Is quick commerce Yulu Bikes' fast lane to growth?

The rise of quick commerce is a big opportunity for Yulu Bikes, which makes most of its revenue from workers in hyperlocal delivery

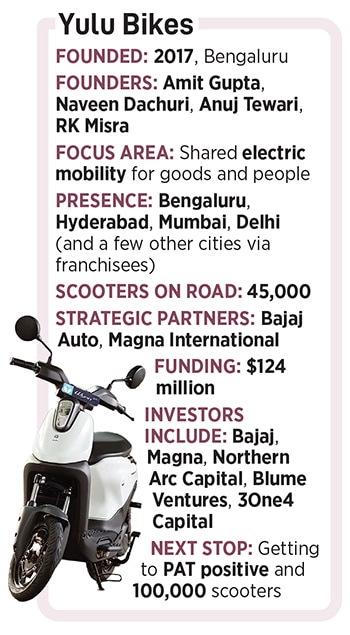

Yulu Bikes, founded by Amit Gupta and his friends Naveen Dachuri, Anuj Tewari and RK Misra in 2017, started with bicycles and a smartphone app. The idea was to coax India’s metro netizens to try out a more planet-friendly mode of hyperlocal transport.

They then began offering a small, low-speed electric scooter, the Yulu Miracle, in ‘Yulu zones’ in partnership with local city authorities. The biggest opportunity, however, revealed itself when hyperlocal delivery took off.

Today Yulu has evolved into a provider of low-speed electric scooters to delivery agents, with its Yulu Dex scooter. Now, with quick commerce beginning to emerge as the next, and potentially even bigger, opportunity in the country’s ecommerce market, Gupta is preparing Yulu to tap that growth.

“The humongous rise in quick commerce is affecting Yulu’s journey very positively," says Gupta. Post Covid-19, demand from hyperlocal delivery agents rose. Today, renting out its low-speed scooters to gig workers has already become the dominant contributor to Yulu’s business, accounting for 90 percent of its revenues, he says.

With Dex’s top speed capped at 25 kmph, and with certain other power consumption restrictions, these scooters don’t require a driving licence, making them ideal for gig workers with limited financial inclusion. They can rent the scooters with minimal hassle at a Yulu centre.

With Dex’s top speed capped at 25 kmph, and with certain other power consumption restrictions, these scooters don’t require a driving licence, making them ideal for gig workers with limited financial inclusion. They can rent the scooters with minimal hassle at a Yulu centre.

Quick commerce, however, hinges on deliveries of everything from groceries to apparel and even iPhones in a matter of 10 to 15 minutes. Therefore Yulu will soon offer a ‘mid-speed’ scooter, Yulu Express, that can go faster (up to 45 kmph) and carry more load.

“It’s an exciting growth phase for us. We’ve hit Ebitda profitability and unit economics profitability, and there’s more demand than what we can supply," Gupta says. He also confirms that on the back of this demand, talks are on to raise more funds to step up Yulu’s expansion.

And despite missing the deadline to hit the target of 100,000 scooters on the road, which was end of 2024 but now looks like early-to-mid 2026, Gupta firmly believes that having persevered with the company’s ‘asset-heavy’ business model was the right path to choose and that Yulu is on the cusp of reaping the benefits of this approach.

On the manufacturing side, Bajaj Auto makes Yulu’s scooters for it in a strategic partnership. And the Bengaluru venture also struck an innovative partnership with Magna, a US-based multinational auto components maker, in 2022. Through a joint venture with Magna, Yulu separated its battery swapping operations as an independent unit.

That business, called Yuma, has now grown to offer battery swapping and related services not only to Yulu but also to other electric scooter providers, e-autorickshaw makers and so on.

The Yulu centres have emerged as one of two important local hubs of activity for the venture. There are some 65 such centres in Bengaluru, Mumbai, Delhi and Hyderabad.

Each centre is typically of 1,500-2,000 sq ft, where delivery agents can rent a scooter they can do this on a subscription basis that ranges from a week at a time to as much as a month. Yulu charges the gig workers about ₹200 per day for its scooters.

The centres, each covering an area of 5 km radius, are also where the gig workers can get help with the scooters. Complementing these centres are the Yuma stations, where batteries can be swapped there are 235 such stations in different cities.

Another way Yulu has tried to expand its operations is via a franchisee network with the venture offering what Gupta calls “Yulu-in-a-box".

Bengaluru alone has some 250,000 workers across all types of hyperlocal deliveries, Gupta says. He expects Yulu can capture as much as 50 percent of the market share when it comes to servicing these workers.

“Today one-third of all quick commerce deliveries in Bengaluru is happening on Yulu," he says, adding that it’s about 30 percent in Mumbai, 10 percent in Delhi and negligible in Hyderabad so there’s huge headroom.

“If you look at Yulu’s journey, they struggled initially, but now they’re on a good track," says Soumen Mandal, a senior analyst at Counterpoint Technology Market Research.

“Last mile delivery is booming in India, and if brands want to be pan India, they’ll need to tap ecommerce and quick commerce to reach Gen Z consumers," Mandal says. “From that perspective the growth of that market could be a good opportunity for Yulu."

Overall, EV penetration in India is expected to go from more than 6 percent today to as much as 40 percent by 2030, Counterpoint projects. This entails a corresponding growth of the ecosystem as well. All this can support Yulu’s growth, helping it source its vehicles from Bajaj at lower cost as volumes rise and form factors crystalise.

Yulu has about 45,000 vehicles, but to service just the ecommerce and quick commerce demand in four cities there is scope to deploy 300,000 to 400,000 scooters in the next few years, Gupta says.

The journey has been one of iterative learning, and only on the evolving business opportunities front. It’s also taken Yulu multiple experiments with the configurations of its scooters—from solid tyres to pneumatic ones, the right grades of components, and even making them sturdier.

By the end of next year, Gupta expects to be in six or seven cities directly, and the franchisee network—where a local entrepreneur buys and operates Yulu scooters—to go from five cities to 15.

“Over the next 18 months, the next big opportunity for us is to also become PAT positive," he says. “Once we hit that, then we prepare ourselves for the road to IPO."

First Published: Apr 11, 2025, 14:56

Subscribe Now