A look at India's cashless revolution

India, in particular, is seeing a digital payments boom, second in growth only to Russia

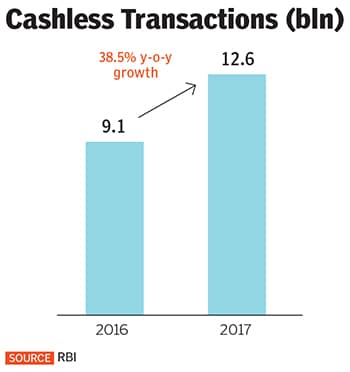

Image: Shutterstock[br] India saw a 38.5 percent jump in non-cash transaction volumes between 2016 and 2017, second only to Russia (39.5 percent). The adoption of digital wallets, the success of ecommerce platforms and innovation in mobile payments have driven this growth, notes consultancy Capgemini it its World Payments Report 2019. India, in particular, is seeing a digital payments boom. The National Payment Council of India’s efforts in promoting instant payments and open APIs is also key.

Image: Shutterstock[br] India saw a 38.5 percent jump in non-cash transaction volumes between 2016 and 2017, second only to Russia (39.5 percent). The adoption of digital wallets, the success of ecommerce platforms and innovation in mobile payments have driven this growth, notes consultancy Capgemini it its World Payments Report 2019. India, in particular, is seeing a digital payments boom. The National Payment Council of India’s efforts in promoting instant payments and open APIs is also key. Cards were the most dominant form of payment globally in 2017, says the report. Debit card transaction volumes grew by 17 percent, most noticeably in emerging markets. Emerging Asia, which includes India, recorded 34 percent growth, Latin America 14 percent and the Middle East and Africa region 23 percent. Credit card volumes grew only by 11 percent globally. “More and more millennials appear to be avoiding credit, while the current levels of interest rates and capital adequacy ratios are challenging the industry,” say the authors of the report.

Cards were the most dominant form of payment globally in 2017, says the report. Debit card transaction volumes grew by 17 percent, most noticeably in emerging markets. Emerging Asia, which includes India, recorded 34 percent growth, Latin America 14 percent and the Middle East and Africa region 23 percent. Credit card volumes grew only by 11 percent globally. “More and more millennials appear to be avoiding credit, while the current levels of interest rates and capital adequacy ratios are challenging the industry,” say the authors of the report.

First Published: Sep 25, 2019, 11:28

Subscribe Now