This is exactly what is brewing in mid and smallcaps in the last few months, ringing in similarities of what panned out in 2018. However, this time markets regulator, the Securities and Exchange Board of India (Sebi), intervened before the euphoria turned into a catastrophe. The possibility of a deeper cut in mid and smallcap stocks appear to have been avoided, at least for now, with Sebi’s nudge and mutual fund schemes stress testing their exposure in mid and smallcaps.

The Nifty Midcap 100 index and the Nifty Smallcap 100 index are down 5 percent and 10 percent, respectively, in the past one month. However, both Nifty Midcap and Nifty Smallcap are still higher by 5 percent and 58 percent, respectively, in the past one year. In fact, about 61 percent of midcap and 63 percent of smallcap stocks have given more than 30 percent returns in the past year even as the bulk of the midcap and smallcap stocks have given negative returns in the past one month, shows a Kotak Institutional Equities analysis.

Despite the corrections in these stocks, analysts find valuations in mid and smallcap stocks to be still expensive and therefore, risky.

“Most mid and smallcap stocks are still trading at full-to-lofty valuations and well above their fundamental value despite the sharp correction in recent weeks. We are not sure if the correction marks a reversal of the market to fundamentals and numbers from sentiment and narratives. If it is the former, many low-quality stocks may still have a long way to fall," says Sanjeev Prasad, co-head, Kotak Institutional Equities.

Prasad adds that it is not clear if there will be any change in the investment behaviour and optimistic view of non-institutional investors because of the recent correction and cautionary statements of the regulator about mid and smallcap stocks.

In the past two decades, slumps of more than 20 percent in smallcap indices have been fundamentally triggered by spikes in interest rates, or liquidity tightening environments, a sharp deceleration in growth, or a combination of these factors.

“Also, such triggers have been preceded by high relative valuations of smallcaps. Recently, India’s GDP has received upgrades along with global growth. Also, while expectations are being tempered on interest rate cuts immediately, the consensus view is that interest rates will moderate hereon, even if it remains ‘higher for longer’," says Vinod Karki, head of strategy, ICICI Securities.

![]()

Mutual fund schemes: Where is the stress?

