Swiggy IPO: Is it worth a bite?

Even though Swiggy is the second-largest in both the food delivery and quick commerce categories, its consistent losses raise questions on its ability

Conventional wisdom says it may not be a good idea to bet on a loss-making business. But does that stance change if the business operates in an oligopoly market providing enough opportunities for the players to create their niche? Investors are caught in a dilemma as the initial public offering (IPO) of Swiggy, a new-age consumer-first technology company, opens for subscription.

With a price band of Rs 371-390, Swiggy aims to raise around Rs 11,327 crore in the three-day sale that ends on November 8. The IPO is a mix of fresh shares worth Rs 4,499 crore and offer-for-sale of Rs 6,828.43 crore. Swiggy proposes to utilise the money of the fresh issue for the expansion of dark stores, brand marketing, technology upgradation and debt repayment.

Even as the company is the second-largest player in India in both the food delivery and quick commerce categories, Swiggy’s business is laden with concerns, point out analysts. Its consistent losses despite being in the business since 2014 raises questions on its competency.

“Swiggy has incurred net losses in each year since incorporation and has negative cash flows from operations. If it is unable to generate adequate revenue growth and manage its expenses and cash flows, it may continue to incur significant losses," says Sneha Poddar, analyst, Motilal Oswal Financial Services.

Poddar adds that the company is still loss-making at an aggregate level, and overall profitability may be some time away. However, Swiggy’s innovation DNA is key to its success and it could again be at the forefront through its new 10-minute food delivery offering, she feels.

Swiggy pioneered the hyperlocal commerce industry in India, launching food delivery in 2014 and quick commerce in 2020.

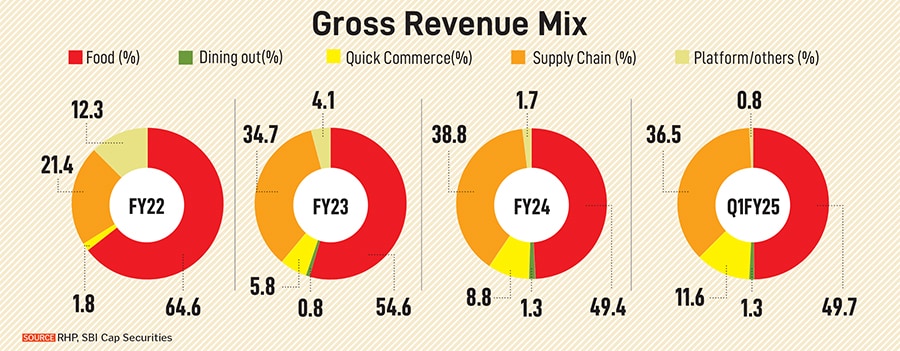

Swiggy operates in five segments, of which the first three are food delivery, out-of-home consumption (covering dining out and events), quick commerce for the on-demand delivery of grocery and household items. The fourth segment is its supply chain and distribution, covering business-to-business (B2B) supplies, warehousing, logistics and distribution for wholesalers and retailers. Last are the platform innovations, covering its new initiatives and offerings, such as Swiggy Genie, Swiggy Minis, among others.

“The company has faced ongoing net losses and negative operational cash flows since its inception, raising concerns about its ability to achieve adequate revenue growth to offset persistent losses," says Rinkle Vira, analyst, Anand Rathi.

