Does it pay to link executive compensation to ESG goals?

More CEOs are getting "ESG pay." Does it improve their companies' sustainability and financial performance?

As ESG investing has boomed, so has a movement to tie executive compensation to environmental, social, and governance goals such as reducing carbon emissions, diversifying the workplace, and improving corporate culture. Like all things ESG-related, this has sparked skepticism and controversy. Are these incentives and bonuses driving CEOs to meet ambitious goals or are they just another way to pad compensation packages?

The questions surrounding “ESG pay" and its efficacy intrigued Stefan J. Reichelstein, a professor emeritus of accounting at Stanford Graduate School of Business and a senior fellow at the Stanford Institute for Economic Policy Research and the Precourt Institute for Energy. With colleagues Shira Cohenopen in new window of San Diego State University, and Igor Kadachopen in new window and Gaizka Ormazabalopen in new window, PhD ’11, of IESE Business School in Barcelona, he recently published an early-stage exploration of the scale of ESG incentives in the C-suite and their impact.

“What we really wanted to understand was what sort of companies tend to adopt ESG pay more frequently, and where are they in the world?" Reichelstein explains. “And there are the harder questions: Can we say anything about the outcomes associated with ESG pay? In what dimensions are the adopters of these ESG compensation schemes really different from the non-adopters?" In other words, what is ESG pay accomplishing?

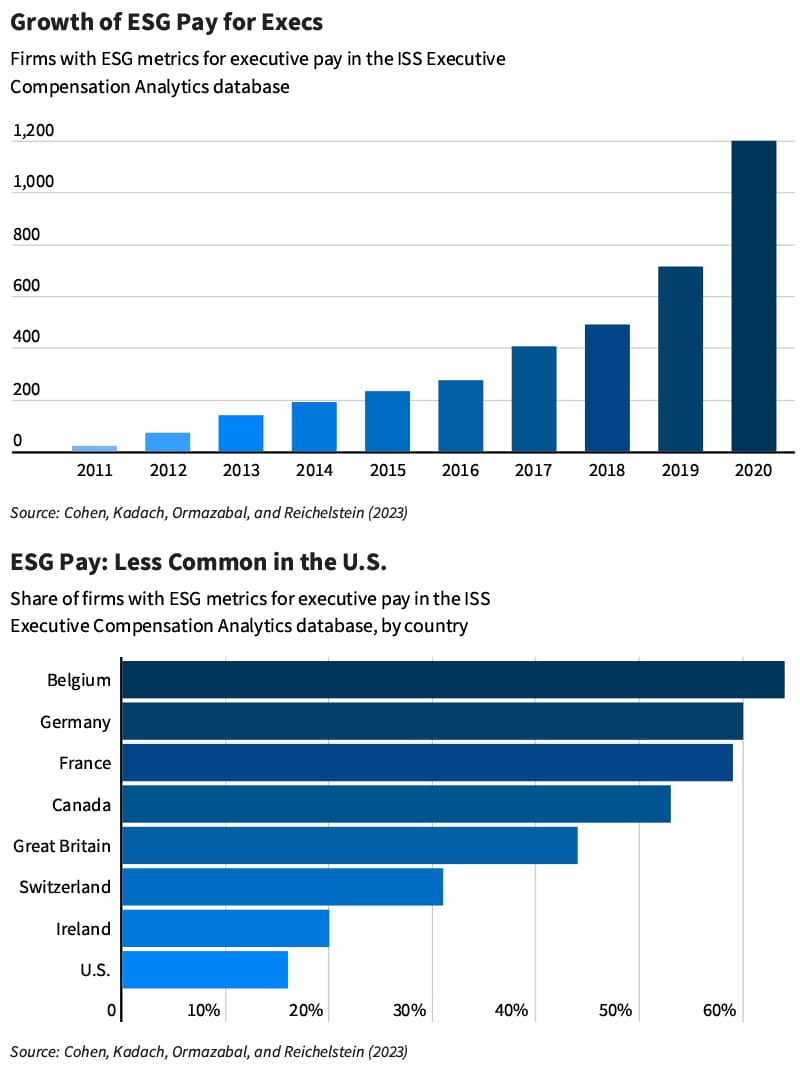

Digging into a global database of executive compensation, Reichelstein and his colleagues looked at a sample of nearly 4,400 public companies in 21 countries. The data yielded several significant insights into the rapid growth of ESG pay. The number of firms that designate ESG metrics as key performance indicators for executives grew from just 3% in 2010 to 38% in 2021. While some large American companies have embraced ESG pay, most U.S. companies have not. In 2020, just 16% of U.S. companies in the sample had adopted ESG pay, compared with more than half of companies in Germany, France, and several other European countries.

