2021: Answering 5 FAQs ahead of the new year

From 'will retail loans go sour' to 'when will we come out of recession', and 'what will happen to US-China relations', and more, we answer 5 pertinent questions

Illustrations: Chaitanya Dinesh Surpur

Illustrations: Chaitanya Dinesh Surpur

1. Will retail loans go sour?

Quite likely, yes. And the unpleasant numbers will show up in January and April 2021, when banks start to disclose asset quality through their quarterly earnings data. Even as much confusion prevails on whether banks will be granted more time to restructure loans—considering that the Supreme Court is hearing matters relating to waiver of interest—most have resorted to upfront provisioning, fearing deteriorating asset quality in the months gone by. But restructuring the loans will not solve the problems for banks, it will only delay them.

Rather than large corporate loans, the pain point for banks is likely to come from unsecured loans, particularly personal loans, education loans, credit card debt or a small vehicle loan. Individuals who have seen job losses or salary cuts or small businesses where revenues have come to a grind have struggled to repay loans.

Between April and October 2020, the bounce rate on auto-debit transactions has been high at an average of 40.4 percent in volume terms and 33.5 percent in value terms, compared to year-earlier levels of 29 percent and 23 percent respectively, for the same period. This was on transactions through the National Automated Clearing House (NACH).

Most bankers fear the worst for the retail loans segment. “The meter is running on the retail side. For the industry, overall slippages are bound to increase,” says Amitabh Chaudhry, managing director and CEO of Axis Bank. These non-performing assets (NPAs) will be higher than what the financial system has seen in the recent six to seven years.

Banks and non-banking financial companies have been struggling to reduce their NPA levels. The overall gross NPA ratio has come down to 8.5 percent for all banks in FY20 from a peak of 11.2 percent in FY18. But this has meant banks, particularly state-owned ones, are seeking recapitalisation to stay alive while making higher provisions. Survival, rather than growth, became the mantra for most.

But even prior to the pandemic, banks had become risk averse and focussed on cleaning up their balance sheets. During the pandemic, most private banks managed to raise fresh capital and have also seen a surge in deposit growth. All this has meant that the Indian financial system is better positioned than it was during the previous financial crisis. It also means that India might be poised for improved credit growth in two to three years, as macro conditions improve.

- Salil Panchal

2. Will India come out of technical recession?

Yes, but this will mostly be due to a statistically positive base effect of 2020. It does not mean the economy would be roaring back to pre-Covid-19 levels.

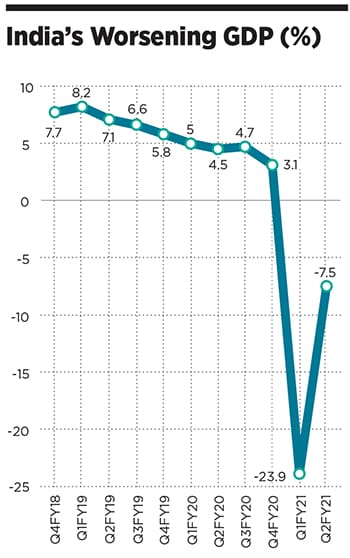

India entered the technical recession in 2020, clocking two successive quarters of year-on-year negative GDP growth. When business activity came to a near-standstill between April and June, halting the manufacturing and services sectors, the GDP contracted 23.9 percent, the worst on record since quarterly data started in 1996.

As the unlocking of economy commenced in July, there was a sharp improvement in agricultural, manufacturing and industrial activity, construction (across some states) and transport and domestic trade. All of this led to a better-than-expected recovery, but the degrowth continued by 7.5 percent for the three months to September.

Economists and rating agencies expect economic activity and growth to improve sequentially in the Q3 and Q4 of FY21. Some analysts expect India to turn marginally positive in the January to March 2021 quarter.

A clearer upswing, however, will be seen by mid-2021. “We will definitely climb out of the recession in FY22, barring any major unforeseen shock,” says Bandhan Bank’s chief India economist Siddhartha Sanyal. “The start of the next financial year ( Q1FY22) will also see a very high number, thanks to the base effect of a year ago, the normalisation of social and business activity which people will force themselves to resume and hopefully a lean patch in the pandemic as vaccines are made available.”

Statistically we may cheer the bounce back, but a meaningful recovery will only be possible through sustained rise in private consumption (which accounts for around 58 percent of our nominal GDP) and government-led capital expenditure. The share of private consumption to GDP remains subdued with consumer confidence low due to concerns over job security, income growth and expenditure towards health.

But moving into the middle of 2021, we could see some more nomalisation in demand for consumer staples and consumer durables. Other aspects of spending towards travel and hotels for leisure are also likely to improve. And the Reserve Bank of India (RBI) is likely to stay supportive in terms of interest rates.

- Salil Panchal

3. Will US-China relations continue to deteriorate?

As Joe Biden takes over as US president, expect a swift reversal of Donald Trump’s policies. One area where there is unlikely to be significant change is US-China relations. There is now broad consensus among the US political class that China is fast morphing from a partner to an adversary. The sooner relations are redefined to reflect that reality the better.

Chief among US concerns is China’s shift towards a more authoritarian state as well as the belief that it is not playing by the rules of the global trading order. Last has been its threats to Taiwan and the throttling of Hong Kong’s protesters though the imposition of a national security law.

In the last year, China has moved to stifle Uighurs through mass detentions as well as indoctrination camps in the country’s remote western provinces. This has resulted in the US imposing sanctions on Chinese state companies as well as officials. What is clear is that disapproval from the West has not deterred China from continuing with its policies.

