How Nomura is building its India business

Since 2016, the firm has been aggressively working on its investment banking business. Now with several IPOs, big-ticket M&A deals, and fundraises under its belt, it is slowly transitioning itself int

It was December 2016 when global private equity fund Advent International acquired a significant minority stake in investment and wealth management firm ASK Group. At that point ASK was managing assets of over Rs 29,480 crore ($4.4 billion). It was the third deal Advent was closing in two years, and the first cheque to be cut for an India deal from their then newly raised $13 billion fund. Advent’s India team roped in Nomura’s investment banking team for support on the financial aspect of the business since it was their first investment in the wealth management business and also the first from their new fund.

“We selected Nomura to lead the process because of their reputation in the financial services industry. They were instrumental in helping us navigate a complex transaction and their dedication to ensuring a successful outcome was admirable," says Shweta Jalan, head of Advent International in India.

In 2018-19, the management of ASK decided to take their company public and Nomura took them for roadshows. Even as they were pinning their hopes on the IPO, capital markets tanked and the plan was put on the backburner. But the firm hired Nomura in 2020 to undertake a financing exercise and by March 2021, they were appointed to undertake the sale of the promoter’s stake and some of the shareholder’s stake which included Advent’s stake. After running a full-blown global domestic sale process, the sale was closed in February this year. According to a report by thecapitalquest.com in October 2021, global private equity firm Blackstone acquired 71.25 percent stake in the company. By the time the sale was officially announced in February 2022, the deal value was pegged at $1 billion and ASK’s assets under management (AUM) was over $10.6 billion. It is estimated that Advent took home nearly four times on its investment.

But the Nomura India team’s job didn’t end here. Now that the investment banking team was done with the sale process, the debt team sprang into action--to raise leverage finance for the largest ever wealth management transaction in Asia. Along with other investment banks, it then provided acquisition financing support to Blackstone for the deal. And finally, it offered Blackstone a currency hedging solution for the transaction. Currency hedging is an important aspect for global investors who need to return capital to their limited partners in dollars, especially when the investment is done in a company whose revenues are generated largely in Indian currency opening them to currency headwinds. As and when Blackstone plans to take the company public, Nomura hopes it will be part of that deal too… after all it has been part of the company’s deal life cycle over the last seven years.

“Five years back, wealth management was an emerging sector that had witnessed very limited deal activity in India. Hence, there were no logical comparable listed players or transactions that could be referenced as a benchmark. In this backdrop, we assisted Advent in the acquisition of ASK by drawing upon our global expertise in the asset and wealth management sector," says Utpal Oza, managing director and head of India for investment banking at Nomura while sitting at their headquarters in Worli in Mumbai overlooking the Arabian Sea.

One of the plus points for Nomura at that point was the fact that Nomura had a huge wealth management business in Japan and they had managed to close about a trillion dollars of wealth in Japan. Globally, the firm knew the growing power of wealth management as a business vertical and the increasing bespoke needs of ultra-high-net-worth individuals (UHNI) and high-net-worth individuals (HNI).

Oza believes the sheer knowledge of the sector globally allowed them to contribute unique insights for Advent’s consideration. He adds, “We not only focused on the transaction at hand but also advised on who could be the potential buyers for this asset when Advent decides to exit in the future."

Strong access to ASK’s management team also allowed them to deepen their engagement with Advent. “First, it was in the financial sector, which is a focus area for most sponsors operating in India. Second, it was an opportunity to acquire a scaled asset in the wealth management space which was a fast growing sub-segment within the financials space with favourable tailwinds," explains Oza.

