Burger King eyes a big slice of the Indian market

A late entrant in the crowded marketplace, Burger King, the international burger chain, has adapted its offering to suit Indian taste buds. But will that be enough?

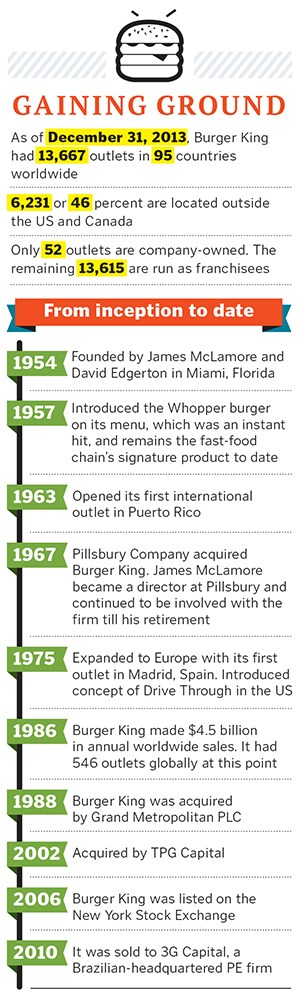

When Forbes India first visited Burger King in July this year, its office in Mumbai’s Lower Parel business district was a beehive of activity. Employees were busy scouting for locations, negotiating with suppliers, conducting blind tastings and fine-tuning the international hamburger chain’s India menu. At the time, the $1.1 billion (2013 revenues) global fast food giant was still a quarter away from launching in India, but the countdown had begun.

A late entrant into the market, Burger King has seen many a competitor trip in its understanding of the Indian consumer.

Which is why, 45-year-old Rajeev Varman, chief executive officer of Burger King’s India operations, emphasises that menu will be the differentiator. “We will have burgers that no one in India has ever had before,” he tells Forbes India.

This would sound like a grand claim, one that is easier said than done: Development of the menu and, more importantly, adapting it to appeal to Indian tastes has taken established international players years to implement. Rivals such as McDonald’s and KFC met with success only after they indigenised their offerings as per local taste profiles. It took them a decade to arrive at a winning and money-making formula.

And therein lies Varman’s biggest challenge. Can he find a shortcut, and give a menu that Indians will love from day one? He is confident of his success.

At the time of writing this story, Burger King was set to open its first India outlet in Select Citywalk in Saket, Delhi, on November 9 this will be followed by a Mumbai launch the week after, at Phoenix Mills. By December, there will be a dozen Burger King outlets but only in Mumbai and Delhi—for now. Varman does not want to reveal the fast-food chain’s long-term India plans.

Burger King is entering the hyper-competitive Western quick service restaurant (QSR) space at a time when consumer spending has been under pressure. Competitors such as McDonald’s, which has over 350 outlets across India, KFC, with a chain of 361 stores, Domino’s Pizza (772 outlets) and Subway (472), have all seen consumer spending—hit by high inflation— slow down in the last year. Still, Crisil Research estimates the market to grow to Rs 7,000 crore by 2018 from the present Rs 3,400 crore this is an annual growth of 27 percent with average spends of Rs 3,700 per household per year in metro cities.

It’s very early days, but 3G Capital, the multi-billion dollar Brazilian private equity parent which owns Burger King, has made all the correct moves. “The only reason we had not entered the Indian market till now was because we couldn’t find the right partner,” says Elias Diaz, president, Asia Pacific, at Burger King. The company was loath to enter the Indian market on its own realising that real estate, sourcing and taxation issues would divert its attention from the task of getting stores up and running.

In 2013, however, in what could well be a master stroke, Burger King tied up with the Sameer Sain-led Everstone Group (an Indian private equity firm with experience in the QSR space) to help it navigate the already-crowded Indian market.