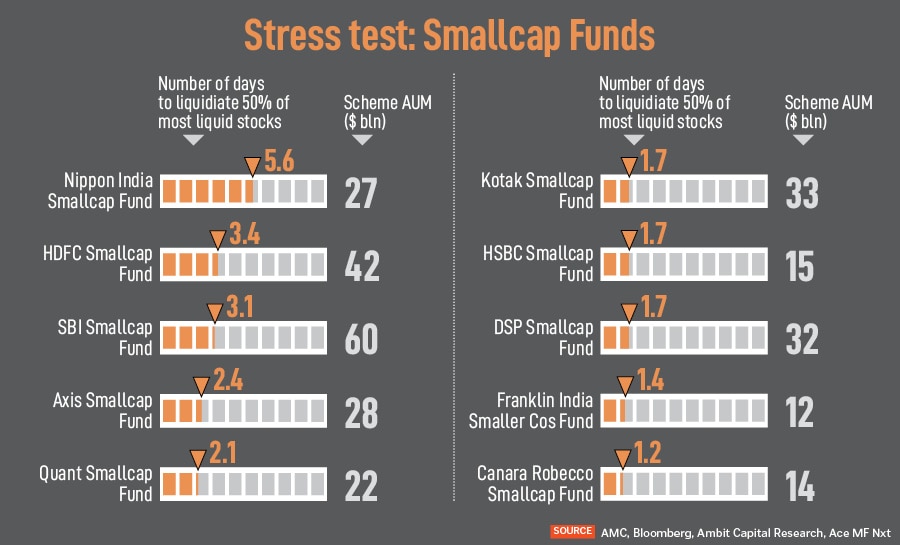

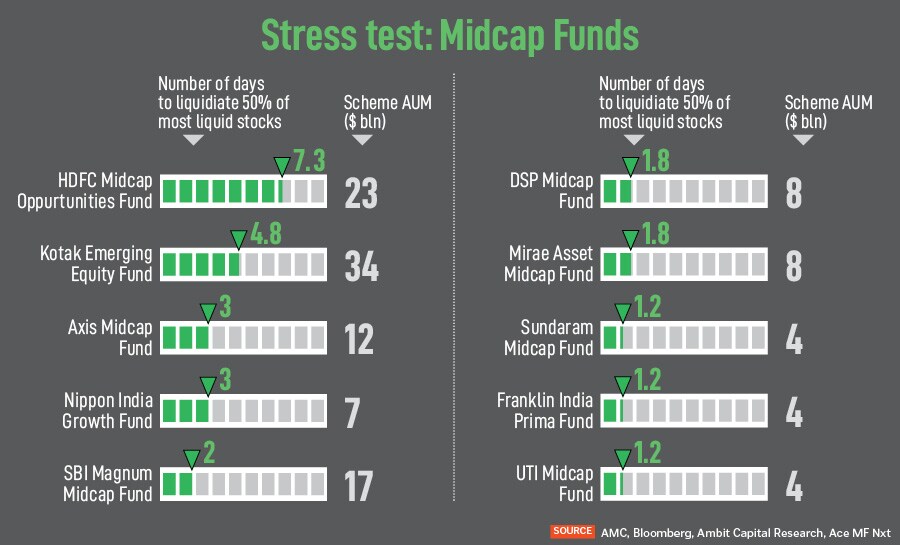

As mandated by Sebi, stress tests on the top 10 mid and smallcap schemes by asset under management (AUM) show they will take an average of 14 to 28 days to liquidate 50 percent of their most liquid portfolios. According to the Association of Mutual Funds in India’s (Amfi), all asset management companies (AMC) will have to disclose the results of stress tests for mid and smallcap schemes within 15 days of each month.

AMCs will be required to measure portfolio liquidity under stress scenarios for the midcap and smallcap funds to determine the days required to liquidate 25 percent and 50 percent of the portfolios. This will be done by determining the number of days required to liquidate 80 percent of the most liquid portfolio on a pro-rata basis. This in turn means that the 20 percent of the portfolio with the least liquid stocks will not be considered for this test.

According to analysts at Ambit Capital, small and midcap stocks may be reasonably liquid but the stock ownership of small and midcap schemes can be significantly large, and hence can take longer to liquidate their position.

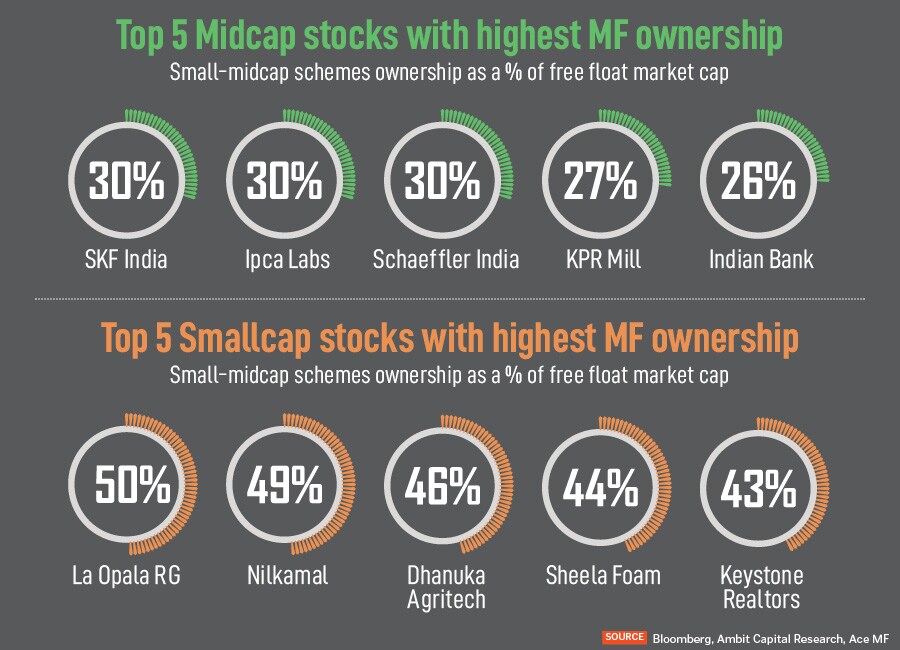

Some stocks with the highest domestic mutual fund ownership in the midcap segment, such as SKF India, Ipca Laboratories, Schaeffler India, KPR Mills and Indian Bank may come under selling pressure if there is redemption, says Ambit Capital. Similarly, in the smallcap segment, La Opala, Nilkamal, Dhanuka Agritech, Sheela Foam and Keystone Realtors may face pressure.

However, Kaustubh Belapurkar, director manager research, Morningstar Investment Research India, feels stress tests will assess the liquidity of underlying portfolios, but these are only one part of the equation. “The spread of investors is equally important, funds with assets spread across millions of investors will be less susceptible to significant redemptions as opposed to funds with a smaller set of large investors. Fund boards do monitor fund sizes from a liquidity and capacity perspective and as stewards of investor capital, if they perceive challenges due to liquidity or capacity constraints, funds can be closed to new investors," he explains.