While critics claim that ESG pay is simply a PR move, Reichelstein and his colleagues found that it does help firms reach ESG benchmarks. “For instance, we find that when firms include emission-specific metrics in their executive compensation packages, they also achieve a subsequent decrease in their CO2 emissions," the researchers write. They also found that the adoption of ESG pay is accompanied by relative improvements, as measured by third-party ESG ratings.

On the other hand, the researchers found that ESG pay does not have a positive impact on companies’ financial performance or share price. However, there’s no indication that it’s the drag on profitability that detractors assume it is.

“There’s this adage that doing good means doing well," Reichelstein says. “We found no support for that paradigm. But you also can’t turn it around and say that companies that incentivize their top management to embrace ESG criteria are doing worse."

By cross-referencing the executive pay data with other sources, the researchers were able to draw a detailed picture of the state of ESG pay. ESG pay is more common in countries with heavier regulation and greater social sensitivity about sustainability. It is also more prevalent in sectors with a bigger environmental footprint, such as heavy industry, and among companies with relatively high carbon emissions — possibly because they face more public scrutiny of their environmental performance. Bigger companies and companies with more independent directors and women on their boards are also more likely to link pay to ESG metrics.

The researchers found a possible factor driving the growth of ESG pay: Institutional investors are more likely to increase their holdings in companies that have adopted ESG incentives for executive compensation. And companies that have been engaged by the “Big Three" of asset management — Vanguard, BlackRock, and State Street — are more likely to adopt ESG pay.

While the study didn’t probe why big investment firms are keen on ESG pay incentives, Reichelstein suggests some potential rationales. It’s possible that investors are genuinely concerned about issues such as climate change or increasing workplace diversity and pay equity. It also could be that investors believe that sound environmental practices and social responsibility will make companies more economically sustainable.

“Our study starts with the hypothesis that companies’ boards of directors use executive compensation schemes to align the interests of owners and managers," Reichelstein says. “So the most natural interpretation of that rationale is that owners believe that good ESG practices and ESG-oriented management is going to pay off in the long run, at least in terms of creating shareholder value. Shareholders may not necessarily care themselves about ESG variables, but they still think that, given the way the world is going, it’s going to contribute to the bottom line."

That might turn out to be true in years or decades to come. But in the short term, ESG pay does not appear to improve financial performance. At the same time, some of the benefits a company gets from linking executive pay to ESG outcomes may not be easily quantified. “If you’re showing that you’re conscious of the problems and you can say, ‘We’re working on it, and we’re incentivizing our management to improve things,’ that probably buys you a lot of goodwill with some stakeholder groups," Reichelstein explains. He notes that “most consumers, investors, and the general public believe that some of these ESG variables reflect a common good for society that is not reflected on its own in profitability measures."

Reichelstein emphasizes the limitations of the data that was available for this study. “We know a few things, such as the types of ESG variables that were included in the compensation arrangements of top-level executives," he says. “But typically, we didn’t have access to the details of the compensation structure, such as the weight that those ESG variables received, relative to other factors such as share price or earnings numbers."

Since there isn’t a common standard for measuring ESG performance — “everybody has their own metrics and their own scores," Reichelstein notes — it’s tricky to make comparisons between companies. The environmental parts of ESG — in particular, direct carbon dioxide and other greenhouse gas emissions on a year-to-year basis — are the simplest and clearest variables to understand. Governance, in contrast, can be much more amorphous, with companies using widely varying metrics.

Reichelstein thinks that rising MBAs can expect that the companies they work for in the future — at least the big ones — will be more likely to link executive compensation to non-financial performance measures such as ESG. “Tying executive compensation to some of these variables makes sense and is doable," he says.

First Published: Dec 12, 2023, 12:07

Subscribe Now