On the trade front, the imposition of tariffs on Chinese imports to the US has failed to slow their growth. In 2016, the trade deficit with China was $347 billion. In 2019, it was lower marginally at $345 billion despite the imposition of 5 to 25 percent tariffs on select Chinese imports.

Last, there have been belligerent moves towards Taiwan with naval exercises close to its coast as well as assertions that China may move to reunify Taiwan. Add to that the confrontations its navy has been getting into with its US counterparts in the South China Sea and it’s clear that China is biding time till its forces are able to mount a challenge to the US military.

All this has meant that global companies have begun to derisk their supply chains and adopt a China-plus-one strategy, with India, Bangladesh and Vietnam being looked at as manufacturing destinations.

The year 2021 could see the US-China relationship undergoing a permanent reset—this time to a more adversarial one.

- Samar Srivastava

4. Will foreign inflows continue to power Indian markets?

Yes, if one seeks a simplistic answer. But their bullishness for Indian equities, or even the emerging markets, is going to be weighed with several concerns and caveats. Factors such as the efficacy of Covid-19 vaccines, the sustained recovery of China’s economy in 2021 and the ability of governments to spend towards health care post-pandemic will influence the regions and corporates that foreign investors will seek to invest in stocks beyond their shores.

India’s markets have jumped to record highs in late 2020 fuelled by fresh buying by foreign investors, as corporates reported improved earnings in the September-ended quarter. Also, India’s weight in the MSCI emerging market index has increased to 8.7 percent from 8.1 percent earlier. In normal years, foreign investors would be winding down business activity towards the year-end. But this year, they have bought heavily in the second half—buying largely into banks and financial institutions, while domestic investors have sold stocks—largely out of relief, booking profit in stocks bought earlier in 2019-20.

Foreign funds have found banking to be an attractive sector. Most banks have strengthened their balance sheets in recent months by raising fresh capital they have improved efficiency of their digital platforms and there is enough liquidity in the system—all positive conditions for fresh investments (although foreign investment limits in India’s large private banks is already high and some valuations stretched).

As business activity for goods and services and manufacturing continues to pick up, banks, insurance and financial institutions, consumer durables and health-tech companies in the large-cap space are likely to emerge as winners in the coming months.

“India is one of the few countries which is likely to end FY21 with zero or marginally positive growth in a period when most large economies could post negative growth,” says Swarup Mohanty, CEO of Mirae Asset Investment Managers (India), “I do not see a change in FII behaviour in 2021. Some funds may book profit but India is the country to be invested in.”

Morgan Stanley’s India research team in November revised upwards their BSE Sensex index target for December 2021 to 50,000 points, to trade at 16x forward earnings. The firm argues that “the coming growth cycle is not fully priced in”, indicating more upside for the markets.

The behaviour of high net worth individuals, who have been focusing on buying into pre-initial public offering (IPO) edtech-focussed companies, will need to be watched. Investors will also eye vaccine- and research-oriented health-tech companies.

- Salil Panchal

5. Will retail inflation prove to be sticky?

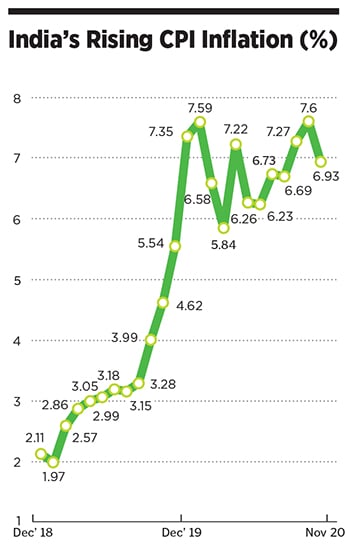

The murmur has only been getting louder. The monetary policy committee members of the RBI had voiced their concern of “some evidence that price pressures are spreading”, in the minutes of the December 2 RBI policy meeting. November was the 10th monthly above-target inflation print in 2020, with the sole exception being March.

Within core inflation, health, education and transport costs have been on the rise and continue to be sticky. Crude oil prices have been on the rise on optimism of a recovery in demand. So it is most likely that retail inflation will be sticky in 2021 as economic activity picks up and demand normalises. But it may not last too long.

“Headline CPI inflation in 2021 will be a year of two halves—sticky in the first half and coming off in the second half,” says Rahul Bajoria, chief India economist at Barclays in India.

The areas of concern will be oil prices and labour costs which are not likely to come off in the next three to six months. But after that inflationary pressures will start to ease.

Much of this rationale is based on the premise that demand is not going to push inflation up in a major way and core inflation at 5.51 percent will consistently decline in 2021. This is because most of the price increases—as cost of operations for businesses have been on the rise—to help boost margins have been front-loaded and are unlikely to increase significantly in the next year.

Food prices, which have been elevated in recent months, are likely to fall in 2021, unless there is a drought-like situation. The same is likely to be seen for milk, egg and meat products, as supplies continue to normalise.

By the time the RBI meets next, India will be on the cusp of starting off their vaccination drive. But even as growth starts to pick up in 2021, the bank is unlikely to act hastily. To ensure that the revival in growth sustains, the RBI is likely to be very accommodative in its stance in its rate action.

It is quite likely that policy decisions will be based on how macroeconomic conditions evolve and also how the pace of vaccination across the country picks up. A hike in interest rates will be a story that is most likely to be told later in 2021-22.

- Salil Panchal

First Published: Dec 28, 2020, 13:20

Subscribe Now