Chaitanya Dinesh Surpur

The India VIX has slipped 12.5 percent from the beginning of January and so has the benchmark index, shows a Forbes India analysis. Illustration: Chaitanya Dinesh Surpur

Volatility Index (VIX) is commonly and ominously known as fear index. Its primary purpose is to present the market"s expectation of volatility over the coming 30 days. It was first devised by the Chicago Board Options Exchange in 1993. India has its own Nifty VIX, calculated by the NSE from the order book of NIFTY options, which informs investors to fine-tune their plans. Amid the global turmoil caused by Trump"s tariff offensive and other geopolitical tensions, India VIX is not showing any signs of uncertainty. It has slipped 12.5 percent since January 2025. Why is VIX not panicking yet? Are Indian investors over-confident, or do they know something that global markets are unaware of? Here"s a quick analysis of why the VIX is not showing any fear.

(From left )Mayank Kumar, co-founder, upGrad, Ronnie Screwvala, co-founder and chairperson, upGrad and Srikanth Iyengar, CEO, upGrad Enterprise. Image: Bajirao Pawar for Forbes India

(From left )Mayank Kumar, co-founder, upGrad, Ronnie Screwvala, co-founder and chairperson, upGrad and Srikanth Iyengar, CEO, upGrad Enterprise. Image: Bajirao Pawar for Forbes India

The edtech business in India is divided into four major segments—school education, test preparation, study abroad, and working professionals. upGrad, co-founded by Ronnie Screwvala, Mayank Kumar, and Phalgun Kompalli, has focused on the latter two. Offering interactive learning experiences directly to students and working professionals, the edtech platform has posted Rs 1,950 crore revenue in 2025. It hosts 2,20,000 active paying learners and is also in markets across North America, APAC, Middle East, and Europe. This progress makes upGrad an outlier in the Indian edtech sector, which has fluctuated over recent years, leading to the decline of its more gigantic peers like Byju’s and Unacademy. With an initial public offering on the horizon for the company, here"s a look at the last decade of the company while we also assess if it can unlock its full potential.

