LIC: Tough road ahead as stock continues to drag

As its stock awaits a fresh embedded value, India's largest insurer wants to strengthen bancassurance and diversify its product mix. But changing the mindset of the organisation and its agents is unli

Nearly a month after the Life Insurance Corporation (LIC) of India stock was listed on May 17, its chairperson Mangalam Ramasubramanian Kumar did rare media rounds, to clarify to investors why the stock of the country’s largest insurer had eroded 31 percent in value from its issue price—and underperformed market indices by more than five times—during this period.

Kumar, an LIC veteran of nearly forty years, gave all the right media bytes, at least from the perspective of a state-owned organisation. He spoke about the need for LIC to change its product mix beyond traditional offerings, the near-term strategy for growth by focusing on Unit Linked Insurance plans (ULIPs) and improving profitability, the push towards bancassurance, going aggressive on digital and the timeline in disclosing embedded value.

LIC’s top leadership has, in previous decades, not spoken publicly on these issues, except in annual reports. But Kumar’s straight talk and favourable analysts’ estimates for the stock are yet to convince investors. A fortnight since then, the LIC stock has edged up just 3.3 percent, much in line with the stock markets and still down 28 percent from its issue price of Rs 949 per share.

Kumar has tried to allay investor concerns, blaming the stock slump on weakening market conditions hurt by rising inflation, as global energy and food prices remain stubbornly high.

Kumar has tried to allay investor concerns, blaming the stock slump on weakening market conditions hurt by rising inflation, as global energy and food prices remain stubbornly high.

In the quarter gone by, LIC reported its first earnings data since being listed the year-on-year consolidated net profit for the March-ended quarter fell 17.4 percent and it also showed a lower 69.24 percent 13-months persistency ratio (a key matrix for an insurance company), compared to the previous Q4FY22 quarter. On June 30, LIC failed to announce the embedded value for the previous quarter, despite clear promises by the management earlier. LIC has said the exercise in determining the embedded value “may take some more time to get completed" and is likely to be disclosed on July 15. LIC declined to participate in this story.

“All of these issues take away investors’ confidence in the stock. It raises fresh concerns over future profitability," a top official with a mid-sized private insurer said, on condition of anonymity.

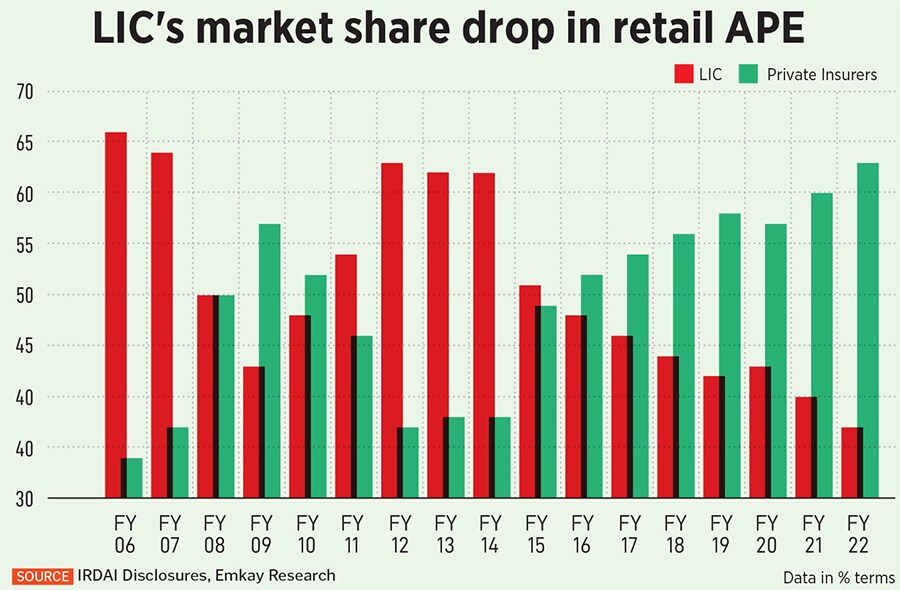

But to understand the business of LIC, some important factors need to be outlined, which make it distinctive. LIC has, for over sixty years, been a household name for all families in India, carrying out most of its business by selling single premium (non-recurring) instruments. But it has also been losing market share for years to private bank-led insurance companies, in retail annual premium equivalent (APE), which indicates new business sales. LIC leads in terms of new business premium (NBP) with a 61.4 percent market share.

