For long, many of them have been rivals.

But, as they say, there are no permanent friends or rivals in business. That’s perhaps why many of them have forgotten their rivalries and come together to forge alliances to tap an opportunity—that is probably as enormous as the GDP of Nepal—in the digital payments space.

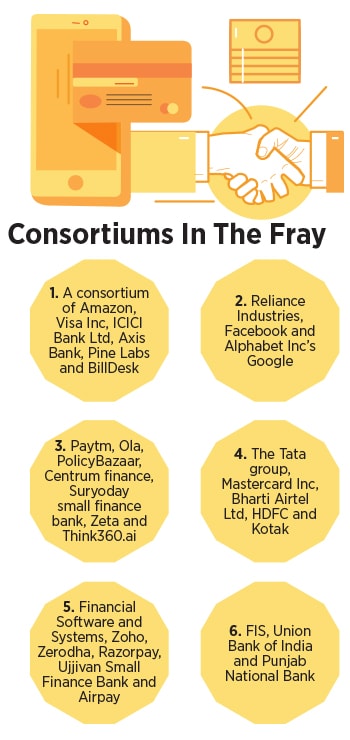

On March 31, six consortiums comprising some of India’s biggest companies submitted their application to the Reserve Bank of India (RBI) to set up a national payments infrastructure rivalling the government-owned National Payments Corporation of India (NPCI). In February 2020, the central bank had sought interest from the private sector to set up a pan-India umbrella entity called the New Umbrella Entity (NUE) to focus on retail payments systems in the country.

The NUE is tasked with setting up, managing and operating new payment systems in the retail space in addition to operating payments systems such as ATMs, white-label PoS, Aadhaar-based payments and remittance services. The entity is also expected to operate clearing and settlement systems, and manage risks such as settlement, credit, and monitor retail payments system to avoid shocks and fraud in the economy, according to the RBI.

Some of those who have evinced interest are Axis Bank, ICICI Bank, HDFC Bank, Amazon, Reliance Industries, the Tata group and Airtel. It isn’t clear how many of them will get the licences from RBI. The applications will be scrutinised by an external advisory committee that will submit its recommendations to the RBI. The central bank intends to complete the process by September.

Among others, a first consortium is led by Axis Bank, ICICI Bank, Amazon, Visa Inc, Pine Labs, and BillDesk while another is led by Reliance Industries, Facebook and Google.

“Rising internet and smartphone penetration coupled with an increase in financial literacy and a strong push towards digitisation by the RBI and government have led to an exponential rise in digital payments in India over the last decade,” Sanjeev Moghe, EVP & head-cards and payments at Axis Bank tells Forbes India. Axis Bank’s consortium with its partners includes a 20 percent stake each by the bank and ICICI Bank, while Amazon, Visa, Pine Labs and BillDesk will hold 15 percent each.

Other applicants, including billionaire Vijay Shekhar Sharma-led Paytm, have joined hands with the Bhavish Aggarwal-led Ola and a clutch of other companies. The salt-to-automobile conglomerate Tata group has come together with telecom operator Bharti Airtel, MasterCard, HDFC and Kotak to set up its NUE. Two other consortiums led by Financial Software and Systems along with Zoho, Zerodha, Razorpay, Ujjivan Small Finance Bank, Cholamandalam Finance and US-based payments firm FIS along with the Union Bank of India and Punjab National Bank are in the fray.

“With aspirations to fuel a less-cash and more-digital micro-payments economy, the RBI has set up a framework to authorise pan-India umbrella entities that will focus on retail payment systems,” Cholamandalam Finance said in a statement. “The interoperable infrastructure will cater to banks and non-banks and enable innovative use-cases to solve the diversity, depth and width of consumers and small businesses in India. The consortium expects to focus on building an agile platform for seamless digital payments.”

In all, the RBI has said the umbrella entity shall have a minimum paid-up capital of Rs500 crore with no single promoter having more than 40 percent investment in the capital of the umbrella entity.

“We believe that the market has significant potential and is big enough to allow new entrants to address white spaces and expand the pie while also fostering greater competition and innovation, leading to financial inclusion,” Moghe adds. “By creating a state-of-the-art payments system that is not only modular but also forward compatible, NUE can act as an ecosystem orchestrator which will solve for many of the unsolved sector-specific digital payments use-cases, resulting in organic adoption and market penetration.”

Taking the pressure off NPCI

Currently, a bulk of the digital transactions in the country are processed by the NPCI, a non-profit, umbrella organisation that’s backed by more than 50 retail banks.

The NPCI also operates the Unified Payments Interface (UPI) that allows users to link their mobile phone numbers to their bank accounts, and has since emerged as the backbone for mobile-based transactions in the country. Among others, companies such as Google Pay, PhonePe and Bhim use the UPI platform to process transactions.