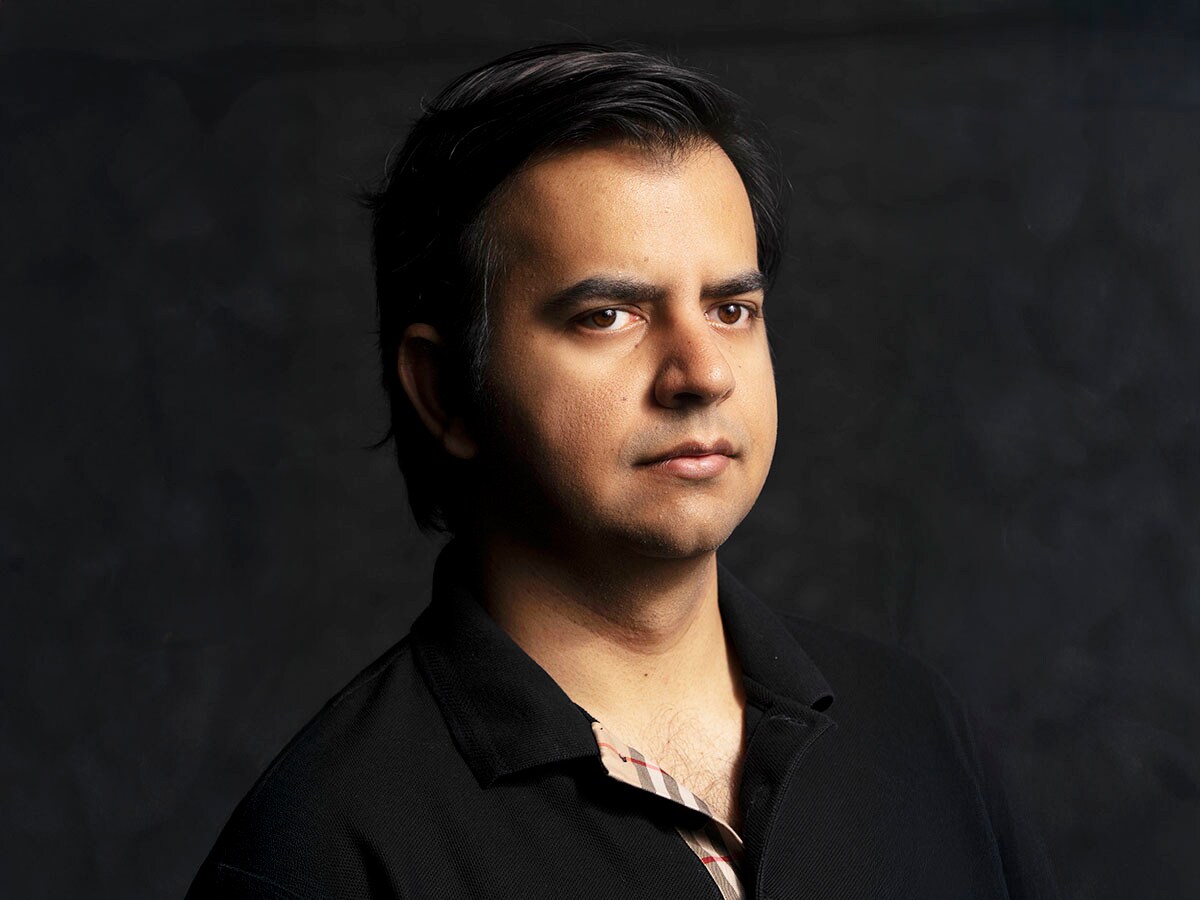

Bhavish Aggarwal, Founder and CEO, Ola Image: Selvaprakash Lakshmanan for Forbes India

Bhavish Aggarwal, Founder and CEO, Ola Image: Selvaprakash Lakshmanan for Forbes India

The world was only figuring out what to do with the artificial intelligence (AI) services provided by Western tech giants such as OpenAI (ChatGPT, Dall.E), Google (Gemini), and Apple (Apple Intelligence). Microsoft (Copilot), Midjourney, Perplexity, when Chinese Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co. Ltd launched DeepSeek, cheaper and outperforming many openly available models. That gave more wind to the AI race, and Indian startups did not want to be left behind. Bhavish Aggarwal, Founder and CEO of Ola, is one of the first to take the plunge with Krutirm AI to build a full-stack AI solution from scratch. Ten months after its launch, the startup achieved unicorn status in January 2024. Beyond the hype, is Krutrim ready to take on the world? Fight the AI giants on their turf or at least win the domestic market? Here are some answers.

Deepinder Goyal, CEO, Zomato Image: Madhu Kapparath

Deepinder Goyal, CEO, Zomato Image: Madhu Kapparath

The size of quick commerce business in India has jumped from $0.3 billion in FY22 to $3.8 billion in FY24, according to the latest research by Blume Ventures. It will likely touch $7.1 billion by the end of the current financial year (FY25). Monthly transacting users will likely touch 26.3 million, from 14.4 million last year. Everybody wants a piece of this pie, and one of the prominent chefs in this sizzling hot Qcommerce kitchen is Deepinder Goyal. What he has cooked with Blinkit seems to be flying off the counters. Over the years, Goyal has also added two more core pillars to his consumer tech business. In conversation with Forbes India, Goyal discusses the quick commerce race, profitability and even the chief of staff job posting.

Jennifer Garvey Berger, designer, teacher and coach of leadership programmes

Jennifer Garvey Berger, designer, teacher and coach of leadership programmes

Jennifer Garvey Berger designs and teaches leadership programmes, coaches senior leaders and their teams, and supports new ways of thinking about strategy and people. Her four highly acclaimed books build on theoretical knowledge to offer practical ways to make leaders’ organisations more successful, their work more meaningful, and their lives more gratifying. Berger has trained senior executives of the world’s biggest business organisations and government sectors worldwide, including Novartis, Google, Intel, and Microsoft. In Mumbai to conduct a workshop with top business leaders in February, US-based Berger spoke to Forbes India about how leadership is a skill that can be learnt, how leaders can motivate their teams and foster good culture at a time of mass layoffs and low employee morale, and how leaders should be allowed to fail, much like sportspeople.

Amit Gupta, co-founder and CEO of Yulu Bikes. Image: Harichandan Arakali

Amit Gupta, co-founder and CEO of Yulu Bikes. Image: Harichandan Arakali

In the latest episode of Forbes India Tech Conversation podcast, Amit Gupta, co-founder and CEO of Yulu Bikes, talks about the opportunity for his company to scale on the back of the rise of quick commerce in India"s metros and large cities. Gupta also shares the many lessons from having painstakingly built an asset-heavy business — an approach that"s not the first preference of VC investors — to the point where the company turned EBITDA positive last year. And if a few things fall into place, including funding, Gupta expects to turn PAT positive by the end of 2026.

First Published: Mar 29, 2025, 10:00

Subscribe Now