Bitcoin: Time to cash in?

It may be time for the RBI to revisit its cryptocurrency strategy. Here's why, according to Rameesh Kailasam, CEO, Indiatech.org

Should central banks add bitcoins to their balance sheet? Surprising as it may seem, the proposal is being discussed in many jurisdictions. What was once unthinkable is now part of policy debates in power circles across the globe. In the US, a proposal dubbed the ‘Bitcoin Act’ has gained renewed attention following Donald Trump’s election victory.

The measure calls for a ‘Bitcoin Purchase Program’ to acquire up to 1 million bitcoins over five years, to be held for at least 20 years. In Brazil, there’s a similar proposal to establish a sovereign strategic bitcoin reserve, known as ResBit. Japan, Russia, Poland and Slovenia are among others considering similar moves. Bhutan’s decision to use its hydropower resources to mine bitcoin and El Salvador’s move to add bitcoin to its strategic reserves seem like making the wary rethink.

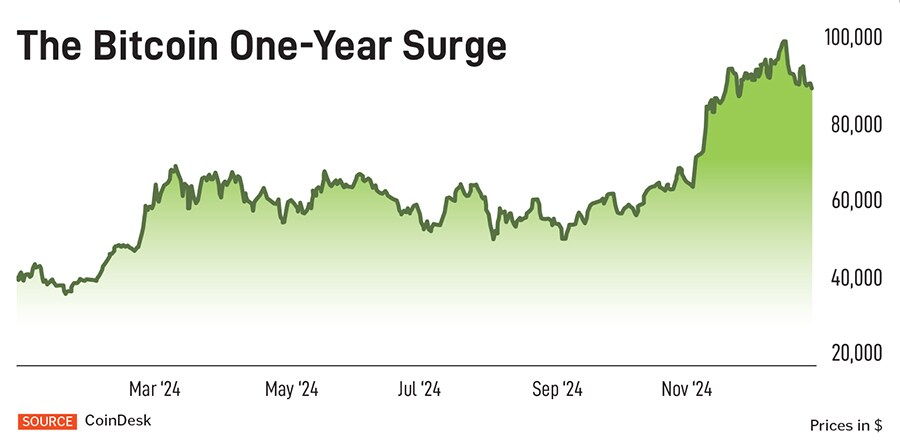

While much of the latest bitcoin rally past $100,000 has been attributed to Trump’s re-election, the numbers point towards the asset class following historical market cycles. Bitcoin was designed with a peculiarity regarding the issuance of new tokens, in that the rate at which new a bitcoin is issued is hard-coded, and halves every four years. This mechanism was put in place to incentivise early users and developers to actively participate in keeping the network functional, with the intention of tapering off as the protocol grew.

It also added a layer of virality to the bitcoin narrative, as each halving event and market cycle brought prognostications of doom, and fertile ground for media outlets to plant their latest eulogies.

But, as experts often counsel, trading is mainly about psychology, and thus far more attention has only preceded renewed interest. In retrospect, this has resulted in the four-year market cycle. Of course, wizened traders will also often caution that past performance is no guarantee of future success.

While bitcoin has followed fairly predictable cycles, the source of this growth has evolved. At the forefront of this particular rally was the early 2024 launch of spot-based bitcoin exchange-traded funds (ETF) by asset management firms, including giants like BlackRock and Fidelity. These products have been a runaway success at over $30 billion, BlackRock’s iShares Bitcoin Trust ETF has surpassed its iShares Gold ETF in terms of net assets. Another driver is rising corporate adoption, led by MicroStrategy, which has amassed over $38 billion in bitcoin. Its success has spurred others, such as Semler Scientific and Metaplanet in Japan, to follow suit. Even Microsoft and Amazon are considering a bitcoin treasury strategy. Others like Tesla already hold significant bitcoin war chests.

That’s not to say that political developments, like Trump’s victory (he holds several million dollars in bitcoin) have no impact on bitcoins’ trajectory. A nurturing regulatory environment that enables the institutionalisation of bitcoin and other crypto assets is a necessity for their growth.

The renewed interest in a bitcoin strategic reserve and the appointment of pro-crypto Paul Atkins as the SEC chair is an indication of change taking place. The relevance of the election is clearly corroborated by data the move higher in bitcoin seemingly stalled for a large chunk of 2024, before picking up steam post the election result.

However, it is unlikely that any of these events will sway India’s apex bank’s earlier position. The Reserve Bank of India (RBI) has been a vocal critic of bitcoin and virtual digital assets (VDAs) for over a decade and went as far as to ‘ring-fence’ financial institutions from dealing with individuals or entities trading in VDAs in 2018.

Despite the Supreme Court overturning the restrictions in 2020, the RBI has remained steadfast in its view that crypto assets should be prohibited in India. Its criticisms are not without merit. For one, political sands can shift quickly.

In his previous term, Trump reneged on his election promises, so his statements should be taken with a grain of salt. Institutional involvement is also no guarantee of price appreciation. Take silver, for example, which has languished for the last 15 years despite JP Morgan owning half of the world’s silver COMEX bullion.

VDAs are just not compatible with Indian law. There is a strict capital control regime, and forex operations are the domain of a few highly regulated entities. Coexistence between crypto assets and legacy finance would require broad changes. It would require coordination between multiple regulators, and perhaps even a dedicated legal framework for VDAs.

To the RBI, this seems like a lot of trouble for a volatile asset that has seemingly no intrinsic value, does not generate any cash flows, and has no controlling entity to be liable in case the protocol is misused to fund illicit activities or crash to zero.

Despite the fact that even the most ardent bitcoin supporters would admit that sentiment and the animal spirits of supply and demand are its primary drivers, trillions of dollars are transacted on bitcoin alone each year. It has had 100 percent uptime for over a decade and has hundreds of millions of investors. Many of the criticisms of the underlying technology related to throughput and scalability have been largely addressed by other networks like Ethereum and Solana any of these solutions can be implemented in bitcoin if the need arises.

Thus, bitcoin may not be money, but it is something, and while it may be difficult to valuate like a company, it does have value. Imagine if every startup with a new business model was fully dismissed if they didn’t follow the playbook of large, established companies?

From a less theoretical point of view, bitcoin has proven difficult to suppress and easy to spread, and thus far entirely robust to all efforts to attack or shut down the network. This has been the case worldwide.

It has also been the case in India, neither the RBI ban in 2018 nor the imposition of a 1 percent tax on every VDA transaction has deterred Indian investors from buying and using crypto assets. In fact, according to various reports, it has only led to an exodus to offshore platforms that the government has no oversight over. The experiences of other nations with crypto prohibition suggests that an isolationist approach does not address any of the risks the RBI has concerns about. Given the fact that crypto assets have taken on a geopolitical flavour, with the US, China and Russia emerging as the key players, common sense legislation harmonised with international standards is the only way out.

So, should the RBI entertain proposals to add bitcoin to its balance sheet? Probably not. But it is time to turn the page on how crypto assets are looked at in India.

â— The author is CEO of Indiatech.org

First Published: Jan 22, 2025, 15:26

Subscribe Now