Today, as India grapples with a gruesome second wave of the pandemic, with over 2.5 crore people getting infected as of May 17, the results of this paper imply that “people with underlying health disorders such as respiratory illness caused by exposure to air pollution might have a higher risk of death following Sars-CoV-2 infection".

The urgent need to take steps toward conserving the environment has been felt for a few years now, as the adverse implications of climate change gradually permeate through our daily lives. This sense of accountability has been, in turn, extending to responsible investing, where custodians of wealth are making sure that businesses are sustainable so that future generations are better-placed because of the investment choices being made right now.

“Before last year, it was primarily financial events that led to systemic crises in markets across the globe. With the pandemic, investors have started believing in the scope of physical risks that impact financial investments and lead to an upheaval in markets," says Abhay Laijawala, managing director and fund manager, Avendus Capital Public Markets Alternate Strategies. As investors look for new ways to mitigate physical risks like Covid-19, he explains, they have will a more enhanced focus on environment, society and governance (ESG) factors.

![]()

Environmental factors refer to how a company fares on metrics like carbon footprint, energy consumption, water and waste management and other environmental impacts. The social dimension takes stock of how an organisation fosters the safety and well-being of employees, local communities and other stakeholders. This aspect has particularly strengthened in the wake of the pandemic. Governance metrics include composition and diversity of the board, anti-corruption, ethics, tax transparency, involvement of the management in mitigating ESG risks etc.

This means as a fund manager, while Laijawala invests in automobile companies that are largely into petrol engines and conscious about their carbon footprint, for instance, he steers clear of automakers with an excessive focus on diesel in engine technology and no coherent vision for electric vehicles. “There is a huge correlation between diesel as an auto fuel and air pollution, particularly in congested cities like Delhi that also ranks high in Covid-19 cases and mortality today," he says. “As people become more aware, they will demand that the government take measures to reduce pollution, which would directly impact auto companies that have high reliance on diesel vehicles, and make them more financially vulnerable in the long run." The Avendus India Large Cap ESG Strategy, launched as an Alternative Investment Fund in February 2019, has since delivered delivered 38.4 percent returns as of March versus the benchmark Nifty100 at 34.6 percent returns.

