FILA Entrepreneur For the Year: Havells' Anil Rai Gupta

Anil Rai Gupta is scripting the growth story of the Havells Group with strategic acquisitions, technology adoption and rural expansion

We want to be something like the Apple of electrical products. We want to be a premium mass electrical company: Anil Rai Gupta, chairman and managing director, Havells India[br]Anil Rai Gupta is well into his fifth year at the helm of Havells.

We want to be something like the Apple of electrical products. We want to be a premium mass electrical company: Anil Rai Gupta, chairman and managing director, Havells India[br]Anil Rai Gupta is well into his fifth year at the helm of Havells.

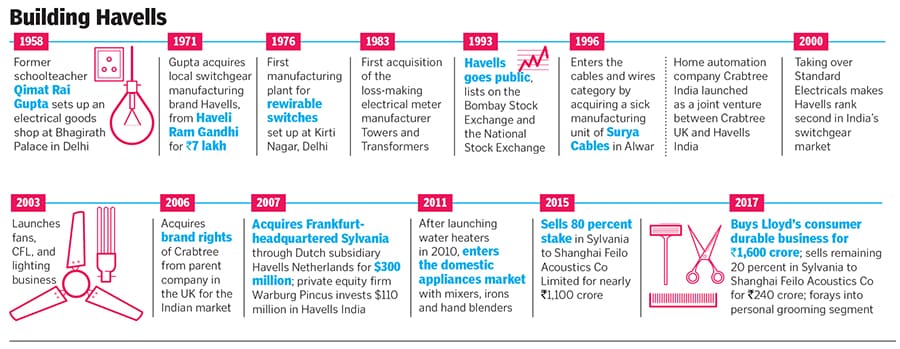

With each passing day, the 50-year-old can’t help but realise the striking similarities he shares with his father, Qimat Rai Gupta, when it comes to matters of running the ₹10,000 crore Havells Group. Qimat Rai Gupta, a former school teacher, built the company from the ground up, after starting as a small-time shopkeeper selling electrical goods and cables in New Delhi in 1958.

“We are more same than different,” Gupta tells Forbes India. The second-generation businessman has been named Entrepreneur for the Year in the 2019 Forbes India Leadership Awards. Gupta took over the mantle of chairman and managing director at Havells India after Qimat Rai Gupta passed away in November 2014. As with many family-run companies, the economics graduate from the prestigious Shri Ram College of Commerce in Delhi had been groomed by his father for many years before he finally took over the reins.

“Sometimes, it would happen that when my father was taking some decisions or doing something, you felt that it could have been done differently,” Gupta says. “But now when I"m in this chair, I do the same things. But obviously, there will be differences and the differences come from the fact that he was a self-made entrepreneur starting with zero capital while I am a trained entrepreneur.”

Yet, the past five years have seen the emergence of Anil, a tactful and astute businessman with a vision for building the group into its next phase of growth. “We want to be something like the Apple of electrical products,” he says. “We don"t want to be considered as another ‘me too’ company. We want to be a premium mass electrical company.”

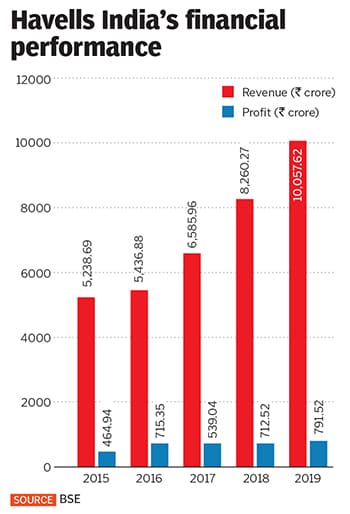

The group already has a significant play in the Indian fast-moving electrical goods and electrical equipment category. Havells manufactures everything from fans, water heaters and personal grooming products to cables, wires, air conditioners, washing machines and television sets. The company boasts of a pan-India dealer network of over 11,000 distributors and some 6,500 employees. In 2019 fiscal, the company had annual revenues of ₹10,057 crore, growing 21 percent over the previous year, while profits grew 11 percent to ₹791 crore. The company currently has a market capitalisation in excess of ₹43,300 crore, making it one of the largest in the segment. Its competitors include Polycab and Apar Industries in the electrical categories while it competes with the likes of Whirlpool, Voltas, Samsung and LG in the consumer appliance category.

