Indian stocks caught in a crossfire of Chinese boosters, West Asia flare-up

The exodus of foreign money out of Indian equities to China is threatening to topple the markets further

The unfolding of a few historic events in Asia rocked the world in the last few weeks, jolting equity investors in India into panic and chaos. The optimistic outlook for India and growth plans for the Asian sub-continent quickly turned gloomy as investors rushed to dump Indian stocks to cut losses. What followed was a long tail of selling and more heavy selling of Indian stocks, taking the shine off from equity markets—once considered the jewel in the emerging markets pack.

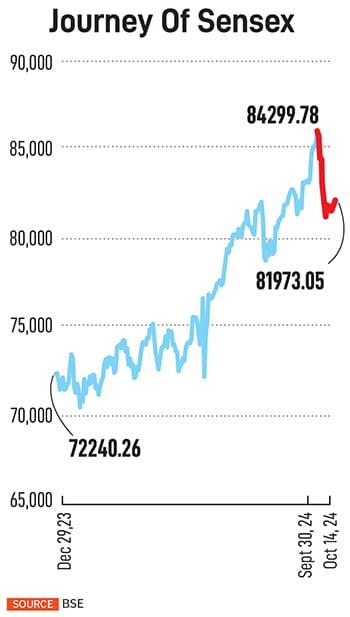

The intensified geopolitical tensions in the Middle East and China’s monetary stimulus to boost its economy led to a massive correction of Indian markets in the first week of October, just after the benchmark indices Sensex and Nifty made new record highs in September. As investors continued to dump Indian equities, both the indices plunged over 5 percent in the first week of October from their respective record highs. What was projected as a north-bound bull market in India took a U-turn in a few days, as almost all domestic asset classes came tumbling.

A widely anticipated recovery in the Chinese economy aided by its government’s stimulus triggered the exodus of foreign funds from India to China. Amidst the chaos, the Indian currency weakened to its lowest level, breaching the ₹84-mark against the US dollar while the Federal Reserve lowered interest rates, sparking fears of recession.

The fear of higher oil prices due to the Iran-Israel conflict also led to a rebalance in global portfolios, impacting India. China and Hong Kong stock markets have been on a tear, however, after the stimulus package was announced. Analysts still pin their hopes on India, calling the sharp corrections “long overdue" while the risks still persist.

The fear of higher oil prices due to the Iran-Israel conflict also led to a rebalance in global portfolios, impacting India. China and Hong Kong stock markets have been on a tear, however, after the stimulus package was announced. Analysts still pin their hopes on India, calling the sharp corrections “long overdue" while the risks still persist.

Chetan Seth, Asia-Pacific regional equity strategist, Nomura, thinks there is a rising risk of some near-term underperformance of India equities against the broader Asia-excluding Japan index due to a renewed interest in China equities on the back of the recently-announced monetary and liquidity measures. However, he does not consider it to be a long-lasting period of underperformance. Seth reasons that the structural story of India remains quite attractive, and if valuations revert to more palatable levels, foreign (and even domestic) investors would likely look to re-enter India. “MSCI India currently trades at a forward price-to-earnings (PE) of 24.1 times and should some of these concerns materialise, we think valuation levels going back to 21 times should become an attractive point for investors to start rebuilding positions in the market," Seth adds.

At the same time, Seth warns that if the recent rally in China equities becomes more self-sustaining amid a large fiscal stimulus, and local investors in China become far more involved, it may force even foreign investors to chase China equities higher. As that occurs, India and other regional markets might see a somewhat sustained underperformance.

In late September, China announced a monetary stimulus and property sector support measures. The People’s Bank of China (PBoC) introduced two fresh tools to shore up the capital market, one of which includes a swap programme allowing funds, insurers and brokers easier access to funding to buy stocks. The Chinese markets rallied by 20 percent within a week.

The PBoC declared interest rate cuts, a one trillion yuan liquidity injection and other steps to support the property and stock markets. China plans to issue special sovereign bonds worth about two trillion yuan ($284.43 billion) this year as part of a fresh fiscal stimulus, according to Reuters. Half of that would be used to help local governments tackle their debt problems, while the other half will subsidise purchases of home appliances and other goods as well as finance a monthly allowance of about 800 yuan, or $114, per child to all households with two or more children, says Reuters.

The PBoC declared interest rate cuts, a one trillion yuan liquidity injection and other steps to support the property and stock markets. China plans to issue special sovereign bonds worth about two trillion yuan ($284.43 billion) this year as part of a fresh fiscal stimulus, according to Reuters. Half of that would be used to help local governments tackle their debt problems, while the other half will subsidise purchases of home appliances and other goods as well as finance a monthly allowance of about 800 yuan, or $114, per child to all households with two or more children, says Reuters.

The money flow has already kicked in. On October 10, the PBoC officially launched its Rmb 500 billion swap facility, which is designed for brokers, insurance companies and asset management firms to tap, using the swapped liquidity for direct equity purchases. “Beijing is attempting to reverse fiscal austerity with sizeable local government debt restructuring—a key move to restore confidence and alleviate the deflation spiral. Decisive reflation still requires rebalancing with consumption stimulus, which we continue to expect to be modest initially," say Morgan Stanley analysts.

Morgan Stanley expects an Rmb 2 trillion supplementary fiscal package in the near term for local debt resolution and bank recapitalisation. For 2025, it expects a Rmb 2 to 3 trillion fiscal package to support debt swaps, housing inventory clearance, and modest consumption/social welfare initiatives.