A Fortuitous Partnership

Burger King has been keen on entering India since it was acquired by 3G Capital in 2010 in a $3.8 billion deal. “Any private equity player will be looking for rapid growth, and India would be an obvious market for a brand like Burger King,” says Devangshu Dutta, founder of Third Eyesight, a retail consultancy in Delhi. And the fast-food chain plans to be in India for the long haul. “Everyone has seen spends slow down in the last couple of years, but if you are entering a market with a 20-year time horizon, this slowdown is just a blip,” says Dutta.

At the time, Everstone Group had its hands full with the takeover of Blue Foods, now Pan India Food Solutions, which owns Copper Chimney, Noodle Bar and Bombay Blue, among other brands. Before it was acquired by Everstone, the restaurant chain had been burdened with heavy debt and high attrition. But it was in turning it around that Jaspal Singh Sabharwal, a partner at Everstone Group, saw an opening in the QSR arena. “We realised that there was room for a brand in the space, but what we needed was an iconic name,” he says.

Everstone was also aware that the Indian market had matured considerably since McDonald’s opened its first outlet in New Delhi’s Basant Lok market in 1996. At the time, most of its machines were imported, and even the fries and meats were flown in. It was only in 1997 that McDonald’s started taking its vendor development programme seriously. Today, all its products are locally sourced and manufactured.

In 2013, Everstone hired STEER Partners to introduce it to fast food players in Europe and the US, and talks with the parent company, Burger King Holdings Inc, began. That very year, the two firms agreed to enter into a joint venture to enable Burger King’s foray into India.

It was a win-win situation for both parties. Everstone, with its keen eye on real estate, helped the chain identify prime locations far more easily, and used its relationships with mall developers to get Burger King in. In Mumbai, for instance, the fast food chain will be opening an outlet in Phoenix Mills, a dozen metres from arch-rival McDonald’s. This would not have happened as easily without Everstone after all, its Blue Foods had already leased the space.  Spicy, Crunchy and Juicy

Spicy, Crunchy and Juicy

Once the joint venture was inked, Rajeev Varman was deemed the best person to head the India operations. He had already made a name for himself as the man behind Burger King’s turnaround in the UK market, and had been with the company for 15 years. His last post was general manager in North-West Europe. However, though he had graduated from Bangalore University, India was an unfamiliar terrain.

“The first thing I did after I got to India was to get on a plane again,” says Varman. He’d been away from the country for the last 25 years and realised that he needed to tour the length and breadth of India to understand the palate. Along with Everstone boss Sameer Sain and Sabharwal, he visited local markets across the country and arrived at three key conclusions.

First, Indians like their food spicy. Second, it must be crunchy. But it was the last insight that surprised him the most: Customers, especially in the South, liked their food juicy. He also realised that the North has a higher proportion of vegetarians than the South. On some days, the percentage of vegetarian food sold in a restaurant can be as high as 70 percent.

Varman knew that he would have to adapt the menu a fair bit for India. He decided to keep his single-minded focus on that job, and is confident that Burger King has got the right formula, one that will appeal to Indians. The menu promises to be juicy, crunchy and spicy.

The proof of the pudding, it would follow, was in the eating. But those were early days in July and Burger King was not ready to share its menu. Three months and many phone calls and follow-ups later, Varman offered to take Forbes India through an exclusive tasting session in October, barely a fortnight before the opening of its first outlet in Saket.

Even before it started designing the India menu, Burger King knew that its USP wouldn’t change. Flame grilling is what the chain is known for worldwide and in India there is no competitor that flame grills its patties. Sure, the Whopper (pronounced ‘Wau-per’) won’t have a beef patty but chicken and mutton patties will be flame grilled and offered to customers. As it stands, the Whopper will be the largest burger in the Indian market, bigger than the Maharaja Mac by McDonald’s.

At the tasting session, we experienced what Varman meant by juicy. (The mutton burger was the tastiest I have eaten in the Indian market.) And if Burger King can get the quality and consistency of the supply right, it has little reason to worry.

