'Am relieved, but not euphoric': Maruti's Shashank Srivastava

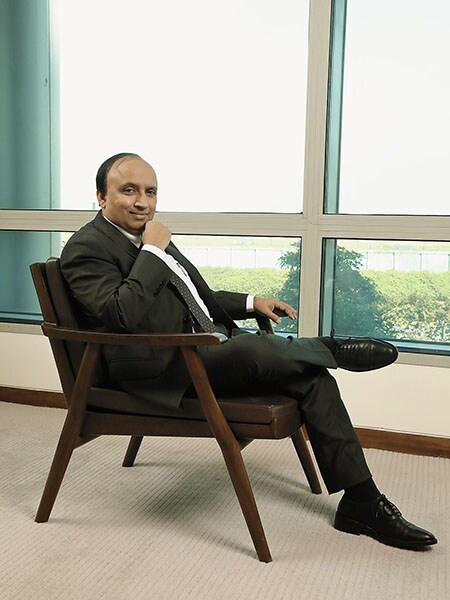

Shashank Srivastava, executive director for marketing and sales at Maruti Suzuki, on impressive July numbers, rural recovery and reimagining business

Shashank Srivastava[br]When Maruti Suzuki India registered sales of 108,064 units in July—a sequential growth of 88.2 percent over June when it sold 57,428 units—it stumped auto analysts. Reason: India’s biggest four-wheeler maker was just 1.1 percent short of what it sold during the same month last year (109,264), signalling the speed at which it was staging a rebound after being battered by Covid. The performance came on the back of a disappointing run in June—the auto major sold just 57,428 units, a dip of 54 percent over the same period last year, which contributed to Maruti posting its first quarterly loss in a decade since listing in 2003. Understandably, Shashank Srivastava, executive director for marketing and sales at Maruti Suzuki, is guarded in his response. “I am relieved, but not euphoric,” he says. Edited excerpts from an interview:

Shashank Srivastava[br]When Maruti Suzuki India registered sales of 108,064 units in July—a sequential growth of 88.2 percent over June when it sold 57,428 units—it stumped auto analysts. Reason: India’s biggest four-wheeler maker was just 1.1 percent short of what it sold during the same month last year (109,264), signalling the speed at which it was staging a rebound after being battered by Covid. The performance came on the back of a disappointing run in June—the auto major sold just 57,428 units, a dip of 54 percent over the same period last year, which contributed to Maruti posting its first quarterly loss in a decade since listing in 2003. Understandably, Shashank Srivastava, executive director for marketing and sales at Maruti Suzuki, is guarded in his response. “I am relieved, but not euphoric,” he says. Edited excerpts from an interview:

ON RURAL RECOVERY

The rural share in our overall sales has gone up from 38 percent to 40 percent, and the rural growth is 7 percent higher than the urban. These are unprecedented times. And I am looking at the bounceback with a lot of optimism. While April had zero sales because of the lockdown, for half of May, the showrooms were not open. But slowly things started to get better. In fact, July has been close to what we did during the same period last year, both in terms of retail and wholesale. Rural sales have bounced back a little faster. For the four-wheeler industry, 80 percent of the demand still comes from urban areas, and for Maruti it’s 38 to 40 percent.

ON CRYSTAL-GAZING DEMAND

Long-term demand depends on factors such as the performance of the economy. At the same time, car buying is a discretionary purchase, and a lot depends on sentiments. There can either be a vaccine upside or a virus downside, or a second wave of virus... or if more areas get affected, it will impact sentiments, and discretionary buying. We also need to see how much of sales now is due to pent-up demand, and how much is due to preference for personal transport over public.

ON FIRST QUARTERLY LOSS SINCE IPO

Fixed cost elements in automobiles are very high. Therefore, the industry is closely tied up with volumes. So when the volume was zero in April and only 13,000 in May, the quarter was expected to be in the negative. But we beat the street estimates on the extent of the loss. This is the positive part.

ON its FOCUS POST-PANDEMIC

During the lockdown, the company worked on a slogan: Ready, resolute, resilience. The idea was one needs to be ready for any eventuality and when the market opens be resolute and fight back and we are there for the long term. Now, there is a shift, and the new slogan is Rethink, reimagine, and recalibrate. We need to think of new ways of doing and reimagining business. It’s not business as usual.

First Published: Aug 18, 2020, 13:48

Subscribe Now