“Anil is symbolic of a new generation of leaders that India currently needs,” says TV Mohandas Pai, chairperson of the board at Manipal Global Education Services and the former director of software giant Infosys, who also serves on the board of Havells. “Anil listens to everybody, is transparent, and respects opinions. He has also been able to carry on the legacy of his father and understands the importance of distribution. Yet, when it comes to hard decisions, he takes them.”

Taking Tough Calls

Selling a company that he led from the forefront to buy when he was the joint managing director of Havells is perhaps the toughest decision Gupta had to take upon becoming chairman.

In 2007, Havells had bought Sylvania in an attempt to tap into the global market. At the time of the purchase, Sylvania was nearly one-and-a-half times the size of Havells, and the idea was to leverage on Sylvania’s brand to sell in India, China and Europe, among other markets. While Havells had annual revenues of ₹2,000 crore, Sylvania clocked over ₹5,000 crore.

“There were two ideas behind the acquisition of Sylvania,” says Gupta. “We wanted to get global access to lighting technology and to the markets of Europe and Latin America. We are a distribution and brand-oriented company and we visualised that it would be a good idea to acquire.”

But, sluggish growth in Europe in recent times meant that the acquisition was becoming a burden on the Noida-headquartered company. In the 2014 fiscal, Sylvania’s losses stood at 4 million euros, rising to 10 million euros in 2015. “We had already taken the advantage of the technology and the technology transfer that had to happen,” Gupta says. “Anyway, technology was also going to change toward LEDs (light-emitting diodes).”

Such developments also meant that Havells was looking for better avenues of growth. Around the time, even as 40 percent of the company’s business was outside India, an impetus to the Indian lighting industry by the central government in 2014 provided an opportunity. Under a new initiative—called the National Programme for LED-based Home and Street Lighting—the government wanted to increase India’s usage of LED lamps across homes and cities and replace conventional lamps, which typically use more power.

“I think around 2014-15 we realised that we want to focus more on the India growth story for the next 15-20 years… while the global market will continue to have their struggles of growth, India is providing a huge growth opportunity for the next two or three decades,” Gupta says. “It is something similar to what happened in Japan between the 1970s and 1980s, and China from 1990 to 2015.”

To begin with, Havells sold an 80 percent stake in Sylvania to engineering services company Shanghai Feilo Acoustics for ₹1,340 crore in December 2015.

“Every big decision is a difficult decision. But I think, thankfully, the kind of management style that my father has taught me depends a lot on consensus-building and we are a great team of people who are open to discussing things rather than just being dependent on one man,” Gupta says. “The final buck stops with somebody, which is me. When the mind is very clear, the clutter goes away and it’s easier to make a decision.” Havells sold the rest of the 20 percent in December 2017. Havells plant in Alwar, Rajasthan, is the largest single location wire and cable plant in the country.[br]

Havells plant in Alwar, Rajasthan, is the largest single location wire and cable plant in the country.[br]

Buying Lloyd

Looking for better avenues of growth within India, Gupta wanted to build Havells for India for the next 15-20 years. “When I took over, we started looking at a different landscape and that meant a different perspective,” he says. This meant that the organisation—which had largely remained an electrical company manufacturing cables, wires, motors, fans, switchboards, kitchen equipment and geysers—began looking at the consumer durables industry as well. This included manufacturing appliances such as air conditioners, washing machines, and television sets.