*****

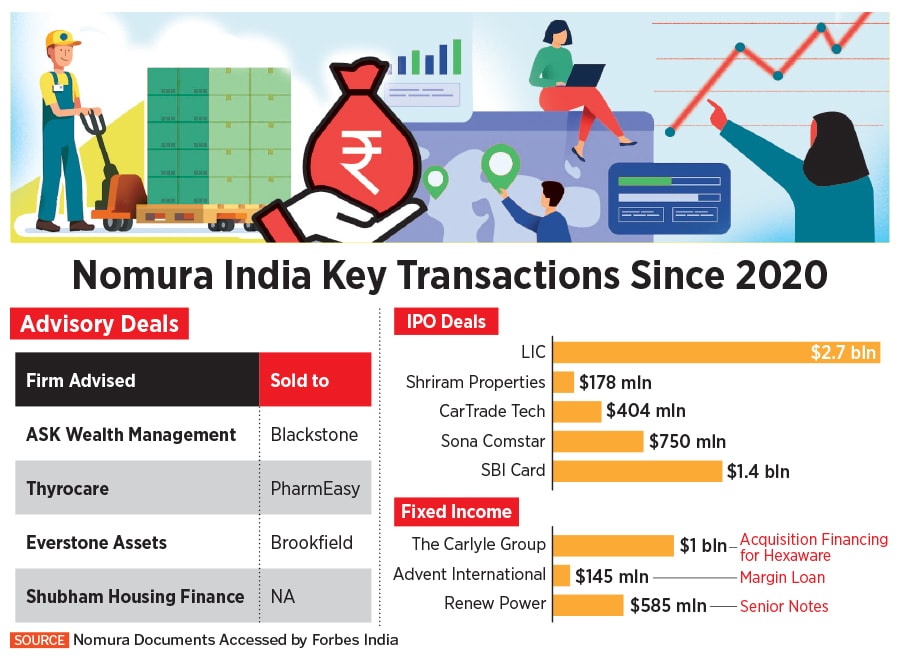

Like most of the financial firms on the street, Nomura too clocked all-time high numbers for its India business last year. Since the pandemic, it has been appointed as merchant bankers for 14 IPOs including the $750 million (Rs5550 crore) IPO of automotive firm Sona Comstar, an automotive supplier firm backed by Blackstone. Since 2017, it has participated in over 51 equity capital markets (ECM) transactions to raise close to $23 billion for its clients. Since 2020, Nomura has closed 13 M&A deals across sectors with a balanced contribution of sell-side and buy-side M&A transactions, the most notable ones being the sale of ASK to Blackstone, the purchase of Eureka Forbes by Advent and the sale of Thyrocare to PharmEasy. Since 2020, it has closed over 20 deals under its debt financing vertical to both financial sponsors and corporate clients. This includes a $1.1 billion fundraise for a global private equity fund for financing its buyout transaction. Nomura also participated in raising $1 billion for The Carlyle Group for the acquisition finance of Hexaware.

The person leading the show in India is Utpal Oza, one of the firm’s earliest recruits, who joined in 2006 and was among the founding team of Nomura’s India franchise. Amit Thawani, who joined shortly after in early 2008, has been at the helm along with Oza. Nomura received its merchant banking licence in 2008 and today employs more than 100 people across all its three operations--investment banking, fixed income and equities. The firm saw significant growth between 2007 to mid-2008 when it participated in merger and acquisition transactions.

Post the Lehman acquisition, the firm grew rapidly in India, when it had close to 60 resources across investment banking and then it went through a period of consolidation and between 2012 and 2014 when the market bounced back, they continued to consolidate. It is since 2016 that the firm has aggressively been building on its investment banking business. A lot of other global banks of similar vintage have pulled the plug on a lot of services they offer, including giving up the equities licence to focus on mergers and acquisitions.

During the peak of the global financial crisis in September 2008, Nomura Holdings Inc. announced the acquisition of Lehman Brothers’ franchise in the Asia Pacific region including Japan and Australia. During the good days, essentially just before the financial crisis, when Lehman even cut a cheque for now bankrupt real estate firm Unitech Group, Lehman’s headquarters was located in the most expensive commercial property of Mumbai, Ceejay House in Worli. It’s been over a decade since Nomura took over the assets and it now works out of Ceejay House.

“For us, India as a country is possibly the most profitable in Asia ex-Japan and with a growing client franchise. And one of the key reasons behind this is the management stability which has significantly contributed to maintaining continuity in client relationships," adds Oza.

Many investment banks (including some of the largest global players) had identified India as the next key market for growth and aggressively wanted to build their business in the country, which is where Thawani believes their approach was different.

He explains, “We very quickly realised that we don’t want to make the same mistake as others. We wanted to build it step by step and that is why initially we focused on building what we call the financing business with a specific focus on private equity transactions."

Currently, close to one-fourth of the firm’s India business comes from financial sponsors. Financial sponsors are private funds which deploy capital in businesses.

It then focused on building its equity capital business with strong research capabilities. One example being, during Covid-19 Nomura’s Business Resumption Index was a widely used reference point by investors and the public in general. Backed by its research offering, it started ramping up its primary market offerings. It started bidding for Government of India’s share sale programmes which, Thawani believes, has helped them build their credibility in the market. This year, Nomura was part of the 10 merchant bankers who took India’s largest insurer Life Corporation of India (LIC) public. LIC’s shares have tumbled since listing the Rs 21008.48 crore initial public offering (IPO). On May 20, the shares listed at a 9 percent discount to its IPO’s upper price band of Rs 949 per share. As on July 14, the shares closed at Rs 712.15 per share on the Bombay Stock Exchange (BSE).

Oza says, “We then focused on our capital markets platform and built the internal expertise on both the regulatory and investors front. Our focus was on delivering the right outcomes for both clients and public investors and eventually client referral has been the key driver that has allowed us to grow our ECM franchise. And finally, M&A was always core to our operations and we have consistently built this business which has grown close to 10 times over the last five years. And to clarify, our M&A franchise was not just focused on leveraging the Japan-India corridor. We strategically focused on domestic sell-side and fund-raising mandates, as well as assisted Indian clients who had global growth aspirations." The firm largely focuses on five sectors--financials, technology and media services, infrastructure, healthcare, consumer and retail.

