Forbes India IPO litmus test: Survival of the fittest

The real test for newly-listed companies comes once the listing pop charm fizzles out. A few survive, while most crack under pressure, eroding investor wealth

What makes an investor excited about a stock before parking money into it? One may argue about factors like long-term growth prospects, sustainable plans to maintain profits, and to some extent management credibility. But nothing is as delicious and appetising as listing pops that make IPOs attractive for investors, especially the retail segment. To put it simply, listing pops are the first day gains a company makes as its shares debut on stock exchanges.

There is nothing wrong in chasing such mouth-watering fast-paced profits on new listings. This plays immensely well for promoters making the company public, for existing shareholders looking for an exit and for new investors betting for a quick buck, but only at a time the overall equity markets are themselves on an adrenaline rush. That very enthusiasm gets cold once the tide turns. And that’s exactly what happened in 2023.

Overall, primary markets slowed down last year, as macro-economic uncertainties and investor sentiment soured after the two wars—Russia-Ukraine and Palestine-Israel. The challenges got intense and difficult, with concerns of steep valuations as well. Investors are gradually becoming more vigilant of IPO-bound companies with a sharp eye on more compelling, convincing and sustainable strategies beyond profitability.

However, the proof of the pudding is in the eating. As listing pop charm fizzles out, the real survival tests the newly listed companies face is after spending time on the stock exchanges, going through the volatility of markets and the cycle of quarterly earnings sessions. Most such new listings crack under pressure, eroding a chunk of investor wealth. Only a few survive.

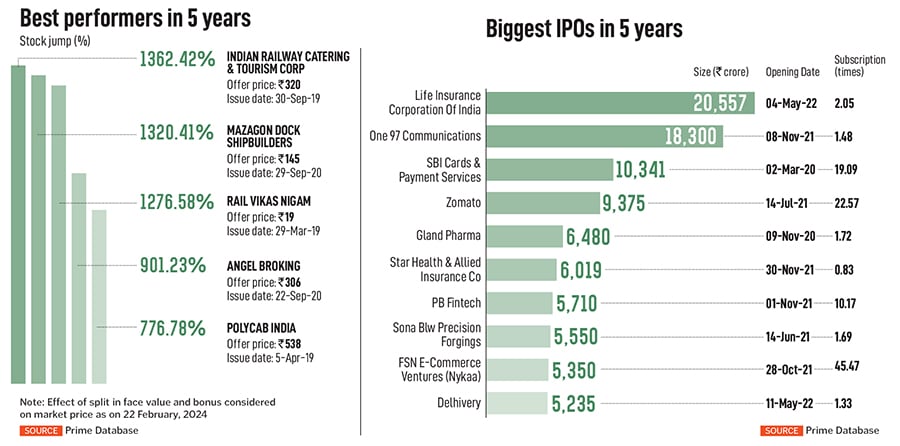

As a flurry of new IPOs hit the stock markets over the last five years, we looked at those that survived the storm and volatility with outstanding performances on the exchanges. We sieved through data of over 200 companies that got listed on main board BSE and NSE starting from 2019 till February 15, 2024, based on data provided by Prime Database.

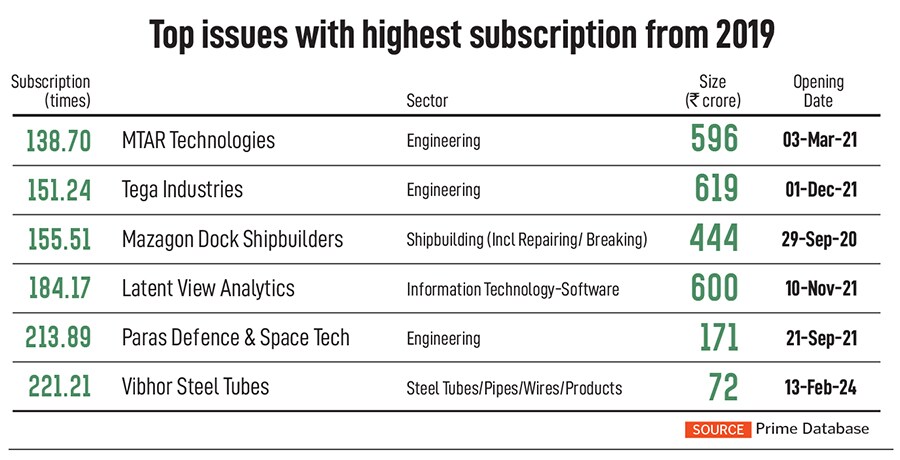

To avoid missing out any companies due to sheer size, we further divided these companies based on the issue size of ₹0-500 crore, ₹500-₹1,000 crore, ₹1,000-5,000 crore and above ₹5,000 crore. The next step was to pull out issues that received over 100 times subscriptions for small and mid-sized issues and 50 times for companies with ₹1,000 crore and above issue. For the final cut, we reviewed the performance of stock prices of these shortlisted ones on a six-month period, based on which we further arrived at 10-15 companies that went public in the last five years, received overwhelming subscription and were still performing well on the stock exchanges.

