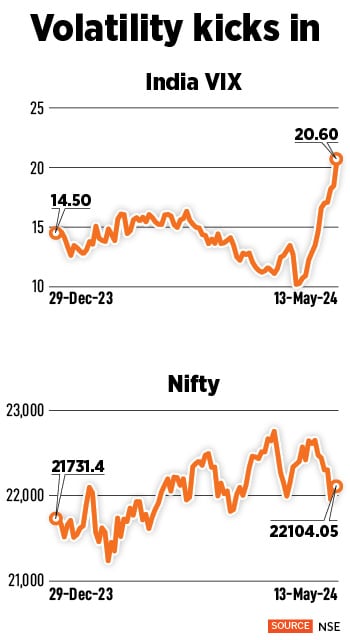

The Nifty has lost over 2 percent in May, but has been gradually recovering. What is eye popping is the India Volatility Index (VIX), which has heated up dangerously. The India VIX has risen 116 percent in the last 13 trading sessions, indicating investors are getting increasingly nervous about a sharp correction in markets in at least the next 30 days. The India VIX, often referred to as a fear gauge or fear index, has an inverse correlation with rising markets. The current rise in the fear index indicate investors are losing confidence in the rally and factors driving the surge in equities.

“This is quite typical of markets in the pre-election timeframe," says Vikaas M Sachdeva, managing director, Sundaram Alternates. He explains that a lot of noise gets generated by multiple opinion makers, which tends to make investors circumspect.

The India VIX has increased 42 percent since the beginning of January, and has spiked 60 percent in May alone. This is not encouraging at all. The VIX is most closely watched by traders as a measure of the expected volatility of stock markets over the ensuing 30-day period and is the primary tool for traders to protect themselves against, or bet on, sharp moves in stocks. Investors, research analysts and portfolio managers assess VIX values to measure markets risks, fear and stress before they make investment decisions.

According to Deepak Jasani, retail research head, HDFC Securities, anxiety in the markets is fuelled by multiple factors. First, as the election progresses in phases, opinion polls and betting markets (‘satta bazar’) about the seat-sharing arrangements of the BJP are influencing markets trends.

Second, March quarter corporate earnings have not been promising. Third, there has been a liquidity drain out by foreign investors from Indian equities. “This is a transitionary phase," Jasani says, adding that once the dust around the election settles, investors’ focus will be on fundamentals.

Elections are underway in seven phases throughout the country and the final results are expected on June 4, which will set the tone for the markets. The polls started on April 19 and the last voting phase will take place on June 1. Markets have priced in expectations for the incumbent party to continue, as policy continuity remains crucial. This election is essentially a contest between the BJP-led NDA, which is seeking a third consecutive term, and a combined bloc of Opposition parties, called the Indian National Developmental Inclusive Alliance (INDIA), which includes the Congress.

“Markets being nervous is not a reflection on the relative strength of any party. It is ‘perception arbitrage’ being played out by various players. One needs to note that the flows into domestic institutions are at an all-time high of Rs 20,000 crore a month, which is the other end of the spectrum. Hence, one should treat these dips as a buying opportunity," Sachdeva says.

Heady swings

One reason for panic in the markets is the low voter turnout in the first three poll phases the average turnout was just over 66 percent, which is surprisingly close to the 2014 turnout. How the following phases progress are critical, since in 2019 the voter turnout kept decreasing through the phases, falling from 69.6 percent to 61.7 percent from phase 1 to phase 7.

“Judging voter turnout based on this comparison can often lead to absurd inferences, as constituencies going into the first phase of 2019 differ significantly this time," says Venugopal Garre, managing director, Bernstein. Quick comparisons also led to panic, as ballot paper numbers for the first two phases were updated after almost one week, raising the turnout by over 5 percent. The most apt comparison is within the same constituency, which does show a decline from 2019, but not too far below 2014.

With Prime Minister Narendra Modi"s BJP-led government looking to win a third consecutive term, this election is set to be the largest democratic exercise ever held. Before voting started, opinion polls signalled an average of 385-390 seats for the NDA. Some polls went as high as 411 and, given the recent performance in state elections and the results of almost all major opinion polls, 390-400 seats have become the new base.

![]() However, the tide has been turning, with betting markets in Phalodi (Rajasthan) suggesting 360 seats for NDA. The Phalodi betting market is popular as the epicentre of betting, be it related to elections or cricket, and is known to be rarely incorrect in its predictions.

However, the tide has been turning, with betting markets in Phalodi (Rajasthan) suggesting 360 seats for NDA. The Phalodi betting market is popular as the epicentre of betting, be it related to elections or cricket, and is known to be rarely incorrect in its predictions.

“We do not follow Phalodi election bets, but we definitely have the trends at the back of our minds while taking investment calls," says the head of a brokerage firm on condition of anonymity.

However, it will take a lot to swing the election results out of favour for stock markets. “Based on our assumptions, a 2 to 3 percent decline in voters along with anti-incumbency will likely lead to figures just below the 2014 tally," Garre says. He explains a large decline of 5 percent without much anti-incumbency should see them repeating figures of 2019 with minor upward or downward revisions.

