Adani fights another fire

How much of an impact will the indictments by US prosecutors have on Gautam Adani's growth ambitions?

With two major crises in just two years, investors of the Adani Group companies are unsettled once again. Even as the conglomerate, led by Asia’s second richest man Gautam Adani, has maintained its composure, claiming “commitment to compliance", the rapid erosion of shareholders’ money on Indian stock exchanges, starting November 21—although there was a comeback by the first week of December—is not for the faint-hearted.

Soon after the US prosecutors indicted Adani and others for allegedly plotting a $265 million scheme to bribe Indian government officials to win solar energy contracts, the listed group companies faced a loss of Rs 2.25 lakh crore combined market value. However, some stocks have bounced back with losses reducing to Rs 54,343 crore market capitalisation (by the closing of December 5) on reiterations of commitments by a few business partners and investors dismissing charges by the US.

What arrested the sell-off in group stocks further is a clarification by Adani Green Energy that allegations against Gautam Adani, Sagar Adani, and senior executive Vneet Jaain, under the US Foreign Corrupt Practices Act (FCPA) by the US Department of Justice (DoJ), were “incorrect". However, the company acknowledged the executives face three charges in the criminal indictment alleged securities fraud conspiracy, wire fraud conspiracy, and securities fraud.

Adani group bonds also faced turbulence reacting to the US charges. Spreads of the group’s bonds, since then, seem to have settled, widening by about 100-200 basis points, with short tenor seeing more spread widening due to higher dollar prices.

The billion-dollar question: How will this development impact business continuity and fund-raising? Love Sharma, analyst, JP Morgan, does not see any signs of stress across key listed businesses of the group. “While we do expect restricted financing, which could delay some of these capex plans, we consider that it would not be a bad outcome for bond investors in any case," says Sharma.

The company has not responded to questions emailed by Forbes India at the time of writing.

Rating agencies were quick to react with downgrades. Moody’s downgraded the outlook for seven Adani companies from ‘stable’ to ‘negative’. “Although the allegations and the charges made by US Attorney"s Office and Securities and Exchange Commission (SEC) pertain to Adani Green Energy (AGEL) chairman and senior management team members, we believe they could have a broader credit impact on all rated Adani Group issuers, given Gautam Adani"s prominent role as chairman of each of the rated entities or their parent companies as well as the controlling shareholder," Moody’s said.

On November 20, the US SEC charged Gautam Adani and Sagar Adani (executives of Adani Green) and Cyril Cabanes (an executive of Azure Power Global) of a bribery scheme. According to the SEC’s allegations, the bribery scheme was orchestrated to enable the two renewable energy companies to capitalise on a multi-billion-dollar solar energy project that the companies had been awarded by the Indian government.

On November 20, the US SEC charged Gautam Adani and Sagar Adani (executives of Adani Green) and Cyril Cabanes (an executive of Azure Power Global) of a bribery scheme. According to the SEC’s allegations, the bribery scheme was orchestrated to enable the two renewable energy companies to capitalise on a multi-billion-dollar solar energy project that the companies had been awarded by the Indian government.

According to SEC, both Gautam and Sagar Adani were engaged in the bribery scheme during a September 2021 note offering by Adani Green that raised $750 million, including approximately $175 million from US investors.

In a parallel action, the US Attorney’s Office for the Eastern District of New York, on November 20, pressed charges against Gautam and Sagar Adani and Cabanes, among other individuals connected to Adani Green and Azure Power. The US prosecutors allege that the board members are involved in a bribery scheme related to solar power contracts in India, and that they breached the anti-bribery compliance policy through misrepresentation to investors in an offshore bond.

“A US indictment of three board representatives of an unrated Adani group entity could affect investor confidence in other Adani group entities (because the founder is on the board of multiple entities within the group), thereby potentially impairing their funding access and increasing their funding costs," says S&P.

As a consequence of the US charges, Adani group had cancelled a planned $600 million concluded bond sale.

As charges are investigated and reviewed against Adani, there are concerns that group companies with large and wide-spread business entities may face near-term liquidity issues which may subsequently impact their growth plans, debt situation and increase refinancing risks.

“We believe the latest developments could hinder the group"s funding access," says Fitch. It explains that two of the indicted board members belong to the founding shareholders of Adani group, which effectively own a majority of shares in all rated group entities (except Adani International Container Terminal). These directors also serve on the boards of most other rated entities, raising contagion risk and renewing governance concerns across the group.

