Model portfolio: Sell first, pay later

Companies with negative working capital are likely to do well as the cost of capital remains high and growth slow

Image: Avijit Ghosh/SOPA Images/LightRocket via Getty Images"‹A business that can get favourable terms from its customers and creditors is a good business to be in. Its customers could pay up before goods are received or suppliers may be willing to wait for payment. The net result is a company can get by just by employing little working capital.

Image: Avijit Ghosh/SOPA Images/LightRocket via Getty Images"‹A business that can get favourable terms from its customers and creditors is a good business to be in. Its customers could pay up before goods are received or suppliers may be willing to wait for payment. The net result is a company can get by just by employing little working capital.

Sometimes this could be due to the nature of the industry. City gas companies (Indraprastha Gas and Gujarat Gas), oil marketing companies (BPCL, IOCL and HPCL) and exhibitors (PVR and Inox Leisure) are examples or it could be simply because a company is so big that it can squeeze favourable terms from suppliers (Reliance Industries, Maruti Suzuki and Bharti Airtel). There are also instances when businesses may encounter a particular bright spot in an otherwise cyclical business and go through a period where creditors are paid later (Indian Hotels, Chalet Hotels).

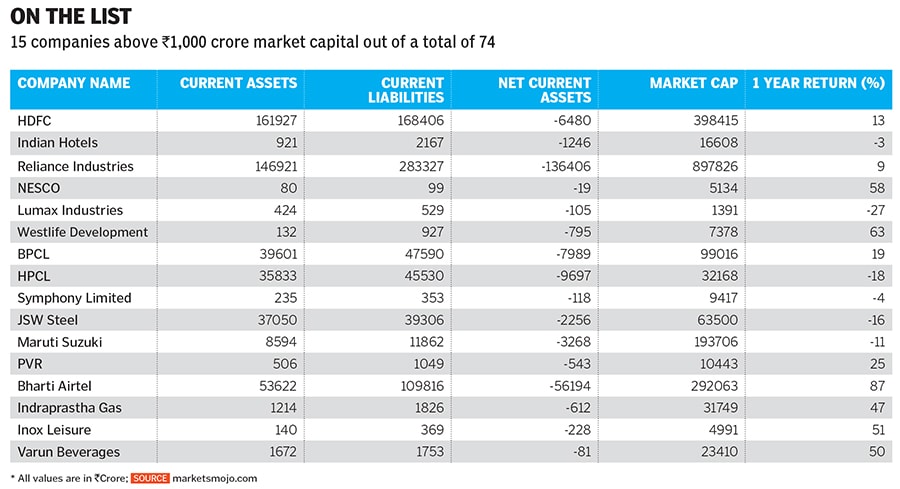

“While analysing, companies give higher importance to operating cash flow than net profits,” says Sunil Damania, chief investment officer at marketsmojo.com. “Companies having negative working capital have a higher return on equity.”Among companies with a market cap of ₹1,000 crore or more, there are 74 that reported negative working capital in the quarter ended September 2019. As credit to industry becomes hard to come by or at rates that are too high, negative working capital provides a breather to businesses and helps them report higher margins on account of lower finance costs. However, this has to be considered along with the overall health of the company or industry. For instance, the list also had companies that simply could not pay their creditors in time (Suzlon, Ruchi Soya, Vodafone Idea). Avoid them!

First Published: Mar 18, 2020, 11:58

Subscribe Now