Back in 2018, America was getting a taste of Adam’s apple. A smart aleck, WeWork’s co-founder and CEO Adam Neumann, stunned the world by reportedly displaying a wide range of accounting stunts in the bond-offering document released in April. Sample the most ingenious and outrageous term: ‘Community-adjusted Ebitda’. The metric measured net income before interest, taxes, depreciation and amortisation, and ‘building-and community-level operating expenses’, which reportedly includes rent, tenancy expenses, utilities, internet, salaries of building staff, and the cost of building amenities.

There were more creative expressions to numb your financial senses. ARPPM (annual average membership and service revenue per physical member), adjusted Ebitda before growth investments, and location contribution happened to be some of the gems devised by WeWork. To be fair, Neumann was not alone in resorting to non-GAAP metrics in reporting earnings.

GAAP stands for ‘generally accepted accounting principles’. According to Investopedia, GAAP refers to a common set of accounting rules, standards and procedures which public companies in the US must follow while preparing financial statements. While the most common accounting principle globally is IFRS (International Framework for accounting Records and Financial Statements), the one followed in India is Ind-AS, which is the Indian version of IFRS and quite close to the US GAAP. Creative accounting—like the one done by WeWork—falls under non-GAAP accounting, which makes the earnings release look more attractive.

Back in the US, Neumann was not the only one showcasing his version of ‘apple’. In 2015, Valeant Pharmaceuticals, which reportedly had been using non-GAAP metrics for years, released its financial numbers. While the company reportedly had a GAAP loss of $291.7 million, it reported an ‘adjusted’ non-GAAP profit of $2.84 billion after stripping out amortisation of intangible assets, acquisition costs and other expenses. The same year, another US company reported two sets of interesting numbers. Online lender LendingClub reported a GAAP loss of $5 million, but non-GAAP net income of $56.8 million.

Back home, in India, a breed of newly listed tech companies, as well as privately held ones, is busy emulating its US counterparts in sharing tailored, customised and non-GAAP financial information. Early in February, online food delivery firm Zomato turned ‘adjusted Ebitda positive’ for the month of January. Paytm, too, recently reported its first adjusted Ebitda positive quarter. Then there is edtech firm Byju’s which reportedly adopted a new revenue recognition norm while reporting its last financial numbers after a delay of 18 months. While 40 percent of its revenue in FY21 was deferred to subsequent years, net loss reportedly widened to Rs4,588.75 crore for FY21 from a comprehensive loss of Rs231.69 crore in FY20.

A Byju’s spokesperson explained the numbers. “About 40 percent of FY21 revenue was deferred to the next two years, but all the associated costs were deemed incurred in the same year. This deferred revenue will feature in our FY22 and FY23 financials," the spokesperson said in an email reply. The company didn’t answer why subscription payment was shown as revenue for one fiscal year, and not staggered over the years.

Analysts are not amused with a wide adoption of non-GAAP reporting metrics. There are a clutch of new-age companies which have used ‘adjusted Ebitda’, ‘adjusted revenue’ and ‘adjusted Ebitda margin’ as financial metrics to show that the company is profitable, or on the path to profitability, says Deepak Jasani, retail research head at HDFC Securities. “It may mislead investors," he reckons, explaining why the retail investors, in particular, might have a hard time understanding such numbers. Retail investors, he underlines, may take the company’s statement on face value without poring into the P&L (profit and loss) statement which paints the true picture. In fact, at times, even analysts are at a loss, finding it difficult to review the company’s results. “If everything is adjusted, how do you value a company in the long term?" he asks.

Let’s deep dive into the curious case of Zomato. The CEO, Deepinder Goyal, congratulated Vijay Shekhar Sharma after the latter reported Ebitda level profitability in the December quarter. “Congratulations, @vijayshekhar and @Paytm on becoming profitable. Sorry, a bit late to the party – was so busy working on our own profitability -)," he tweeted in February. A few days later, Zomato declared its results, underlining that excluding Blinkit acquisition, it turned adjusted Ebitda (positive) in January.

