The IPO gold rush is likely to continue in 2025

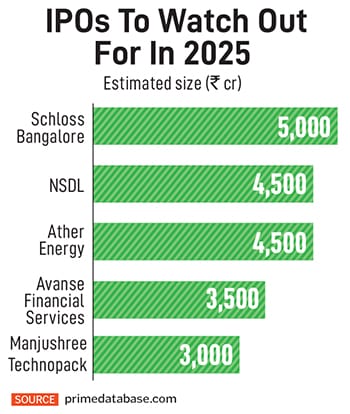

29 companies have already received Sebi's approval to raise a cumulative Rs 46,250 crore. Another Rs 1.18 lakh crore worth of IPOs are waiting for the markets regulator's approval to go public

As businesses are embracing transformation, adapting new strategies to align with the shifting demands of investors, primary markets are expected to stay red hot in 2025 with IPOs opening the door to new opportunities for such companies. Adding to that is the gushing liquidity in secondary markets that companies are tempted to tap into.

After unprecedented fundraising via initial public offerings (IPOs) in 2024 following a slowdown in the previous year, primary markets are set to be roaring in 2025 too. Investors are expected to show increasing willingness to allocate capital toward IPOs as markets are emerging from election-related uncertainties. However, slower economic conditions and concerns of steep valuations may pose a threat to this hyper-active IPO market in India.

“Looking ahead to 2025, investor demand for fundamentally sound companies with a proven track record of good corporate governance remains robust. With market liquidity at an all-time high and investors hungry for new avenues through which they can deploy capital, we can expect to see larger IPOs," says Gaurav Sood, managing director and head, equity capital markets, Avendus Capital.

A clutch of 29 companies have already received Securities and Exchange Board of India (Sebi) approval to raise a cumulative ₹46,250 crore via IPO. Another ₹1.18 lakh crore worth IPOs are waiting for the markets regulator’s approval to go public, shows data by Prime Database.

Sood explains that India’s primary market is further buoyed by a strong network of entrepreneurs, backed by marquee private investors, and a growing preference among strategic investors to view IPOs as a viable exit strategy. “The liquidity and premium valuations in Indian markets coupled with strong investor demand are driving global parent companies of Indian subsidiaries to consider India as a preferred listing destination," he adds.

According to Sood, the above trend, along with the growing practice of redomiciling, allows companies to unlock value, achieve profitable exits and benefit from India’s rapidly growing market.

In 2024, for the first time, India has risen to the number one position globally in IPO volume, listing almost twice as many IPOs as the US and more than two-and-a-half times as many as Europe. An EY Global analysis shows India and Chinese mainland have reported positive average returns across all sectors, reflecting the high calibre of recent market entrants and their strong investor appeal in 2024.

In 2024, for the first time, India has risen to the number one position globally in IPO volume, listing almost twice as many IPOs as the US and more than two-and-a-half times as many as Europe. An EY Global analysis shows India and Chinese mainland have reported positive average returns across all sectors, reflecting the high calibre of recent market entrants and their strong investor appeal in 2024.

“In 2025, India’s IPO market is expected to maintain its strong momentum despite potential headwinds from economic slowdowns," say analysts in EY Global.

Others agree. According to Abhimanyu Bhattacharya, partner, Khaitan & Co, India’s IPO momentum is expected to continue into 2025, driven by several key factors, such as the government’s initiatives to focus on ‘Make in India’ and rising retail participation.

“The government’s focus on initiatives like ‘Make in India’ is expected to boost fundraising activities, particularly in the manufacturing and industrial sectors," he explains. However, Bhattacharya adds that while the outlook for India’s primary markets in 2025 is optimistic, potential challenges such as global economic uncertainties and domestic policy changes could influence this trajectory.

