Why General Atlantic has an edge over its peers

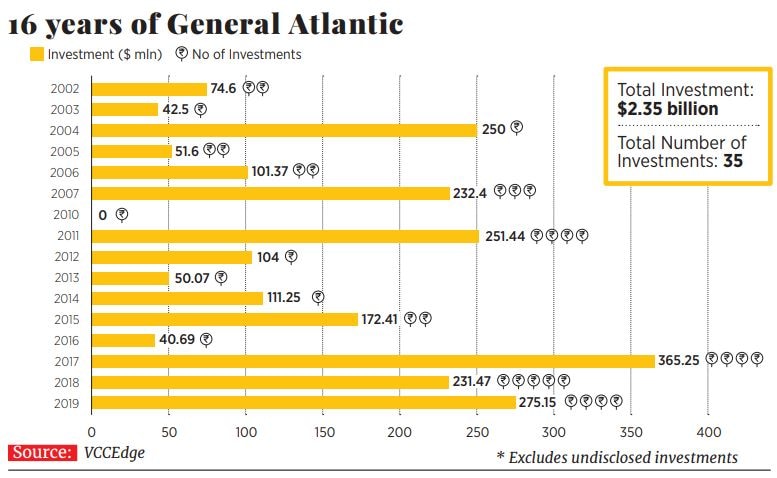

Global private equity fund General Atlantic, which has returned $2.4 billion of the invested $2.6 billion in India, has been on an investment spree in the past three years

(From left) Shantanu Rastogi, managing director, and Sandeep Naik, managing director and head of GA’s business in India & Asia-Pacific

(From left) Shantanu Rastogi, managing director, and Sandeep Naik, managing director and head of GA’s business in India & Asia-Pacific

Image: Aditi Tailang[br]In September 2013, Rizwan Kotia and Jagdish Moorjani, founders of Mumbai-based health tech services company CitiusTech, hired Citibank to find an investor for their company. After eight years of building the firm, the founders had decided to sell a minority stake. A six-month-long process and multiple discussions later, in March 2014, global private equity fund General Atlantic (GA) emerged as the winner. It had beaten its peers like Warburg Pincus, ChrysCapital and Advent Capital, among others, to own a nearly 35 percent stake in the company for $110 million.

“There were two or three key reasons why we felt GA would be the right investors,” says Moorjani during a chat on a rainy afternoon in Mumbai. “We saw they had a terrific team and a very strong chemistry between their India and US offices—everyone was equally involved in the transaction. Also, they had a tremendous reputation of being a knowledgeable technology investor, and finally, we saw they had a good healthcare portfolio. Of course, the fact that they have a permanent fund structure without any lifetime gave them a further advantage,” he says.

Since GA invested in the company, it has helped Citius build a world-class board of directors, including the likes of Dr William Winkenwerder Junior as chairman of the company. Winkenwerder is one of the most influential names in the healthcare space in America. Apart from him, Gary Reiner, operating partner at GA LLC, is one of the directors on the board.

The fund also helped with the recruitment of senior management talent and establishment of strong financial processes and systems in the company.

“As the organisational structure evolved over time, we started looking at mergers and acquisitions two years ago and last August, we completed our first acquisition. They even helped us focus on the payer and provider business, which now contributes two-third of our revenues,” says Moorjani.

When GA entered the company, Citius was making $60 million in revenues. Last year, the company reported $180 million.

Five years on, earlier this year, GA decided it was time to exit the business and along with Citius’ founders it hired investment bank JP Morgan to run the sale process. The deal has been sealed, with Citius becoming one of GA’s multibagger exits. The founders, too, are selling a majority stake though they will continue to run and grow the business. According to media reports, Baring Private Equity Asia and buyout major KKR are in the final round of deal closure and have valued the company at nearly a billion dollars.

*****

Sandeep Naik, the reclusive managing director and head of India and Asia Pacific for GA, has a huge grin on his face even as he knocks on a wall in his office and says, ‘Touchwood, it should

go well.” [br]It has been a hectic year for the 11-member GA India team, which prefers doing proprietary transactions (where a buyer directly engages with the seller) rather than chasing deals propped up through investment bankers. And not just this year. According to VCCEdge, the research and data platform of VCCircle, the fund has deployed nearly $907 million in India in the last three years alone.