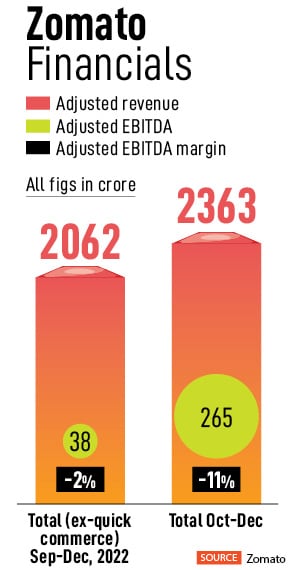

But is Zomato really profitable? The answer is ‘no’. Even after adjustments made for the Blinkit acquisition, Zomato’s adjusted Ebitda and adjusted Ebitda margin are in the negative (year-on-year) in the three months ending December 2022. During the December quarter, its adjusted Ebitda loss was at Rs265 crore due to losses of Blinkit, while adjusted Ebitda margin was down 11 percent on an overall adjusted revenue of Rs2,363 crore.

![]() “Zomato is loss making," says Swapnil Potdukhe, internet analyst at JM Financial Institutional Securities. The reason, he cites, is the high cash burn in business segments like Blinkit, Hyperpure and dining out. “However, food delivery, which is the core segment, is profitable. This is where the profit will come when it scales up," he adds.

“Zomato is loss making," says Swapnil Potdukhe, internet analyst at JM Financial Institutional Securities. The reason, he cites, is the high cash burn in business segments like Blinkit, Hyperpure and dining out. “However, food delivery, which is the core segment, is profitable. This is where the profit will come when it scales up," he adds.

Though analysts are bullish about Zomato, they don’t see any value in Blinkit. “We stay unconvinced on Blinkit and accord a near-zero value to the same," reckon analysts at Ambit Capital, adding that Zomato’s core food business (food ordering, dine-in and Hyperpure) looks promising despite near-term hiccups in food ordering. In fact, analysts at JP Morgan expect the food business to break even by the first quarter of FY24 and overall business in the third quarter of the same financial year.

Zomato, for its part, reckons that adjusted revenue and Ebitda are important metrics. “No particular metric can exhaustively indicate the health and performance of any business," points out a company spokesperson in an email reply. Adjusted revenue and Ebitda are two important metrics that the company discloses in addition to multiple other KPIs and audited financials. “They are relevant to understand the performance of our business," the spokesperson underlines. Adjusted revenue and adjusted Ebitda are metrics derived from revenue and PAT (profit after tax) reported in audited financial statements. The company also provides the reconciliation between them so that investors can understand them better. “Additionally, these metrics are not new metrics introduced in the Q3FY23 quarter. We have been using the same terms since our first quarterly results (August 2021) that we reported as a publicly listed company," the spokesperson adds.

The company also explained the move to share info on Blinkit. “Q3FY23 was the first full quarter of consolidation of Blinkit financials in our financial statements," the spokesperson points out. To help investors understand the business better, the company shared the performance of the business with and without Blinkit. “We have also shared commentary on the outlook we have for the Blinkit business in terms of growth and profitability in our last few shareholders" letters and on our earnings calls," he says.

Does the outlook look exciting for Paytm?

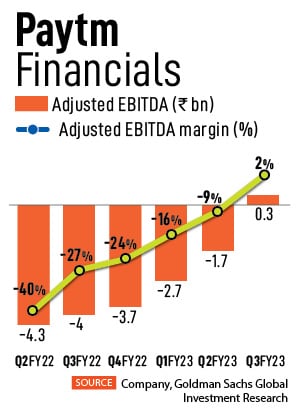

Paytm reported its first adjusted Ebitda positive quarter with adjusted Ebitda margin of 1.5 percent, led by sharp expansion in contribution margin and reduction in indirect costs despite missing UPI incentives. Paytm, point out analysts at JM Financial, has achieved adjusted Ebitda (adjusted for ESOPs) break-even before its stated target of Q2FY24. The performance, they underscore, was driven by strong revenue growth across segments, moderation in payments processing and pr,omotion incentives and controlled indirect expenses. “While we have remained cautious on Paytm’s business model since our initiation given the high cash burn, risk on take rates in the financial services business and long road to profitability, its operating metrics are gradually improving," the brokerage highlighted in its report. The management’s focus on increasing efficiencies and profitability should aid Paytm to turn profitable by FY26, the analysts noted.

