Decoding L&T's defence blueprint

With its Industry 4.0, digitalisation and shipbuilding capabilities, the defence arm of the engineering major has been growing its order book across land, sea and air, making everything from tanks and

It was around three years ago that the idea of a light tank germinated at L&T Defence. The defence arm of the engineering and construction major had been working on the Vajra K9 howitzers for the Indian Army the need for equipment at high altitudes like in Ladakh and the Sino-India border was the driver for such a product. L&T Defence teamed up with the Defence Research and Development Organisation (DRDO), which was also looking at a light tank, to develop it. After co-designing the 25-tonne light tank, the DRDO in 2022 placed an order with L&T as a development-cum-production partner to build the first prototype.

“Main battle tanks like Arjun typically weigh 60 tonnes and carry high calibre cannons. If you want to move in high altitude areas or operate in sand dunes, you need a more agile and lighter armoured vehicle," says Arun T Ramchandani, who took over as executive vice president & head, L&T Defence, last year. “So we are talking about a tank in the ballpark of 25 to 30 tonnes as opposed to 60 to 70 tonnes, to an extent of the same family but different in terms of pretty much how a large SUV is different from a compact SUV."

The prototype, being built at L&T’s Armoured Systems Complex at Hazira in Gujarat, is at an advanced stage. “We should shortly be ready for trials and demonstrating it to the Army," says Ramchandani.

According to an Acceptance of Necessity (AoN), or in-principle agreement for acquisition, the Ministry of Defence’s (MoD) Acquisition Council (DAC) greenlit six light tank regiments, each equipped with 59 tanks. The AoN specifies that L&T, as development-cum-production partner to DRDO, will build one regiment of light tanks, while the MoD acquires the balance five regiments under the government’s ‘Make’ procedure for which L&T will compete with other industry players.