In its initial years, McDonald’s had launched a mutton burger, but discontinued it citing supply chain issues. In a March 2011 conversation with Forbes India, Vikram Bakshi, who had led McDonald’s in the North and East before exiting the joint venture, said that the fast-food chain dropped mutton from the menu because of customer preference. Undeterred, Burger King will be offering a mutton option on the menu.

There’s also no mistaking the fact that Burger King is not a me-too brand. Small, but subtle differences pepper its offerings. For instance, unlike the seven-mm French fries its competitors offer, the chain has a thicker nine-mm variety.

One place where it has left no stone unturned is the vegetarian menu. “In India, at times, people are vegetarian due to its lower price, and we wanted to make sure we give them enough reasons to come to the store,” says Sudhir Tamne, vice president, new product development, at Burger King India. The Crispy Veg and Paneer King Burgers seem to be a step up from the competition. And of course, they have the juiciness that Indians crave.

While Burger King has kept its pricing under wraps, it did indicate that there will be four burgers available for Rs 25 each. These are most likely from the crispy series—patties with a hint of spice that is unmistakably Indian.

Another key learning for Varman during his travels across India was the fact that customers want complete meals and that portion sizes must be large. He’s made sure that Burger King’s buns and patties are larger than those offered by competing brands. With its burgers hitting all the right spots, pricing and efficient service delivery levels are key areas that can make or break Burger King.

Scaling Up

India’s QSR market has tripped up many formidable competitors. Contrast Starbucks and Dunkin’ Donuts: Both entered India two years ago, but while Starbucks has had a successful run to date, Dunkin’ Donuts has been struggling to understand what Indian consumers want.

Starbucks, which had a clearly differentiated product and an efficient supply chain, has been able to expand across India with 58 outlets spread through Delhi, Mumbai, Bangalore, Pune, Hyderabad and Chennai. Dunkin’ Donuts, which has 35 outlets across India, has now added burgers to the menu. This, however, has led to considerable brand dissonance among consumers.

Burger King, on the other hand, has a differentiated offering and promises a slow and steady ramp-up. Case in point: The company plans to build the brand only through social media and word-of-mouth publicity it will not be investing in expensive full-page print or TV advertisements. Varman has kept the corporate office as lean as possible with only 27 employees. The Everstone team guides him on real estate locations and other compliance matters. For now, his sole aim is to get a dozen outlets up and running by the end of the calendar year. Being owned by two private equity companies also means that the clock is ticking. “If we don’t have an outlet that is Ebitda (earnings before interest, taxes, depreciation and amortisation) positive in three to six months, then we know that something is wrong,” says Sabharwal of Everstone. He is unwilling to let this be a slow burn business.

Profitability Matters

In a conversation with Forbes India last year, Amit Jatia, who runs McDonald’s in West and South India, had mentioned that it took the fast-food chain nearly a decade to become profitable in India. Varman (and Burger King) does not have that luxury.

Varman, who eats thrice a week at a Burger King outlet, though his tall athletic frame belies this, will spend between Rs 2-2.5 crore in setting up a single outlet. It has to have the cash register do Rs 5 crore of business in a year. He’s unwilling to discuss profitability as the chain will be in investment mode for the first few years. But if an outlet does not make money in the first six months, it will be shut down. He believes there is enough cream in the large metros to skim in the first year. “I will only worry about the ability to grow rapidly once I am past, say, 200 outlets. Right now, there is a lot to play with,” he says. As for what the competition thinks of Burger King’s India plans, neither Yum! (which owns brands such as KFC) nor McDonald’s was willing to comment.

As we sign off on our tasting session, Varman, who is fanatical about service delivery, notices that the fries have less salt. He frowns and immediately checks the salt dispenser to see if the salt has coagulated. It hasn’t. And he smiles again.

First Published: Nov 25, 2014, 07:03

Subscribe Now