[br]It has been a hectic year for the 11-member GA India team, which prefers doing proprietary transactions (where a buyer directly engages with the seller) rather than chasing deals propped up through investment bankers. And not just this year. According to VCCEdge, the research and data platform of VCCircle, the fund has deployed nearly $907 million in India in the last three years alone.

“We are thematic investors. We don’t react to the deals that come to the market, and are more focussed on thinking through what the next big investable theme is in a particular geography, and sector. We then proactively go ahead and create deals in companies that play to these themes. In many cases, there is no deal to begin with,” says Naik.

Naik is proud of the fact that, over the last seven years, of the 14 deals that the fund has closed, 13 have been proprietary transactions and one an auction process where the fund was the third highest bidder and yet made the cut.

One such deal this year has been real estate classifieds platform NoBroker where the fund deployed $51 million. Shantanu Rastogi, managing director at GA who was also with Naik in his previous stint at Apax Partners, had been interacting with the founders of NoBroker for a year. “Both (founders) are juniors from my college (IIT Bombay) and when the time came for them to raise capital they asked us if we would be interested. We had been meeting them regularly and saw how they were executing against their plans. The opportunity also fit well with our emerging growth initiative to back best-in-class hyper growth companies. We were able to move quickly and did the deal in five weeks,” says Rastogi.

Since January, GA has invested over $311 million across five deals. Besides $51 million in NoBroker, it invested $100 million in pharmaceutical company Rubicon, $26 million in a follow-up round in education technology startup Byju’s, a follow-on round in Karvy Computershare for an undisclosed sum and it upped its stake in PNB Housing Finance by deploying another $134 million. And there will be a few more by the time the year ends. Media reports suggest GA is also eyeing an investment in entertainment ticketing platform Bookmyshow.com. While the deal process is still on, the new round is pegged at a little over $100 million, which will push the company into the group of unicorns.

*****

Globally, GA has an AUM (assets under management) of $31 billion. Since its inception in India in 2002, it has committed nearly $2.6 billion across 27 companies in the country and realised $2.4 billion, having completely exited 13 of its investments.The private equity fund owns nearly 80 percent stake in Karvy, a little over 60 percent stake in Rubicon, and a 5 percent stake in Byju’s. But that doesn’t deter GA from being on the table as a growth investor.

“GA has done growth minority investing for the last 39 years. We get the fabric of partnerships really well—it’s embedded in our DNA, and it’s our secret sauce for investing. Irrespective of what your ownership is, you need to be able to have the right partnership and influence over the entrepreneur to guide them in the right way it doesn’t matter whether you own 5 or 70 percent,” says Naik.

Globally, GA pursues two large themes. One, digital transformation and technological disruption, and how that is impacting the traditional industries it means looking at companies using technology as a disruptor of the old economy and having the ability to scale up and make money in the long run. It is one of the large themes that is playing out across all the developed and developing markets for the firm.

The second is focusing on emerging markets consumerism.

“If we look at where growth is coming from today, a large part is from Asia and especially from countries like India, China, Indonesia, and we are playing in those markets. We are backing businesses across the sectors of our focus, which are predominantly retail consumer, healthcare, financial services and technology,” says Naik.

In India, 50-55 percent of its portfolio is dominated by investments in financial services because Naik believes one of the best ways to play emerging markets is through financial services and financial services products. “It is the levered way to play the economy,” he says.