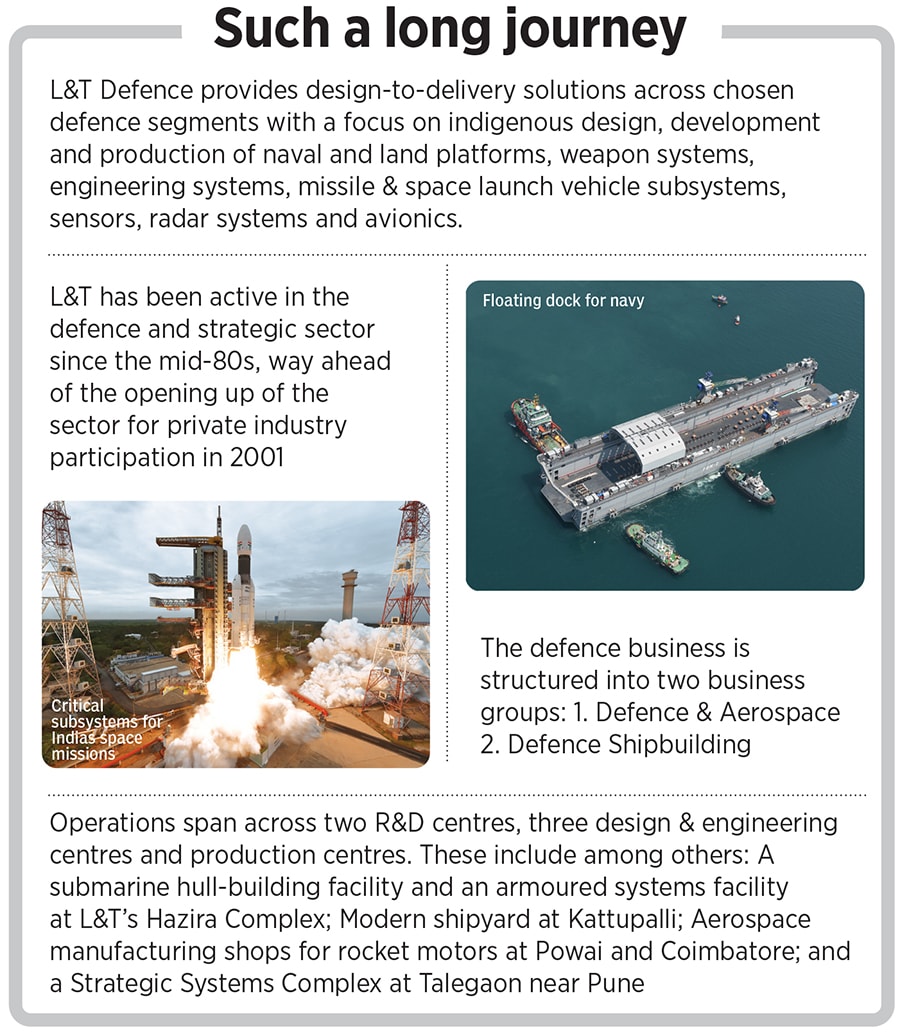

In the bigger scheme of things at L&T, L&T Defence is a small part of the whole—bringing in 2 to 3 percent of the total group revenues in the projects and manufacturing segment. But within the private sector in defence in India, it is one of the major players with a gamut of offerings covering everything from ships and submarines to land combat vehicles, radar systems and PSLV rockets the light tank is just one of several projects and contracts the company currently has under its belt.

Defence orders could take between two and three years from bid to winning, and among the contracts L&T has is a procurement contract for supply of 41 indigenous modular bridges at an estimated cost of Rs2,585 crore. The contract, signed by the defence ministry with L&T Defence in February, is being executed at the Strategic Systems Complex in Talegaon near Pune. The 46-metre assault bridge can be employed over various obstacles like canals and ditches with quick launching and retrieval capabilities.

In March, the MoD also signed a contract with L&T for the procurement of three cadet ships worth Rs3,100 crore under the Buy (Indian-IDDM) category, which essentially means procurement of products from an Indian vendor that have been indigenously designed, developed and manufactured with a minimum of 50 percent Indigenous Content (IC) on cost basis of the total contract value.

In March, the MoD also signed a contract with L&T for the procurement of three cadet ships worth Rs3,100 crore under the Buy (Indian-IDDM) category, which essentially means procurement of products from an Indian vendor that have been indigenously designed, developed and manufactured with a minimum of 50 percent Indigenous Content (IC) on cost basis of the total contract value.

Cadet ships are complex ships fitted with capabilities that include a large number of systems, besides facilities, including classrooms and accommodation.

The company is also executing a contract for two multi-purpose vessel ships and has finalised a contract for supply of 61 flights of an indigenously developed close-in weapon system to the Indian Air Force for protection of vital assets and positions.

“We are also executing the order for the Pinaka Artillery Launch system developed by L&T as part of the Pinaka development programme of the DRDO," says Ramchandani. Pinaka is a high-tech, all-weather, long range, area fire artillery weapon system. There is also a long range radar contract where “we have kind of completed the contract negotiation, but it’s through the pipeline of approvals", he adds.

Among other projects in the pipeline is a project for six diesel electric submarines with air independent propulsion, an advance technology that gives them extra endurance. The project is on a strategic partnership model where the company is competing with Mazagon Docks Limited. Part of the 75I programme [Project-75 (India) submarine acquisition project], the bid submission, says Ramchandani, is due in August, “though it will take some time to unfold". A repeat order for another 100 K9 Vajras is also in the pipeline.

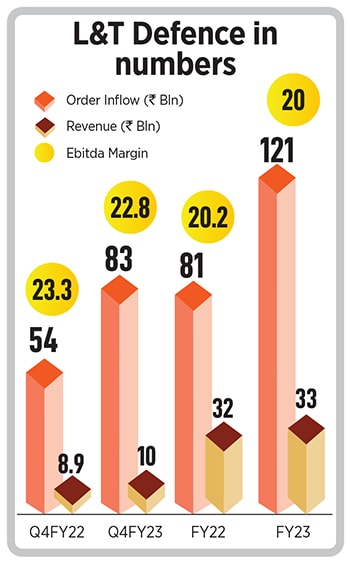

In FY23, the company had order inflows of over Rs 12,000 crore, up from Rs 8,000 crore in FY22 (see box). Market intelligence and advisory firm Mordor Intelligence had in June 2022 pointed out that L&T’s experience in ship and submarine building will be the leading factor for the company’s growth as India plans to procure numerous modern ships and submarines for the Navy.