Group’s flagship company Adani Enterprises has already trimmed its capex target for FY25 twice. In an analysts call post September quarter earnings, Jugeshinder Singh, group CFO, said Adani Enterprises plans to spend Rs 67,000 crore on capital expenditure by the end of March 2025 due to a longer period of monsoon this year. This compares lower to an already set capex target of Rs 80,000 crore.

Analysts have further raised concerns on the group’s fundraising capability post the US charges. “US prosecutors" indictment of senior Adani Group leadership could affect the group"s funding access," says S&P. The rating agency is watching out for any signs of weaker funding access or concerns from existing lenders—which could be demonstrated by the lowering of funding limits, nonrenewal of facilities, or significantly higher credit spreads.

Given its large growth plans, the Adani Group will need regular access to both equity and debt markets in addition to its regular refinancing. Domestic, international banks and bond market investors consider Adani entities as a group, and could set group limits on their exposure, says S&P.

Given its large growth plans, the Adani Group will need regular access to both equity and debt markets in addition to its regular refinancing. Domestic, international banks and bond market investors consider Adani entities as a group, and could set group limits on their exposure, says S&P.

S&P downgraded the outlook on Adani Electricity, Adani Ports and Special Economic Zone, and Adani Green as cash flows could be materially affected if their funding access weakens, their funding costs rise significantly, or the allegations are proven, in addition to the assessment of their governance and business profiles.

Moody’s revised outlook on seven entities of the conglomerate to ‘negative’ from ‘stable’ but affirmed its ratings on all seven firms. Moody’s said a downgrade is also likely if the group is unable to address or rectify governance issues associated with the ongoing legal proceedings, but an upgrade of the ratings is unlikely in near term.

Fitch has also placed the Adani Group’s infrastructure-related entities on ‘negative watch’ rating. The outlook reflects the risk of higher funding costs and materialisation of weakness in corporate governance and internal controls.

Following the US allegations, a few investments commitments in the Adani Group by external sources have been also put on hold. French energy giant TotalEnergies said in a press release that “until such time when the accusations against the Adani group individuals and their consequences have been clarified, TotalEnergies will not make any new financial contribution as part of its investments in the Adani group of companies."

In January 2021, TotalEnergies acquired a minority interest in the listed company Adani Green Energy, of which it now owns 19.75 percent. Between 2020 and 2024, TotalEnergies had also acquired 50 percent stakes in three joint ventures operating renewable assets.

