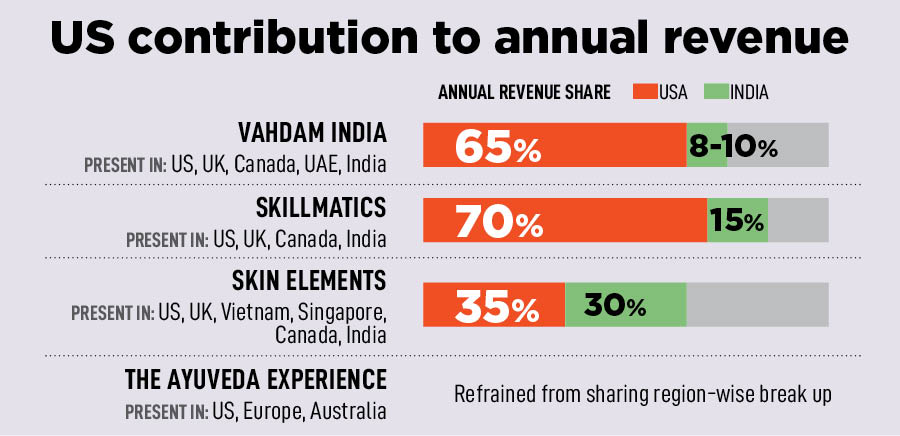

It"s a similar tale for Mumbai-headquartered Skillmatics. The PeakXV [earlier known as Sequoia Capital India]-backed firm is selling its educational-based games—for kids—online and across more than 15,000 stores in US-headquartered retail chains, including Walmart, Target and Hobby Lobby.

The Ayurveda Experience, which started operations in 2014 as an ayurveda content platform, started selling serums and cleansers in the US and Australia. And men’s hygiene player Skin Elements gets more than 60 percent of its revenue by selling in the US.

Over the last two decades, India has developed a reputation for being the backend tech support for many American multinational firms. The nation is also known as one of the best software services providers in the world, thanks to Freshworks and Zoho, among other Saas [software as a service] platforms.

But Indian brands have not been able to rule the American consumer market as much as US brands—from food and clothing to bathing—have done in India. From Levi’s and McDonald’s to Cetaphil, every person living in India regularly uses an American brand. “But it was only a matter of time before the trend of selling service from India to the world came for consumer brands," says Vinay Singh, co-founder and partner, Fireside Ventures.

To be sure, brands, including Himalaya and Dabur, have been operating in international markets for decades now. Himalaya started its first international office at Houstan, Texas, in 1996, and opened its first brand store in Cayman Island in the same year.

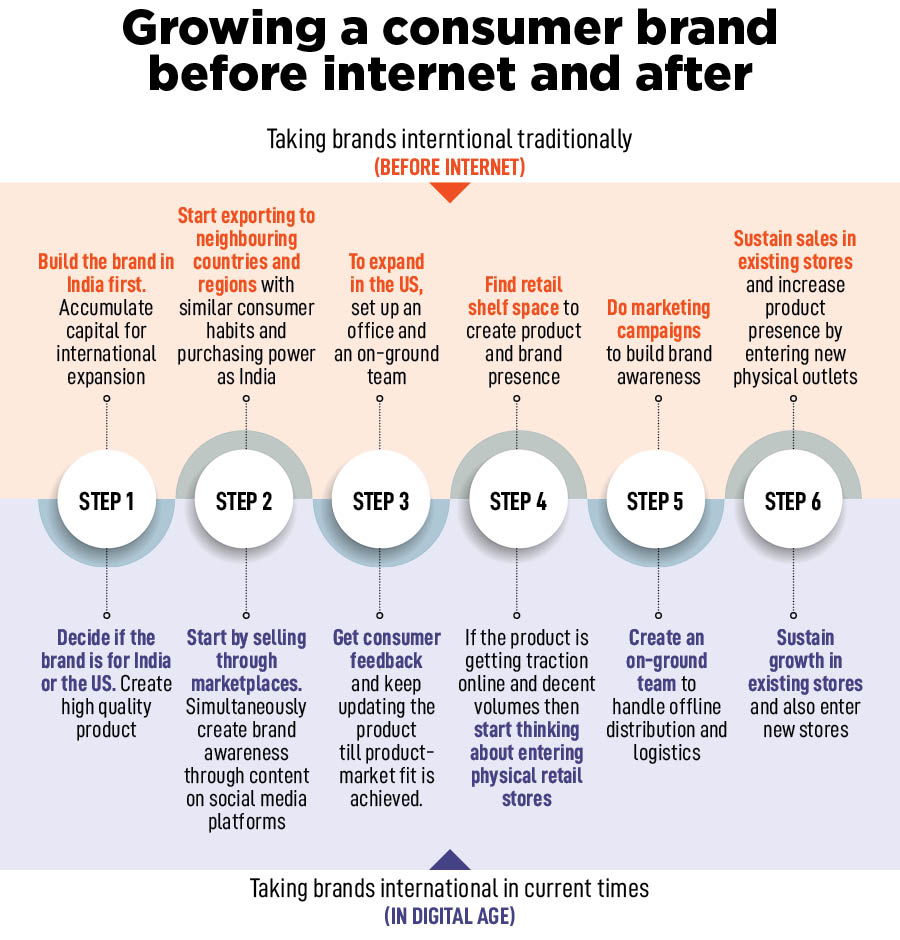

“Indian papad and bhujiya companies have also been selling internationally through India food stores for many years now," says Mohit Satyanand, an angel investor. But going international took Himalaya almost 66 years, while the new-age Indian consumer brands aim to sell to American consumers from Day 1 of starting their business.