![]() Interestingly, a set of analysts are not perturbed by the ‘adjusted’ profitability metric. “We see Paytm reporting adjusted Ebitda profitability as a significant catalyst for the stock, and expect net income profitability in FY25," Goldman Sachs maintained in its report.

Interestingly, a set of analysts are not perturbed by the ‘adjusted’ profitability metric. “We see Paytm reporting adjusted Ebitda profitability as a significant catalyst for the stock, and expect net income profitability in FY25," Goldman Sachs maintained in its report.

Back in the US, non-GAAP metrics are now widely prevalent. In an article published in May 2021, the Harvard Business Review (HBR) highlighted that over 95 percent of S&P 500 companies report both GAAP and non-GAAP earnings. So, there can be no doubts about the popularity of non-GAAP antics.

But the question that arises is: Is there anything to worry about while relying solely on non-GAAP numbers to judge a company? “Non-GAAP reporting can totally change the picture of a company’s profitability," HBR pointed out in its report titled ‘Mind the GAAP’. Take, for instance, Pinterest. For fiscal 2019, Pinterest reported a loss of $1.36 billion. It reportedly converted that loss into a non-GAAP profit of $17 million by adjusting certain costs. “Losses turning into profits are becoming quite common for firms of all sizes," the article underlined. Hand-collected data from 2010 to 2019 shows that almost a fifth of firms that report GAAP losses turn their GAAP loss into a positive non-GAAP number, the article pointed out.

Back in India, an independent auditor tells us why desi companies are indulging in non-GAAP theatrics. “The answer lies in mounting pressure to turn profitable," says the Mumbai-based accountant requesting anonymity. When the larger narrative is driven by the path to profitability or profit, especially during a downturn or a choppy macro global environment, companies, listed as well as privately held, come under intense scrutiny because of their prolonged track record of posting losses and excessive cash burn. “The over-prominent use of non-GAAP terms only puts a lipstick on ugly financial numbers," he says. Anything ‘adjusted’ can’t be normal. The use of non-GAAP terminologies in communications can especially be harsh for retail investors.

Meanwhile, a venture capitalist (VC) in Delhi-NCR decodes the ‘legal’ and ‘moral’ nuances of non-GAAP metrics by talking about the gentleman’s game. In cricket, Mankading is a method where a bowler can run out the non-striker by knocking off the bails if the latter is outside the crease before the ball is released. “Though Mankading is legally allowed, it is considered against the spirit of the game," says the VC, who shares a golden nugget attributed to Charlie Munger. “I think that every time you see the word Ebitda, you should substitute the word ‘bullshit’ earnings," the American billionaire investor and vice chairman of Berkshire Hathaway once reportedly remarked.

To the purists, there are no adjustments. ‘A’ will always stand for apple, and ‘P’ will mean profit.

“Zomato is loss making," says Swapnil Potdukhe, internet analyst at JM Financial Institutional Securities. The reason, he cites, is the high cash burn in business segments like Blinkit, Hyperpure and dining out. “However, food delivery, which is the core segment, is profitable. This is where the profit will come when it scales up," he adds.

“Zomato is loss making," says Swapnil Potdukhe, internet analyst at JM Financial Institutional Securities. The reason, he cites, is the high cash burn in business segments like Blinkit, Hyperpure and dining out. “However, food delivery, which is the core segment, is profitable. This is where the profit will come when it scales up," he adds. Interestingly, a set of analysts are not perturbed by the ‘adjusted’ profitability metric. “We see Paytm reporting adjusted Ebitda profitability as a significant catalyst for the stock, and expect net income profitability in FY25," Goldman Sachs maintained in its report.

Interestingly, a set of analysts are not perturbed by the ‘adjusted’ profitability metric. “We see Paytm reporting adjusted Ebitda profitability as a significant catalyst for the stock, and expect net income profitability in FY25," Goldman Sachs maintained in its report.