Covid-19, reverse migration, smartphones: Scripting demand for ayurveda startups

As the pandemic makes Indians turn to the age-old formulations of holistic and preventive health care, startups are riding the internet wave into smaller cities

Image: Neha Mithbawkar for Forbes India

Image: Neha Mithbawkar for Forbes India

The outbreak of the Covid-19 pandemic last year gave rise to renewed interest in traditional ways of boosting immunity and respiratory health, with even the Ministry of Ayush recommending products such as herbal teas, turmeric milk and Chyawanprash. Not only did this shine the spotlight on India’s age-old traditions of Ayurveda, which emphasises preventive rather than curative health care, but also gave companies in the sector further impetus.

“Indian consumers are willing to spend more on health care, which includes traditional immunity boosters like Chyawanprash and other herbal health supplements. Healthier lifestyles are now becoming a priority and the consumption of vitamins and mineral supplements is skewed towards holistic and preventive health," says Nidhi Sinha, head of content, Mintel Reports India, a global market research firm. “Consumers are looking for additional aids to boost their immune systems," she adds.

“Indian consumers are willing to spend more on health care, which includes traditional immunity boosters like Chyawanprash and other herbal health supplements. Healthier lifestyles are now becoming a priority and the consumption of vitamins and mineral supplements is skewed towards holistic and preventive health," says Nidhi Sinha, head of content, Mintel Reports India, a global market research firm. “Consumers are looking for additional aids to boost their immune systems," she adds.

While the impetus and push provided by the Ministry of Ayush has encouraged several startups to enter the Ayurveda segment, the pandemic has provided a further boost to the demand for their products. Moreover, although these companies are based in the metros, they are finding an expanding consumer base in tier 2 and 3 cities. This is because of factors such as reverse migration, by which people who lived and worked in the metros have moved back to their hometowns, taking with them their big-city awareness of brands and ecommerce, and also because of increased internet penetration and usage among smaller cities.

Ankush Passi with his father Jogesh Passi, who is a director at Add Veda

Ankush Passi with his father Jogesh Passi, who is a director at Add Veda

Therefore for companies such as Add Veda and Aadar, a digital-first and direct-to-consumer sales strategy has reaped its benefits. Add Veda was founded in Ludhiana in 2016 by Ankush Passi, and has investors such as Olympic gold medallist Abhinav Bindra’s company Shooting Star Sports LLP, and Franchise India, an integrated franchise solutions company. Add Veda was clocking sales of ₹20 lakh a month in 2018-19, and “in 2020-21, our gross revenue has grown by 300 percent. If consumer interest continues, we hope to keep growing in a similar fashion," says Passi.

Therefore for companies such as Add Veda and Aadar, a digital-first and direct-to-consumer sales strategy has reaped its benefits. Add Veda was founded in Ludhiana in 2016 by Ankush Passi, and has investors such as Olympic gold medallist Abhinav Bindra’s company Shooting Star Sports LLP, and Franchise India, an integrated franchise solutions company. Add Veda was clocking sales of ₹20 lakh a month in 2018-19, and “in 2020-21, our gross revenue has grown by 300 percent. If consumer interest continues, we hope to keep growing in a similar fashion," says Passi.

And although 60 percent of Add Veda’s customer base is in the metros, Passi says that internet penetration is slowly getting his company visibility in tier 2 and 3 cities too. “Many of our orders have started coming from Kashmir, and some parts of the South," he says.

Passi is now in talks with Sequoia India and some more investors, and believes the company has the potential to grow because, “the overall perception of people [opting] for healthy and natural things is genuinely true. People want to stay healthy and be in a preventive state of mind rather than a curative one," says Passi.

Mumbai-based startup Aadar, which focuses on tier 2 and 3 cities, has grown 400 to 500 percent in 2020-21, over the previous year, with its digital-first, direct-to-consumer model, and is operating at an annual run rate of $500,000. Founded in 2016 by Aadil Shah, it raised $250,000 in a seed round in 2019 from Sprout Venture Partners, LetsVenture and JITO Angel Network.