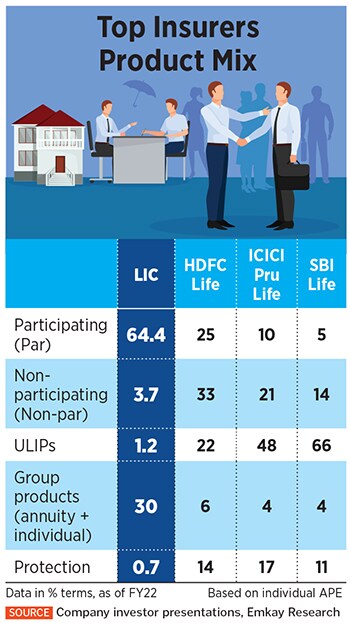

Unlike most private insurers, LIC’s product mix comprises selling participating (Par) policies, through its vast agent network of 1.3 million people as of April 2022. Participating policies are those where policyholders benefit in the form of a share of profits that the insurance company makes. This has led to lower profitability. LIC’s sales of ULIPs and retail protection schemes are negligible, which are usually expected to offer better returns to customers.

LIC can boast of having the highest reach and productivity in selling policies across India, with offices in 91 percent districts in India compared to 81 percent for the entire private sector combined. Its agents’ productivity is the highest at Rs3.93 lakh in new business premium in FY22, followed by SBI Life at Rs 2.81 lakh, according to IRDAI data.

LIC can boast of having the highest reach and productivity in selling policies across India, with offices in 91 percent districts in India compared to 81 percent for the entire private sector combined. Its agents’ productivity is the highest at Rs3.93 lakh in new business premium in FY22, followed by SBI Life at Rs 2.81 lakh, according to IRDAI data.

JP Morgan India’s analyst Deepika Mundra finds LIC’s agent network to be a strong investment moat. “LIC, with its wide reach, should be able to make some dents into new product segments while maintaining focus on its participating book. New channels bancassurance, digital, are also a key focus. That said, channel costs are higher as compared to peers," Mundra says in a note to clients, referring to operating and expanding the agency network.

LIC should be concerned as most of the private insurance companies have gone beyond the traditional agents’ sales to distribute policies. These include the well-established bancassurance (which financial companies, banks and insurance companies are well entrenched in), direct sales and tie-ups with payment banks and wallet firms. Private insurer Max Life, which has automated the issuance of new insurance policies, now uses AWS as its cloud provider for storage, computation and data analytics of policies.

Private insurance companies have, for more than a decade, had a high dependence on bancassurance for new business, at 55 percent in FY21 for the industry, according to a JP Morgan June report. Subhankar Sengupta, who oversees IndiaFirst Life Insurance’s partnership businesses, says the market share of bancassurance in India has increased to 56 percent from 27 percent between 2011 and 2019.

LIC, which had 70 bancassurance partnerships in FY21, is keen to add more bancassurance and alternative channels to sell more policies. Its current tie-ups are with 57,919 outlets of these banks all over the country. But LIC has not been able to capitalise on these relationships so far. Around 96 percent of LIC’s NBP for individual products is through its agents and only 3.38 percent through banks and alternative channels.

LIC, which had 70 bancassurance partnerships in FY21, is keen to add more bancassurance and alternative channels to sell more policies. Its current tie-ups are with 57,919 outlets of these banks all over the country. But LIC has not been able to capitalise on these relationships so far. Around 96 percent of LIC’s NBP for individual products is through its agents and only 3.38 percent through banks and alternative channels.