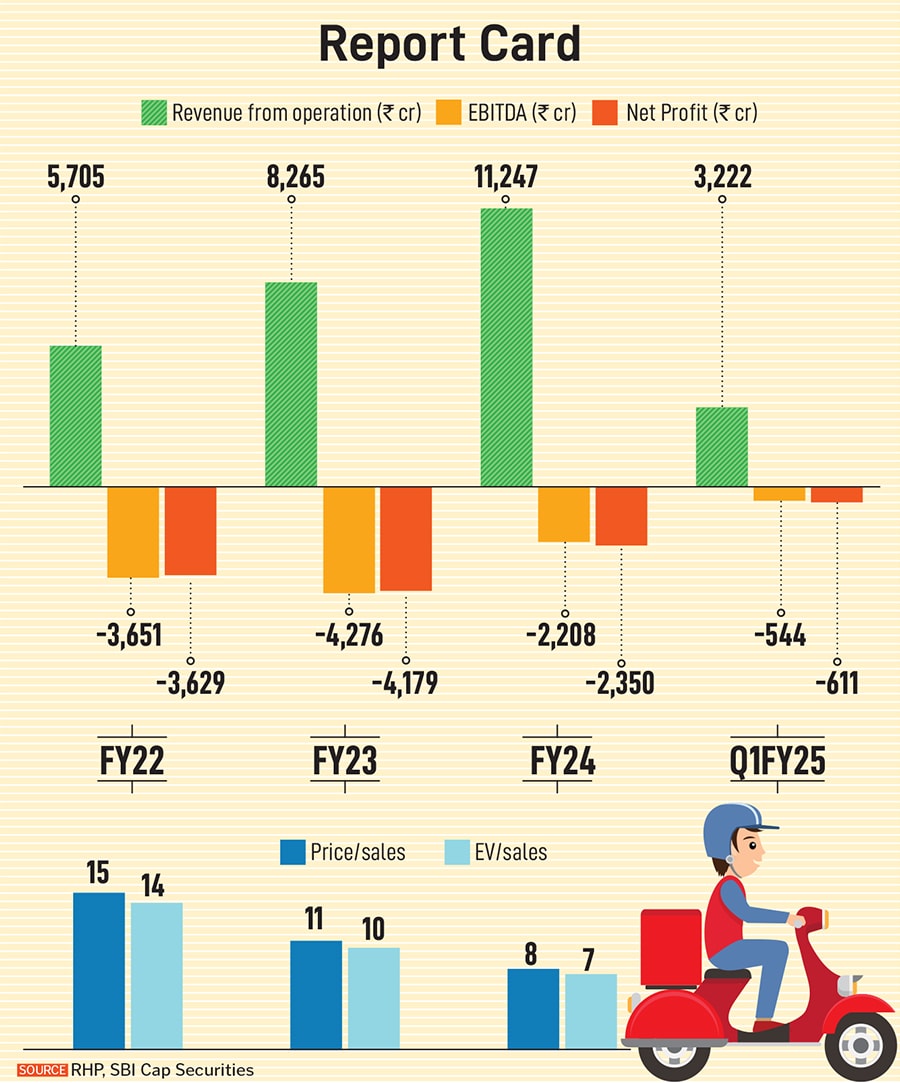

According to Poddar, at the upper price band of Rs 390, the issue is priced at 7.8 times FY24 market cap to sales and looks reasonably priced compared to Zomato, which is trading at 17.5 times.

Overall, its revenues from operations expanded to Rs 11,247.4 crore in FY24 from Rs 5,705 crore in FY22. Though Swiggy is not profitable, it has been able to cut its losses to Rs 2,350.2 crore in FY24 from Rs 3,629 crore in FY22. In FY23, its loss was at Rs 4,179.3 crore.

Overall, its revenues from operations expanded to Rs 11,247.4 crore in FY24 from Rs 5,705 crore in FY22. Though Swiggy is not profitable, it has been able to cut its losses to Rs 2,350.2 crore in FY24 from Rs 3,629 crore in FY22. In FY23, its loss was at Rs 4,179.3 crore.

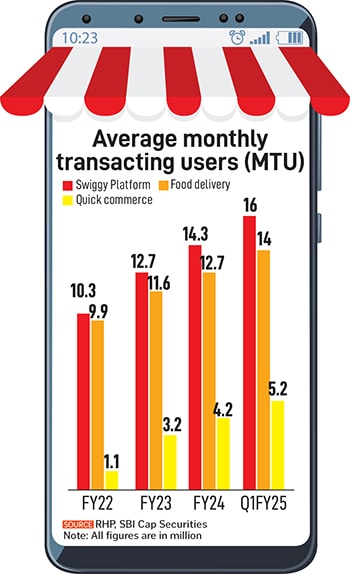

Swiggy’s food delivery business has turned Ebitda positive in Q1FY25 with an adjusted Ebitda of Rs 57.8 crore. It has 1.4 crore average monthly transacting users (MTU) as of June as compared to 1.27 crore in FY24, with a constant increase in average order value (AOV) per order.

Swiggy’s Instamart has been a significant revenue driver and is their second largest business segment by revenue. The company plans to deploy Rs 1,179 crore up to FY28 for expansion of its dark store network across India. As of the first half of FY25, Instamart operated 605 active dark stores across 43 cities.

Vira feels that, with low cash burn, Swiggy is well positioned and funded to fight out existing as well as new entrants into this space. Like its rival (Zomato) in its initial days, the food delivery operator is yet to turn profitable, but shows steady revenues and is scaling up its quick commerce vertical amid intense competition, she added, stating that the Swiggy issue is fairly priced. “Swiggy is well positioned to tap huge opportunities in quick commerce. Therefore, we believe that, as it is fairly priced, the issue may be considered for its long-term growth as it scales up its revenue and gradually improves its bottom line," Vira explains.

Analysts at SBICap Securities agree the issue is fairly priced when compared to its rival Zomato. “Swiggy, at an upper price band of Rs 390, is valued at price/sales, EV/sales and price to book value multiple of 7.8 times, 7.3 times and 7.1 times, respectively, of its FY24 financials on post issue capital," SBICap Securities says.

From the fresh issue net proceeds, the company will be utilising Rs 164.8 crore for the repayment of borrowings of the material subsidiary, Scootsy, and Rs 1,178.7 crore for the expansion of the dark store network, covering the setup of dark stores and lease payments. Additionally, Rs 703.4 crore is allocated for technology and cloud infrastructure, while Rs 1,115.3 crore is designated for brand marketing and promotion to enhance platform visibility. The residual proceeds will be used for funding inorganic growth through acquisitions and general corporate purposes.

Ahead of the share sale, Swiggy has already raised Rs 5,085 crore at the upper price band of Rs 390 from a clutch of anchor investors. Some of the investors, which participated in the anchor book, are New World Fund, Fidelity, Omnis Portfolio Investments, Nomura, Government Pension Fund Global, PGGM World Equity, Blackrock, Carmignac, Eastspring Investments, Citigroup, TOCU Europe, Integrated Core Strategies, CLSA, Matthews Asia Funds, and Societe Generale.

The Indian online food delivery market is expected to grow at a CAGR of 17-22 percent between 2023 and 2028. Of the total market in 2023, the share of the top 60 cities (metro and Tier 1) is 75-80 percent, which shows the large untapped potential beyond these cities that could drive growth.

The online dining-out market is expected to grow at a CAGR of 46-53 percent between 2023 and 2028, driven by high adoption from the existing online food delivery users as well as the expansion of the restaurant partner networks.

First Published: Nov 06, 2024, 16:32

Subscribe Now