Sensex at 50k: The sun is out, but don't ignore the dark clouds yet

Earnings growth and liquidity have helped improve investor sentiments, say experts, but will the momentum sustain?

Image: Himanshu Bhatt/NurPhoto via Getty Images

Image: Himanshu Bhatt/NurPhoto via Getty Images

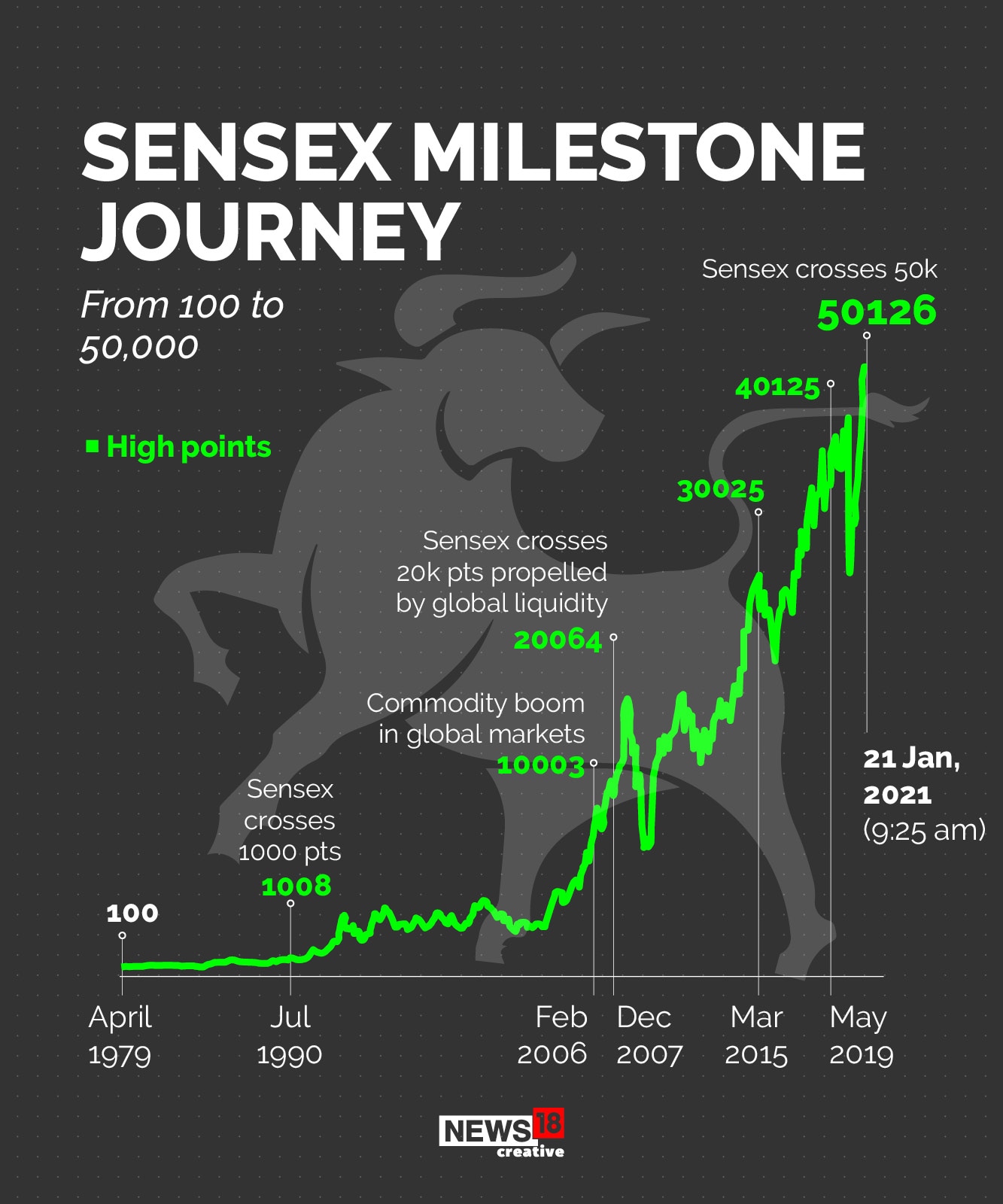

The benchmark 30-share Sensex index scaled the 50,000-points level early on Monday to its lifetime high, and nearly doubled from its low in March last year when corporate India was deeply concerned over business activity that came to a standstill due to the Covid-induced lockdowns.

The Sensex retraced on profit booking to close down 167.36 points at 49,624.76. But at this closing, the Sensex has risen 91 percent from its March 23 low of 25981.24 points.

The good news in 2021 has not stopped. Most large nations appear to have solutions— through the rollout of vaccines—for the pandemic foreign investors continue to pour in money into emerging markets liquidity from global central banks is high and the Reserve Bank of India in 2020 was benign on inflationary concerns.

So if you have made profits from equities in 2020, is it time to pour in more funds at the expense of other asset classes? Experts think not. The sun may be out for now, but there are dark clouds which loom.

Though corporate earnings improved sequentially from Q1FY21 TO Q2FY21—and they look encouraging in the December-ended quarter—some concerns remain. “Valuations are stretched, whether you look at PE ratios or GDP to market capitalisation. Yes sure, right now there is good news and it can continue for some time. But a bubble can become larger before it bursts,” says independent market expert Ambareesh Baliga.

Baliga refrained from calling the current scenario a bubble but says investors who have already made profit in 2020 should take their capital out. “Don’t pour in more money. If 2020 was about how to recover capital from previous years’ losses, 2021 will be about how to protect your capital,’’ Baliga says. The truth which investors probably do not want to accept is that bubbles can also last a long time and there is no telling when they will burst.

Indian equities saw inflows of $23 billion from foreign institutional investors in 2020, the highest among emerging markets. In 2019, the inflows were $14.2 billion. In India, where oil prices have been benign, capital will chase better returns and hence we could see more flows into the country.

Abhimanyu Sofat, vice president, research, at IIFL, said earnings growth post lockdowns and improved liquidity in 2020 from global central banks to deal with economic slowdowns were factors which are keeping investor sentiment buoyant.

Already, technology companies such as Infosys and TCS have reported encouraging earnings for the December-ended quarter. So has paints giant Asian Paints, with a 63 percent jump in profit.

But we need to see if this earnings momentum will sustain, particularly from the financial services sector. Any disappointment is likely to induce an exaggerated reaction. “From an index level, if there is a tapering in liquidity and from a corporate perspective if earnings growth disappoints, then there are concerns. If both these factors take place together, then the markets are likely to correct by 10 percent,’’ says Sofat.

A further unknown factor is what might emerge from the Union Budget set to be announced on February 1. While noises form the government are positive, there are concerns that finance minister Nirmala Sitharaman may announce a pandemic-related cess. If that happens, it could be a huge dampener for investors and tax payers.

The deeper concern is about how small businesses turn around their fortunes in 2021 and whether banks can start to lend aggressively again, even as they try to deal with fresh bad loans, particularly in the retail segment. The RBI has improved its growth forecast for the economy, lowering the contraction from about -9.8 percent earlier to -7.5 percent.

Investors will need to watch corporate earnings in the current January to March quarter and also the commentary from global central banks on any tapering in liquidity and how they will deal with inflationary pressures in the coming quarters.

Baliga is sceptical about the staying power of the new investors, who entered the markets after the low in March. “When the market trend starts to reverse, will they have the patience to ride through the pain of erosion of wealth? They have not seen market crashes…only heard of them in previous years,” he says.

"‹

First Published: Jan 21, 2021, 19:02

Subscribe Now