![]()

Ayushi Gudwani, founder of clothing brand Fable Street, claims her firm has been shipping products internationally since around the second month of being founded in 2017.

![]() Dhvanil Sheth, founder, Skillmatics

Dhvanil Sheth, founder, Skillmatics

All this is because of the technological advancement in the consumer shopping category and digital marketing, which can start for about a thousand dollars. “To start a brand, you need a place to sell, a distribution channel and someone who can take your products to the consumers," says Dhvanil Sheth, founder, Skillmatics (Grasper Global Pvt Ltd).

Ecommerce marketplaces and seller platforms such as Etsy take care of these needs. Avenues, including social media platforms and one’s website, can be used for brand-building, solving for advertising, while courier partners take care of delivery.

Over the last decade, most new-age brands, including the newly listed Honasa Consumer Pvt Ltd, Mamaearth’s parent company, and Boat Lifestyle, got their start on Amazon, among other digital marketplaces.

But isn’t it still difficult to attract American consumers, who are not only being lured by domestic firms but also by French, British, Israeli and Chinese companies?

No Me-toos Allowed

So far, brands from India which have found success in the US have some form of differentiation. “Any category or product, which is known to be India’s specialty, has a consumer base in international waters. India is known for silk, indigo, teas and handicraft, among many other things," says Singh of Fireside Ventures. Just like South Korea is associated with electronics and Japan with matcha tea.

![]()

While The Ayurveda Experience is bringing in ayurvedic products, Vahdam India’s proposition is locally sourced high quality tea from India.

But companies could also enter a category where there might be headroom to grow. Skin Elements’ founder Raghav Sood claims when he launched his men’s intimate hygiene wash, the category was non-existent on Amazon’s domestic and US website.

Similarly, TeaFit’s founder Jyoti Bharadwaj found a gap in the unsweetened beverage space in India and is now tapping into the international tea drinking market in Singapore and New Zealand.

“There should be a real differentiation and not a perceived differentiation in your product," explains Skillmatics’ Sheth. This means having a similar product as another brand and selling it for cheaper cost would not suffice in the American consumer market.

Pricing is an important factor to consider while selling in the US. More than half-a-dozen consumer brand founder Forbes India spoke with, however, say the quality needs to always trump everything else.

International Sensibilities

“People in the US are quality sensitive," claims Sood. If the consumer is satisfied with the product, it can also be priced at a premium.

For instance, one of Skillmatics’ game called Space Explorer retails for Rs664 ($7.97) on Amazon India, while the same is being sold on the marketplace’s US website for $24.99 (Rs2,082). Similarly, Vahdam’s lemon ginger tea, with 50 tea bags, retails for Rs374 ($4.5) in India, while it’s sold on the brand’s website in the US for $24.99 (Rs2,082) for 100 tea bags.

![]()

Manufacturing in India is cheaper and the rupee is weaker compared to the dollar. Hence, the pricing might seem high if compared in rupee to the US dollar.

In India, the market is so price sensitive that consumers wouldn’t mind switching brands if there is a slight hike in pricing and the competitor brand’s product is a bit cheaper.

Moreover, the products also need to be made with American sensibilities. In the initial years, Sheth hired US-based agencies to help him with developing the first few SKUs [stock keeping units]. And Vahdam India kept building its online distribution channel to test its tea among the American consumer to see what works.

Undercutting on price is not a wise strategy just because you are manufacturing from India and the manufacturing cost is lower. “Your company is manufacturing in India. So, maybe your production cost is cheaper. But there is another company, which is manufacturing from China," adds Sheth.

“When it comes to products, the US market is not driven by emotions but by facts," says Sujata Biswas, co-founder of Suta, a sari brand. Consumers would rather want the company to be direct and show them the functionality of the product rather than have sentimental slogans like ‘Desh ka namak’, a Tata Salt slogan. If Suta were to advertise in the US, the campaign would revolve around, easy-to-wear saris and fabric quality, adds Biswas.

The bootstrapped sari player has made inroads in the US by selling through individual stockists. The company is also exploring US-based companies to tie up with, who could show them the rules of the new land. Since the rules are not clear, the founders are shipping their products to the US with help of courier partners, including DHL Express. “Courier partners get the paperwork sorted for sellers looking to export to the US or the UK," says Muskaan Sancheti, founder, The State Plate. The four-year-old ethnic snack platform started selling products internationally two months ago and claims the largest number of orders as of now have come from the US.