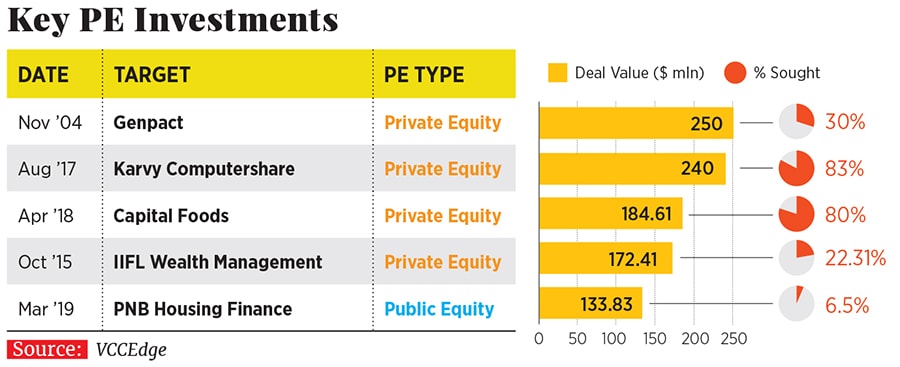

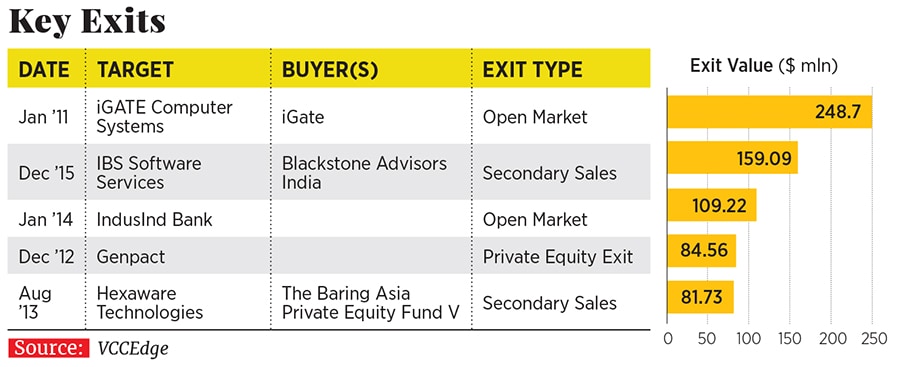

The fund had invested in IndusInd Bank from which it exited in January 2014 and took home nearly $109 million. According to VCCEdge, it was one of the top three exits for the firm in India. In October 2015, it went on to back IIFL Wealth Management Ltd in a deal pegged at $172.41 million—one that started taking shape after a conversation between Rastogi and Karan Bhagat, founder of the wealth management business, at a Diwali party.

It’s a deal Naik elaborates on with a childlike enthusiasm. Nobody had done a deal on wealth management at that point, he says, and the call they took was that global banks will find it difficult to succeed in India unlike in some other markets. It was a contrarian call at that time. “We said here is a young team—very hungry but exceptional at what they do and could we back that team to create the largest wealth management business in India? It is a bet we took on Karan and stitched up a completely proprietary deal where no banker was involved, five weeks from start to finish, and when they announced the deal the market woke up to it and said, ‘when did this happen and how did this happen, we didn’t know there was even a deal to be done’.”

IIFL Wealth is the largest home-grown wealth management business in India and after the parent IIFL Holdings Ltd’s demerger in August it will be a standalone listed firm on the bourses.

Some of GA’s other financial services bets include payments processing firm BillDesk, mortgage-backed lender PNB Housing Finance Ltd and Karvy Computershare. It was also an early investor in National Stock Exchange (NSE) and continues to stay invested in it as it believes the true value of the firm will be discovered only during its listing. It’s a bet many other fund managers have taken on their books.

In technology, the other sector GA is known for globally, the company has tweaked its model for India. The firm started investing in technology in India in 2002 by cutting a cheque to acquire business process outsourcing firm Genpact. At that time, it took a call that India is a market where it can have an arbitrage on the human capital side. It did deals across the IT services space including Patni Computers, Hexaware, IBS and Infotech Ltd. Some of these early investments have helped GA clock multibagger returns from its Indian portfolio. In December 2015, it sold IBS Software Services to global buyout major Blackstone Group for $159.09 million and it reaped $248.70 million through the sale of its stake in iGate Computer Systems in 2010. According to VCCEdge, these have been the firm’s two largest publicly recorded exits in India.

“We identified that trend very early on and played that up until 2010, where we predominantly did deals in the IT services space. By then we had a significant presence in India and we realised there is lot more happening in the country domestically than just IT services,” says Naik.

By late 2010, the IT services space was getting commoditised with the onslaught of multiple players and value arbitrage was shrinking. BPO jobs were shifting to countries like Vietnam and specialised skill sets were required to ride the next wave. That’s when it decided to invest in data analytics firms like Mu Sigma and CitiusTech.

In 2010, GA also decided to start in India the traditional investments it did across the world, including in financial services, healthcare and retail. It went on to invest in fashion designer Anita Dongre’s brand AND, Capital Foods—makers of Ching’s sauces and chutneys, and buffet restaurant chain Absolute Barbecue, among others.

But infrastructure is one area where they burnt their fingers. GA invested $107 million in Fourcee Infrastructure Equipments in 2012, two years after India Equity Partners invested $24 million in the company. In 2013, both took Fourcee to the Company Law Board (CLB) alleging forgery and wilful deceit. In another investment in 2010, the firm led a $425 million commitment along with a consortium of global investors like Morgan Stanley Infrastructure Partners and Goldman Sachs among others. This investment too ended up in a sour legal battle. Since then, the fund has stayed away from these investments and focussed on its core sectors.