Belapurkar adds that stress tests are important for the asset management trustees and board from a risk management perspective to ensure if there are any liquidity or capacity issues that need to be addressed. “Investors need not read too much into these numbers, unless certain funds are significantly worse from a liquidity perspective and are outliers in their peer group," he says.

There are only 277 stocks currently that have an average median quarter-sigma order size of Rs 1 crore and above, which indicates the importance of liquidity risk within smallcaps during a downturn in terms of the impact cost, shows an analysis by ICICI Securities. Quarter-sigma order size refers to the value of the buy or sell order size on the NSE, which will move the stock price by 0.25 standard deviation, based on data over the past six months.

However, the same liquidity factor becomes an upside risk due to the impact cost in an upcycle, when the demand for smallcaps is high. The analysis shows in 2023, FPIs and MFs bought more mid and smallcaps compared to large-caps, which boosted their liquidity as indicated by the rise in their quarter-sigma order size threshold. “Recent measures by MFs to curb flows will likely impact liquidity towards smallcaps, but it remains to be seen if FPIs and other investors follow suit," says Karki.

2018: Déjà vu

In 2014, smallcaps fell nearly 8 percent while midcaps slipped 4 percent, with many stocks correcting as much as 30 to 50 percent, prompted by Sebi warning of expensive valuations in the midcap and smallcap space.

“This has now triggered concerns on the possibility of a much deeper correction in these names, as was seen in 2018, which could also weigh on overall market sentiment and trigger a broader risk-off move in the market as well," says Amit Sachdeva, India equity strategist, consumer & retail analyst, HSBC Securities and Capital Markets (India).

In 2018, the BSE midcap index slipped about 14 percent, while the smallcap index slid 24 percent in contrast to a 5 percent rise in the benchmark Sensex. That was the steepest decline of both midcap and smallcap indices in the previous seven years. In 2017, midcap and smallcap indices were up 48 to 59 percent, while the Sensex gained 28 percent.

“Both periods coincide with a nearly four-year prior period of outperformance of small and midcap names over the broader market, with the bull run before the correction similar in both the contexts. Hence the worry about whether a similar period lies ahead, and if this correction is only the beginning," reasons Sachdeva.

![]()

In early January 2018, Indian equity markets were trading at extremely high valuations for all segments of the markets with Nifty 50 trailing price-to-earnings ratio of 28 times, while small and midcaps were trading at an unsustainable premium over Nifty valuations at about 100 percent premium, a clear sign of a peaked-out markets. Such markets just need a trigger to crash which happened in 2018 as entire mutual fund industry had to rebalance their portfolio.

“In 2018, almost the entire mutual fund industry was on one side of the market, trying to rebalance fund portfolios out of mid and smallcaps to comply with the Sebi-defined standard market cap definition and the new mandate of scheme characteristics. Given the fact that almost the entire MF industry was on rebalance mode, there were not many takers to offer counter-balancing flows to the small and midcap segment in the market," says Motilal Oswal Asset Management Company.

The crisis in non-banking financial corporations (NBFCs), impending the elections in 2019 and later the introduction of capital gains tax on equity, also added to market sentiments and sustained the weak sentiment for small and midcap segment then.

However, before the markets could reach a crash-rationalisation in 2024, the Sebi nudge for stress testing of small and midcap schemes helped.

“The nudge worked, and brought down the small and midcaps premium back to acceptable levels within a short span. From a premium of 24 percent and 29 percent for mid and small caps over Nifty respectively in early February 2024, which sharply corrected to 14 percent for both. Partly on account of relative strength in large caps and sharp correction in small cap index of 12 percent from February 2024 peak," explains analysts at Motilal Oswal Asset Management Company.

![]()

Mid and smallcap: Still a bet?

As Sachdeva remains constructive on the broader market, he feels any deep sell-off in midcap from current levels seems unlikely and investors will likely use these opportunities to buy into midcaps. Midcap valuations have already come down to a five-year mean as midcap market breadth has declined to 73 percent from over 90 percent at the beginning of the year.

If a major unknown risk-off macro event were to play out, then small and midcaps in their current state would offer low margin of safety in terms of their ‘earnings yield spread’, even after the recent correction in stock prices. “Given that such assets have relatively low liquidity only exacerbates the problem in a risk-off environment," explains Karki.

Midcap and smallcap indices are still trading at historically elevated levels versus their large-cap counterparts, despite the recent correction. “We find the valuations of the majority of the midcap and smallcap stocks to be quite expensive, especially in the context of their business models as well as their own history," Prasad says.