From the Archives | ESG Funds: How to invest in a sustainable future

![]() Green Wave in a Pandemic

Green Wave in a Pandemic

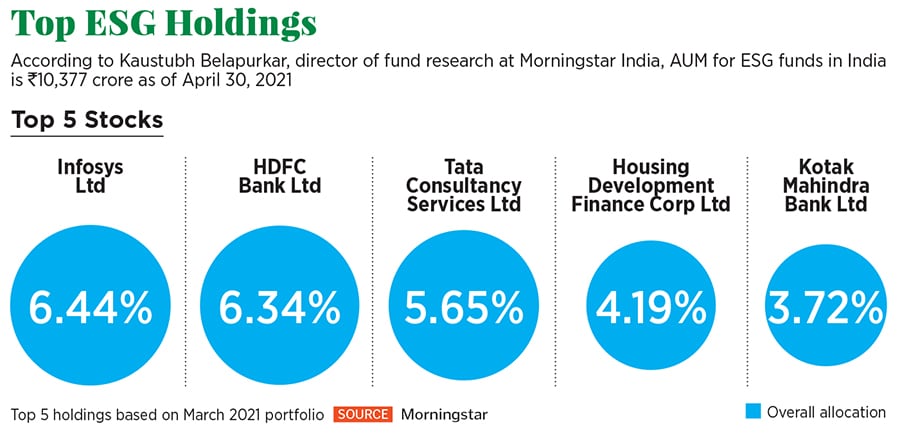

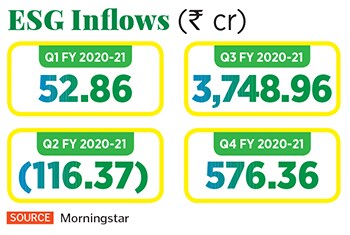

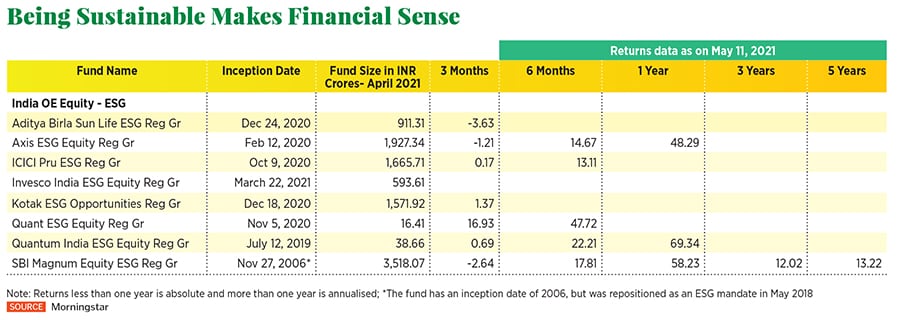

The Covid crisis has been an inflection point because investor interest and money flowing into ESG funds have significantly increased, says Kaustubh Belapurkar, director of fund research at Morningstar India. For one, at least half a dozen asset management companies, including ICICI Prudential AMC, Kotak and Aditya Birla, have introduced ESG-centric fund plans since October 2020. While SBI Magnum Equity ESG Fund is the oldest ESG fund in India, repositioned as an ESG fund in May 2018, the latest is the Invesco India ESG Equity fund launched this March. According to data from Morningstar, there was a net inflow of ₹3,749 crore into ESG funds in the quarter ended December 2020. Net inflow in the quarter ended March 2021 stood at ₹576 crore.

ESG funds in India, according to Belapurkar, manage assets of ₹10,377 crore as on April 30, 2021. Globally, ESG assets are on course to exceed $53 trillion [approximately ₹4,028 lakh crore] by 2025, according to Bloomberg, thereby representing more than a third of $140.5 trillion [approximately ₹10,678 lakh crore] in projected total assets under management.

While ESG in India is still nascent compared to global markets like the European Union (EU), US and China, fund managers say that the ESG index not only outperforms the traditional equity index in India over the long term, but it also protects downside risks better. As per the NSE Indexogram on April 30, one-year total returns for companies on the Nifty100 ESG Index stood at 54.08 percent, as opposed to 49.23 percent for Nifty100. The five-year total returns stood at 16.3 percent for the ESG Index and 14.64 percent for Nifty100.

“Several managers who have been inculcating ESG within their broader investing framework are thinking it is a good time in the market to start talking with the retail audience in India, and it’s seen a fair bit of interest, at least from a fund launch perspective," Belapurkar says. He explains that ESG goes beyond excluding taboo or sin stocks like alcohol, tobacco, weapons, gambling etc. to inclusionary or impact investments that determine which industries and companies are doing well in managing environmental, social and governance risks.

![]()

The regulator, Securities and Exchange Board of India (Sebi), has also stepped up. First, it mandated that the Top 1,000 listed companies publish an annual Business Responsibility and Sustainability Report (BRSR) on a voluntary basis in FY22 and then on a compulsory basis from FY23. This will drive material and sector-specific disclosures on a range of ESG metrics across industries, says Soumya Rajan, founder of Waterfield Advisors. “We need one full year where you just get companies to report based on set ESG parameters. Even if 500 of them put out this data, we can see how they fare across these parameters and that itself will be a huge step forward." According to her, apart from environmental and social concerns, India’s history has been particularly littered with instances of corporate governance scandals in the bluest of blue chip companies. Those taking steps to address ESG concerns around their business, she says, will reduce the volatility in the stock and make investors more confident.

Rajan also points out that not every company gets it right and there are many aberrations when it comes to sustainable business practices. So it is up to fund managers to hold investee companies accountable, she says. “Sebi’s Stewardship Code [launched in July 2020, applicable to all mutual funds and alternative investment funds] is necessarily forcing fund managers to ask the right questions while allocating money to a particular company."

As reporting requirements increase, disclosure standards in India will also become more transparent over time, says Chintan Haria, head of product development and strategy at ICICI Prudential AMC. Launched in October 2020, the size of the ICICI Prudential ESG fund was ₹1,650 crore as of March 31. “Managements across the board are trying to improve their ESG scores through reporting, because many investors, particularly global investors, are investing only in those companies that have high ESG scores," he says. “So it is a two-way street, where the government and corporates work together to encourage higher ESG standards and sustainable business practices, which in turn is also in the interest of the management as the company will benefit from high-quality investors."