L&T Defence is one of the few private companies worldwide to possess niche submarine manufacturing capabilities, says Sourabh Banik, project manager, aerospace and defence at data analytics and consulting firm GlobalData. The company has contributed to manufacturing India’s first Arihant-class nuclear powered ballistic missile submarine (SSBN), which is pivotal in maintaining the country’s strategic sea-based nuclear deterrence. “Within the submersible domain, L&T has an impressive product line-up that is geared towards the requirements of both domestic and international markets. The line-up includes the SOV-400 midget submarine and Adamya, Amogh, and Maya autonomous underwater vehicles (AUVs)," he says.

Analysts add that the space sector is another area of its specialisation. L&T has partnered with and contributed to the indigenous capability of the Indian space sector for over five decades. Ramchandani points out that currently they have an order for supply of solid stages of five PSLVs Lead System Integrators through their industry consortium partner HAL. The approval of the Indian Space Policy 2023 is also expected to enable the private industry in the sector, and is likely to prove to be another avenue of growth for the company.

According to government data, India’s defence exports have risen from Rs1,521 crore in 2016-17 to Rs15,920 crore in 2022-23, a tenfold increase, with the government aiming for Rs35,000 crore by 2025. And though there are challenges and competition, this is another space in which L&T Defence has been using its capabilities of in-house design and development to win contracts and where it sees potential for growth.

“We are able to integrate new equipment or upgrade some legacy weapon systems for foreign countries. And there we have a strong competitive edge over, say, West European suppliers and so on," says Ramchandani. The company has supplied high speed guard boats, torpedo launchers and sonar systems, as well as upgraded systems on countries’ legacy warships. “So I see growth in this market. We are already seeing some potential repeat orders of what we have done."

L&T’s defence journey started in the mid-80s, way before the defence sector was opened up to the private sector in 2001. The company is also one of the leaders in Industry 4.0 adoption, having adopted Industry 4.0 across its engineering and manufacturing plants in India. The recent K9 Vajra-T programme, where 100 K9s were delivered as per a Rs4,500 crore defence contract to the Army, is a case in point of their use of Industry 4.0 and automation capabilities. According to the company, while the first hull took 100 hours of resources in terms of manpower hours and time, by the time they had reached the 40th, they had come down to 20 percent. The Vajra tank programme was delivered ahead of schedule, in February 2021.

“We are always looking at how we can make processes more digital, more connected," says Ramchandani, recollecting how they operated through Covid and delivered the Vajra guns during the pandemic. “There were eight inspection agencies from the Director General of Quality Assurance and they were digitally connected onto our shop floor and they accepted guns in that kind of an arrangement. The scale of digitalisation we have achieved today is something we have put a lot of effort into," he says.

Although making ammunition can be a source of regular revenue for a defence firm, L&T Defence has dissociated itself from the image of destruction, consciously positioning itself as a manufacturer of defensive weapon systems. “We’ve decided not to build any ammunition. A lot of what we do is related with national security, we work on a lot of defensive weapon systems. For example, the air defence systems, which protect critical installations from attack. There are certain things we do and certain things we will not do," says Ramchandani.

Among the things they have done is help create an ecosystem in light of the government’s thrust on Make in India. Ramchandani says there are a large number of MSMEs who are engaged with them and are learning “the quality requirements of defence equipment, the systems of supply defence products and so on". And while India has gaps in various aspects of advanced manufacturing, like in semiconductors, “there is a vibrant MSME sector that is growing, is innovative, and is looking at delivering more with less and we are able to integrate this sector into our ecosystems", he says.

With an investment of around Rs8,000 crore so far, the defence arm of L&T has been readying itself for the future by being nimble and agile. And Ramchandani, for one, has his vision mapped. “My sense is the entire defence and security landscape is changing pretty fast, there’s a lot of adoption of technology into this. So our vision [is] to be able to keep pace with that, to build contemporary solutions. And to vie for the top spot in the segment and become a large-scale, reliable supplier of contemporary and different defence systems to the government and worldwide, to friendly countries, wherever it is needed."

First Published: Jun 14, 2023, 10:54

Subscribe Now