After Naik was brought in in late 2012, a slew of new hirings was done in April 2013 and that team continues till today. Naik was also not ready to bite when it came to consumer technology, a space that was seeing a lot of investment.

“My view has always been that merely replicating models that have worked in the US or China is not going to work in India. Though a lot of companies raised a lot of capital in that period, we decided we will only back companies solving real India needs [rather] than products that have worked elsewhere,” Naik says.

GA scouted for deals for a long time. None of the deals matched its unit economics because consumer tech companies were guzzling cash by the barrel.

“That model was not resonating with us. I don’t mind the cash burn as long as you are solving a real Indian need. We then came across Byju’s, and that is a model I loved because he was solving a real Indian need,” Naik says.

Rastogi agrees. “We are looking for companies focussed on unsolved Indian problems. There might be some pockets in the consumer internet space where there is some level of valuation inflation, but outside of that there are enough deals to be done,” he says, adding that GA is looking at transactions in the media, gaming, beauty and real estate segments that are led by tech disruption.

“GA has demonstrated steady returns from their India investments and they have the knack to pick up the winners across sectors that they focus in,” says Ajay Garg, founder of financial services firm Equirus Capital. “It started with technology, then financial services and now they are actively pursuing consumer technology deals. Even in the case of IIFL they were the early movers in the wealth space in India. They have been at the forefront of picking up early trends.”

*****

General Atlantic currently deploys nearly 15 percent capital from its global pool in India, which Naik expects to increase to about 20 percent. Of its total kitty, 40 percent is deployed in the US and rest is across Europe, Latin America, China, India and Australia. In any given year, it deploys nearly $4-5 billion globally. GA’s current portfolio in India comprises 14 companies, with an investment of $1.6 billion.As it continues its investments, GA has an edge over its blue-eyed global peers. The fund does not come with a lifeline. Usually, private equity funds are close-ended, which means they have life tenures within which they have to deploy and exit their investments and their carry and returns are dependent on these timelines. GA comes with no such restrictions. The regional heads are allowed to hold investments for a longer period if they believe that the best value creation is yet to happen. Apart from that, all partners are incentivised the same way for any deal across the world.

“It is a close-knit firm and we have a single pool of capital for everyone to deploy from and everyone is incentivised equally. So if we need someone from the London or US office to vet a deal they fly in and help us do due diligence and similarly we help other teams,” Naik explains.

Apart from its investment teams, it has a large pool of portfolio support teams called the Resources Group, which helps portfolio companies across the globe on various aspects. For example, David Buckley, an operating principal and part of the operations group, offers advice to the fund managers and portfolio companies on product pricing and topline revenue growth. He determines if there is a possibility for the portfolio company to increase its prices, tweak the brand and introduce a new line of products with a price point that will attract more customers.

It also has similar resources across verticals, and provides services including talent management mapping and devising an organisational structure when a due diligence process is on for an investment, providing human talent when the company is seeking board members or senior resources as well as tech process implementations across portfolio companies. It’s a methodology increasingly being followed by global private equity firms, which gives them the fillip to swing a deal in their favour as founders are keen to tap this pool.

While the Indian private equity ecosystem has witnessed a paradigm shift towards majority and control deals over the last four years, GA is sticking to its good old growth investing model.

Naik believes issues arise when the investment time horizon is short, and as a result you are not thinking like the founder and your outcome decisions may not align well with the entrepreneur. In those situations you would rather be a buyout firm who can change the direction of the asset but if you are a buyout firm and stuck in a minority investment then you don’t know how to push that equation. As Naik says, “In the end people pick people they like in these kind of situations.”

As the meeting comes to an end, one can’t help but be intrigued by a huge installation of the Ashoka Stambh (Lion capital of Ashoka) at the entrance of GA’s office in Worli in Mumbai. It’s an unusual installation for a PE fund in India. But it also summarises the kind of consumer tech deals GA is trying to do here, backing firms that focus on the larger needs of the country rather than targeting the upper echelons whom everyone is trying to chase in a bid to grow their size and scale.

As Naik concludes, “We will back the Bharat consumer model [rather] than just focusing on the 40-million India.”

First Published: Jul 25, 2019, 11:57

Subscribe Now