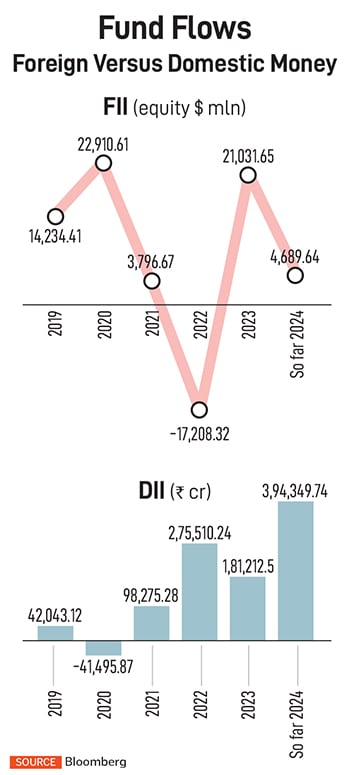

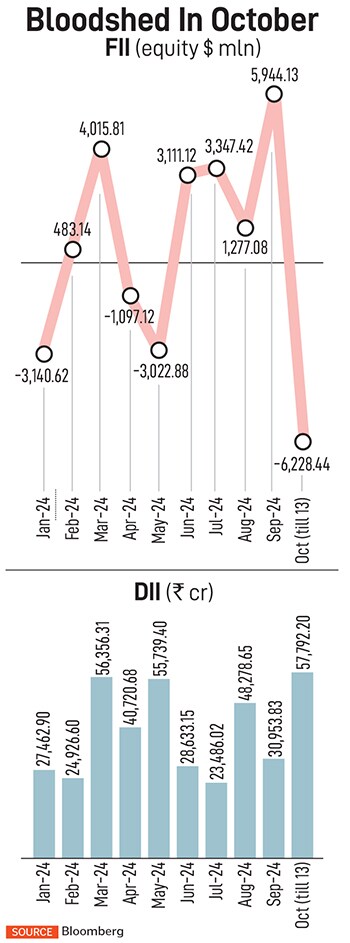

Foreign liquidity drain-out from India has been acute in the last few weeks starting October. In October, foreign institutional investors (FIIs) so far have sold Indian equities worth $6.2 billion, the highest monthly outflow in the year. Surprisingly, this follows a record monthly FII inflow of $5.9 billion in September. FIIs have been consistently buying Indian shares from June. In 2024, FIIs are net buyers of Indian stocks worth $4.7 billion. The tide has turned now in favour of China.

The fund flow from India to China is mostly led by expectations of better returns at lower valuations. However, Seth feels that while China has pledged fiscal support, if it disappoints on announcement and execution, investors will likely be quick to pounce their money back into India equities Others concur. “The bull market is very much intact," says Amar Ambani, executive director, Yes Securities. “For now, China’s monetary stimulus seems to have made its markets more appealing than India due to lower valuations. However, China faces deeper structural challenges that monetary and likely fiscal stimulus alone cannot resolve. In contrast, India has a stronger macroeconomic profile, which is unlikely to divert investment flows away from it. India’s weight in MSCI has been rising over the years and now stands at the second-highest place in the emerging markets basket," he explains.

The fund flow from India to China is mostly led by expectations of better returns at lower valuations. However, Seth feels that while China has pledged fiscal support, if it disappoints on announcement and execution, investors will likely be quick to pounce their money back into India equities Others concur. “The bull market is very much intact," says Amar Ambani, executive director, Yes Securities. “For now, China’s monetary stimulus seems to have made its markets more appealing than India due to lower valuations. However, China faces deeper structural challenges that monetary and likely fiscal stimulus alone cannot resolve. In contrast, India has a stronger macroeconomic profile, which is unlikely to divert investment flows away from it. India’s weight in MSCI has been rising over the years and now stands at the second-highest place in the emerging markets basket," he explains.

According to Ambani’s analyses of broad ratio of MSCI China and MSCI India over several years, China has had multiple short-term recovery moves, which lasted approximately two months before resuming the downtrend. “Therefore, we believe the current China trade is a tactical one, not a long term one," he says.

The US Federal Reserve’s aggressive cut of interest rates have sparked fears of recession, while investors are flocking to less riskier assets like gold. “Fed rate cuts have typically preceded recessions," says DBS.

For instance, the burst of the dot-com bubble saw the Fed slashing rates by 550 basis points over 30 months as recession took hold in February 2001. Next, during the subprime crisis, the central bank slashed rates in an aggressive fashion again as the economy spiralled downwards into a tailspin. On each of these occasions, the S&P 500 registered average declines of 3 percent in the subsequent 12 months.

However, DBS says that given that the start of aggressive rate-cutting cycles has traditionally preceded major recessions, the relationship between Fed monetary easing and equity market performance is not as straightforward.

As expected, the US Federal Reserve made significant adjustments to the monetary policy by making 50 bps cut in the federal funds rate, bringing it down to a range of 4.75-5 percent in September. This was the first rate cut since 2020, marking a pivot from the Fed’s previous focus on combating inflation, which had kept rates at a 23-year high.

According to analysts at Mirae Asset Mutual Fund, global risk has risen due to concerns on the US entering a recession, flare-up of the Israel-Iran war, and recession worries in Japan. “While near-term concerns have risen and could weigh on investor sentiments, the medium- to long-term India story remains intact," they add.

Amidst the fund outflow, there are expectations of passive money coming to India through the bond route as FTSE Russell has announced the inclusion of Indian instruments into its global index. Indian government bonds will form a part of the Emerging Markets Government Bond index with effect from September 2025 and will represent 9.35 percent of the index.

Mitul Kotecha, head of FX & EM Macro Strategy Asia, Barclays, estimates the inclusion may draw in around $7 to $9 billion of passive inflows spread over the six-month phase-in period." The inclusion of India into the FTSE Russell EM bond index adds further impetus for inflows into IGBs and should drive a further decline in yields," he says.

First Published: Oct 18, 2024, 12:08

Subscribe Now