State-owned IDBI Bank is LIC’s foremost bancassurance partner, contributing 45 percent (Rs 863 crore out of Rs 1,900 crore) of its total banca business, LIC said in its 2021 annual report.

But inclination to drive bancassurance is not going to mean success for LIC in coming months. Most of LIC’s banca partners are co-operative banks, regional rural banks and public sector banks. None of the large private retail banks, barring Axis Bank, is its partner. “This limits the reach of its banca partners among the mass-affluent customers," says Avinash Singh, a senior research analyst at Emkay Global Research. “Bancassurance requires a relatively flexible and low-cost employee base to manage the business at the bank branches. LIC has the problem of high-cost employees, making it difficult for LIC to position its employees in the bank branches," Singh said.

“LIC works on bancassurance like a sign-up relationship with a bank and then assumes that it is the bank’s responsibility to sell policies. This mindset of the corporation needs to change," says Singh, a private insurance expert.

LIC’s Kumar has been talking about making that shift in focus towards non-par products and ULIPs. But this is not likely to be an easy transition. Singh says that “products such as ULIPs have a very limited ability to absorb costs well and still remain profitable." Ultimately, LIC will need to evaluate costs and its distribution structure to determine which type of products the insurance company will sell to customers.

LIC’s agents have, traditionally, found it difficult to sell the more complex policies to their customers, due to the lack of financial sophistication. Selling a higher ticket non-par savings or a ULIP product to the typical LIC customer will not be easy. Emkay’s Singh says that ULIPs, traditionally, have been bought by mass affluent customers or high net-worth individuals in the 35-50 age bracket, which has not been LIC’s traditional customer.

The challenge is that peers such as SBI Life, ICICI Prudential Life and HDFC Life are well entrenched in this segment (see portfolio mix table). And segment leader SBI Life is not likely to take its foot off the pedal soon. In its latest earning call with analysts, SBI Life Managing Director and CEO Mahesh Kumar Sharma said they will continue to sell ULIPs if there is demand. “Our ULIP products are positive margin products. I think the persistency in ULIP are excellent and they are likely to continue that way it gives a lot of liquidity and flexibility to the customers. So we do not see ULIP being discouraged by us…," Sharma said.

They also do not feel threatened by LIC’s plans to strengthen their presence in the ULIP space. Responding specifically to a query on LIC, Sharma said: “We have a huge distribution network, which is not dependent on LIC doing well or otherwise." SBI Life works with about 75 banks of different sizes and has an additional 1.46 lakh agents, besides brokers and corporate partners to distribute their products.

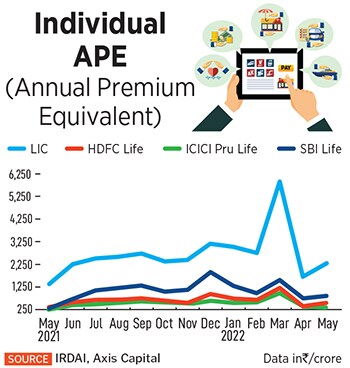

SBI Life, a private life insurance firm, reported the highest growth in Individual weighted received premium (WRP), which is the sum of the first-year premium on renewal policies and 10 percent of single premium policies. SBI grew by 193.6 percent year-on-year in individual WRP in May 2022, at Rs 838.1 crore. LIC reported a growth of 65.1 percent in the individual WRP for the same period.

So, considering various factors, LIC will find it “difficult to enter this segment where banks, wealth managers and digital financial advisors have already made significant inroads," Singh says.

So, in all probability, while LIC plans to make inroads into bancassurance and diversify its product mix, this process will be gradual. Macquarie Capital Securities India analysts Suresh Ganapathy and Param Subramanian assess that LIC’s “ability to sell high-margin non-par products—as opposed to par products that provide policyholders a significant share of policyholder’s surplus—will require a change in the mindset of the organisation and its agency force, which could be LIC’s biggest challenge."

