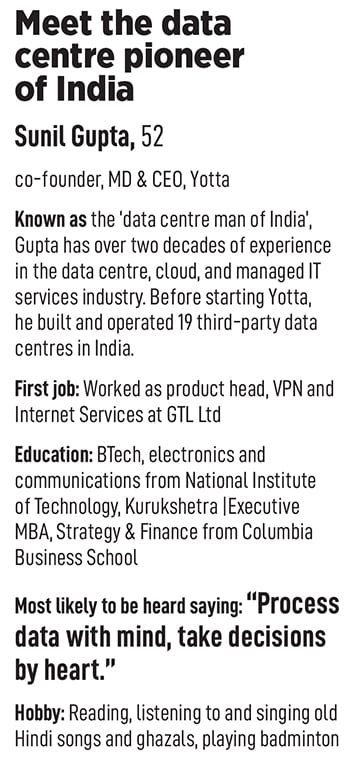

Hailing from Ambala in Haryana, Gupta studied BTech in electronics and communications at the National Institute of Technology, Kurukshetra. After a short stint in Delhi, he moved to the financial capital in the late 1990s.

Following the Ambani brothers’ split in 2005, Infocomm went to Anil, who renamed it Reliance Communications. The data centres continued to be one of the strongest businesses and were unaffected by the change of leadership. “We used to have more than 50 percent of the market share. The business generated much higher Ebitda compared to the telecom business and allowed me to add capacities across multiple cities," says Gupta, who set up nine data centres until 2009, when he moved on.

Till 2013, data centres were not the talk of the town in India. Soon, the digital wave triggered by ecommerce, 4G, and social media, among others, led companies to set up availability zones (separated group of data centres within a region). Around 2016, global giants like Amazon, Microsoft, and Google started building their data centres in the country. Simultaneously, Gupta launched India’s largest data centre in Mumbai’s Chandivali while working with the NTT Group. This earned him the moniker of the ‘data centre man of India’.

“Within three weeks of discussion, we decided to start Yotta Data Services," the 52-year-old tells Forbes India at the Yotta Navi Mumbai 1 (NM1) data centre located in the 600-acre Hiranandani Fortune City in Panvel. The 12-story NM1 tower holds 7,200 data racks with a 60 MW capacity. Making one such building costs about ₹1,200 crore.

Hiranandani initially announced ₹15,000 crore investment plans to raise five such buildings in seven years. However, within two years of inception, they doubled their investment plans to ₹30,000 crore. It was followed by the opening of a data centre park in Greater Noida with an investment of ₹1,500 crore and another one ₹500 crore in Gujarat’s GIFT City.

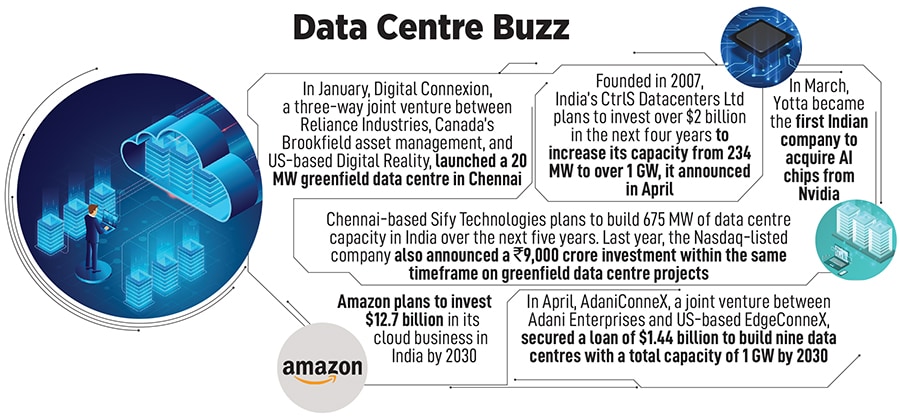

The five-year-old startup was recently in the limelight after it became the first Indian company to acquire AI chips from Nvidia in March. During his India visit in September, Jensen Huang, founder and CEO of Nvidia , met Prime Minister Narendra Modi and ensured high priority allocation to India. Huang said the country is going to be the largest AI market in the world, and he would prioritise any orders from data centre operators in the country.