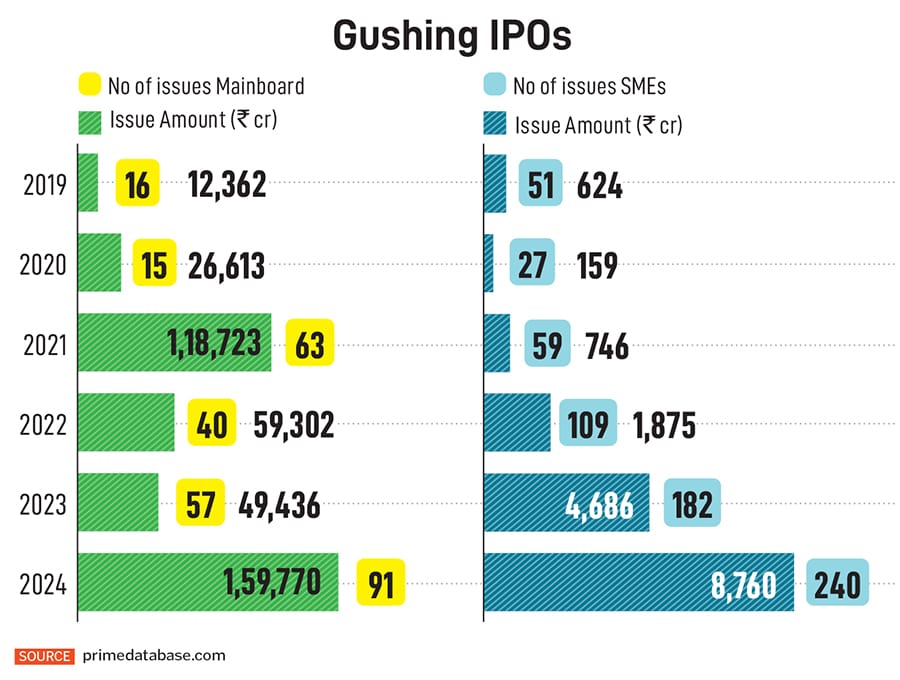

In 2024, a record ₹1.60 lakh crore was raised via IPOs as the highest-ever number of companies (91) went public. This is more than double the fundraise of ₹49,436 crore through 57 IPOs in 2023. It also surpasses the previous record of ₹1.18 lakh crore raised via 63 IPOs in 2021 as the post-Covid liquidity gush made primary markets attractive with wider retail participation.

“In 2024, the Indian markets demonstrated remarkable resilience and strength amid weak global macros, high interest rates, and geopolitical uncertainties that kept global markets volatile and jittery," says Gautam Duggad, head of research, institutional equities, Motilal Oswal Financial Services.

“In 2024, the Indian markets demonstrated remarkable resilience and strength amid weak global macros, high interest rates, and geopolitical uncertainties that kept global markets volatile and jittery," says Gautam Duggad, head of research, institutional equities, Motilal Oswal Financial Services.

Companies across a diverse range of 23 sectors, rather than being limited to a select few or emerging sectors, went public in 2024. “This diversification is, in our opinion, a positive indicator for the Indian capital markets as it provides investors with various opportunities to engage with India’s growth narrative," Duggad says.

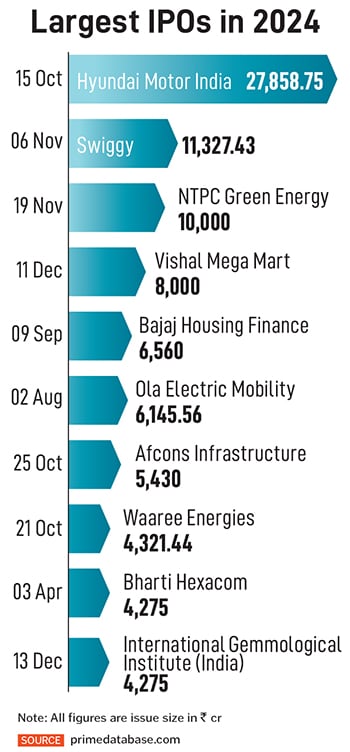

The largest IPO in the year was Hyundai Motor India (₹27,858 crore) surpassing the previous record set by LIC, which raised ₹21,008 crore in 2022, followed by One 97 Communications (Paytm) with ₹18,300 crore in 2021.

Of the top 20 companies by issue size in 2024, the leading debut performers were Bajaj Housing (over 136 percent), Premier Energies (up 87 percent), Waaree Energies (up 55 percent), Brainbees Solutions (up 46 percent), and Bharti Hexacom (up 43 percent). Only three companies (in the top 20) ACME Solar (down 12 percent), Hyundai Motor (down 7 percent), and Sagility India (down 2 percent)—have debuted with a decline from their offer prices.

Sood adds that public markets are increasingly appealing, not only as a platform for raising primary capital but also as a lucrative avenue for strategic investors to secure exits. Investors are becoming more receptive to quality companies in previously underexplored sectors, particularly those available at reasonable valuations. This trend is likely to continue, with several new-age listings anticipated in the coming year.

A few sectors expected to attract investors’ money through IPOs are manufacturing, renewable energy, healthcare and new-age consumer tech companies.

Sood is pinning his hopes on sectors like renewable energy, infrastructure, healthcare, new-age consumer tech companies and SaaS where there are several listings lined up on the back of strong macroeconomic tailwinds. He feels Indian markets are becoming more receptive to professionally managed firms with 100 percent free float, driving private equity (PE) exits through IPO routes. “Many of the IPOs in 2025 are expected to be driven by PE exits or sponsor-driven sales," he adds.

