PE returns gather pace

48 percent of all exits since 2003 took place in past three years: McKinsey report

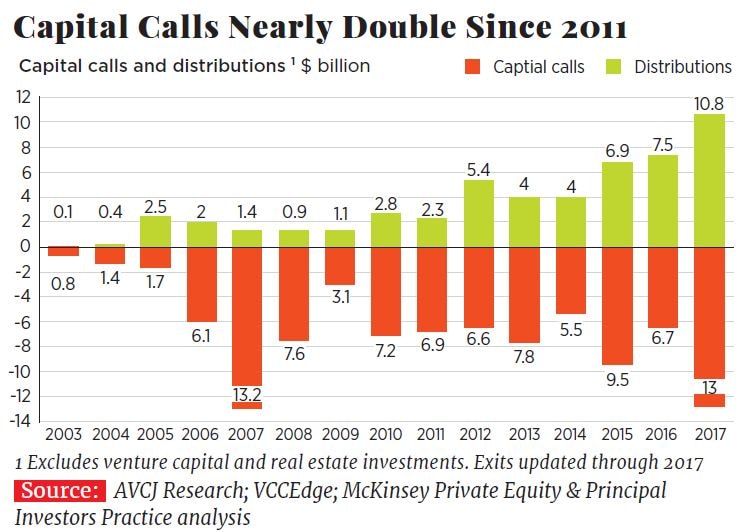

Image: Shutterstock Private equity (PE) funds invested in India have been returning capital at a faster pace than ever before, says consulting firm Mckinsey & Co. According to its report dated November 21, fund managers who have deployed capital in India have returned $10.8 billion in 2017—a tenfold growth since 2009. In fact, 48 percent of all exits since 2003 by value took place in the past three years. On an average, at least $4 billion has been returned by Indian fund managers annually since 2012. These exits do not include venture capital and real estate deals. The value of investments not yet exited in 2017 stands at 4.6 years of investment, down from its peak of 6.2 years in 2014.

Image: Shutterstock Private equity (PE) funds invested in India have been returning capital at a faster pace than ever before, says consulting firm Mckinsey & Co. According to its report dated November 21, fund managers who have deployed capital in India have returned $10.8 billion in 2017—a tenfold growth since 2009. In fact, 48 percent of all exits since 2003 by value took place in the past three years. On an average, at least $4 billion has been returned by Indian fund managers annually since 2012. These exits do not include venture capital and real estate deals. The value of investments not yet exited in 2017 stands at 4.6 years of investment, down from its peak of 6.2 years in 2014.

Since 2003, PE fund managers have invested $93 billion in India in 2017 they deployed $13 billion—the highest since the financial crisis in 2008.

As deal count fell by about 20 percent between 2015 and 2017 compared to 2012-2014, the number of deals higher than $100 million more than doubled to 245 deals. At the same time, the number of deals less than $25 million fell by 40 percent.

Also, as markets mature, fund managers have shied away from investing in peak bull markets. Over the past three years, PE exits grew faster as markets became more expensive, the result of fund managers becoming more disciplined about exits and less inclined to invest in an aging bull market.

First Published: Dec 04, 2018, 11:53

Subscribe Now