![]() Is it making a difference ?

Is it making a difference ?

World over, there is no clear consensus about the contours of ESG investing and how to rate companies, leading to almost everything made to fit into an ESG box. “While financial market experts may know a lot about measuring net profits, earnings before interest and other financial figures, they are still learning how to analyse the environmental and social impacts of investments," says an April 30 report in Mongabay by Fernanda Wenzel. “Despite its exponential growth in the last few years, ESG investment is still unclear and controversial, which makes it hard to define what it means."

Laijawala of Avendus says regulators in EU and China, for instance, are clearly realising that too many funds are being repurposed and sold as ESG. “Last month, Europe came out with rules where every fund has to define itself under specific rules as to why it is defined as ESG. In the US too, there is a lot of expectation that the US Securities and Exchange Commission will start demanding greater accountability from corporates and asset management firms. More and more stringent disclosures on every facet of sustainability are being demanded around the world."

In India, he says, there is first a need for voluntary disclosures on part of companies than compulsory disclosures. “The BRSR regulation is a good move, but Sebi will soon need to do more, mandate and define what constitutes an ESG fund."

From the Archives | ESG–A fad or here to stay? By Waterfield Advisors" Soumya Rajan

Rajan says apart from the need for more stringent standards of disclosure for companies, Indian investors also suffer from a huge awareness gap. “In ESG overseas, a lot of success has come from the asset owners, who have been asking if their money has been invested correctly. In India, more funds are getting launched with an ESG focus, but asset owners are not really asking fund managers what they are doing," she says. “Fund managers have launched these funds because many of their Limited Partners (LPs) and investors are foreign institutional investors or pension funds, who, from their side, mandate investing alongside ESG parameters."

Rajan adds that the ESG landscape in India also needs a lot more quality data being made available for investors to decide that being environmentally conscious leads to better financial outcomes. It is important to have ESG conversations keeping in mind the local context, and socioeconomic situation of the country, says Harsha Upadhyaya, chief investment officer-equity at Kotak Mahindra AMC.

He gives an example of how many developed markets completely leave out stocks related to coal, but India not only has one of the largest reserves of coal, but also does not have many alternative energy sources at this point of time. "This means the country needs coal for its energy use, so we cannot keep it out based on experiences of other countries and say we won’t invest in it at all," he says. “There will be nuances you have to consider and pick companies that have progressive ESG standards. It has to evolve over time."

The Kotak ESG Opportunities Fund, launched in December 2020, has a fund size of ₹1,571.92 crore as of April 2021, as per Morningstar. Upadhyaya says they strive to maintain a balance between financial and non-financial parameters. “We want to look at the best of both worlds because we do not want to compromise on the likely returns of investors, but at the same time, we want to make sure those returns are coming to us in a way that fulfil ESG requirements." He agrees that while currently there is no standardised way to grade companies on ESG parameters, the regulations put forth by Sebi are likely to improve disclosure standards and make it easy for fund managers to analyse those disclosures and make a good decision.

Haria of ICICI Prudential AMC believes that change will be driven by the younger generation of investors. “The youth is more aware of what is happening with respect to climate change, governance etc. compared to the previous generation and they will demand a higher ESG compliance across all funds," he says. “This would mean that companies, investors and fund management teams have to be aligned in their approach." Belapurkar of Morningstar India believes that while the country has just started on the journey toward responsible investing, a few years down the line, ESG will become an integral part of looking at the fundamentals of a company and not just a separate theme. “Many investors are taking active ownership by not allocating capital to companies that are not following sustainable practices. When capital starts to dry up, companies have to start acknowledging the need to comply with ESG principles," he says. “The world is headed toward making that difference, and it will only continue to grow in India."

Illustration: Sameer Pawar

Illustration: Sameer Pawar

Green Wave in a Pandemic

Green Wave in a Pandemic

Is it making a difference ?

Is it making a difference ?