Last year, NPCI carried out as many as 37.5 billion transactions worth a staggering Rs 1.6 lakh crore in retail payments on its platforms. That was nearly 40 percent more transaction compared to the year-ago period, although the value of the transactions had gone up by only three percent. A move to allow more players is also an attempt at fostering competition, which in turn will help innovation and create a new product lineup, and reduce risks.

“The payments systems in India have grown in a manner that is characterised by a few operators while there is a wide array of payments systems,” the RBI had said in a report in January 2019. “This has given rise to certain questions which range largely around concerns of concentration, need for competition and the resultant impact on economic efficiency and financial stability.”

“Right now, the primary burden of retail transactions falls on the NPCI,” says Vivek Belgavi, partner and fintech leader at consultancy major PwC India. “While it remains a not-for-profit organisation, the goal with NUE is to foster competition. The NPCI has done a phenomenal job, but there is a possibility to carry out more than five or ten times the transaction currently taking place on the platform. That’s where NUE will play a role.”

As of now, apart from retail payments, the NPCI also owns and operates the RuPay network and other payment and settlement functions. However, with the government looking at widening cashless transactions, NUEs will be able to create new products such as UPI, IMPS and other payment modes.

That’s perhaps why the different consortiums that have come together boast different capacities. “It is a mix of well-established institutions with decades of experience and agile fintech, all of which are leading ecosystem players across various categories and are continuously striving to create best-in-class retail payments offerings,” adds Moghe of Axis Bank. “Key strengths of the consortium members include specialisation in core banking products, customer access and distribution, payments switching and routing, cloud and data services, merchant acquiring and running large scale payments network. In our view, the creation of NUE is a pioneering step to build and shape innovative, cutting-edge retail payments systems for India and the world.”

Massive Opportunity

Digital payment has been growing at a phenomenal pace for the past few years, ever since the government demonetised high-value currencies. The volume of transactions has been growing at a compound annual growth rate of 23 percent, according to PwC, helped largely by the launch of UPI, the National Electronic Toll Collection and Bharat Bill Pay Service.

“With new payment technologies and use cases across sectors emerging, this growth momentum is expected to continue,” PwC said in a report titled ‘The Indian payments handbook—2020-2025’. “Growth in digital payments in India has been driven by multiple factors such as the launch of new and innovative payment products, increasing smartphone adoption, a growing need for faster payment modes, and a strong push from the government and regulators towards adoption of digital channels.”

India is expected to have over 907 million internet users by 2023, accounting for 64 percent of the country"s population, according to technology major Cisco. Over half a billion already use the internet in India. “Prior to 2010, digital transactions saw single-digit growth. From 2010-2016, this figure rose to 28 percent owing to the launch of faster payment modes in the country and jumped to 56 percent in 2016-17 following demonetisation,” the PwC report says. “Covid-19 has further accelerated the shift to digital payment modes. Together, these factors are likely to create a revenue pool of Rs2,937 billion by 2024-25 for payment players—a figure that stood at Rs1,982 billion in 2019–20.”

That’s precisely why no player wants to miss the Indian digital payments revolution. According to the RBI, NPCI had a 64.5 percent volume market share and 4.07 share by value in the total payments landscape of FY20. In March, with 216 banks live on its UPI, transactions worth some Rs5.04 trillion were carried out, up from 2.02 trillion a year ago.

At the same time, the rapid growth in the shift to digital payments has meant an increase in failed transactions due to technical declines. Ten of the top 30 Indian banks recorded a three percent failure in UPI transactions in September 2020, according to PwC. “The surge in UPI transactions is also testing the banking infrastructure and technical systems, which are not adequately equipped to handle the rise in volumes. The RBI, along with the NPCI, is pushing banks to reduce the number of technical failures and work on a real-time redressal system for handling customer complaints. This will reduce the turnaround time for banks and speed up the whole process.”

Therefore, the potential for private players to enter the digital payments ecosystem and ramp up offerings is significant. “We are yet to achieve the full potential of the digital payments ecosystem,” adds Belgavi of PwC India. “There are numerous innovations, including insurance or lending that can form the backbone of the digital play and new business models that emerge. Customers will be willing to pay for the experience, and there is a massive untapped potential when it comes to micropayment.”

“Digital payments has a long way to go although the trend has started,” says Rajesh Narain Gupta, managing partner at SNG Partners, a law firm and an expert in finance and banking laws. “With the help of private players in the ecosystem, the penetration in the country will increase. With the entry of new players, there will be new technology, price effectiveness, reach and huge penetration at all-India levels to the consumers as well as new sectors that can be converted to the digital payments process.”

A digital payments revolution is only starting out. And it has all the potential to change the Indian digital payments landscape forever.

Image: Shutterstock

Image: Shutterstock