This demand for luxury housing—projects priced above Rs 1.5 crore in most Indian cities—has kicked off a series of new launches in the category. As per an October report by real estate consultancy Anarock, out of 1,16,220 units launched in Q3 2023 in India’s top seven cities across various price brackets, about 27 percent were in the luxury category. In Q3 2018, the supply share of luxury housing was just 9 percent: Of 52,120 units launched across price segments, 4,590 were luxury homes.

“This is the highest quarterly luxury supply entering the market in the past five years," says Anuj Puri, chairman of Anarock Group.

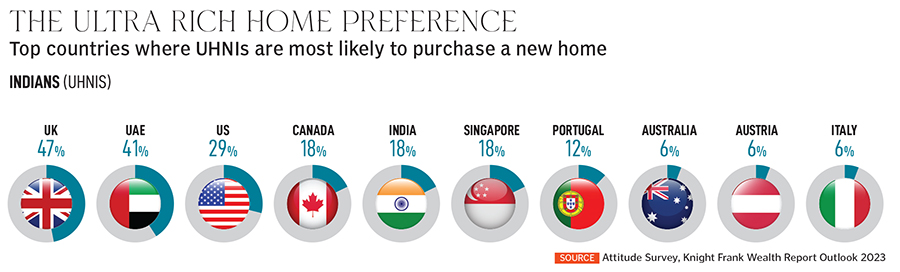

In the past year, ultra high-net-worth individuals (or UHNIs), with net worth of $30 million or more including their primary residence, have also shown their purchasing power across the globe, according to Sotheby’s International Realty 2023 Luxury Outlook report.

“While ultra high-net-worth individuals [in India] turned to the domestic market during the pandemic to purchase high-end luxury real estate, this year they are looking at international cities," says Akash Puri, director of international business, India, Sotheby’s International Realty, in the report. “The volatility and uncertainty in recent years has encouraged wealthy Indians to apply for residence opportunities via investment in real estate or an alternative passport."

In the UAE, Indians form 43.5 percent of the total population, Puri says, adding that they are also among the highest number of property owners in London.

“With the rise of the global and financially savvy Indian, buying a property is not wishful but a necessity to enhance the wealth portfolio," Puri states. “From a second home, the shift is now to a prudent investment decision."

Beyond borders

UHNIs in India have an average of 5.1 properties per individual, with investments worth $113 million in foreign nations. In 2022, 35 percent of them saw a 10 percent growth in their wealth, hence they are seeking to invest abroad to strengthen and diversify their portfolios, according to real estate consultancy, JLL.

“Roughly, 10 percent of this population is also looking at citizenship options through investments, especially in the case of Dubai," says Siva Krishnan, head of residential services-India, JLL.

Providing for children studying abroad is also a key reason. Education is the motivating factor for 8 percent of prime purchases globally.

Puri says that the relaxed Reserve Bank of India (RBI) norms also push Indians to consider buying foreign property. For instance, in 2015, the RBI doubled the Liberalised Remittance Scheme (LRS) for resident individuals to $250,000 annually.

This trend of buying homes abroad is more than a couple of decades old, but the interest in such acquisitions keeps fluctuating with the economy, job prospects, family presence in a particular country, and changing immigration laws.

![]()

According to Anarock, London, Dubai, Singapore, and Australia have been more or less perennial favourites among Indians wanting to invest in real estate abroad. The US, particularly New York, is also a preferred hot spot. “There is also evidence of increasing interest in some other Middle Eastern countries," says Puri.

Dubai is a current favourite due to its tax and business-friendly environment, feels Krishnan.

According to reports, in Q1 2023, Indian investors contributed 20 percent of all property transactions in Dubai, worth close to $2 billion. In 2022, Indian investments in Dubai amounted to $4.32 billion.

Indians also get the benefits of retaining their golden visas, which come with advantages such as sponsoring their family and long-term residency. These visas are typically offered to HNIs in return for investments in the host country. The proximity to India also plays a role in Indians eyeing Dubai.

One of the key factors attracting Indians to London’s real estate is the potential for capital growth, strong rental yields, currency appreciation, and the easy purchase process, Krishnan says.

