Bonds play: FII money into Indian debt market fizzling out again

Indian bonds are losing FII support despite inclusion in two major global indices from June. Is it too early to panic?

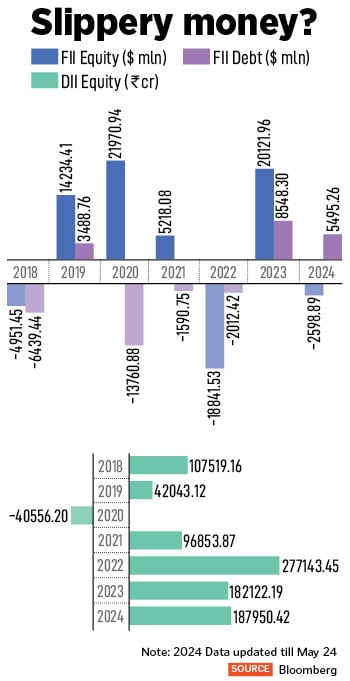

It is not a surprise that Indian bond markets have been less attractive for foreign institutional investors (FIIs). However, inclusion of Indian government bonds in two global indices, starting this June, was widely expected to turnaround flows. Rather, the excitement seems to be fizzling out as FII inflows into Indian bonds have once again begun to limp, after the initial burst of money.

In May, FIIs became net buyers of Indian bonds only in the second half of the month, following a hectic sell-off in the previous month in April, FIIs sold Indian bonds worth nearly $1.9 billion. So far FII inflows into Indian bonds is a feeble $273 million in May. One of the major factors leading to the drastic fall is volatility in the 10-year sovereign yield, especially in the US.

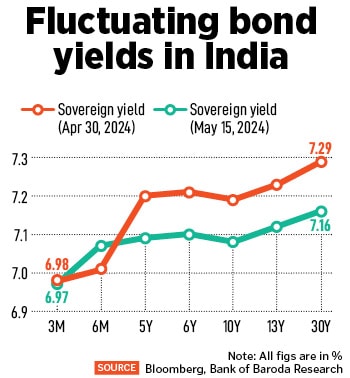

The 10-year yield in India heated up by 13 basis points in April, but later fell to 7.08 percent by May 15 due to a gradual decline in US 10-year treasury rates. Thereby, the pace of outflow of FII in debt markets slowed down in May. Typically, bond prices and bond yields are inversely related.

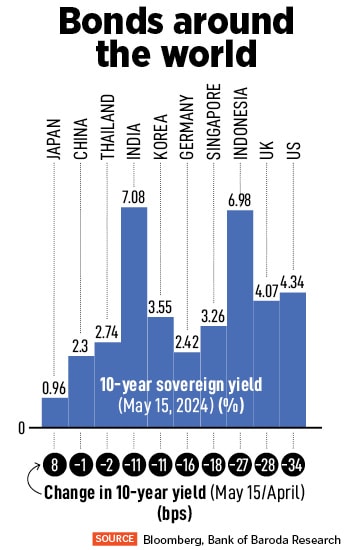

According to Dhawal Dalal, president and CIO, Fixed Income, Edelweiss Mutual Fund, FIIs selling in IGBs was partly linked to rising US treasury yields and an appreciation in the dollar index, which made investing in dollar bonds more attractive as compared to holding debt products in emerging markets (EM). “FPI selling debt in EM was not confined to India but it was broad-based across other Asian nations as well. The other part could be booking gains and de-risking ahead of the outcome of general elections," he explains.

The US 10-year treasury yields were volatile in April and May, rising 48 bps in April. By May 15, it had hit 4.43 percent, cooling off 34 percent in nearly a month. Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions. As a result, the yields on US treasuries rose significantly. Indian government bond yields too mirrored the moves of the US treasury and rose 14 bps to 7.2 percent in April.

The US 10-year treasury yields were volatile in April and May, rising 48 bps in April. By May 15, it had hit 4.43 percent, cooling off 34 percent in nearly a month. Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions. As a result, the yields on US treasuries rose significantly. Indian government bond yields too mirrored the moves of the US treasury and rose 14 bps to 7.2 percent in April.

“In April, monthly FII net investments in debt turned negative for the first time in 2024. FPI outflows continued in April, owing to a surge in US treasury yields and increase in crude oil prices. Geopolitical tensions and apprehensions around the timing of rate cuts in the US also put pressure on FIIs’ sentiments, leading to outflows in Indian debt market," says Piyush Gupta, director, Fund Research, Crisil Market Intelligence and Analytics.

Headline inflation in the US elevated 3.5 percent in April, leading to a significant increase in the yields of US treasuries, as the possibility of interest rate reductions by June has diminished due to the Federal Reserve’s statements.

“Factors that drove yield higher were stickier inflation and tighter labour market data. These, coupled with speeches of central bank officials also signalled the market of a wait-and-watch cautious approach going forward. However, the undertone completely changed when US 10-year yield fell by 34 bps," says Dipanwita Mazumdar, economist, Bank of Baroda.

