Net FDI in India plunged over 38 percent in the first 10 months of financial year 2024 to $15.42 billion mainly due to a rise in repatriation, shows Reserve Bank of India (RBI) data. In the same period of April 2022-January 2023, FDI in India was at $24.99 billion.

Repatriation and divestment in April 2023-January 2024 increased by 36 percent to $34 billion from $24 billion in year-ago period. Repatriation in FDI terms refers to remitting money back to the host country.

Actually, it was only in January that net FDI climbed to $5.74 billion from an outflow of $3.86 billion, the data showed. Gross inward FDI declined by 3.6 percent to $59.5 billion during April 2023-January 2024 as compared with $61.7 billion during the corresponding period a year ago.

“FDI inflows to India have slowed significantly versus the recent peak (largely due to equity capital repatriation), raising concerns if the country is really gaining prominence in the China plus 1 supply chain shift," says Tanvee Gupta Jain, chief India economist, UBS Securities India.

She explains that the slowdown in FDI flow has been largely due to a rise in repatriation of equity capital, global economic slowdown, and reduced venture capital funding at startups.

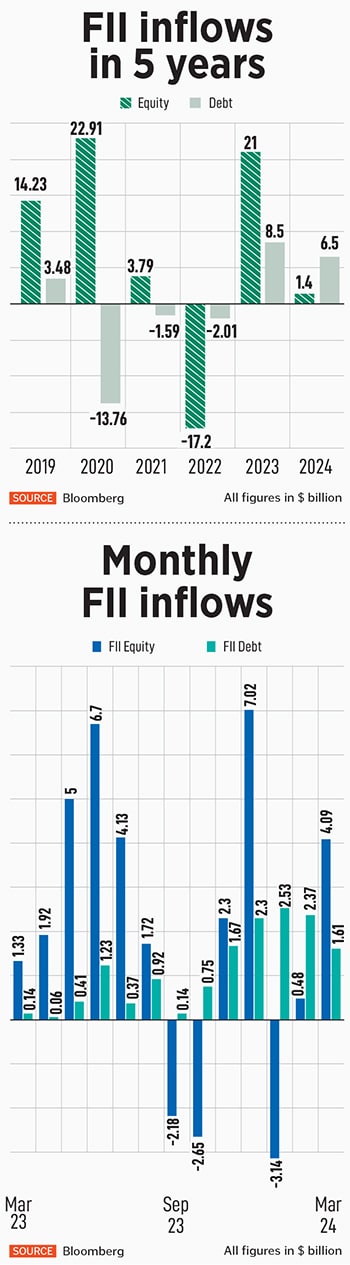

Similarly, even FIIs have been on the sidelines on their equity bets. But the debt segment bolstered by Indian bonds inclusion into global index like JP Morgan and Bloomberg got fund managers excited. Only recently, in March, FIIs have started infusing capital into Indian stocks once again.

However, it is not an ‘India-alone’ issue. Foreign investors have been cutting their exposure from Asia-Pacific countries, either exiting deals or not making any further investments in the region.

Asia-Pacific private equity funds raised just $100 billion in 2023, the lowest level in a decade, according to management consulting firm Bain & Company. Deal value fell to $147 billion, extending the dealmaking slump that began in 2022. Exits plunged, and fund-raising declined to its lowest level in 10 years.

The reasons for staying away from this region is the uncertainty hovering over Asia-Pacific private equity markets. “Many investors put dealmaking on hold in 2023, worried about slowing economic growth across much of the region, persistently high interest rates that raise the cost of PE debt, and volatile public stock markets," says Bain & Company.

According to Madanagopal Ramu, fund manager and head-equity, Sundaram Alternate Assets , FDI is on a decline due to a funding winter in private equity markets globally. “Efforts taken by the government with new policies in semiconductors, electric vehicles, electronics manufacturing etc will help improve FDI flows in the coming years," he says.

Declining FDI in India

Despite global FDI flows remaining weak in 2023 with only a modest increase of 3 percent over 2022, India fared better than its Asian peers, says RBI in its March bulletin.

![]() Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE.

Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE.

Experts feel this may be just a blip and soon FDIs will be rushing back to India.

“We expect FDI flows to start picking up again after the general elections in India," says Nishit Master, portfolio manager, Axis Securities PMS. He explains that the slowdown could be due to corporates waiting for the general election results before committing further capital investments. It could also possibly be due to the general economic slowdown, which one is witnessing in the developed markets and China, impacting the total aggregate demand environment for Indian manufacturing plants.