The belief was that since Havells had already established itself as a premium brand, it could broaden its portfolio to offer newer products. “Over the past 20 to 30 years we"ve been investing heavily in three or four things,” Gupta explains. “On the brand side, we moved from [being] a B-grade brand to A grade, and we’ve moved from an industrial-oriented brand to a consumer-oriented brand. Distribution was a huge investment that the company made over the last few years. We also invested heavily in technology and manufacturing capabilities.”

That’s when a banker informed the group about a potential sale of Lloyd by its promoters. “Around 2015-2016, we started looking at opportunities in the other electrical and electronic products which are big industries that we were not present in,” Gupta says. “This is one consumer durable category, which is a large industry in India. But the segment is dominated by multinationals and there isn’t one dominant Indian company in this segment.”

India’s appliance and consumer electronics market was worth a staggering ₹2.05 trillion ($31.49 billion) in 2017 and is expected to increase at 9 per cent CAGR to reach ₹3.15 trillion ($48.37 billion) in 2022, according to the India Brand Equity Foundation, a trust established by the Ministry of Commerce and Industry. Of this, the washing machine, refrigerator and air conditioner markets in India were estimated to be around ₹7,000 crore ($1.09 billion), ₹19,500 crore ($3.03 billion) and ₹20,000 crore ($3.1 billion) respectively. Companies such as Samsung, LG, and Whirlpool dominate the industry currently.

“While we had an idea of getting into this industry ourselves, unlike the other additions that we have done in the past through organic expansion like in fans and lighting, here we wanted to get into acquisition because we wanted to acquire a distribution channel as well as a brand that is already in this business,” Gupta says. “So that’s when this Llyod opportunity came along, which could get us an entry into the consumer appliances industry.”

Havells then spent a staggering ₹1,600 crore to buy out the consumer durable business (CDB) from Lloyd Electric and Engineering. The company, which was struggling with debt, was primarily engaged in the sourcing, assembling, marketing and distribution of products such as air conditioners, televisions, washing machines, and other household appliances. “It already had a distribution channel all across India and was well-suited into the ‘deeper into homes’ philosophy of Havells,” Gupta says. By the time Havells purchased Lloyd, the company already had a network of over 10,000 direct and indirect dealers across India, with a 14 percent market share in the home AC segment. Becoming a household name

Becoming a household name

Today, a bulk of Havells’s focus is on research and development, particularly on new product categories and technologies. Alongside this, the company has also been investing in setting up manufacturing units for Lloyd. “A lot of times, even today customers ask me whether [our] electrical products come from China. Everything that we sell is manufactured in India,” says Gupta. “And we have been able to financially do it successfully, contrary to what people think.”

Another focus has been on turning more professional, bringing in management professionals to run various functions. Last year, Havells hired Mukul Saxena—credited with setting up a research and technology centre for German conglomerate Siemens in Bengaluru—as executive vice president and chief technology officer. “So for each business, and each function like R&D and manufacturing, we now have professionals who manage those people who have done this in very large organisations… we"ve been able to attract that kind of talent to our organisation,” Gupta says.

Yet, the past few years have not been very easy. Much of that has been largely due to a slowdown in the Indian economy. For Gupta, however, since his business depends largely on real estate, the period also provided an opportunity to strengthen its foundation. “The growth continues, and we want to keep getting deeper into consumers’ homes,” Gupta says. “So we’ve realised that if we want to keep giving the best product to the consumer with better technology over a period of time, then we must get away from this ‘value for money’ tag and be a mass premium player.”

To start with, Havells has initiated a restructuring of Lloyd’s distribution network. “When we acquired Lloyd, it was a value for money brand and it was going into a certain channel that was not selling mass premium products,” Gupta says. “That means Lloyd was not available at stores such as Vijay Sales or Croma or Reliance Digital. While we want to continue to retain those existing channels, we also want to expand the distribution channel. So the right investments are being made.” The company also brought in new brand ambassadors, including actors Ranveer Singh and Deepika Padukone from March this year, in addition to Mohanlal and Mahesh Babu.

