Welcome, Home

The residential sector has shrunk in five years; the good news is power may have finally shifted towards the buyer

With Capital, Lanchester attempted to capture the tribulations of city living on a street that is witness to prices riding a rollercoaster, contentious redevelopment and gentrification. Those staying in the sprawls of Indian suburbia will have few problems empathising with Pepys Road: Migrants trying to fit in with city slickers, redevelopment that transformed them into millionaires, and the inevitable delusion that owning property is an assurance that you will take home all the chips.

To be sure, a recurring full house may be a thing of the past in India’s big cities. The residential sector has shrunk in the past five years, and sales and launches have plunged over this period. The good news, though, is that power may have finally shifted towards the buyer. Homes in cities like Pune, Bengaluru and Chennai are more affordable and prices have dropped in Mumbai and the NCR, although they may still be beyond the income levels of most of the working class.

It’s against this backdrop of consolidation, relative affordability and transparency, courtesy of structural reforms like the Real Estate (Regulation and Development) Act, 2016, or RERA, that the property market assumes a fresh hue. For instance, according to Knight Frank, sales volumes of developers picked up in 2017 in select markets where RERA has matured. This was because of their ability to re-launch projects at attractive prices.

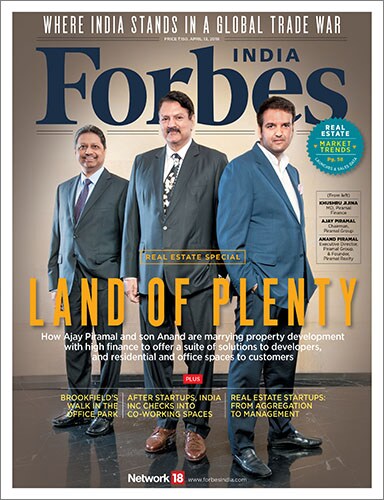

In this Real Estate Special, we take a look at how developers, investors and funds are reacting to the structural changes. Our cover story dives deep into Ajay Piramal’s real estate-focussed portfolio , which extends from development to real estate loans, construction finance, lease rent discounting and housing finance. Read Salil Panchal’s feature on how the Piramals—Ajay and son Anand—are attempting to provide a suite of financing solution to developers even as they build residential and office spaces for customers.

In other stories in the package, we take a close look at Canada’s Brookfield Asset Management , which is focussed on investing in long-life real estate and infrastructure assets. Samar Srivastava analyses Brookfield’s expanding India portfolio worth some $5 billion at last count and spread across office parks, roads and solar power assets.

Other must-reads are Varsha Meghani’s and Sayan Chakraborty’s pieces on the evolution in the co-working and real estate startup spaces, respectively. Along with startups and freelancers, corporations and conglomerates, too, are now warming up to shared working spaces. The reasons: To imbibe the startup culture and to meet people who think differently. And check out how online property ventures are moving beyond mere aggregation.

If you are a billionaire, just an apartment may not be good enough. Anshul Dhamija gives us a ringside view of the villas bought by the rich and famous in some of India’s toniest addresses . Clearly, for the moneybags, a swanky home maketh the man (or woman). As Lanchester put it in the context of the fictional Pepys Road: “…the houses had become so valuable to people who already lived in them, and so expensive for people who had recently moved into them, that they had become central actors in their own right.”

Best,

Brian Carvalho

Editor, Forbes India

Email:Brian.Carvalho@nw18.com

Twitter id:@Brianc_Ed

First Published: Mar 29, 2018, 08:23

Subscribe Now