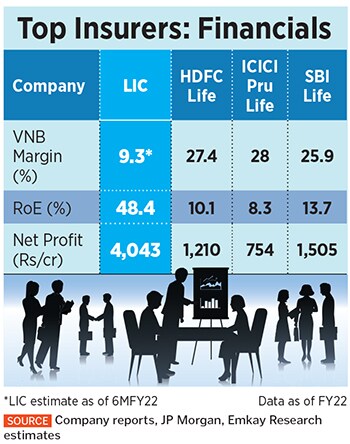

In that scenario and with no track record of reporting of the embedded value for LIC, analysts have been a little conservative in their valuation of the LIC stock. Most of them agree that the fair value for the stock needs to be closer to the embedded value (EV), rather than deriving value from future new business. In LIC’s case, analysts point out that LIC adds only about 1 percent of EV from its VNB each year, but this is about 9-11 percent for private insurers.

In June, Emkay’s Singh initiated coverage on LIC with a hold rating and a target price of Rs875, due to this factor and the possibility of higher volatility in the EV. They have used a 0.9x June 23 P/EV multiple to arrive at the LIC stock target price. Macquarie, after LIC’s listing in May, also initiated an investment into LIC, with a neutral rating and a target price of Rs1,000. They have applied a P/VNB multiple of 10x on FY24E VNB. JP Morgan’s Mundra believes that the markets have mispriced the stock, with a target price of Rs840 for the stock and forecasting a 6 percent FY22-24E growth in business.

In June, Emkay’s Singh initiated coverage on LIC with a hold rating and a target price of Rs875, due to this factor and the possibility of higher volatility in the EV. They have used a 0.9x June 23 P/EV multiple to arrive at the LIC stock target price. Macquarie, after LIC’s listing in May, also initiated an investment into LIC, with a neutral rating and a target price of Rs1,000. They have applied a P/VNB multiple of 10x on FY24E VNB. JP Morgan’s Mundra believes that the markets have mispriced the stock, with a target price of Rs840 for the stock and forecasting a 6 percent FY22-24E growth in business.

Jayesh Bhanushali, AVP-Research at IIFL Securities, says the LIC stock has outperformed several technology-led other companies that raised capital in 2021 at questionable valuations. Food delivery firm Zomato is down 56 percent from its listing price, FSN E-Commerce (Nykaa) is down 41 percent and One97 Communications (Paytm) is down 59 percent from its listing price.

“As a portfolio bet, LIC is a good value stock. LIC, at the time of its IPO, commanded a PE of around 200, which has now fallen to 103. Investors can enjoy a 3 to 4 percent dividend yield and a 5 to 10 percent annual gain, so it could provide 10 to 12 percent CAGR stock returns," Bhanushali says.

The government, which currently holds a 96.5 percent stake in LIC, may seek to offload more in coming years, possibly down to 75 percent in the next 4-5 years. But at the current price, the government may not get a good valuation. Any bounce in the stock will get sold into because there will be an overhang of government supply.

Bhanushali says the LIC stock is likely to hover between Rs650 and Rs750, due to the current choppy market trends, where rising inflation, further interest rate tightening and high input costs are unlikely to attract fresh inflows. Bhanushali says the markets could see a further correction, with inflation unlikely to cool down.

Bhanushali also says insurers may find the macro-economic conditions difficult to ramp up growth in new business due to low disposable income amid high inflation, stock market volatility and rising interest rates.

LIC’s Kumar wants to retain their market share over the next 2-3 years, with a change in the portfolio mix. Both are going to be tough tasks. Transparency and corporate governance will become equally challenging issues, if – as in previous decades -- LIC facing an overhang to try and shore up investments in companies with weak balance sheets. “Investors have to be patient and look out for the good signs to come. We will be able to demonstrate our ability to grow and retain leadership in the market," Kumar has told television channels last month. But Kumar will need to walk the talk on various fronts.

First Published: Jul 04, 2022, 16:13

Subscribe Now