The next day, Gupta received a call from the Nvidia team asking if he could meet the CEO in Pune. Gupta saw an opportunity in that late-night call and immediately agreed to be there for the meeting scheduled for next morning. “Our name was proposed to Jensen because, with 700 chips, Yotta was the largest Nvidia chip owner in the country," says Gupta.

![]()

That meeting translated into Yotta placing an order for 16,000 H100 chips, including the newly-announced Blackwell AI-training GPU. The first batch of 4,000 chips arrived in March, comprising Nvidia H100 Tensor Core GPUs. The Mumbai-based venture will offer managed cloud services along with the ability for enterprises to use Yotta’s cloud for training large language models (LLMs) and building applications like OpenAI’s ChatGPT.

In the same visit, Nvidia also announced partnerships with Reliance and Tata. The companies will work together to create an AI computing infrastructure and platforms for developing AI solutions. But the Indian giants have yet to order the AI chips. “AI could be built in India, used in India, and exported from India," Huang said during the media interaction.

![]() The rise of generative AI has made countries invest in sovereign AI, which refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce, and business networks. There’s a worldwide demand for sovereign clouds for data production and for data to be in the hands of countrymen. “There’s a big latent and explicit need for India’s own sovereign cloud. That is what I’ve been working on for the last two years," explains Gupta.

The rise of generative AI has made countries invest in sovereign AI, which refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce, and business networks. There’s a worldwide demand for sovereign clouds for data production and for data to be in the hands of countrymen. “There’s a big latent and explicit need for India’s own sovereign cloud. That is what I’ve been working on for the last two years," explains Gupta.

Yotta will be spending $1 billion on 16,000 chips over a period of three years. The majority will go into capex, power, and running costs because accommodating these chips will require a lot of reengineering, including specialised storage equipment and cabling. The company has installed them in server racks, loaded them up in data centres, connected them to the internet, and will be renting them out to customers.

The company is raising funds to complete this order and, at some stage, will dilute its equity holdings. Currently, the Hiranandanis are the majority stakeholders, with Gupta holding a minority stake. Reportedly, Yotta ended FY23 with a net operating revenue of ₹103.7 crore and a net profit of ₹2.7 crore. “We are growing over 100 percent YoY, and I expect this to continue for the next three years," says Gupta. Till date, the company’s invested over ₹4,000 crore.

The critics are questioning this huge order of AI chips and whether there are buyers for them in India. But according to Gupta, India would need 10 times more than that. “The first batch of 4,000 graphics processing units [GPUs] will go live in the first week of June, and it’s already subscribed," says Gupta. Apart from Indian startups, companies from the US, Europe, and the Middle East have also subscribed to these GPUs amid global scarcity.

![]()

Based on his years of experience, Gupta is confident that India will become a market to serve the global AI demand. For instance, in the latest quarter, Nvidia ’s data centre business grew by a whopping 427 percent from a year earlier. The biggest drivers are its clients Amazon Web Services, Microsoft Azure, Google Cloud, and Oracle Cloud, who purchased its AI processors.

![]()

With Yotta’s hyperscale cloud Yantra and India’s first AI-centric GPU-based Shakti Cloud overlaid with Nvidia ’s reference architecture, co-founder Darshan Hiranandani says, “We’ve created the world’s most sophisticated yet most cost-effective cloud infrastructure in India, available to both Indians and global companies."

![]() The Yotta team at the unboxing of Nvidia H100 Tensor Core GPUs, which arrived in March

The Yotta team at the unboxing of Nvidia H100 Tensor Core GPUs, which arrived in March

![]() As an integrated service provider, Yotta’s business is primarily divided between two services: Colocation and tech. Much of the market in India and worldwide only offers colocation services like renting rack space and power. But Yotta generates 70 percent of its business from tech services like GPUs, CPUs, cloud computing, and cybersecurity.

As an integrated service provider, Yotta’s business is primarily divided between two services: Colocation and tech. Much of the market in India and worldwide only offers colocation services like renting rack space and power. But Yotta generates 70 percent of its business from tech services like GPUs, CPUs, cloud computing, and cybersecurity.

