Crypto crash: A wake-up call

Retail investors are finding their way through the sharp crypto crash. As prices remain subdued, experts warn against looking at the space as a get-rich-quick scheme, even as investments into the ecos

Akash Jain, a 34-year-old crypto investor and miner, is the true new-age investor. Investing full time in cryptocurrencies since 2015-16, he thought he spotted opportunity and invested nearly Rs 2 lakh ($2,600) into what had become a nearly worthless risky digital coin Luna, just before it got delisted at the major crypto exchanges. Luna was one of the digital coins that triggered a sell-off in the global cryptocurrency market which saw an estimated $2 trillion of losses in May.

The Luna coin, at the time of writing, remains temporarily delisted from global exchanges Coinbase and Binance and several Indian crypto exchanges including CoinSwitch Kuber and CoinDCX (where Jain holds Luna). Practically, Jain cannot exit from this trade and cannot do much until the coin is relisted.Jain, who has a Masters in International Business from University of Greenwich, owns a designing firm which is mostly managed by his wife due to his full-time commitment to investing. Till 2021, Jain was making good profits out of these crypto investments. But in 2022 his losses have mounted close to Rs 10 lakh ($13,150).

Nearly 70 percent of his investment portfolio is into cryptocurrencies. Experts recommend only around 10 percent.

“The biggest mistake I made in crypto was that I would sell off after every small profit… that was my mistake," Jain told Forbes India, from his home in Ahmedabad. This is contrary to the investment doctrine of locking in gains in an uncertain global economic and trading environment, assuming one’s goal is ensuring safety of capital.

“In 2020, I realised that after every four years, a bull market starts. Now I’m only making long-term investments," Jain said. His major investments are in XRP, Ethereum, Bitcoin and Solana.

So should Jain’s investment philosophy be dismissed as being too unorthodox? Not really. After all, there are takers for penny, or now-called, rupee-stock investing too. Jain has moved away from his family business of dry colours and has the capacity and willingness to take risks and be flexible enough to keep changing one’s philosophy. He is aware of the risk these assets hold and is confident of building a future through them before they go mainstream.

Vedant Jogani, a 21-year-old student, has been a little more opportunistic than Jain, having bought into and exited from Luna just before it got delisted. Risky, but it worked for him.

He had invested in Luna in December 2021, when priced Rs 2,500, and exited with a 75 percent return in just a month. Though Luna jumped to Rs 7,000 levels in 2022, Jogani stayed away all this while until the crash came in May. Just before Luna got delisted, Jogani bought it at $100 at the Binance exchange and made a $50 profit with a sale in the next two hours.

Jogani, who has been investing in cryptos since September 2021 at WazirX and CoinSwitch Kuber, is confident of “staying invested in a coin. It is always a good thing because in the long run, it’s surely going to give you returns", he says.

But no investor, young or experienced, was prepared for the carnage that the cryptocurrency markets saw on May 10-11. A range of macro-economic factors and some technical factors played their part in this crypto price crash. To start with one has to understand stablecoins like TerraUSD (UST) and Luna and the role they are expected to play in the cryptocurrency ecosystem.

Stablecoins are digital currencies that are pegged 1:1 to a ‘stable’ asset like a US dollar, hence the name. The term algorithmic stablecoins has been commonly used in the last few weeks. These are riskier crypto products, based on a mix of technology and mathematics but are not backed by any underlying asset. The price of these products fluctuates but algorithmically, the holding pattern of the basket is changed so that the aggregate value stays at $1.

UST is the largest stablecoin algorithm by market cap and a blockchain in its own right, similar to Bitcoin and Ethereum. Crypto traders use stablecoins as hideouts when the markets in DeFi (decentralised finance) get bumpy.

According to financial and crypto experts, investors have been buying UST for the past couple of months with one goal in mind: To profit from a lending and borrowing site called Anchor that provided a 20 percent return to anybody who purchased UST and loaned it to the protocol. Some investors are said to have short sold, resulting in a run on the asset as investors sought to sell and exit before it was too late. The overall crypto market collapsed as a result of this. And a day prior to the crash, on May 10, crypto exchange Coinbase missed estimates for its first quarter revenues and reported a net loss of $429.7 mln, which raised concerns for crypto investors.

The UST collapse has had a ripple effect on Bitcoin too. At its peak, UST was the fourth largest stablecoin and Luna was a top ten crypto asset. “So the Terra collapse was a shock to the market," says Ashish Singhal, co-founder and CEO of India’s crypto exchange CoinSwitch Kuber.

Nischal Shetty, co-founder and CEO of another crypto exchange WazirX says: “The major dip that is being witnessed in crypto is a global phenomenon. Developments in the macro environment such as increasing inflation, raising of interest rates by the Federal Reserve, the Russia-Ukraine war, have all had their impact."