“We see demand from smaller towns surging because people have moved back from the metros to their hometowns and have carried the exposure they got, and inform their friends and relatives too," says Shah.

Also riding the internet wave into tier 2 and 3 cities is Oziva, a plant-based nutrition brand that combines Ayurveda. Says co-founder Aarti Gill, “There is growing awareness, as well as growing incomes, and growing stress levels. So although our focus has always been on women in tier 2 and 3 cities, we’re seeing a rise in demand for clean, plant-based products from all over the country." In 2020, Oziva’s annualised revenue stood between ₹180 crore and ₹200 crore, after growing 3x from June 2020, and it is targeting ₹500 crore in the next three years.

Co-founders of Oziva, Mihir Gadani and Aarti Gill

Co-founders of Oziva, Mihir Gadani and Aarti Gill

Oziva raised $12 million in a series B funding round led by Eight Roads Ventures, Matrix Partners India and F-Prime Capital, and aims to add products in the vitamins and minerals category.

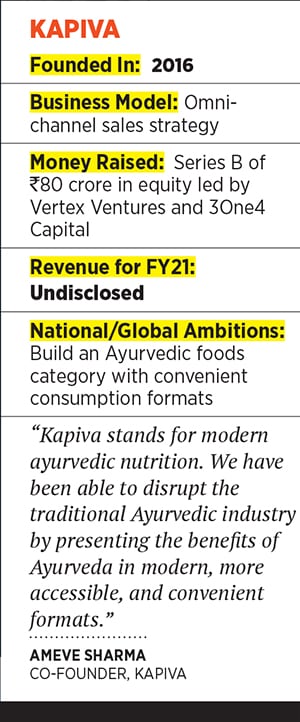

Not relying on a digital sales strategy alone, but also leveraging its strong, old-school distribution network of 6,000 outlets in 12 cities, is Kapiva, founded by Ameve Sharma, the third-generation entrepreneur of the 103-year-old Ayurvedic company Baidyanath, along with co-founder Shrey Badhani. The company had seen monthly revenue grow 3x between March 2019 and March 2020, and achieved a revenue run rate of ₹80 crore per annum by April 2021. “Although we see a stronger demand from metros, we are seeing the demand rise from tier 2 and 3 cities as well. The pandemic has helped us get access to new customers," says Sharma. “The company is expected to cross ₹300 crore in revenue in the next five years. Kapiva is also aiming for profitability within the next two years."

Not relying on a digital sales strategy alone, but also leveraging its strong, old-school distribution network of 6,000 outlets in 12 cities, is Kapiva, founded by Ameve Sharma, the third-generation entrepreneur of the 103-year-old Ayurvedic company Baidyanath, along with co-founder Shrey Badhani. The company had seen monthly revenue grow 3x between March 2019 and March 2020, and achieved a revenue run rate of ₹80 crore per annum by April 2021. “Although we see a stronger demand from metros, we are seeing the demand rise from tier 2 and 3 cities as well. The pandemic has helped us get access to new customers," says Sharma. “The company is expected to cross ₹300 crore in revenue in the next five years. Kapiva is also aiming for profitability within the next two years."

The company completed a series B fundraise this January, with a total of ₹80 crore in equity, led by Vertex Ventures and 3One4 Capital, along with its earlier investors Fireside Ventures, Sharrp Ventures and Jetty Ventures.

Investor-speak

For venture capitalist like Devang Mehta, a partner at Anthill Ventures, and angel investor Abhilash K Ramesh, executive director of Kairali Ayurvedic Group, these Ayurveda startups couldn’t have come at a better time.