“Even in a slow market, Anil and his team have maintained their push on branding and marketing, which I think will stand them in very good stead,” says Devangshu Dutta, chief executive of retail consultancy Third Eyesight. “The Indian market is growing, though the pace may increase or decrease at different times strongly establishing brands in the minds of the consumer and the distribution network is the best moat to build against competition, both domestic and international, now and as the market grows in the future.”

Gupta reckons that the results are beginning to show. “I think there is a huge transition in the minds of the trade and the consumer that Lloyd is a good quality product coming out the Havells portfolio,” says Gupta. “Havells does not call itself a luxury player. At the same time, you are not compromising on technology because you want to sell a cheap product, but you’re giving the right technology to the consumer at the right price.”

Pai says that Gupta, like his father, spends a lot of time with the distributors. “He has a wonderful team and is very detail oriented. Yet, despite all the success, he remains simple and humble.” What’s next?

What’s next?

Today, Lloyd is in the midst of a transition, says Gupta. “I think there’s a huge change in perception in the mind of the consumer, but more importantly, what happens in the first one or two years of any brand transitioning is that the trade changes their perception first and the consumer takes a bit longer to change his/her perception,” he explains.

He is confident the change will happen soon. He had already seen that with Havells when he was at the company with his father. The roots of the company can be traced back to 1958, when Qimat Rai Gupta set up an electricals trading business in Delhi’s Bhagirath Palace, a wholesale market for electrical goods. In 1971, when a fellow trader’s business ran into some difficulties, Qimat raised capital and bought out the firm, which was named Havells.

Over the next few decades, the company primarily focussed on switchgear, switchboards, and industrial electrical requirements. Then, around 2004, Havells entered consumer products like fans and lights, followed by the acquisition of Crabtree India in 2006 and Sylvania in 2007. “Just as the perception about Havells has changed over the last 15 years, the same will happen over the next four or five years in the case of Lloyd,” says Gupta.

Meanwhile, Gupta has also divided the businesses at Havells into four major categories, with separate business heads to look after these businesses. These include the building circuit protection business, cables, electrical consumer durables and a lighting business that also includes consumer lighting and professional lighting.

“We are a very entrepreneurial organisation,” Gupta says. “Even this personal grooming business [launched in 2017] was just like a start-up. Havells is a culmination of a huge number of startups over the last 20 years. We invest in the business for two or three years once we have the results, we ramp it up.”

The company is currently number two in the fans segment, number two in the personal grooming category and number one in the geyser market and the premium lighting category. Much of that is largely due to the group’s philosophy of making it to the top three in the first five years of starting a category. “We have a plant in Rajasthan that manufactures 700,000 water heaters in a year. We have only 70 people in that factory. So it’s highly automated with huge investments. But many people [other industry players] still want to get it [the process] outsourced.”

Now, as the company looks for growth over the next two decades, it has also been busy ramping up its rural distribution network, to tap into the growing demand in the country. Over the past few years, India has laid much focus on rural electrification, with the government claiming near 100 percent electrification of villages.

“Within two-and-a-half years, we have set up a completely new rural distribution network. Electrification has already reached all the villages now, and those people will be buying more and more electrical products in the future. Already, in the last one-and-a-half years we’ve set up close to 1,500 distributors and 30,000 electrical products outlets in the rural areas. Within one year we will double this.”

Yet, even as it chases high volumes, Gupta is clear that they won’t venture into offerings that compromise on quality. “Like in fans, for example, there is an economy segment. We don’t want to be a part of that because that is low quality and cheap quality. If you compromise on quality in electrical products, either you’re compromising on safety or on electricity consumption. We want to be an energy-saving producer of products. We want to be highly reliable for the consumer.”

So where does Havells go from here? “We are getting ready,” Gupta says. “We’re trying to tune out the noise around this whole slowdown so that we continue to invest. The markets will be tough and our growth may not be 20 percent as earlier. But even if we grow at 10 percent, we are happy with that.”

First Published: Dec 04, 2019, 10:44

Subscribe Now