“Only the case of a large vote share decline [over 5 percent] and significant anti-incumbency is where the elections become a market-defining event. The fact that the Opposition is more united nationally this time should start having meaningful repercussions only at this stage," Garre adds.

Foreign liquidity drain-out

Sachdeva adds that foreign institutional investors (FIIs) have been selling parts of their holdings over the last few weeks, which adds to the overall pressure on indices. “One also needs to note that other markets, like China, have reached a valuation where the margin of safety is relatively high, which in turn is attracting global money," he elaborates.

FIIs have drained out $2.4 billion in Indian equities in the first six sessions of May, after withdrawing $1 billion in the previous month. According to Sanjeev Prasad, MD and co-head of Kotak Institutional Equities, FIIs seem to have taken a negative view on Indian equities, as shown by the large outflows over the past few weeks. He attributes the same to their perception of multiple factors relating to unfavourable risk-reward balance in India and better returns elsewhere, especially China.

“Anyways FIIs have been less active in India for a while, due to low inflows to emerging markets funds and a high share of passive flows, full-to-rich valuations across sectors, and low interest in outperforming ‘narrative’ stocks. India’s weight has increased steadily in the MSCI EM Index, but active GEM funds have stayed underweight," Prasad adds.

Earnings overhang

Corporate earnings for the March quarter have not been reassuring about business growth recovery. An analysis of corporate earnings of 161 companies (excluding BFSI) by Bank of Baroda shows there has been a significant decline in profitability as tailwinds from lower input costs have largely dissipated. On the positive side, demand conditions seem to have improved, with sales growth inching up. The analysis showed net sales of these companies rose 8.1 percent year-on-year (y-o-y) in Q4FY23, while net profit slipped 13.8 percent y-o-y.

Earnings of the 28 Nifty companies that have declared results till May 4 jumped 13 percent y-o-y, propelled by HDFC Bank, Coal India, ICICI Bank, Maruti Suzuki, and TCS. These five companies contributed 75 percent to the incremental y-o-y accretion in earnings.

“The earnings spread has been decent, with 70 percent of our coverage universe either meeting or exceeding profit expectations. However, growth has primarily been led by the BFSI and automobile sectors. Nifty is trading at a 12-month forward price-to-earnings of 19.3 times, at a 5 percent discount to its own long-period average [LPA]," says Gautam Duggad, head of research, Motilal Oswal Financial Services.

Analysts at Axis Mutual Fund say that the earnings season has been lukewarm so far and mid- and small-caps witnessed earnings downgrades compared to their large-cap counterparts. This season did not witness any major recovery in consumer staples, and growth in the IT sector has been modest. In addition, sluggish export demand and slow B2B execution due to the elections are all expected to keep earnings tepid in the near future. However, forward guidance is suggestive of improving demand in select B2C sectors due to a positive impact of heat wave in certain categories and a base effect. The K-shaped trajectory continues. The B2B segment, especially capital goods, are witnessing election-related slowdowns.

So, what now?

Prasad hopes there is no untoward incident to jolt the market out of its ‘riskless’ mode. “The market has seen increased volatility of late, linked to fluctuations in expectations around the outcome of the ongoing national elections. We have limited insights to offer on election results and any positioning on the back of the election outcome. However, it is quite evident that the recent correction in many ‘narrative’ stocks can be hardly called a correction in the context of the massive returns in the stocks over the past six to 12 months," he says.

According to him, there is a struggle to find value in the market with most sectors and stocks trading at full-to-rich valuations and many sectors and stocks trading at outlandish valuations, with absolutely no link to fundamentals. “The markets are conveniently baking in optimistic profitability and volume assumptions, using wrong valuation methodologies and fabricating implausible narratives to justify the current market capitalisation of stocks. In our view, the narratives and fanciful valuations surrounding many of the fancied stocks in the automobile, capital goods and PSU sectors will not stand even a modicum of scrutiny. We are surprised at the vehement conviction of certain investors about these stocks," he says.

Meanwhile, India’s long-term growth story remains intact, with the country being one of the fastest growing economies globally. High frequency indicators such as PMIs, GST collections, rail freight and domestic passenger growth remain encouraging, compared to historical standards.

“While FY25 has indeed commenced on a positive note for Indian equities, the global scenario presents a slightly more challenging outlook than what was anticipated at the onset of the calendar year. Many economists now predict that there may be no rate cuts throughout the year," say analysts at Axis Mutual Fund.

However, the tide has been turning, with betting markets in Phalodi (Rajasthan) suggesting 360 seats for NDA. The Phalodi betting market is popular as the epicentre of betting, be it related to elections or cricket, and is known to be rarely incorrect in its predictions.

However, the tide has been turning, with betting markets in Phalodi (Rajasthan) suggesting 360 seats for NDA. The Phalodi betting market is popular as the epicentre of betting, be it related to elections or cricket, and is known to be rarely incorrect in its predictions.