“India witnessed significantly strong FDI inflows over the last decade on the back of policy reforms and the attractiveness of Indian manufacturing and domestic consumption base. FDI inflows from an annual run-rate of $35-40 billion during FY08-14 period moved to $60-62 billion in FY17-19 and then to $75-85 billion in FY20-22, which have come down marginally in FY23 and had a further slowdown in FY24 to date," he adds.

However, there is a silver lining. India’s current account deficit narrowed in the October to December 2023 period despite a wider merchandise trade deficit, cushioned by a record high services trade surplus and secondary income.

In the third quarter of FY24, India’s current account deficit narrowed to $10.5 billion or 1.2 percent of gross domestic product (GDP) from $11.4 billion in the previous three months. This compares to $16.8 billion in the December quarter of 2022. What helped is some improvement in the FDI inflows and FII money in that quarter.

Within the capital and financial account, net FDI flows rebounded to $4.2 billion in the December quarter from net outflows of $0.6 billion in the three months ending September. “Still, overall in the fiscal year, FDI flows have disappointed on the downside, and they are likely to print lower than the previous year in FY23-24. FDI flows globally were on a downtrend in 2023," says Rahul Bajoria, MD & head of EM Asia (ex-China) Economics, Barclays

As per UNCTAD"s World Investment report (2024), global FDI flows were 18 percent lower in 2023 (excluding flows to European conduit nations) because of economic uncertainty and high interest rates. “For India, the drop in flows was sharper year-on-year, but stable numbers for new project announcements meant that India was still in the top five of global greenfield project destinations," Bajoria adds.

What about FII inflows in equity and debt?

Net FII inflows were in the negative on Indian stocks till the mid of March, only to rebound later. So far, in 2024, FII inflows were at $1.4 billion into equities after January saw a major withdrawal of funds worth around $3.14 billion.

![]() In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework," says Master.

In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework," says Master.

However, that’s not all. Steep valuations and rising bond yields are two other critical reasons to keep FIIs away from Indian equities. Other concerns are about rising crude oil prices and the impact of general elections on the country"s policy direction. “Unattractive valuations and opportunity elsewhere might drive FIIs to sell on rally," Ramu says.

He explains that the spread between corporate earnings yield and bond yield in India and globally are at 2007 levels, making it difficult to argue for a large return in equities in 2024. “More-than-expected interest rate cut by Federal Reserve will help push bond yields down globally and in India, which can make equities attractive again. Or we need to see earnings upgrade. It’s difficult to argue for earnings upgrade at this point in India… on the contrary, we expect some cut to the 14 percent earnings growth expectation of FY25," Ramu says.

However, the once-ignored debt segment is getting all the attention by FIIs. FIIs have pumped $6.5 billion into debt in 2024 so far following a record $8.5 billion inflows in 2023. In March, the debt segment received $1.61 billion FII inflow.

Economists feel Indi’s bond inclusion into two major global indexes will fetch in more money even if overall FDI lags. “We believe India"s growth resilience, along with the forthcoming bond index inclusion (worth $30 billion of flow and nearly half of India"s annual current account balance), will keep the capital account in a surplus," says Gupta.

Also read: There"s a bit of froth as valuations are a little overbearing our markets are definitely heated up: Anil Singhvi

Bright spark: Bond inclusion into global index

In March, Bloomberg announced the inclusion of India Fully Accessible Route (FAR) bonds in the Bloomberg Emerging Market (EM) Local Currency Government Index and related indices, to be phased in over a 10-month period, starting January 31, 2025.

Indian FAR bonds will be included in the Bloomberg EM Local Currency Government indices with an initial weight of 10 percent of their full market value on January 31, 2025. The weight of FAR bonds will be increased in increments of 10 percent of their full market value every month over the 10-month period ending October 2025.

Once completely phased into the Bloomberg Emerging Market 10 percent Country Capped Index, India is expected to join both China and South Korea as markets that reach the 10 percent cap. Within the market cap weighted version of the index, India is expected to be the third largest country after China and South Korea.

Using base data as of January 31, 2024, the index would include 34 Indian securities and represent 7.26 percent of a $6.18 trillion index on a market value weighted basis.

Index provider JP Morgan will include India Government Bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion in the widely tracked index is likely to benefit India by roughly around $20-40 billion in the next 18 to 24 months as Indian bonds will be accessible to foreign investors while the rupee is likely to be strengthened, thus boosting the economy.

The inclusion, which starts from June 28, 2024, will be in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBM-EM GD index.

“Given India"s impending bond index inclusion in June 2024, increased capital flows are likely to result in a balance of payment surplus for FY24-25 as well," says Bajoria.

Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE.

Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE. In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework," says Master.

In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework," says Master.