Will FIIs push Indian markets up this year? The stage looks set for a grand show

Foreign ownership in BSE 200 stocks is low and many global funds are still underweight India, but FIIs are likely to increase their allocation to domestic stocks in 2024. Here's why

As part of the investment strategy, market watchers believe FIIs would be looking to re-enter stocks of companies they sold off in the last couple of years which comprises substantial holding in large private sector banks.

Image: Shutterstock

As part of the investment strategy, market watchers believe FIIs would be looking to re-enter stocks of companies they sold off in the last couple of years which comprises substantial holding in large private sector banks.

Image: Shutterstock

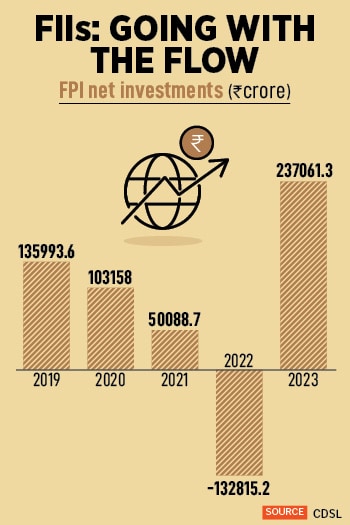

In 2022, foreign investors cashed out of Indian stocks. The massive sell-off did not deter domestic investors though. Mutual funds and retail investors drove the market to new highs. In 2023, foreign investors sent mixed cues. In the first two months they exited holdings to the tune of Rs32,000 crore, only to return as net buyers of stocks worth nearly Rs1.69 lakh crore over the next six months. They continued the selling spree until end-November. But December marked a major shift in strategy as they sprang into action to join the bull-run on Dalal Street.

What changed?

The sudden pivot by the US Federal Reserve in its December meeting was a surprise. The US central bank signalled three rate cuts in 2024 and went as far as it could to indicate it had ended the most aggressive rate-hiking cycle seen in decades. The fall in US bond yields and the slump in the greenback nudged investors to increase allocations in emerging markets.India’s share in the MSCI Emerging Market Index has doubled to nearly 14 percent over the past decade and is expected to increase given the lack of appetite for China stocks after it dragged the performance of the index with flat returns in the last 10 years. “Risk appetite in China is shockingly low; market apathy is spreading to economic outlook,” Bank of America said in a recent investor survey. Foreign portfolio allocations have been shifting to Asian markets such as Japan, Taiwan, Korea and India.

As part of the investment strategy, market watchers believe FIIs would be looking to re-enter stocks of companies they sold off in the last couple of years which comprises substantial holding in large private sector banks. In fact, banks and financial institutions are among the top picks for global investors looking to ride India’s growth story. Also, the improvement in asset quality has resulted in stronger bank and corporate balance sheets, and this has strengthened the confidence of investors.

The government’s thrust on capital expenditure to kickstart the growth cycle pushed India’s GDP growth to 7.6 percent in the September-quarter. Most economists see India’s GDP growth around the 7 percent mark in FY24. The current account deficit is seen at about 1.3 percent of the GDP and exports have been resilient despite headwinds in many western markets. Foreign exchange reserves at $623 billion are at a 22-month high and the overall macro-outlook is stable.

As the world’s fastest growing global economy with the world’s largest young population, India is an attractive consumer market and high-growth domestic companies with strong governance and attractive valuations are a big draw for foreign investors. Goldman Sachs expects corporate profit of MSCI India companies to grow 15 percent in 2024 (and 14 percent in 2025).

As the world’s fastest growing global economy with the world’s largest young population, India is an attractive consumer market and high-growth domestic companies with strong governance and attractive valuations are a big draw for foreign investors. Goldman Sachs expects corporate profit of MSCI India companies to grow 15 percent in 2024 (and 14 percent in 2025). In 2023, for instance, headline large-cap indices rallied 20 percent and mid and small-caps went up by 50 to 60 percent. But the foreign brokerage now sees opportunities in the large-cap space with focus on high-growth companies with reasonable valuations in sectors such as defence, energy transition, and the Make in India theme.

In 2023, for instance, headline large-cap indices rallied 20 percent and mid and small-caps went up by 50 to 60 percent. But the foreign brokerage now sees opportunities in the large-cap space with focus on high-growth companies with reasonable valuations in sectors such as defence, energy transition, and the Make in India theme. While FII flows into India picked up in November and December, the overall foreign ownership in BSE 200 stocks is near the bottom decile since 2013. Many global funds are still underweight and the allocation of Emerging Market Asia funds is low.

While FII flows into India picked up in November and December, the overall foreign ownership in BSE 200 stocks is near the bottom decile since 2013. Many global funds are still underweight and the allocation of Emerging Market Asia funds is low.