Thawani chips in, “There are a few things that clearly stand out for us, the key one being that we are very clear about what we don’t want to do. Like we don’t do deals in the metals and mining sector. When the firm and the team are focused and you’ve chosen the battles that you want to fight, then you fight hard with a clear goal of winning all battles in that space. You will see Nomura advising on $100 million transactions as well as $5 billion transactions in these focus sectors. We don’t believe in the concept of small deals, we cover the entire spectrum."

Thawani, who joined Nomura in 2008, looks after the entire coverage function which essentially means investment bankers across coverage areas report in to him, and he is deeply focused on the financial institutions sector.

*****

Over the last six years, debt has become one of Nomura’s strongholds. The people who have traditionally dominated the debt space are deposit taking banks, or credit funds with a large amount of investible capital. But Nomura’s capital neither has a large amount of investible capital pool nor does it offer cheap capital to its clients, yet it has found takers for its products in a highly competitive market.

The fixed income business is divided into the structured corporate debt business and the second is a risk solutions business. For sponsors (private equity and venture capital funds), the strategy is very simple. It would like to be a one-stop shop for them with respect to every kind of financing or risk management solution that they need for themselves. “When it comes to debt, the more the complexities in the transaction, the more bespoke it is, the more we like it. The depth of our intellectual capital to make these deals happen is something we are very proud of," adds Oza.

While mainstream deals continue to be their mainstay, Nomura is slowly transitioning itself into an ESG-themed business. It has been raising capital for green energy companies—for instance, it has helped Renew Power raise $585 million senior notes and Rs 4.9 billion in non-convertible debenture (NCDs).

Thawani adds, “And we think that as markets and investors focus more on ESG, we expect to see that companies that have strong ESG credentials would want to tap the primary markets. These could be environmental-focused companies, such as those into renewables advanced transportation companies, such as electric vehicle OEMs and component manufacturers or companies that are into businesses with a very strong social angle, such as the upliftment of an entire community. Investors will gravitate towards these companies because each bank, each and every investor, now has a very strong ESG mandate."

Nomura has been busy stitching green deals globally as part of its larger mandate (it has advised over $70 billion worth of M&A in the clean energy sector) including the sale of Terraform Power to Brookfield for $9.85 billion in July 2020.

Since the last 12 months, Oza is of the view that there has been a lot of media hype around unicorns. Oza sheepishly smiles and says, “There’s no doubt that the Indian start-up world is a big beneficiary of fund flows into India, which in turn has been driven by global funds raising huge Asia-dedicated funds that need to be deployed in the region. Valuations kept increasing as there was euphoria in the market, backed by very strong tailwinds and momentum for new economy investments, which led to a robust appetite from retail HNIs and institutional investors in the public market."

He further breaks it down saying that in the effort to not miss out on potential multi-bagger opportunities, investors looked at growth, compromised on profitability and ignored established valuation benchmarks, which has resulted in the recent valuation corrections that have impacted all sectors including tech and new economy. “There are several other sectors where some of the froth has been taken out. Given the general high exposure to tech assets in the private fundraise domain, it has come to the limelight more than the other sectors," he says.

In the tech space, it had advised Nazara Technologies $81 million IPO, CarTrade’s $404 million listing and the $160 million listing of Fino Payments Bank. While it is betting on future deals in the tech space, it believes global valuation correction in this space will allow for rational investing valuations in the coming months.

“They have been trying to participate in large transactions and one thing that has helped them is their ability to price their clients well with global investors during roadshows. They are now actively trying to do deals in the sustainable space where competition is toughening among global banks, and everyone is eyeing the same pie, so it will be interesting to see how they build on this practice," says the head of a domestic investment bank who did not wish to be named, as they directly compete in the same verticals.

While markets have been languishing owing to global inflation, the war between Russia and Ukraine and continual job losses, Oza and his team at Nomura remain constructive on the market. They expect the second half of FY23 will see high-quality companies with sound business fundamentals and reasonable valuations tap the capital markets. “The private equity market, whether in terms of buyouts or capital raising, remains active. With valuations correcting and a lull in capital markets activity, it provides interesting opportunities for private equity funds over the coming months, that could spur the financing markets," says Oza. Another interesting and relatively new dynamic that Nomura has been witnessing is the domestic consolidation led by large conglomerates across tech and traditional old-economy sectors which is expected to continue to drive deal activity in the country.

Even as concerns of a global recession are slowly gaining voice, the firm is busy going on roadshows and raising new mandates.

As Oza says, “Over the last 15 years, we have had some ups and downs but as we take a step back and review our growth trajectory, every setback was an enriching learning experience and every success was a culmination of painstaking team effort by a committed and experienced team. The team remains stable, the hunger to do more and do better has not changed, and clients remain core to our operations. So we are confident that we will continue to trend in only one direction–upwards."

First Published: Jul 15, 2022, 13:09

Subscribe Now