Including the world’s two largest data centre companies, Equinix, Digital Realty, and others, 80 percent of the data centre business worldwide is just colocation. They provide space, power, and cooling and wait for the customers to bring in their IT and run their business in it, explains Gupta. “My approach has always been different from this. I’m focusing on building India’s own sovereign cloud."

Decoding India’s data centre rumble

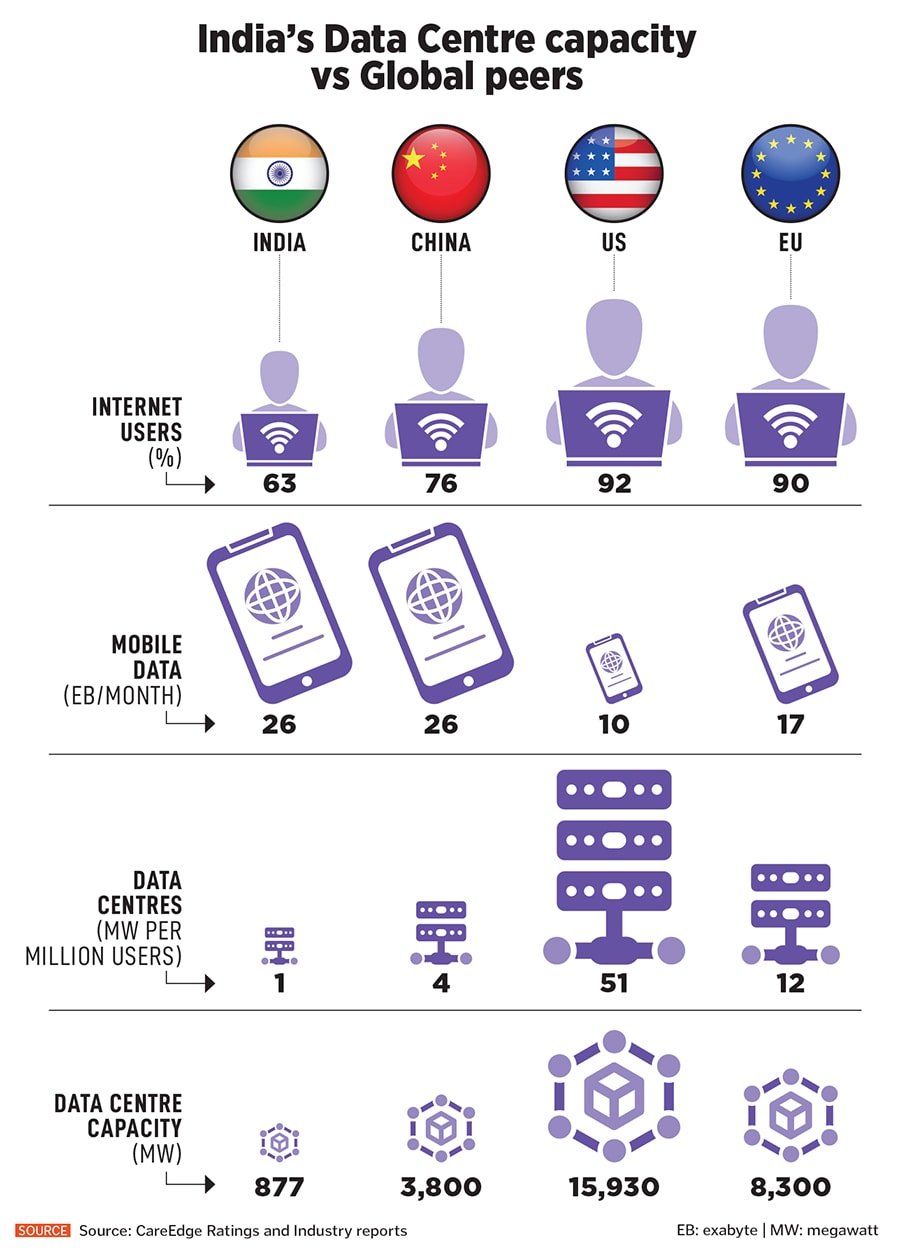

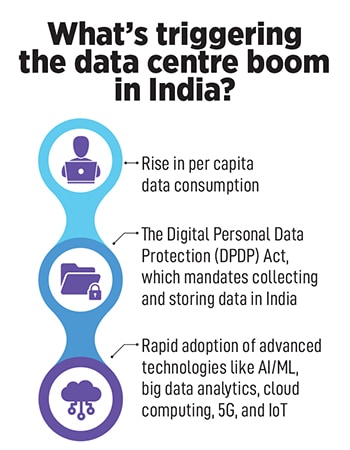

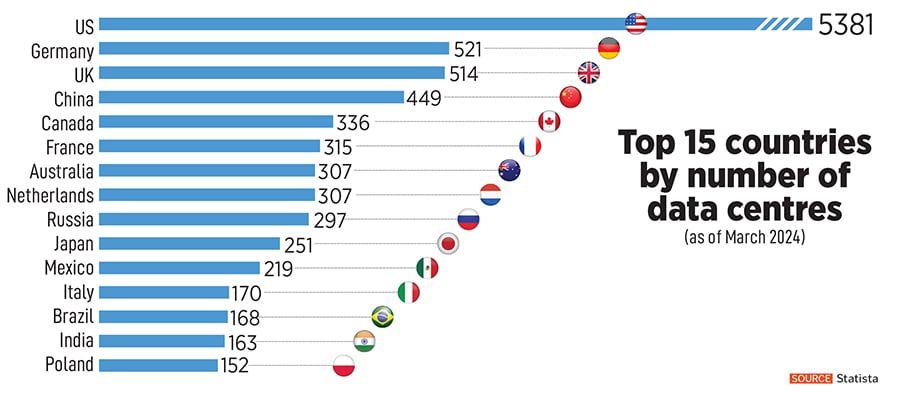

India has over 880 million internet users, almost twice that of the US and about 12 times higher than that of the UK. Despite having half the number of internet users, according to Statista, the US stands at the top with over 5,000 centres and India us at number 14 with 163 centres. Data centre capacity per 1 million internet users stands at 1.2 MW, which is glaringly low compared to established markets like the US (at 12.6 MW) and China (at 2.3 MW). As data localisation becomes the norm, India’s data centre market is witnessing fast growth.

![]()

An increase in data consumption would drive demand for all types of data centres. While colocation centres offer renting space for enterprise and hyperscale customers, cloud data centres offer both space and additional services such as infrastructure servers, software, and more, explains Anand Kulkarni, director at CRISIL Ratings. “The increase in 5G adoption will also lead to higher-edge DC deployments, which are smaller facilities that are located close to end users. They are connected to larger data centres. With 5G applications requiring low latency, edge DCs are best suited to meet this demand."

