Exclusive: Samir Modi claims royalty for retail chain 24Seven

The executive director of tobacco maker Godfrey Phillips India fires fresh salvo in the family feud with his mother Bina Modi, demands royalty of Rs389.6 crore from the company

In a fresh turn in the ongoing family feud of the late industrialist KK Modi, Samir Modi has sought a royalty payment of Rs389.6 crore from tobacco manufacturing company Godfrey Phillips India (GPI) for using the intellectual property rights (IPR) of the retail chain brand 24Seven.

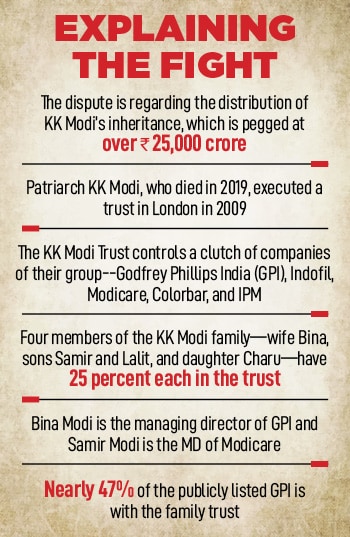

In a letter sent to the board of GPI on June 5, Samir, KK Modi"s younger son and the founder-president of 24Seven, claimed that the IPR of the convenience retail grocery chain vests in Twenty Four Seven Retail Stores (TFSRS) and its use was allowed in consideration of the payment of royalty. “While the 24Seven Retail Division was growing, I didn’t want to burden the business with royalty costs. I, therefore, agreed to defer such payment," Modi underlines in an email, a copy of which was accessed by Forbes India from one of the senior officials of the company. “Royalty is required to be paid to TFSRS from June 2005 till July 31, 2024," says Modi, who is an executive director of GPI, and is embroiled in a bitter fight with his mother Bina Modi over an inheritance battle pegged over Rs25,000 crore.

The royalty demand puts a wrench in the potential sale of 24Seven, which was reportedly put on the block after GPI decided to exit from the loss-making retail business division in April this year. “If GPI doesn’t own the brand, then what are the potential suitors of 24Seven buying," one of the high-ranking GPI officials underlined, adding that Samir Modi owns the IP rights of 24Seven brand, which has 154 stores across Delhi-NCR, Chandigarh, Punjab, Haryana, and Hyderabad. “Would they (the suitors) buy just the outlets without the brand," the official wondered, requesting anonymity. In FY23, 24Seven reportedly posted a revenue of Rs396 crore. “The retail business division had a negative net worth as of March 31, 2023," Godfrey Phillips India highlighted in its regulatory filings.

A demand for royalty caps up a roller-coaster ride for 24Seven, which was started in 2004. Explaining the pending royalty amount of Rs389.6 crore, Samir Modi has sought 7 percent of total sales of Rs3,289.4 crore from June 2005 till March 31, 2024. “This amount includes interest of Rs159.3 crore @18 percent per annum for each year of royalty due," Modi highlights in his letter, adding that a royalty of Rs4.72 crore is also due for April and May this year. “We have a further right to charge royalty for June and July when the actual sales figures are made available," he writes.

Early this month, the simmering family feud erupted when Samir Modi accused his mother of orchestrating an attack on him. “This attack was orchestrated because of greed and to deprive me of my rights, my inheritance and with an intention to kill me or make me settle on their dictated terms," he said in a complaint filed at Sarita Vihar police station in Delhi. Forbes India has reviewed a copy of the FIR. “The assault not only represents a gross violation of my rights and safety but also a serious breach of corporate governance and ethics," he pointed out in his latest letter sent to the board on June 5. The emergency board meeting on June 1, which led to the alleged assault, was the third emergency board meeting in four months. “The emergency board meetings are called for the convenience of a few and to ensure non-attendance of some," he maintained in another letter sent to the board on June 5.

Samir Modi has also questioned the speed with which the decision to exit 24Seven was taken. “The procedure adopted to undertake a major decision without discussion with the actual operating management and in a short span of 15 minutes is incomprehensible," he pointed out in his letter. “Whether the exit meant sale or shutting down the retail business was not discussed and left as a mystery to be unraveled," he noted, adding that there was no consideration about the fate of 1,600 people dependent on the retail division. “A score of senior officials have been asked to leave," claims another senior official of GPI, requesting not to be named. “It’s a self-destructive fight, which will not only erode the businesses built by KK Modi, but also erase his legacy," the senior official says.

Samir Modi has also questioned the speed with which the decision to exit 24Seven was taken. “The procedure adopted to undertake a major decision without discussion with the actual operating management and in a short span of 15 minutes is incomprehensible," he pointed out in his letter. “Whether the exit meant sale or shutting down the retail business was not discussed and left as a mystery to be unraveled," he noted, adding that there was no consideration about the fate of 1,600 people dependent on the retail division. “A score of senior officials have been asked to leave," claims another senior official of GPI, requesting not to be named. “It’s a self-destructive fight, which will not only erode the businesses built by KK Modi, but also erase his legacy," the senior official says.

In a valuation exercise conducted by Grant Thornton last year, direct-selling company Modicare and cosmetics brand Colorbar were valued at Rs819 crore and Rs 800 crore, respectively. “Now, add to this the market cap of GPI, which is close to Rs20,000 crore, the cash reserve of over Rs4,000 crore, and the value of Indofil, the value of the inheritance shoots to close to Rs30,000 crore," the official mentioned above claims.

First Published: Jun 10, 2024, 11:29

Subscribe Now