At the broader level, the fall of UST and Luna has raised concerns of their role in the crypto ecosystem. Ethereum co-founder Vetalik Buterin has on Twitter spoken about the dangers of algorithmic stablecoins like UST but extended support for other stablecoins such as USD coin (USDC).

As the belief in holding technology stocks has waned over the last 12 months, there is a clear impact on cryptocurrencies, particularly in those where there is no physical underlying asset.

WazirX’s Shetty says that increased inflation has also influenced investor decisions across asset classes.

Talking about the correlation with Nasdaq technology stocks, Singhal of CoinSwitch says when technology stocks have fallen, so has Bitcoin and when they have risen, so has Bitcoin. “This to me shows the fall in the crypto market is not a reflection of any fundamental concern, but simply the nature of capital flow and market sentiments," Singhal told Forbes India.

The Crypto Volatility Index (CVI) hit a near one-year high of 127.03 on May 12, but is still below the 2021 level of 163.89 on May 23, after Bitcoin prices crashed just after China and the US Treasury had announced steps to tighten regulations further.

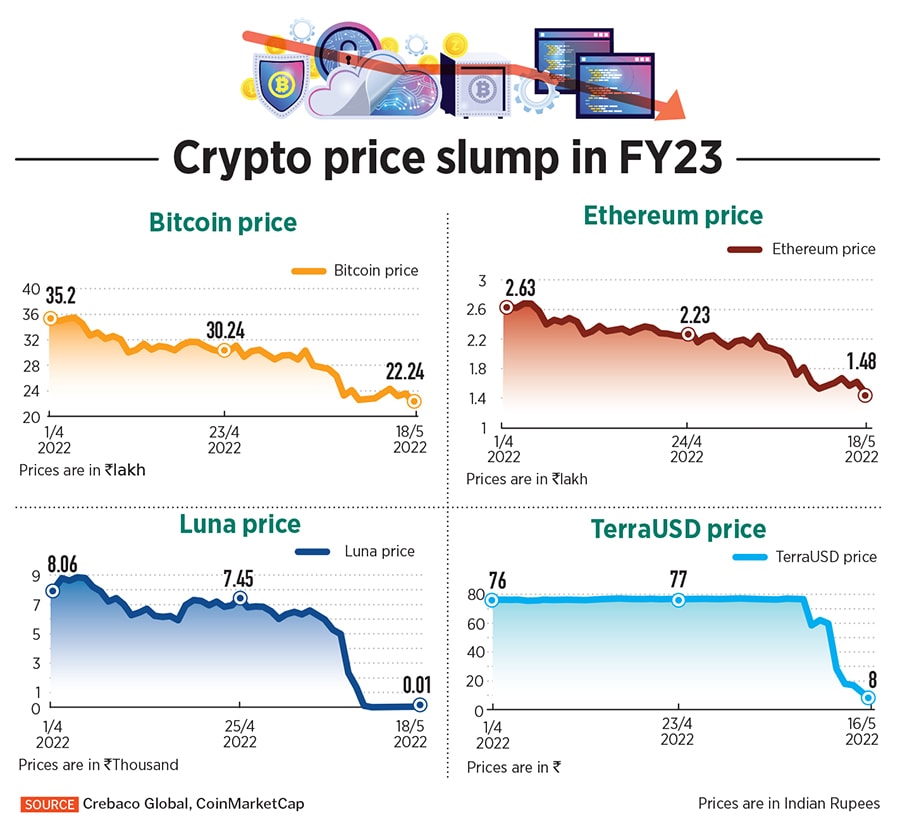

Prices of most of the main cryptocurrencies, including Bitcoin and Ethereum, have gained marginally from their May 12 lows (see charts), but are still well off prices recorded in March-April this year.

Sidharth Sogani, founder and CEO of Crebaco Global, a rating, research and intelligence firm focussed on blockchain and cryptos warns of a recession-like situation. “The global markets have lost close to $15 trillion in the last one week, and the Federal Reserve has not even started to settle or make adjustments to its balance sheets till now. This indicates that there is more to come and we may enter into an official recession-like situation. In that case for the crypto markets we should see further down or a sideways movement for the next three to six months before it enters the bull market again."

The deeper concern will be that fresh money is unlikely to flow into equities, commodities, bonds or cryptocurrency markets in the coming months. It will only mean that until economic growth and corporate earnings forecasts are altered, the sluggish trend is likely to sustain for most of these markets.

In the United States, US Treasury Secretary Janet Yellen has called for the need for “a regulatory framework to guard against the risks" to ensure that “there are no gaps in the regulation", during an internal House committee hearing.