![]() The sector has seen new entrants with players from multiple domains like construction, power, and real estate, as well as investments by global fund and private equity players. But the project execution challenges, availability of equipment with a shorter lead time, maintaining cost competitiveness in light of high power costs, and balancing carbon neutrality are some barriers for the players, explains Puja Jalan, associate director at CareEdge Ratings.

The sector has seen new entrants with players from multiple domains like construction, power, and real estate, as well as investments by global fund and private equity players. But the project execution challenges, availability of equipment with a shorter lead time, maintaining cost competitiveness in light of high power costs, and balancing carbon neutrality are some barriers for the players, explains Puja Jalan, associate director at CareEdge Ratings.

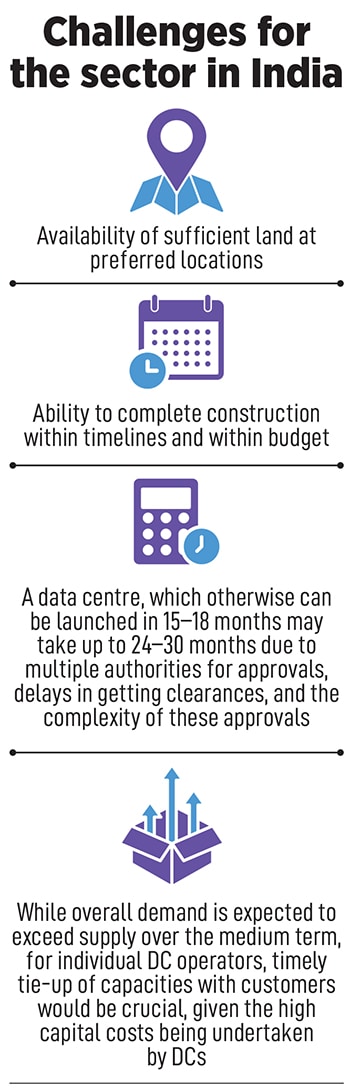

Kulkarni concedes. While there are significant growth opportunities, some of the hiccups, like the availability of sufficient land at preferred locations, the ability to complete construction within timelines and within budget, on-time approvals from authorities, and connectivity, will be key factors in determining the success of ventures in the sector.