For instance, shares of Paras Defence and Space Technologies are on a dream run. Its shares surged over 200 percent in a 12-month period post listing. With an issue size of ₹171 crore, it was subscribed 214 times with retail segment at 100 times subscription. The offer price was at ₹175, which jumped 171 percent at stock markets debut on October 1, 2021.

Next is MTAR Technologies with a stellar listing premium of 85 percent from its issue price of ₹575. The company made a stock markets debut on March 15, 2021. The IPO size was ₹596 crore, which was subscribed 139 times.

The ones that stand out in the pack are Mazagon Dock Shipbuilders and Mrs Bectors Food Specialities, both of which were among the first few IPOs to test the markets after a long hiatus in new listings due to the Covid lockdown impacting overall investment sentiment in 2020. The ₹444 crore PSU IPO of Mazagon Dock Shipbuilders was oversubscribed 155 times. It was listed with a bumper gain of nearly 50 percent.

Mrs Bectors Food Specialities, the only food company to go public in 2020 after Burger King, also had a stellar run on the stock exchanges. The ₹541 crore issue was oversubscribed 138 times with the HNI bids at an overwhelming 620 times, the first ever to see such high HNI participation in 2020. The stock was listed at a whopping 74 percent premium of its issue price of ₹288 a piece.

The stellar listing of companies like Mrs Bectors boosted investor confidence in the primary markets while promoters and investment bankers rebuilt faith in the resurgence of equities after Covid-led uncertainties had hit sentiment. That gave way to a record fundraising of ₹1,18,704 crore via IPOs through a total of 63 companies in 2021.

The IPOs hit hurdles in 2023 as a total of 57 companies raised ₹49,434 crore through main board IPOs, a decline of 17 percent from the previous year. In 2022, 40 companies raised ₹59,302 crore via IPOs, according to Prime Database. However, excluding the mega LIC IPO in 2022, the IPO fund mobilisation in 2023 increased by 28 percent from the previous year.

However, the last three months of 2023 saw an exceptional number of IPOs. There were 31 (including one InvIT) in the fourth quarter of 2023, marking a significant uptick compared to the same period in 2022 and the third quarter of 2023, says EY. The fourth quarter of 2023 emerged as the standout period, accounting for nearly 40 percent of the total listings in 2023. This represents a remarkable 72 percent increase over Q4 2022 and a substantial 41 percent increase over Q3 2023.

“From a sectoral perspective, power and utilities, health, automotive and transportation, and banking and capital markets sectors have emerged as the most active, based on recent DRHP filings," says Adarsh Ranka, partner and financial accounting advisory services leader, member firm of EY Global. Furthermore, the recent amendment by SEBI to the Real Estate Investment Trusts Regulations, 2014, facilitating the creation of Small & Medium Real Estate Investment Trusts (SM REITs), is poised to spur further growth and innovation in the market, he adds.

Despite all the fan following of new age technology companies (NATC), new IPOs in that segment almost dried up in 2023. There were only two companies from the NATC space, which cumulatively raised ₹2,476 crore through the IPO route in 2023. Shares of Yatra Online made a stock market debut in September while Mamaearth’s parent Honasa Consumer was listed in November.

Large new age technology companies like Nykaa (FSN E-Commerce Ventures), Zomato and Paytm (One97 Communications), which went public in 2021, have performed badly in the secondary markets with severe value erosion for shareholders.

“There are several factors at play that have delayed IPO plans by the NATCs. The poor post-IPO performance of some of India’s startup unicorns, which went public in 2021, dampened the market sentiment towards such issuers coupled with larger global macro-economic concerns," Abhimanyu Bhattacharya, partner, Khaitan & Co had said in an earlier interview with Forbes India.

However, prospects of new listings look promising in the rest of 2024, even in the NATC space, with big issues like Ola Electric, FirstCry and Swiggy. There are 19 companies which have already received market regulator Sebi’s approval to raise nearly ₹25,000 crore via IPOs. Meanwhile, there are another 38 companies awaiting approval from the market regulator. These 38 companies are cumulatively aiming to raise ₹45,000 crore.

Bhavesh Shah, managing director and head investment banking, Equirus, says, “We are seeing windows of opportunity for an IPO widening significantly compared to before with stronger domestic capital inflows and lower dependence on the moody foreign portfolio inflows. The other trend we are seeing is nice and differentiated businesses being able to raise public money on the back of top-of-the-line management, corporate governance, and profitable growth."

Shah expects the financial year 2025 to accentuate these trends with more IPOs raising significantly higher capital. “We would also see some of the new age businesses, who have been able to pivot their business into profitable business, to be able to raise capital from the public markets. We would also see this giving an exit to a lot of private equity investors," he adds.

First Published: Apr 02, 2024, 15:38

Subscribe Now