South Korean entrepreneur Kwon do-hyung (more commonly as Do Kwon), who founded the now tainted Luna coin in 2018-–and is under scrutiny of investors worldwide--this week took to Twitter to announce a fresh revival plan to resurrect the Terra ecosystem. It remains to be seen if he will get the flexibility from voters/investors to execute this plan.

For markets such as India, the tax regulations are being ironed out. Industry experts have had conversations with regulators relating to tax policies for cryptocurrencies. “Right now discussions are on with tax authorities. But we have not had any interface with the finance ministry officials. The tax authorities want to understand how to tax products and said they are willing to listen," an industry source said on condition of anonymity.

Sathvik Vishwanath, co-founder of crypto exchange Unocoin, says that India might want to be in a position where they have the ability to adopt [cryptos] but will also want to mitigate all risks involved. Vishwanath on May 18 said on Twitter that he was “not sure if we got into crypto bear market already. The taxes and loss offset provisions which gets formulated by Govt in bull market gonna seriously hurt citizens during bear market years."

The bigger scare is that this may be an opportunity for the naysayers to come and kill the whole field, whether via policy or finance. “In the current conversation on regulation policy of treating crypto as an investment asset only (where the gains should be taxed), we are losing out on the bigger conversation of opportunity of how these technologies like NFTs and blockchain can benefit the economy at large," says Praphul Chandra, founder and CEO of KoineArth, a startup working at the intersection of blockchains, machine learning and mechanism design.

WazirX’s Shetty does not want crypto assets regulation to hurt Web3 space innovations and job creation. In recent months, Indian Web3 entrepreneurs have spoken about several developers wanting to seek jobs outside of India, due to the lack of clarity in policies and friendly crypto centres elsewhere. “However, the current bill lays down parameters that could reduce participation and increase inefficiencies instead of encouraging more people to join the bandwagon," Shetty says, adding that due to current taxation laws, there is a possibility for them to shift their capital to unregulated or decentralised P2P or foreign exchanges. “This could become a challenge not only for the exchanges but also for the government to get revenue from taxes. But the more significant implication will be the disadvantage to the Web3 space where it will intercept innovation and job creation as entrepreneurs will move to countries with more friendly policies and taxes towards crypto."

"There has never been a better time to build in Web3. Platforms are continuing to mature, there"s broader adoption as key Web2 companies are announcing support, there"s a wider base of investors, and deeper talent pools than ever before. Sequoia Capital India remains committed to being an active participant in making Web3 mainstream," says Shailesh Lakhani, managing director of Sequoia India.

Crypto exchange CoinDCX in April this year got a fresh $135 million funding, which has doubled its valuation to $2.15 billion in the past eight months. CoinDCX became a Unicorn in 2021. Steadview and existing investor hedge fund Pantera co-led the Series D financing in CoinDCX. Coinbase Ventures, Kingsway, Draper Dragon and others also participated in the fresh funding.

One venture capitalist said that for retail investors little has changed, unless they were investors in the Terra-Luna space. “We will keep on trying to make crypto mainstream and keep on forcing crypto building for sustainable products and companies," he said on condition of anonymity.

Rishabh Parakh, chartered accountant and founder-mentor of NRP Capitals wants retail investors to stick to investing 2 percent of their portfolio or only the money they can afford to lose, into crypto. He calls on investors to avoid crypto investing “until it becomes widespread or investors gain a better understanding of the market. You don"t need to buy the deep without first determining how much deeper it can go, and you shouldn"t try to grab falling knives since they may fall further", Parakh says.

CoinSwitch’s Singhal calls the May crypto crash a “wake-up call" for retail investors to focus more on research and look at crypto as a part of a well-rounded portfolio and not a get-rich-quick scheme. The risk is clearly higher and one needs to factor that in while making investment decisions.

He feels the market has absorbed the Luna collapse “better than we all thought". The crypto market has in the past decade seen and survived several shocks, be it Mt. Gox hack in 2011 in 2012, a Ponzi scheme by certain fraudulent actors and in 2021, China’s ban on crypto mining and trading.

The crypto market has survived all this due to the underlying premise that the blockchain is a powerful idea which can change the way the next generation of digital products are built, Singhal adds.

Each crash has and will make retail investors mature and understand that the promise of getting rich quick is not always real. They will need to be ready for the TDS norms which come into effect on July 1. Investors like Jain hope that Luna gets relisted and prices stabilise. “I’m not worried or feeling guilty about crypto investing because eventually over time, losses will be coped with and there will be a profit cycle. All my current investments are for 2024-25," Jain says.

First Published: May 20, 2022, 14:20

Subscribe Now