![]() High-end properties in London attract luxury homebuyers from India. Image: Shutterstock

High-end properties in London attract luxury homebuyers from India. Image: Shutterstock

New York is another viable option for Indian investors as it’s guaranteed to fetch good returns, he says. “Although the market is volatile, it shows a lot of promise for long-term investments. Another reason is the high rental yields by increased land development and rising property prices."

What buyers seek

Premium amenities have always been a big draw for luxury homes but recently there has been a shift in what buyers seek in a new home. “Nowadays, well-heeled consumers are preferring to spend less on obvious symbols of affluence and are instead focusing on personal wellness and health," says Puri.

This has created a demand for wellness amenities such as yoga studios, meditation rooms, and spas.

He also feels that besides swimming pools, gymnasiums, and other community amenities, consumers want and are willing to pay for are digital amenities and technology add-ons. These may include features such as secure access via keyless entry with special codes for guests, smart home systems that control heat, humidity, lighting, and security via smartphones, and more. High-tech fitness centres with Fitbit integration and Bluetooth connections are also in demand.

“Right from theme-based homes to smart homes to giving state-of-the-art amenities and prime locations, to associating with ultra-luxe brands like Armani, builders are trying their best to lure customers with extra features. Thus, different parameters give a luxury tag to a property," says Puri.

However, in terms of price and area, they may vary from city to city. Nature-inspired homes have gained prominence in recent times, especially after the pandemic, he says. This could mean using wood or organic materials, to having open spaces both inside and outside the house.

Closer home

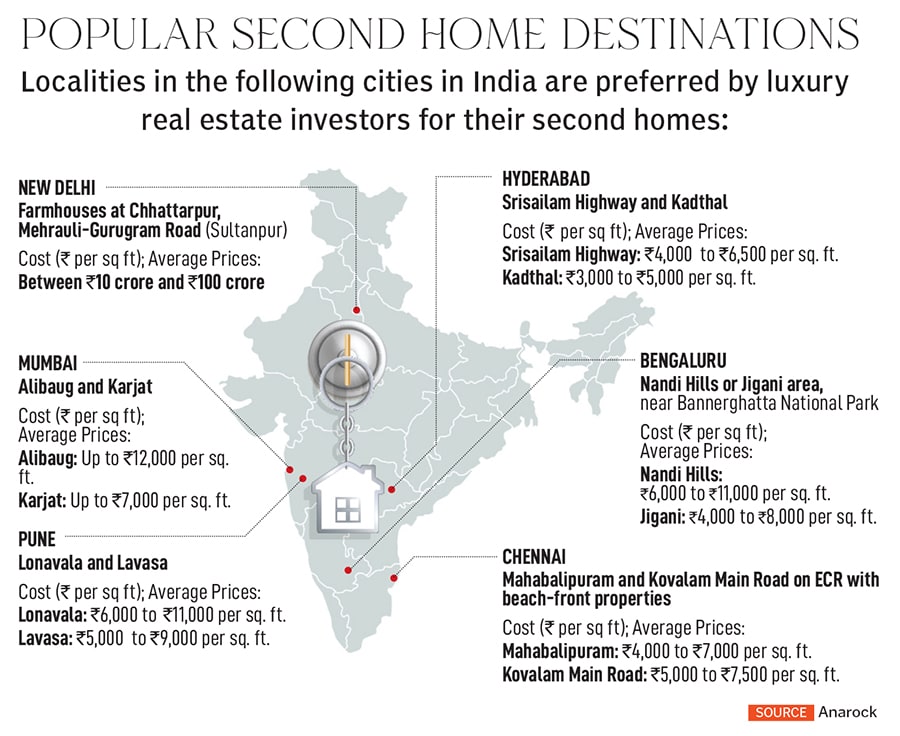

Among the top seven cities—Mumbai, New Delhi-NCR, Bengaluru, Chennai, Hyderabad, Pune, and Kolkata—Hyderabad churned out the highest new luxury supply in Q3 2023, followed by the Mumbai Metropolitan Region (MMR), according to Anarock’s data.

![]()

Until September, MMR, NCR, and Hyderabad have seen significant sales in the luxury segment, with more than 63,000 units sold collectively.

“Demand for luxury homes is significantly boosted by HNIs like the corporate C suite and start-up entrepreneurs residing in these cities," says Puri. “Post the pandemic, their sights were fixed on sprawling luxury properties as alternative living destinations. More so, the hope of owning a second home within salubrious, green surroundings became very much part of the overall Indian ethos."