“For example, from the initiation of a data centre project to its going-live for commercial use, there are more than 50 approvals required." A data centre, which otherwise can be launched in 15-18 months, may take up to 24-30 months due to multiple authorities for approvals, delays in getting clearances, and the complexity of these approvals.

CareEdge Ratings estimates that data centre capacity in India is expected to double to around 1,950 MW by 2026 from 877 MW in 2023, entailing a capital investment of ₹50,000 crore.

Digitisation followed by AI-led automation across different verticals like telecom, ecommerce, finance, content networks, social media, and applications will drive opportunities for data centres to store, train, and inferencing at the India-level. In terms of the sheer capacity and infrastructure to store and process the data, AI models warrant significant energy, which could soon be the bottleneck as power or energy is still a scarce resource, explains Neil Shah, vice president of Counterpoint Research.

Demand for AI chips will increase in the next couple of years in areas such as AI for cybersecurity, 5G telecom networks, social media, startups, banks, and more.

“Science and space research would also be niche verticals looking for advanced chips to build on the foundational models such as Meta Llama2, Mistral, or OpenAI," adds Shah.

Meanwhile, Gupta is preparing to take the first batch of 4,000 AI chips live in June. For a change, India is not lagging in getting its hands on the most powerful chips. It will now boil down to keeping the momentum going.

Eighteen years after building, managing, expanding, and running the data centres for Reliance and NTT, Gupta could foresee the boom coming up in India. In 2019, real-estate billionaire Niranjan Hiranandani got interested in investing in this sector. Having worked with them in the past and being a part of the same social circle, Gupta took this opportunity and approached Hiranandani with a business idea.

Eighteen years after building, managing, expanding, and running the data centres for Reliance and NTT, Gupta could foresee the boom coming up in India. In 2019, real-estate billionaire Niranjan Hiranandani got interested in investing in this sector. Having worked with them in the past and being a part of the same social circle, Gupta took this opportunity and approached Hiranandani with a business idea.

The rise of generative AI has made countries invest in sovereign AI, which refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce, and business networks. There’s a worldwide demand for sovereign clouds for data production and for data to be in the hands of countrymen. “There’s a big latent and explicit need for India’s own sovereign cloud. That is what I’ve been working on for the last two years," explains Gupta.

The rise of generative AI has made countries invest in sovereign AI, which refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce, and business networks. There’s a worldwide demand for sovereign clouds for data production and for data to be in the hands of countrymen. “There’s a big latent and explicit need for India’s own sovereign cloud. That is what I’ve been working on for the last two years," explains Gupta.

As an integrated service provider, Yotta’s business is primarily divided between two services: Colocation and tech. Much of the market in India and worldwide only offers colocation services like renting rack space and power. But Yotta generates 70 percent of its business from tech services like GPUs, CPUs, cloud computing, and cybersecurity.

As an integrated service provider, Yotta’s business is primarily divided between two services: Colocation and tech. Much of the market in India and worldwide only offers colocation services like renting rack space and power. But Yotta generates 70 percent of its business from tech services like GPUs, CPUs, cloud computing, and cybersecurity.

The sector has seen new entrants with players from multiple domains like construction, power, and real estate, as well as investments by global fund and private equity players. But the project execution challenges, availability of equipment with a shorter lead time, maintaining cost competitiveness in light of high power costs, and balancing carbon neutrality are some barriers for the players, explains Puja Jalan, associate director at CareEdge Ratings.

The sector has seen new entrants with players from multiple domains like construction, power, and real estate, as well as investments by global fund and private equity players. But the project execution challenges, availability of equipment with a shorter lead time, maintaining cost competitiveness in light of high power costs, and balancing carbon neutrality are some barriers for the players, explains Puja Jalan, associate director at CareEdge Ratings.