Kaleidofin: Fintech platform for the women, by the women

Chennai-headquartered financial technology platform Kaleidofin helps under-banked customers, particularly women, meet their real-life goals by providing tailored financial solutions

For Sucharita Mukherjee, it was all very personal.

A former CEO of financial inclusion services provider IFMR Holdings, and more importantly, as a woman, she knew very well the problem she wanted to solve when she set out to become an entrepreneur. “It was clear that we wanted to build for informal India, Bharat, and for women in particular," Mukherjee tells Forbes India over a video call. “That’s the reason that drives you. There’s no right or wrong. In that, it’s personal."

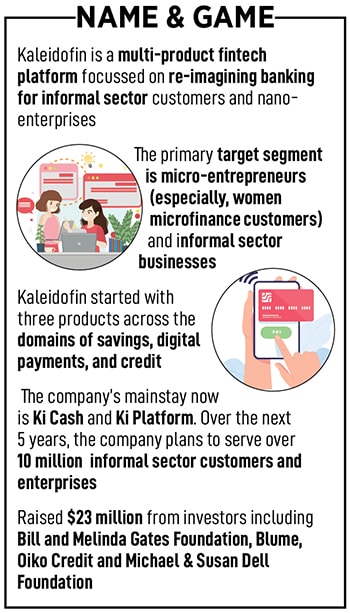

Mukherjee is co-founder and CEO of Kaleidofin, a Chennai-headquartered financial technology platform that helps under-banked customers, particularly women, in meeting their real-life goals by providing tailored financial solutions. “We believe that everyone deserves and requires access to financial solutions that are intuitive and easy to use, flexible and personalised to real goals that can make financial progress and financial freedom possible," she adds.

Since its founding in 2017, along with co-founder Puneet Gupta, and backed by the likes of Bharat Fund, Blume Ventures, Flourish Ventures, Bill & Melinda Gates Foundation, Michael & Susan Dell Foundation, Oikocredit, and Omidyar Network, Kaleidofin has built up a user base of over 3 million, of which 97 percent are women. A million of them are small-time entrepreneurs.

“Our customers’ lives are extremely volatile," Mukherjee says. “They probably need savings, credit and insurance all put together. But they don’t have the time or money because time is money for them. We thought how can we deliver financial solutions that make a real-life goal happen?"

Goal-based savings, Mukherjee says, could be anything from expanding a tailoring business to sending a child to medical school to even building a bathroom in the house. “The journey is always hard," she says, “and when you’re going on a path that has fundamentally been trodden before, you know it’s going to be more difficult, but this is what makes it worth it, and you get that satisfaction."

Mukherjee’s decision to turn entrepreneur came from finding her purpose in life.

Life was pretty settled for Mukherjee, a Lady Shri Ram College and IIM-Ahmedabad graduate, in London where she worked with Deutsche Bank after graduation. The daughter of an Army officer, she says the fundamental idea of giving back comes closely from that upbringing.

At Deutsche Bank, Mukherjee worked in the credit derivatives structuring team before moving to Morgan Stanley. “I began to ask myself, why am I doing this? What impact am I having? What is my purpose? Do I respect the culture of this place? And I honestly could not answer any of those questions for myself and that left me with a little bit of emptiness."

At Deutsche Bank, Mukherjee worked in the credit derivatives structuring team before moving to Morgan Stanley. “I began to ask myself, why am I doing this? What impact am I having? What is my purpose? Do I respect the culture of this place? And I honestly could not answer any of those questions for myself and that left me with a little bit of emptiness."

That meant, over time, during her visits to India, Mukherjee would spend time with people outside her domain, and work closely with NGOs focussed on primary education among others. “But I was also trying to find a place where my special skill in credit structuring in markets could be put to use," Mukherjee says. That’s when she met Nachiket Mor, a former veteran at ICICI Bank who was busy setting up the IFMR Trust, which was looking to make the markets work for the poor.

“I was pretty struck by the vision," Mukherjee says. Over the next 10 years, she worked at IFMR, where she became a co-founder and was also the founder of Northern Arc Capital, building capital markets’ access for financial inclusion, and Northern Arc Investments, an alternative fund management platform focussed on informal sector finance.

Much of that was because the target group for Kaleidofin remained vulnerable, Mukherjee says, with those who need savings, credit and insurance all put together. “We also had a sharp focus on women customers, in particular women in small businesses," she explains. “I strongly believe that women like me are the product of the opportunities we’ve been given."

Kaleidofin started as a platform to connect large financial services providers, including banks and insurance, to women-led small businesses. The company started with mutual funds, graduating to insurance companies before onboarding banks and lenders. Kaleidofin also partners with microfinance institutions and cooperative banks, all done through a wide network of agents.

“The first product that we launched was with SEWA Bank," Mukherjee says. “We took recurring deposit products and combined them with insurance to make a goal-based saving solution."

“The first product that we launched was with SEWA Bank," Mukherjee says. “We took recurring deposit products and combined them with insurance to make a goal-based saving solution."

Today, Kaleidofin offers four products. The first is Ki Score, which Mukherjee calls the company’s most mature product. Ki Score is a credit health and financial health score that helps a lender make credit decisions. “One of the big gaps that lenders have is that they don’t know how to underwrite the customer," Mukherjee says. “So, it’s an AI/ML (artificial intelligence/machine learning)-based model."

The second offering from the company is Ki Credit, a middleware that helps largely with the onboarding process and in conducting fraud checks for lenders. Kaleidofin also offers a risk management dashboard, Ki view, which can be used by lenders post-disbursement for monitoring and managing risks. “It also has alerts in natural language, which basically means that as a risk manager, I don’t need to look at 50 tables to figure out where the anomaly is and then figure out what to do," Mukherjee says.

The last is Ki Cash, the company’s customer engagement platform, and a fully digital savings bank. “The bank account is a useful layer because it makes all the other financial products better," Mukherjee says. “We want our customers to feel a sense of dignity." It’s through this platform that the company engages in the distribution of mutual funds and insurance.

Indian fintechs are expected to generate revenue to the tune of $190 billion by 2030, according to a report by Boston Consulting Group. “When any loan goes through the platform, we make a platform fee, which is a percentage of either disbursements or AUM," Mukherjee says. “We have lending income and the other is the fee for other IP products on a platform like Ki Score."

It also helps that a majority of Kaleidofin’s board members are women, something uncommon in India’s corporate sector. “I know it’s unusual, and I can tell you it’s a huge competitive advantage." The company operates through 50 channel partners spread across 17 states.

“Sucharita and Puneet have been possessed founders with the ambition of making a serious impact at the bottom of the pyramid for India and even other parts of the world," Ashish Fafadia, a partner at venture capital firm, Blume says. “Their product Ki Score combines Data, AI, and debt to make efficient credit decisions that help financiers price and distribute credit. I believe that over a period of time, most financial institutions will use data and technology better using Kaleidofin’s product range worldwide."

Over the next few months, Mukherjee and her co-founder Gupta are gearing up to ramp up their credit platform in addition to improving the Ki Score offering. “We always want to be ahead of the curve," Mukherjee says. “Whether it is on Ki Score, which means underwriting better or in retaining our customers better, we want to scale up our customer impact."

First Published: Nov 23, 2023, 13:54

Subscribe Now