“Ayurveda startups are at the intersection of next-gen technology and traditional Indian wellness. Globally, holistic wellness using traditional Indian sciences is gaining recognition and this makes for very large markets. This is a very attractive market for investors," says Mehta, who has invested in Ayurythm, an Ayurvedic diagnostic app. “Startups focusing on breathing, immunity, spiritual awareness and optimising lifestyles will drive the growth of this industry. They will replace industries that look at health from a single viewpoint, unlike Ayurveda that looks at holistic development."

Ashish Venkataramani, principal, Eight Roads Ventures, one of the investors in Oziva, adds, “For the long term, the sector is promising because consumer health is significantly under-penetrated and will continue to grow given the speed at which the internet is reaching people."

Ramesh, of Kairali Ayurvedic Group, says that within the FMCG category, Ayurveda and related products are in the $5-10 billion category. However, he adds, the industry had been lagging for two reasons. First, to enter a market and conduct trials, a new company has to incur substantial investments in time and money, and it is only in the last few years, thanks to the push by the Ministry of Ayush, that Ayurvedic products are experiencing an uptick. “A lot of lobbying is needed for licensing and recognising Ayurveda as a science," says Ramesh. Second, the lack of standardisation and the absence of a single set of international licensing norms makes overseas acceptance and sales very complex.

“In order to serve global markets, we will need to follow global standards of clinical validation and trials," says Sharma of Kapiva. “The average cost of a clinical validation process overseas would be in the range of $500 million or more. Ayush would need to establish the right standards, and support organisations to carry them out."

Regardless of the hiccups, Olympian Abhinav Bindra, who has invested in Add Veda, is optimistic about the international potential of Ayurvedic products: “I think the preventive care sector will see considerable growth in coming years. The Indian Ayurveda industry has a lot of scope to grow both domestically and internationally, and has a huge potential for global scalability."

Ameve Sharma, Co-founder, Kapiva

Ameve Sharma, Co-founder, Kapiva Beyond India

Beyond India

In 2017, the global Ayurvedic market was valued at $4.57 billion, and is expected to reach $14.62 billion by 2026, growing at a CAGR of 16.14 percent, according to Invest India, a non-profit venture under the Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry. The report adds that the total export value of Ayurvedic and herbal products amounted to $446 million in FY19. “This upward trend brings India into the limelight as one of the largest producers of raw materials for Ayurveda products," it says.

Although there are bigger export markets, such as China, US, and Germany for Indian Ayurvedic products, even smaller markets are now warming up to the idea of holistic healing. For instance, KoreaShop24, a B2B company that facilitates trade with the Korean market, has observed a growing interest in herbal drinks. In May 2021, it closed a deal to import amla powder worth ₹85 lakh from India. “Owing to the pandemic, we’ve noticed a surge in the consumption of healthy and immunity-boosting superfoods. Also, there is a rising awareness around amla’s health benefits, with its high concentration of vitamin C and antioxidants, which make it a go-to ingredient to build immunity," says Seo Youngdoo, spokesperson of KoreaShop 24.

Words of caution

Despite the popularity that Ayurveda has managed to gain because of the pandemic, the lack of scientific validation and evidence-based research are some reasons why consumers should do their homework before buying any and all “Ayurvedic" products, warns Ramesh. “Just a good-looking website should not be the key reason for buying the products. Their certifications, acknowledgements, reviews, licenses and manufacturers are as important," he says.

The perception of Ayurveda also takes a beating when its practitioners call unfavourable attention to it. The recent instance of Baba Ramdev calling allopathy a “stupid and bankrupt science" and blaming drugs such as FabiFlu and Remdesivir as the cause of Covid-19 deaths, rather than an oxygen shortage, harms the industry, says Dr Kamal Kishore, an Ayurvedic practitioner in Bengaluru. “That, along with launching Coronil, claiming to cure Covid-19, without any scientific evidence is more harmful than the disease itself because we are a country with a population that is still largely uneducated, and hesitant to take vaccines. Influential people like Ramdev dismissing science will do no good to this industry."

First Published: Jun 12, 2021, 08:03

Subscribe Now