According to Bhattacharya, the key sectors to watch are technology and digital services including wearable technology, renewable energy, telecommunications, financial services sector and electric vehicles.

For Mathew Thomas, partner, Saraf and Partners, sectors which look hot for 2025 are renewable energy, manufacturing, technology and electronics.

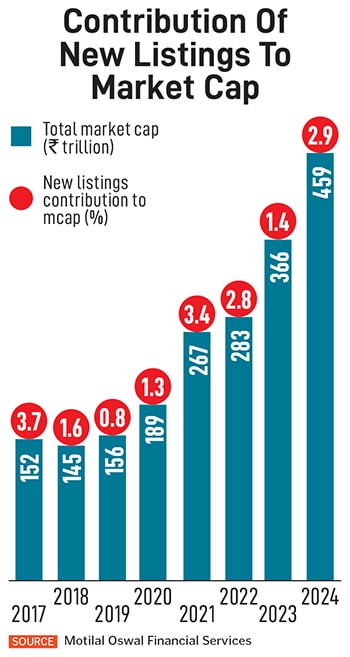

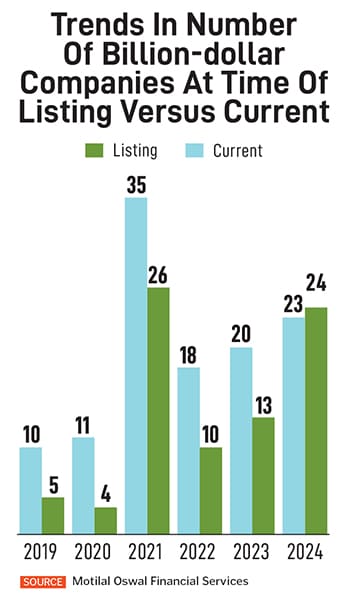

Despite the gold rush to list companies in stock exchanges in India, concerns of steep valuations continue to keep investors cautious. Last year, 24 companies were listed with a billion-dollar market capitalisation, reflecting an 85 percent jump over 2023, shows an analysis by Motilal Oswal Financial Services. However, this remains below the peak of 26 companies in 2021.

“Recent listings have shown that investors are receiving gains on listing. However, valuations may not always justify long-term expectations. IPOs should continue to be evaluated based on fundamentals, market conditions and growth potential rather than immediate market sentiments," says Bhattacharya.

“Recent listings have shown that investors are receiving gains on listing. However, valuations may not always justify long-term expectations. IPOs should continue to be evaluated based on fundamentals, market conditions and growth potential rather than immediate market sentiments," says Bhattacharya.

Over the last 10 years, 113 companies have debuted with a billion-dollar market capitalisation, of which eight lost their position in the club. Only 63 new companies entered the club during this period. Of the total 1,487 new issuances in the last 10 years, 11 percent currently represent the billion-dollar club.

Sood believes there have been instances in the past where overpricing has triggered negative investor reaction, even for well-established companies. As a result, price discovery during the IPO phase has become a closely monitored process, with companies being cautious about leaving money on the table to ensure strong value creation opportunities for IPO investors.

In this context, IPO stakeholders, particularly investment banks, have demonstrated strong efficiency. “We believe that investors are getting access to high-quality companies at attractive valuations in the IPO phase," he says.

Insatiable hunger for great returns chased IPOs in the SME (Small and medium-sized enterprises) segment leading to a highest-ever fundraising of ₹8,760 crore through a record 240 companies. This compares to 182 SME IPOs raising ₹4,686 crore in 2023 and a mere ₹1,875 crore via 109 companies in 2022.

Out of the total, around 141 SME IPOs were subscribed by over 100 times.

Out of the total, around 141 SME IPOs were subscribed by over 100 times.

However, the wide participation in SME IPOs has concerned Sebi leading to tightening of norms to protect investors. Sebi has tweaked the framework for merchant bankers and custodians by raising their minimum net-worth requirements.

The new mandate is to limit the offer for sale (OFS) by promoters in small and medium enterprises’ (SME) IPOs to 20 percent of an issue size and they won’t be allowed to sell more than 50 percent of their holding in an IPO.

Bhattacharya agrees that the new regulations are a proactive step towards safeguarding investors by ensuring that only financially sound and compliant SMEs can access the capital markets. “By tightening eligibility criteria, monitoring fund utilisation, and limiting the extent of share sales during IPOs, SEBI aims to enhance transparency and reduce the risk of market manipulation in the SME segment. However, investors must continue to exercise caution before investing in SME securities," he says.

First Published: Jan 16, 2025, 14:08

Subscribe Now