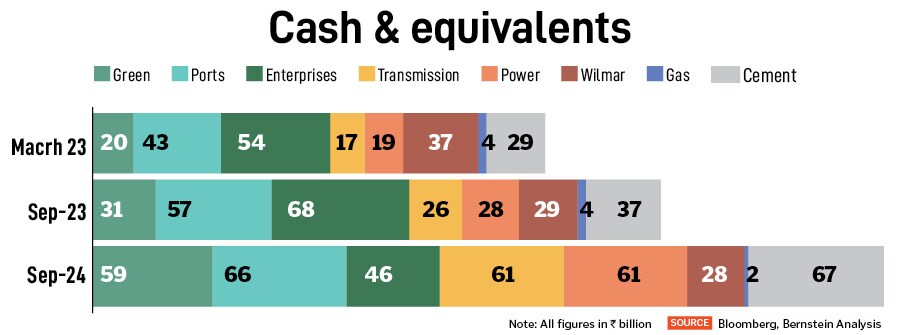

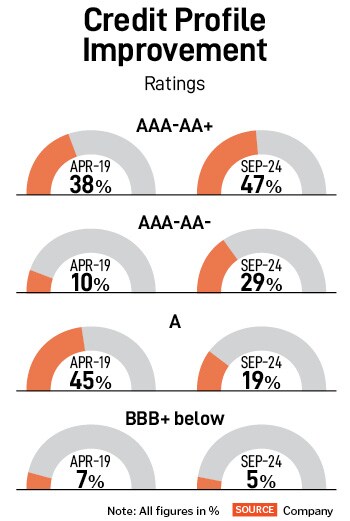

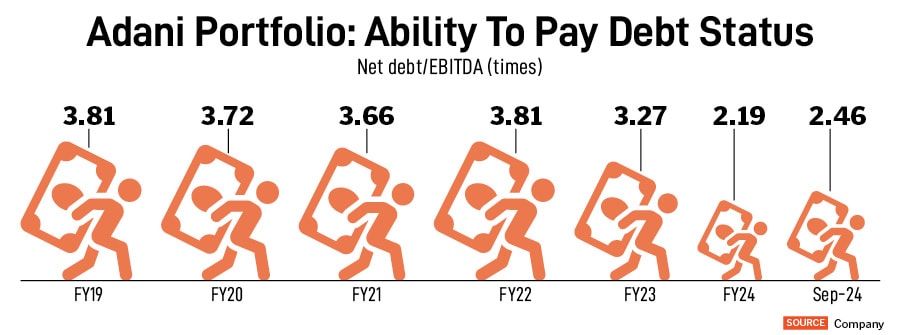

According to Nikhil Nigania, Bernstein, Adani Group’s current financial position has improved from the time it was hit by Hindenburg Research questioning its financial health and disclosures. Nigania has examined the Adani Group (three companies Adani Ports, Adani Green and Ambuja) on four key parameters: Pledged shares by promoters, leverage of debt, debt repayment (and bonds) and valuations.

He explains that there has been a dramatic drop in share pledges across companies. For instance, share pledge in Adani Power is 1 percent now from 25 percent in December 2022 (Pre-Hindenburg issue) and in Adani Ports it is nil from 17 percent.

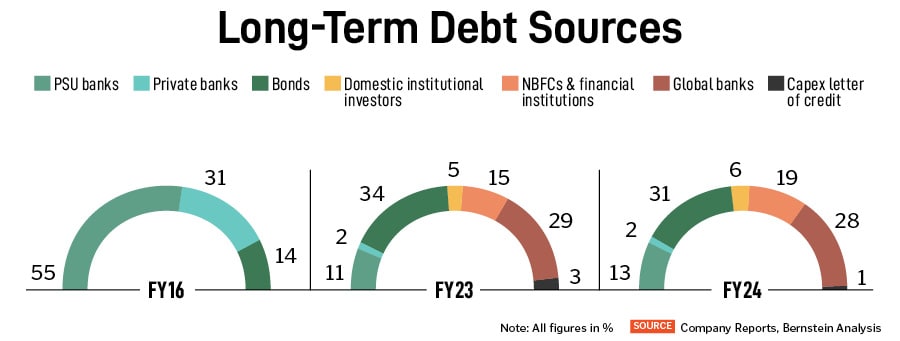

“In terms of the source of funds, over the years, the group has shifted away from banks to bonds. Since March 2023, however, we have seen the share of dollar bonds decrease and that of NBFCs increase in the source of funds—which we expect was due to favourable rates in Indian markets versus dollar bonds," adds Nigania.

“In terms of the source of funds, over the years, the group has shifted away from banks to bonds. Since March 2023, however, we have seen the share of dollar bonds decrease and that of NBFCs increase in the source of funds—which we expect was due to favourable rates in Indian markets versus dollar bonds," adds Nigania.

The overall debt for the group decreased post Hindenburg event reaching Rs 2,38,500 crore in September 2023 from Rs 2,41,000 crore in March of the same year. It has risen again now to Rs 2,79,300 crore primarily driven by Adani Enterprises (including their lease liabilities).

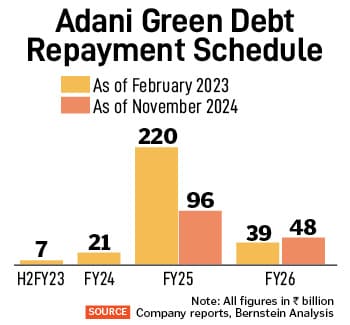

Adani Green had a significant part of its debt up for repayment in calendar year 2024. “This time, the repayment schedule is more balanced however, our discussions with fixed income investors suggest the concern is around a dollar-revolving facility Adani Green has taken of Rs 17,700 crore, of which Rs 8,900 crore is due in March next year," Nigania explains. He adds that it seems lesser of a concern this time considering the company is sitting on Rs 5,900 crore of cash. Also, for the group, the next dollar bond is maturing only in August 2026.

Meanwhile, Crisil Ratings is optimistic that the Adani Group has sufficient liquidity and operational cash flow for debt obligations and capital expenditure over the medium term.

First Published: Dec 06, 2024, 17:04

Subscribe Now