The Rule of the Land

To build a respectable brand in the US, a company has to adhere with certain rules and regulations, and acquire a bunch of licenses. For instance, if a brand wants to operate in the food and beverages category, it would have to get a Food and Drug Administration (FDA) licence. It would also need an import export licence, says Chirag Gada, vice president (new businesses), Think9 Consumer. Founded in 2022 by Ashni Biyani, Think9 Consumer Pvt Ltd has taken a house of brands strategy and acquired multiple brands to grow outside of India.

![]()

A company would also need to have a few members working locally, according to at least four founders running their brands in the US. Currently, Vahdam India, Skillmatics and The Ayurveda experience have on-ground teams in the US.

“If you are trying to build a brand for the American consumers, you would need to have a marketing team there to understand the market’s nuances," says Sarda of Vahdam. For instance, Vahdam would have a Halloween tea collection as it is a popular festival in the States, and also release testimonials of Ellen DeGeneres and Oprah Winfrey, who are popular personalities in the country.

Similarly, Skillmatics advertises its products with American kids. “If you see our website and social media, no one would be able to say that this brand comes from India," says Sheth. “We are currently doing Rs400 crore in revenue. At this stage, we have to expand in retail."

A local logistics team can help in figuring out the retail route and whether the products should be shipped by air or sea. “A company’s cost can also inflate quickly if they do not get the air-to-sea export ratio right," adds Gada.

![]() Perfora co-founders Jatan Bawa (L) and Tushar Khurana (R)

Perfora co-founders Jatan Bawa (L) and Tushar Khurana (R)

If a product is being sold for $100, about one-tenth of the cost goes in shipping by air, according to Jatan Bawa, co-founder, Perfora. The two-year-old oral care brand started selling in the US through Amazon international. “It is too soon to talk about numbers. But we want to get better volumes so that we can start shipping by sea," says Bawa.

Counting The Dollars

Customer acquisition cost (CAC), which is major expense for digital-first brands in India, can also be cash guzzler in the US. “The cash burn becomes even more expensive there because the spends are in dollars," says Rishabh Chopra, founder, The Ayurveda Experience. Similarly, hiring a full-time US-based team is also an expensive affair as salaries are paid in dollars.

![]() Rishabh Chopra, Founder, The Ayurveda Experience. Image: Madhu Kapparath

Rishabh Chopra, Founder, The Ayurveda Experience. Image: Madhu Kapparath

But entering in offline stores can only get the necessary volumes, which could then make for better unit economics. “It is difficult to pinpoint how much a brand would earn and what volumes are required because every category has its own play. There is no formula or one-size-fits-all kind of approach," says Think9’s Gada.

Expanding offline is the only next logical step to building a brand in the US. A local operations team is required to set up offline expansion. As of now, Vahdam India is present across more than 6,500 stores in the US, UK, Canada and the UAE, while Skillmatics is in over 15,000 stores in the US and the UK. These numbers are miniscule, claims Fireside Venture’s Singh. “Instead of thinking of store count, a brand should focus on figuring out how it can increase its presence across various retail chain formats," he adds.

If Walmart has 4,623 stores in the US and if a brand is present across more than 4,000 stores that’s when it would have successfully expanded in retail stores, according to Singh.

More than 50 percent of India’s retail market is unorganised, run by kirana stores. In the US, though, 90 percent retail is run by organised chains, including Walmart, Target, Walgreens, Costco and Macy’s.

Sustaining in these retail stores is another battle. “Getting into the US retail market is not easy. And once you do get in, your product needs to keep moving and you need to keep delivering growth in sales to the retail chain year after year. Or they will not stock your product anymore," says Vahdam India’s Sarda.

Why Leave India?

India’s consumer spends have been on an upward growth trajectory. In the June-ended quarter, consumer spending stood at Rs23,126 billion compared to Rs21,824 billion for the same quarter last financial year, according to research firm Statista.

Fashion brand FableStreet has decided to focus on the Indian market as there is still room to grow. And even for Skillmatics, close to 15 percent of revenue comes from India, with the country being the fastest growing for the kids’ brand.

But consumer brand founders still aspire to be treading in international waters. “As an Indian consumer brand founder, I can definitely say that we, as a country, have not yet produced a worldwide enduring brand like a Coke or a Red Bull," says TeaFit’s Bharadwaj. But unlike two decades ago, Indian brands are also catering to and finding product acceptance from consumers outside of the India diaspora.

“If your brand is successful in the US, you have recognition in the world’s biggest consumer market," says Gada. This is equivalent to having global recognition, he claims.

Building a brand in the US is also not completely different from doing it in India. Factors, including digital marketing, customer acquisition cost and timely retail expansion, are similar for both countries. Major differences come in creating a differentiated product with top-notch quality, cost effective management of supply chain, understanding the consumer nuances, and figuring out retail distribution and sustaining in those stores.

“To be able to build a made-in-India consumer brand and find acceptance the world over is a dream of every founder… it"s also a testament to the quality of products by the brand," says Bharadwaj.