Back home, the heat was felt too. FII inflows had not been encouraging for a long time. It is only in 2023, that FIIs were net buyers of IGBs, to the tune of $8.55 billion in anticipation of inclusion in two global indices, ie JP Morgan and Bloomberg. Since 2020, FIIs were net sellers of IGBs for three consecutive years. However, buying of IGBs by FIIs continued from September after the JP Morgan announcement (of including Indian bonds) but later fell in April, as 10-year US treasury yields hardened.

“The rise in US bond yields led to FPI outflows from emerging markets like India, indicating a flight to safety by investors. The recent RBI dividend payout announcement and easing in US treasury yields in May over April have boosted FII inflows in debt markets in the latest week of May," Gupta says.

India"s fixed income is at an inflexion point, with the demand quotient likely to get a boost from a wider investor pool, says Radhika Rao, senior economist, DBS. Even as domestic institutions retain their position as the main source of demand, she expects active and passive foreign fund inflows to increase their exposure to the rupee sovereign bonds as the official index inclusion gets underway. This will also allow investors to gain exposure to the economy"s positive and improving macro environment.

Index provider JP Morgan is due to start IGB inclusion by June 2024, and it will extend over 10 months, with 1 percent increments on its index weighting, till it likely reaches 10 percent. Separately, Bloomberg Index Services will include India’s bonds in its Bloomberg EM Local Currency index and related indices from January 2025, over a 10-month period to October. Once complete, India would join both China and South Korea as markets that reach the 10 percent cap in that index.

Index provider JP Morgan is due to start IGB inclusion by June 2024, and it will extend over 10 months, with 1 percent increments on its index weighting, till it likely reaches 10 percent. Separately, Bloomberg Index Services will include India’s bonds in its Bloomberg EM Local Currency index and related indices from January 2025, over a 10-month period to October. Once complete, India would join both China and South Korea as markets that reach the 10 percent cap in that index.

“While there are concerns over increased volatility over these inflows, the phased increase in weightage and prudent move by the authorities to beef-up foreign reserves to a record high in the run-up will help to defend the currency against unexpected shocks," Rao explains.

For the year ahead, she expects a steeper rupee government securities curve, with the 10-year yield seen slipping below 7 percent in the second half of 2024. “Indian government bonds have low beta to global bond movements, which is a good diversification trade for international debt market investors," she says.

Despite the sell-off in the debt market by FIIs, staggered inclusion of IGBs in the global indices is anticipated to fetch foreign money, at least through passive funds, starting June. The JP Morgan bond inclusion will lead to $25 billion inflow in FY25, according to estimates by Sandeep Yadav, head, Fixed Income, DSP Mutual Fund. “But incremental flows will reduce drastically to less than $3 billion in FY26," he adds.

Yadav explains that Indian 10-year yields will rally (as bond inflows and rate cuts get priced in) but they may find it difficult to breach 6.7-6.5 percent. “By Q4FY25 the sugar rush of bond inclusion will be behind us, probably yields will sell off, unless global and Indian rate cuts and falling global yields provide counter pressure," he says.

He is not alone in his optimism about Indian bonds becoming attractive again. According to Dalal, FIIs will start buying IGBs to the tune of $2 billion a month on average from June 2024 as part of index inclusion till March 2025. In the meantime, any positive news on India"s sovereign credit rating upgrade could result in increased demand from FIIs.

He is not alone in his optimism about Indian bonds becoming attractive again. According to Dalal, FIIs will start buying IGBs to the tune of $2 billion a month on average from June 2024 as part of index inclusion till March 2025. In the meantime, any positive news on India"s sovereign credit rating upgrade could result in increased demand from FIIs.

“Indian bonds are experiencing a nice tailwind amid strong local macro-economic landscape and improving demand-supply dynamic. Further, potential rate cuts by developed markets’ central banks could cause further compression in yields as it will raise a clamour for rate cuts by the Reserve Bank of India. The only risk is geopolitics, in which rising commodity prices and sub-par monsoon could keep inflation from trending lower. However, it is not our base case," says Dalal.

Ongoing uncertainty around the outcome of the general elections, geopolitical tensions, global interest rates, liquidity conditions are factors that will decide FII inflows in the Indian debt market. While RBI dividend announcement has provided a positive sentiment boost, policy continuance and the July budget will determine the long-term direction for FII flows.

“The recent RBI announcement about dividend payment has boosted market sentiments, with FII flows turning positive for May. Further announcement by Bloomberg in March, on inclusion of Indian G-sec in their Bloomberg EM local currency index and inclusion of Indian G-sec in JP Morgan index starting from June 28, will aid in the pick-up of FII flows in the Indian debt market," adds Gupta.

According to analysts at Phillip Capital, FII investments in India bonds are set to pick up after inclusion in two key global indices. The impact of the FII inflows will be significant on the borrowing programme of FY25, as the index inclusion is set to start from June 2024 to March 2025. There would be some spillover in FY26 as well to the extent limits are not utilised by FIIs in FY25 and active funds buying in FY26 on the feel-good factor, they add.

“Depending on the extent of flows, it would be 15-20 percent of the government borrowing program (net) of Rs 11.75 lakh crore in FY25. This is significant and will have a positive influence on yield levels in the market," analysts at Phillip Capital say.

First Published: May 28, 2024, 17:53

Subscribe Now